Whole Term Life Insurance

Life insurance is a crucial financial tool that provides security and peace of mind to individuals and their families. Among the various types of life insurance policies available, whole term life insurance stands out as a comprehensive and long-term solution. In this comprehensive guide, we will delve into the world of whole term life insurance, exploring its unique features, benefits, and considerations to help you make informed decisions about your financial future.

Understanding Whole Term Life Insurance

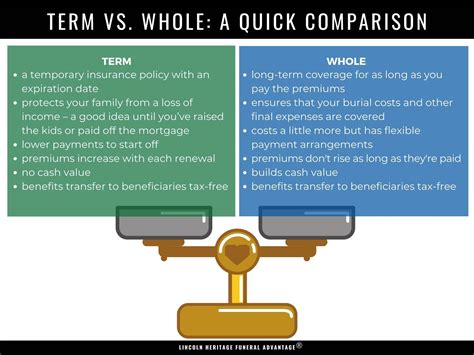

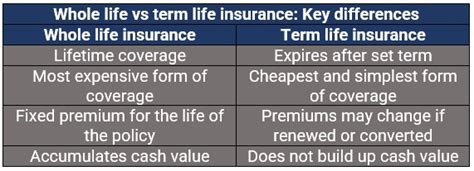

Whole term life insurance, often referred to simply as “whole life insurance,” is a permanent life insurance policy that offers coverage for the entire life of the insured individual. Unlike term life insurance, which provides coverage for a specific period, whole term life insurance remains in force as long as the policyholder continues to pay the premiums. This type of policy combines the traditional benefits of life insurance with additional savings and investment components, making it a versatile financial tool.

One of the key characteristics of whole term life insurance is its guaranteed death benefit. Regardless of when the insured passes away, their beneficiaries will receive the face value of the policy, ensuring financial protection and stability. This feature makes whole life insurance an attractive option for those seeking long-term security and a reliable safety net for their loved ones.

Key Features and Benefits of Whole Term Life Insurance

Whole term life insurance offers a range of benefits that make it a popular choice among individuals seeking comprehensive financial protection:

- Permanent Coverage: As mentioned earlier, whole life insurance provides coverage for the entire lifetime of the policyholder. This means that as long as premiums are paid, the death benefit remains intact, offering uninterrupted protection.

- Cash Value Accumulation: One of the unique aspects of whole term life insurance is the accumulation of cash value over time. A portion of the premiums paid goes towards building a cash reserve within the policy. This cash value can be accessed through loans or withdrawals, providing policyholders with financial flexibility during their lifetime.

- Guaranteed Premiums: Whole life insurance policies typically come with guaranteed premium rates. Once the policy is issued, the premium amounts remain fixed throughout the policy term. This predictability allows individuals to budget effectively and plan their financial future with confidence.

- Tax Advantages: The cash value within a whole term life insurance policy grows on a tax-deferred basis. This means that any gains or earnings are not subject to immediate taxation, providing a tax-efficient way to save and invest.

- Investment Opportunities: Some whole life insurance policies offer policyholders the option to allocate a portion of their cash value to various investment vehicles. This allows for potential growth and diversification of their financial portfolio.

- Estate Planning Benefits: Whole term life insurance can be an essential tool for estate planning. The death benefit can be used to cover estate taxes, pay off debts, or provide a substantial inheritance for beneficiaries, ensuring a seamless transition of assets.

How Whole Term Life Insurance Works

To understand the workings of whole term life insurance, let’s break down the key components and processes involved:

Policy Premiums

Policyholders pay regular premiums to maintain their whole life insurance coverage. These premiums are typically paid on a monthly, quarterly, semi-annual, or annual basis. The amount of the premium is determined based on factors such as the policyholder’s age, health, and the desired level of coverage.

Death Benefit

The death benefit is the primary purpose of whole term life insurance. It represents the face value of the policy, which is paid out to the designated beneficiaries upon the insured’s death. The death benefit provides financial support to the beneficiaries, helping them cover expenses, pay off debts, or maintain their standard of living.

Cash Value Accumulation

As mentioned earlier, whole life insurance policies accumulate cash value over time. This cash value is a result of a portion of the premiums being invested by the insurance company. The investment earnings, along with the policyholder’s contributions, add up to create a substantial cash reserve. The cash value can be used for various purposes, such as taking out policy loans, making withdrawals, or surrendering the policy for its cash value.

Policy Loans and Withdrawals

Policyholders have the option to access the cash value within their whole term life insurance policy through policy loans or withdrawals. Policy loans allow individuals to borrow against the cash value, with the loan amount and interest accruing against the policy. Withdrawals, on the other hand, involve taking a portion of the cash value out of the policy, reducing its overall value.

Dividends (Participating Policies)

In some cases, whole life insurance policies are participating policies, meaning they may pay dividends to policyholders. Dividends are based on the insurance company’s performance and profitability. These dividends can be used to reduce future premiums, purchase additional paid-up insurance, or be paid out in cash.

Considerations and Factors

While whole term life insurance offers numerous benefits, there are certain considerations and factors to keep in mind when evaluating this type of policy:

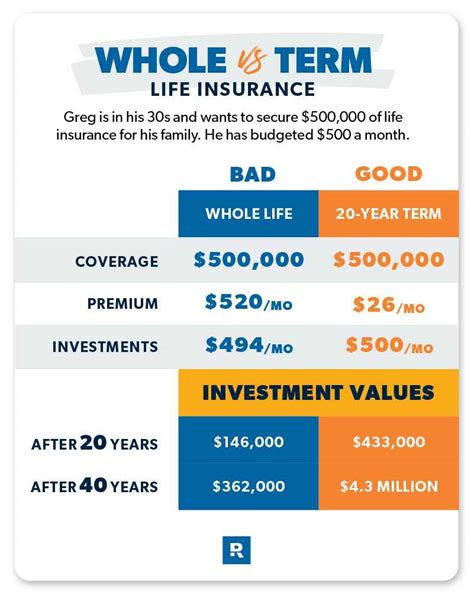

Cost

Whole term life insurance policies generally have higher premiums compared to term life insurance policies. The cost of whole life insurance is influenced by factors such as the policyholder’s age, health, and the desired coverage amount. It is important to carefully assess one’s financial situation and budget to determine if the premiums are affordable and sustainable over the long term.

Policy Flexibility

Whole life insurance policies are designed to be long-term commitments. While they offer flexibility in accessing the cash value, policyholders should be aware that early withdrawals or surrenders may result in tax implications and potential penalties. It is crucial to understand the policy’s terms and conditions to make informed decisions regarding cash value usage.

Investment Considerations

The investment component of whole term life insurance can be attractive to those seeking long-term growth. However, it is essential to understand the investment options available within the policy and assess their suitability based on personal risk tolerance and financial goals. Consulting with a financial advisor can provide valuable insights into maximizing the investment potential of whole life insurance.

Comparison with Other Life Insurance Options

When considering whole term life insurance, it is beneficial to compare it with other life insurance options available in the market. Term life insurance, for example, offers a more affordable and flexible alternative for those seeking coverage for a specific period. Universal life insurance, on the other hand, provides similar permanent coverage but with more flexible premium and death benefit options.

Case Studies and Real-Life Examples

To illustrate the impact and benefits of whole term life insurance, let’s explore a few real-life examples:

Estate Planning for Business Owners

John, a successful business owner, wanted to ensure the continuity and smooth transition of his business upon his retirement or unexpected passing. He opted for a whole term life insurance policy with a substantial death benefit. The policy provided the necessary funds to cover estate taxes, buy out business partners, and ensure the business’s long-term stability. Additionally, the cash value within the policy allowed John to access funds for business expansion and investment opportunities.

Providing Financial Security for Family

Sarah, a young mother, sought to secure her family’s financial future in the event of her untimely demise. She chose a whole life insurance policy with a guaranteed death benefit that would cover her family’s living expenses, mortgage payments, and education costs for her children. Over time, Sarah also utilized the policy’s cash value to pay for her children’s extracurricular activities and contribute to their college funds.

Retirement Planning and Legacy Building

Michael, approaching retirement, wanted to leave a substantial legacy for his grandchildren. He invested in a whole term life insurance policy with a focus on building up the cash value. Over the years, Michael’s policy grew in value, providing him with a substantial sum to leave as an inheritance. Additionally, the policy’s tax-deferred growth allowed him to maximize the potential of his retirement savings.

Future Implications and Long-Term Benefits

Whole term life insurance offers a range of long-term benefits that extend beyond the immediate financial protection it provides:

Financial Stability and Security

By maintaining a whole life insurance policy, individuals can ensure long-term financial stability for themselves and their loved ones. The guaranteed death benefit provides a safety net, allowing beneficiaries to maintain their standard of living and address any financial obligations without the added stress.

Wealth Accumulation and Legacy Planning

The cash value component of whole term life insurance allows policyholders to build wealth over time. This accumulated wealth can be utilized for various purposes, such as funding education expenses, investing in real estate, or leaving a substantial legacy for future generations. Whole life insurance becomes a tool for creating and preserving wealth.

Intergenerational Wealth Transfer

Whole term life insurance policies can be structured to facilitate the transfer of wealth across generations. By utilizing the policy’s death benefit and cash value, individuals can ensure that their financial legacy is passed on to their children, grandchildren, or chosen beneficiaries, creating a lasting impact and providing financial security for future generations.

Conclusion

Whole term life insurance is a powerful financial tool that offers individuals and their families comprehensive protection and long-term financial security. With its guaranteed death benefit, cash value accumulation, and investment opportunities, it provides a versatile solution for various life stages and financial goals. By understanding the workings and benefits of whole term life insurance, individuals can make informed decisions and take control of their financial future.

What is the difference between whole term life insurance and term life insurance?

+

Whole term life insurance provides coverage for the entire life of the insured, whereas term life insurance offers coverage for a specific period, typically ranging from 10 to 30 years. Whole life insurance also includes a cash value component, while term life insurance does not.

How does the cash value within a whole term life insurance policy work?

+

The cash value within a whole term life insurance policy accumulates over time as a result of a portion of the premiums being invested by the insurance company. This cash value can be accessed through policy loans, withdrawals, or surrenders, providing financial flexibility to the policyholder.

Can I access the cash value of my whole term life insurance policy without penalties?

+

Yes, policyholders have the option to access their cash value through policy loans or withdrawals. However, early withdrawals or surrenders may result in tax implications and potential penalties. It is important to understand the policy’s terms and conditions to make informed decisions.

Are there any tax advantages associated with whole term life insurance?

+

Yes, the cash value within a whole term life insurance policy grows on a tax-deferred basis. This means that any gains or earnings are not subject to immediate taxation, providing a tax-efficient way to save and invest. However, it is important to consult with a tax professional for specific tax advice.

Is whole term life insurance suitable for everyone?

+

Whole term life insurance may not be suitable for everyone due to its higher premiums and long-term commitment. It is essential to assess one’s financial situation, risk tolerance, and coverage needs to determine if whole life insurance aligns with their goals and budget.