Will My Insurance Cover Wegovy

The demand for weight loss treatments has grown significantly, with Wegovy, a medication designed for long-term weight management, gaining popularity. As individuals explore their options, a crucial question arises: "Will my insurance cover Wegovy?" This article aims to provide an in-depth analysis, offering expert insights and real-world examples to help you understand the coverage landscape surrounding this medication.

Understanding Wegovy and Its Benefits

Wegovy, also known by its generic name Semaglutide, is a prescription medication that has been making waves in the weight loss industry. It belongs to a class of drugs called glucagon-like peptide-1 (GLP-1) receptor agonists, which work by mimicking the action of a natural hormone in the body, helping to regulate appetite and control blood sugar levels.

Wegovy is specifically approved for chronic weight management in adults with a body mass index (BMI) of 27 or higher who have at least one weight-related condition, such as type 2 diabetes or high blood pressure. It is administered once weekly via a prefilled pen injection, providing a convenient and effective solution for long-term weight loss.

The benefits of Wegovy extend beyond simple weight loss. Clinical trials have shown that individuals using Wegovy experienced significant reductions in body weight, with some participants achieving weight loss of up to 10% or more of their initial body weight. Additionally, Wegovy has been associated with improvements in various health markers, including blood pressure, cholesterol levels, and insulin sensitivity.

Insurance Coverage for Wegovy: An Overview

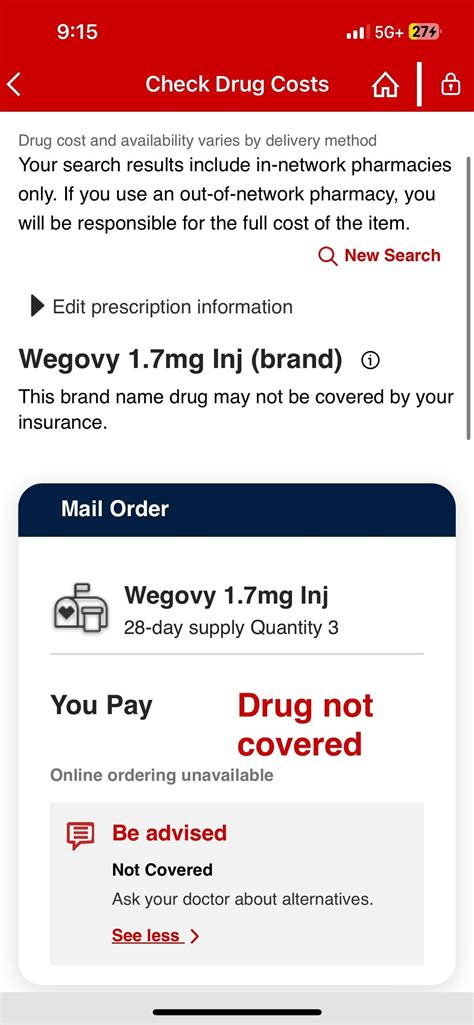

Determining whether your insurance will cover Wegovy involves considering several factors, including your insurance plan’s specific policies, the medication’s approval status, and your individual health circumstances. While insurance coverage for weight loss medications can vary widely, there are some general trends and strategies to consider.

Policy Considerations

Each insurance provider has its own set of policies and guidelines regarding coverage for weight loss treatments. Some plans may offer comprehensive coverage for medications like Wegovy, while others may have more restrictive policies. It’s essential to review your insurance plan’s details, particularly the section on prescription drug coverage, to understand the scope of your benefits.

Look for key terms such as "weight loss medications," "anti-obesity drugs," or "chronic weight management treatments" to determine if your plan specifically mentions coverage for these types of medications. If your plan includes a formulary or a list of covered drugs, check if Wegovy is included and what tier or classification it falls under. Higher-tier drugs may require prior authorization or additional steps to obtain coverage.

Prior Authorization and Medical Necessity

Many insurance plans require prior authorization for weight loss medications like Wegovy. This process involves your healthcare provider submitting a request to your insurance company, providing medical records and justifying the need for the medication. The insurance company then reviews the request to determine if the medication is medically necessary and covered under your plan.

To increase the chances of approval, your healthcare provider will need to demonstrate that you meet specific criteria, such as having a BMI of 27 or higher and at least one weight-related health condition. They may also need to provide evidence of previous attempts at weight loss through lifestyle modifications or other treatments, highlighting the need for a more intensive intervention like Wegovy.

Cost-Sharing and Out-of-Pocket Expenses

Even if your insurance plan covers Wegovy, you may still be responsible for certain out-of-pocket expenses. These can include deductibles, copayments, or coinsurance. Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in, while copayments are fixed amounts you pay for each prescription fill. Coinsurance, on the other hand, is a percentage of the medication’s cost that you are responsible for.

The specific cost-sharing arrangements for Wegovy can vary depending on your insurance plan and the pharmacy benefit manager (PBM) that manages your prescription drug benefits. Some plans may offer preferred cost-sharing for certain medications, including Wegovy, making it more affordable for you. It's crucial to understand these costs and factor them into your decision-making process.

Navigating Insurance Coverage for Wegovy

To ensure a smooth process when seeking coverage for Wegovy, here are some practical steps and expert insights to consider:

Consult Your Healthcare Provider

Your healthcare provider plays a crucial role in determining whether Wegovy is an appropriate treatment option for you and in navigating the insurance coverage process. They can assess your eligibility for the medication based on your medical history and current health status. Additionally, they can guide you through the prior authorization process, providing the necessary medical documentation to support your case.

Research Insurance Plan Details

Take the time to thoroughly review your insurance plan’s coverage details, especially the sections related to prescription drugs and weight loss treatments. Look for any specific exclusions or limitations that may apply to Wegovy. Understanding your plan’s policies will help you anticipate potential challenges and plan accordingly.

Explore Patient Assistance Programs

If you face financial barriers to accessing Wegovy, consider exploring patient assistance programs. These programs, often sponsored by pharmaceutical companies or nonprofit organizations, can provide financial support or even free medication to eligible individuals. Check with the manufacturer of Wegovy or search for independent patient assistance programs that may cover this medication.

Utilize Pharmacy Benefits

Pharmacy benefit managers (PBMs) play a crucial role in managing prescription drug benefits for insurance plans. They can offer valuable insights into coverage and cost-saving strategies. Contact your PBM or your insurance company’s pharmacy department to inquire about any specific programs or discounts related to Wegovy. They may have preferred pharmacies or pricing arrangements that can reduce your out-of-pocket costs.

Advocate for Coverage

In some cases, your insurance plan may initially deny coverage for Wegovy. If this happens, don’t lose hope. You have the right to appeal the decision and advocate for your treatment. Work closely with your healthcare provider to gather additional evidence or supporting documentation that can strengthen your case. Appeal processes can vary, so be sure to follow the guidelines provided by your insurance company.

Real-World Examples of Insurance Coverage for Wegovy

To provide a clearer picture of the insurance coverage landscape for Wegovy, let’s explore some real-world scenarios:

Scenario 1: Commercial Insurance Plan

John, a 35-year-old with a BMI of 32 and type 2 diabetes, sought coverage for Wegovy through his commercial insurance plan. His plan’s formulary included Wegovy as a covered medication, but it was classified as a higher-tier drug, requiring prior authorization. John’s healthcare provider submitted the necessary documentation, highlighting his medical history and previous unsuccessful attempts at weight loss. After a thorough review, the insurance company approved coverage for Wegovy, requiring a copayment of $50 per prescription fill.

Scenario 2: Medicare Part D Plan

Sarah, a 65-year-old retiree with a BMI of 28 and high blood pressure, wanted to explore coverage for Wegovy through her Medicare Part D plan. She contacted her plan’s customer service to inquire about coverage and was informed that Wegovy was covered as a Tier 4 medication, meaning it had a higher cost-sharing requirement. Sarah’s healthcare provider submitted a prior authorization request, and after providing additional medical records, the insurance company approved coverage with a 20% coinsurance rate.

Scenario 3: Medicaid Coverage

Michael, a 40-year-old with a BMI of 30 and a history of cardiovascular disease, applied for coverage for Wegovy through his state’s Medicaid program. Medicaid programs can vary in their coverage policies, so Michael’s case manager reviewed his eligibility and determined that Wegovy was indeed covered. However, due to budget constraints, Medicaid required a prior authorization process. After submitting the necessary documentation, Michael’s request was approved, and he was able to access Wegovy with minimal out-of-pocket costs.

Future Implications and Expert Insights

As the demand for weight loss treatments continues to rise, insurance coverage for medications like Wegovy is likely to evolve. Here are some expert predictions and insights on the future of insurance coverage for Wegovy:

- Increasing Coverage: With growing awareness of the health benefits associated with weight loss, insurance companies may gradually expand their coverage for weight loss medications. This trend could lead to more inclusive policies and reduced barriers for individuals seeking treatment.

- Cost-Effectiveness Considerations: Insurance providers are increasingly focusing on cost-effectiveness when making coverage decisions. As more research emerges demonstrating the long-term health benefits and cost savings associated with medications like Wegovy, insurance companies may be more inclined to provide coverage.

- Advocacy and Policy Changes: Patient advocacy groups and healthcare professionals play a crucial role in shaping insurance policies. Continued efforts to educate insurance companies and policymakers about the value of weight loss treatments could lead to positive changes in coverage.

- Personalized Medicine Approach: The future of insurance coverage may involve a more personalized approach, considering individual health profiles and treatment needs. This could mean more tailored coverage decisions, taking into account factors like genetic predispositions and specific health conditions.

Conclusion

Navigating insurance coverage for Wegovy can be a complex process, but with the right knowledge and strategies, it is possible to access this effective weight loss treatment. By understanding your insurance plan’s policies, working closely with your healthcare provider, and exploring available resources, you can make informed decisions about your weight loss journey. Remember, seeking professional guidance and staying persistent can make a significant difference in achieving your health goals.

Frequently Asked Questions

Can I use Wegovy if I don’t have a weight-related health condition?

+While Wegovy is primarily approved for individuals with a BMI of 27 or higher and at least one weight-related health condition, some insurance plans may cover it for off-label use. Discuss your specific situation with your healthcare provider to determine if you could benefit from Wegovy despite not meeting the typical criteria.

How long does it take to receive approval for Wegovy coverage?

+The timeline for prior authorization and coverage approval can vary depending on your insurance plan and the complexity of your case. In some instances, it may take a few days to a week, while more complex cases could take several weeks. Stay in communication with your healthcare provider and insurance company to monitor the progress of your request.

Are there any alternative weight loss medications that might be covered by insurance?

+Yes, there are several other weight loss medications that may be covered by insurance. These include medications like Orlistat, Phentermine, and Liraglutide. It’s important to consult with your healthcare provider to determine which medications might be suitable for you and to understand the coverage options available through your insurance plan.

What if my insurance denies coverage for Wegovy? Are there any appeals processes?

+If your insurance plan denies coverage for Wegovy, you have the right to appeal the decision. The appeals process can vary depending on your insurance provider, but typically involves submitting additional documentation or evidence to support your case. Work closely with your healthcare provider and insurance company to navigate the appeals process effectively.

Are there any discounts or programs that can help reduce the cost of Wegovy?

+Yes, there are several programs and initiatives that can help reduce the cost of Wegovy. These include patient assistance programs offered by the manufacturer, as well as co-pay assistance programs or coupons. Additionally, some pharmacies may offer discounted prices or loyalty programs that can lower the out-of-pocket costs associated with Wegovy.