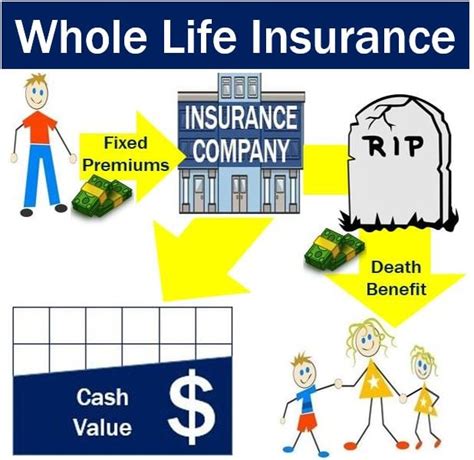

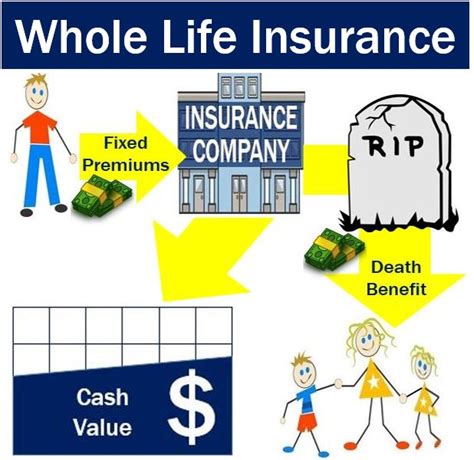

Whole Life Life Insurance Definition

Whole life insurance, also known as permanent life insurance, is a type of insurance policy that provides coverage for an individual's entire life, offering long-term financial protection to beneficiaries. Unlike term life insurance, which has a fixed coverage period, whole life insurance remains in force as long as the policyholder continues to pay the premiums. This makes it a popular choice for individuals seeking lifelong peace of mind and a guaranteed death benefit for their loved ones.

The primary objective of whole life insurance is to provide a substantial sum of money to the policyholder's beneficiaries upon their death. This benefit, often referred to as the death benefit, can be used to cover a wide range of expenses, including funeral costs, outstanding debts, or even to provide long-term financial security for the family.

Key Features of Whole Life Insurance

Whole life insurance policies are renowned for their stability and predictability. Here are some of the key features that set them apart:

Guaranteed Death Benefit

The most fundamental aspect of whole life insurance is the guarantee of a specified death benefit. This benefit remains unchanged throughout the policy’s term, ensuring that the beneficiaries receive the full amount regardless of when the policyholder passes away.

| Death Benefit Example | Death Benefit Amount |

|---|---|

| A 45-year-old male | $250,000 |

| A 38-year-old female | $300,000 |

Fixed Premiums

Whole life insurance policies typically require the policyholder to pay fixed premiums at regular intervals, usually on a monthly or annual basis. These premiums remain constant throughout the policy’s term, providing policyholders with a predictable financial commitment.

Cash Value Accumulation

One of the distinctive features of whole life insurance is the accumulation of cash value. A portion of the premium payments goes towards building up a cash value within the policy, which can be accessed by the policyholder through loans or withdrawals. This cash value can grow over time, offering financial flexibility and potential tax advantages.

Policy Loans and Withdrawals

Policyholders can borrow against the cash value of their whole life insurance policy or make withdrawals. This provides a source of funds during financial emergencies or for other purposes, such as funding a child’s education or covering unexpected expenses.

Tax Advantages

Whole life insurance policies often offer tax benefits. The cash value within the policy grows on a tax-deferred basis, and policy loans or withdrawals are generally tax-free as long as they don’t exceed the cost basis of the policy. This makes whole life insurance a potentially attractive option for tax planning.

Benefits and Considerations

Whole life insurance offers several advantages that make it a preferred choice for many individuals and families:

- Lifetime Coverage: Whole life insurance provides lifelong protection, ensuring that beneficiaries receive a substantial sum regardless of when the policyholder passes away.

- Stability and Predictability: With fixed premiums and a guaranteed death benefit, whole life insurance offers stability and predictability in financial planning.

- Cash Value Accumulation: The cash value within the policy can grow over time, providing a financial safety net and potential investment opportunities.

- Tax Benefits: The tax-deferred growth of cash value and tax-free loans or withdrawals make whole life insurance an appealing option for tax-efficient wealth accumulation.

However, there are also considerations to keep in mind:

- Higher Premiums: Whole life insurance policies often come with higher premiums compared to term life insurance, as they offer lifelong coverage and cash value accumulation.

- Long-Term Commitment: Policyholders must be prepared for a long-term financial commitment, as premiums must be paid consistently to maintain the policy.

- Potential Underperformance: The cash value within the policy may not grow as expected, especially if market conditions are unfavorable.

Real-Life Examples and Use Cases

Whole life insurance can be a valuable tool in various financial and life scenarios:

Financial Security for Family

Mr. Smith, a 40-year-old businessman, purchases a whole life insurance policy with a $500,000 death benefit. This ensures that his wife and two children will receive a substantial sum upon his passing, providing them with financial security and peace of mind.

Estate Planning

Ms. Johnson, a successful entrepreneur, uses her whole life insurance policy’s cash value to pay estate taxes upon her death. This strategy ensures that her heirs receive the full value of her estate without incurring significant tax liabilities.

Supplemental Retirement Income

Mr. Davis, approaching retirement, decides to utilize the cash value of his whole life insurance policy to supplement his retirement income. He takes out a policy loan to fund his retirement expenses, ensuring a comfortable lifestyle during his golden years.

Performance Analysis and Future Implications

The performance of whole life insurance policies can vary based on several factors, including the insurance company’s financial strength, interest rate environment, and policy design. Here’s a brief analysis:

Financial Strength of Insurance Companies

The stability and performance of whole life insurance policies are closely tied to the financial health of the insurance company. Policyholders should choose reputable and financially sound companies to ensure the long-term viability of their policies.

Interest Rate Impact

Whole life insurance policies are sensitive to changes in interest rates. When interest rates are high, the cash value within the policy tends to grow faster. Conversely, low interest rates can slow down cash value accumulation.

Policy Design and Flexibility

The design of whole life insurance policies can vary. Some policies offer more flexible premium payment options or allow policyholders to adjust the death benefit over time. These features can be advantageous for individuals with changing financial needs.

Future Trends

Whole life insurance is expected to remain a popular choice for individuals seeking lifelong financial protection. However, the rise of alternative investment options and changing consumer preferences may lead to more diverse policy designs and flexible features in the future.

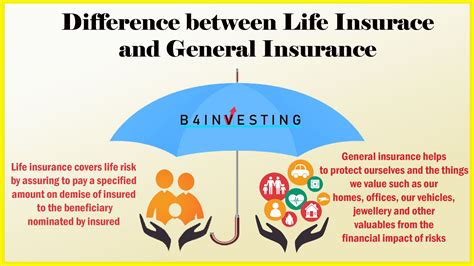

What is the difference between whole life and term life insurance?

+Whole life insurance provides lifelong coverage with a guaranteed death benefit, while term life insurance offers coverage for a fixed period, typically 10 to 30 years. Term life insurance tends to have lower premiums but no cash value accumulation.

How does the cash value within a whole life insurance policy grow?

+The cash value within a whole life insurance policy grows through a combination of interest earnings and a portion of the premium payments. The interest rate applied to the cash value is determined by the insurance company and can vary based on market conditions.

Can I withdraw money from my whole life insurance policy?

+Yes, policyholders can access the cash value of their whole life insurance policy through withdrawals or policy loans. Withdrawals reduce the death benefit and cash value, while policy loans must be repaid with interest.