Why Is It Important To Have Insurance

Insurance is an integral part of modern life, offering protection and peace of mind in an uncertain world. From safeguarding our health and assets to mitigating financial risks, insurance plays a crucial role in managing various aspects of our lives. This article explores the significance of insurance, delving into its historical context, the diverse types available, and its impact on individuals and society as a whole.

A Historical Perspective on Insurance

The concept of insurance has evolved over centuries, rooted in ancient practices of risk management. In ancient civilizations, people would pool their resources to provide support in times of need, laying the foundation for the modern insurance system. The development of maritime trade in the 17th century further propelled the need for insurance, leading to the establishment of the first insurance companies in London, such as Lloyd’s of London.

Over time, insurance has expanded to cover a myriad of risks, including health, property, life, and liability. This evolution has been driven by societal changes, technological advancements, and the growing awareness of potential risks and vulnerabilities.

The Types of Insurance: A Comprehensive Overview

Insurance encompasses a broad spectrum of policies, each designed to address specific risks and needs. Here’s an overview of some of the most common types of insurance and their significance:

Health Insurance

Health insurance is perhaps one of the most vital forms of insurance, providing financial protection against medical expenses. With rising healthcare costs, health insurance ensures individuals can access necessary medical treatments without incurring significant financial burdens. It promotes early detection and treatment of illnesses, improving overall health outcomes and quality of life.

Property Insurance

Property insurance protects individuals and businesses from financial losses resulting from damage to their properties. This includes coverage for homes, businesses, and personal belongings. In the event of natural disasters, theft, or accidents, property insurance provides the means to repair or replace damaged assets, helping individuals and businesses quickly recover and resume normal operations.

Life Insurance

Life insurance offers financial protection to beneficiaries in the event of the policyholder’s death. It provides a safety net for families, ensuring they can maintain their standard of living and cover expenses such as funeral costs, outstanding debts, and ongoing living expenses. Life insurance is a crucial tool for financial planning and can help secure the future of loved ones.

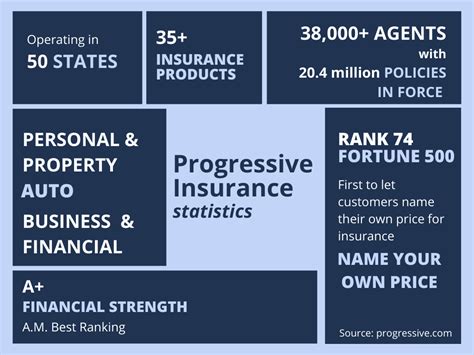

Auto Insurance

Auto insurance is mandatory in many jurisdictions and provides coverage for vehicle-related incidents. It protects policyholders from financial losses resulting from accidents, theft, or damage to their vehicles. Additionally, auto insurance often includes liability coverage, which protects the policyholder from legal and financial consequences if they are found at fault in an accident.

Travel Insurance

Travel insurance is designed to provide coverage for unexpected events that may occur during travel. This includes medical emergencies, trip cancellations, lost luggage, or travel delays. By offering financial protection, travel insurance ensures that travelers can enjoy their journeys with peace of mind, knowing they are covered in the event of unforeseen circumstances.

The Impact of Insurance on Individuals and Society

Insurance has a profound impact on both individuals and society as a whole. On an individual level, insurance provides a sense of security and stability, allowing people to plan for the future and mitigate potential financial disasters. It empowers individuals to take risks, pursue their passions, and make significant life decisions with confidence, knowing they are protected.

At a societal level, insurance plays a vital role in promoting economic stability and growth. By spreading risk across a large pool of policyholders, insurance companies can effectively manage and minimize financial risks. This, in turn, encourages investment, supports entrepreneurship, and fosters a more resilient economy. Insurance also plays a critical role in disaster recovery, providing the necessary funds for rebuilding and rehabilitation.

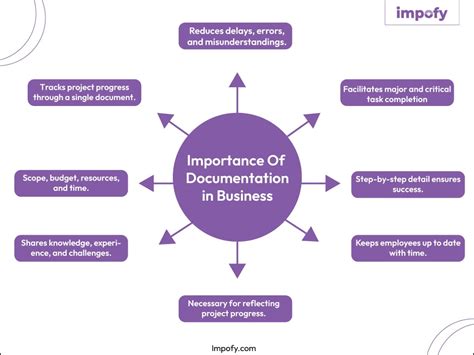

Risk Management and Mitigation

One of the primary functions of insurance is risk management. Insurance companies assess and manage risks, helping individuals and businesses identify potential hazards and develop strategies to minimize their impact. Through actuarial science and data analysis, insurance providers can accurately price policies, ensuring fair and sustainable coverage for policyholders.

Promoting Financial Security

Insurance is a cornerstone of financial security, offering a safety net against unexpected events and financial losses. By providing a means to manage and transfer risk, insurance allows individuals and businesses to protect their assets, maintain financial stability, and plan for the future with confidence. This aspect of insurance is particularly crucial in an increasingly uncertain world, where unforeseen events can have significant financial implications.

| Type of Insurance | Key Benefits |

|---|---|

| Health Insurance | Financial protection against medical expenses, early detection and treatment of illnesses |

| Property Insurance | Coverage for damage to properties, quick recovery and resumption of normal operations |

| Life Insurance | Financial security for beneficiaries, peace of mind for policyholders |

| Auto Insurance | Protection against vehicle-related incidents, including accidents and theft |

| Travel Insurance | Coverage for travel-related emergencies, ensuring a stress-free journey |

How does insurance benefit society as a whole?

+Insurance benefits society by promoting economic stability and growth. By spreading risk across a large pool of policyholders, insurance companies can effectively manage and minimize financial risks. This encourages investment, supports entrepreneurship, and fosters a more resilient economy. Insurance also plays a critical role in disaster recovery, providing the necessary funds for rebuilding and rehabilitation.

What is the primary function of insurance?

+The primary function of insurance is risk management. Insurance companies assess and manage risks, helping individuals and businesses identify potential hazards and develop strategies to minimize their impact. Through actuarial science and data analysis, insurance providers can accurately price policies, ensuring fair and sustainable coverage for policyholders.

How does health insurance improve health outcomes?

+Health insurance improves health outcomes by providing financial protection against medical expenses. This encourages early detection and treatment of illnesses, as individuals are more likely to seek medical attention without the fear of financial burden. Additionally, health insurance often includes preventive care measures, promoting overall wellness and reducing the risk of severe health issues.