Workers Comp Insurance Ca

Workers' compensation insurance is an essential aspect of the business landscape, providing vital protection for both employers and employees in the event of workplace injuries or illnesses. In California, known as the Golden State, the workers' compensation system plays a crucial role in ensuring the well-being and financial security of its workforce. This comprehensive article will delve into the intricacies of Workers' Comp Insurance in California, offering an in-depth analysis of its regulations, benefits, and impact on businesses and workers alike.

Understanding California’s Workers’ Comp Framework

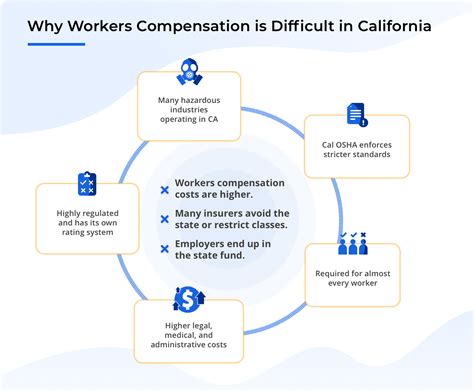

California has one of the most comprehensive and complex workers’ compensation systems in the United States. The state’s regulations are designed to protect employees by ensuring they receive timely and adequate medical care and financial support when injured on the job. Simultaneously, the system aims to provide reasonable costs for employers, striking a balance between employee protection and business viability.

The California Division of Workers' Compensation (DWC) oversees the state's workers' compensation program. This division sets the rules and regulations that govern how workers' comp insurance operates, including determining benefits, resolving disputes, and ensuring compliance.

Key Regulations and Requirements

Employers in California are required by law to carry workers’ compensation insurance, with few exceptions. This coverage is essential to protect both the employer and the employee in the event of a workplace injury or illness. The DWC has set specific guidelines for insurance coverage, including minimum limits and coverage requirements tailored to different industries.

California's workers' comp system is unique in that it offers a no-fault system, meaning injured workers are entitled to benefits regardless of who was at fault for the injury. This system aims to provide swift assistance to injured workers without the need for lengthy legal battles.

Additionally, California has implemented various reforms over the years to address issues like fraud and abuse, ensuring the sustainability and effectiveness of the workers' compensation program.

| Key Statistic | Data |

|---|---|

| Number of Claims in California (2022) | Over 1.2 million |

| Average Cost of Workers' Comp Insurance per Employee (2023) | $1,020 |

| Percentage of Employers with Workers' Comp Coverage (2023) | 97% |

Benefits and Coverage for Injured Workers

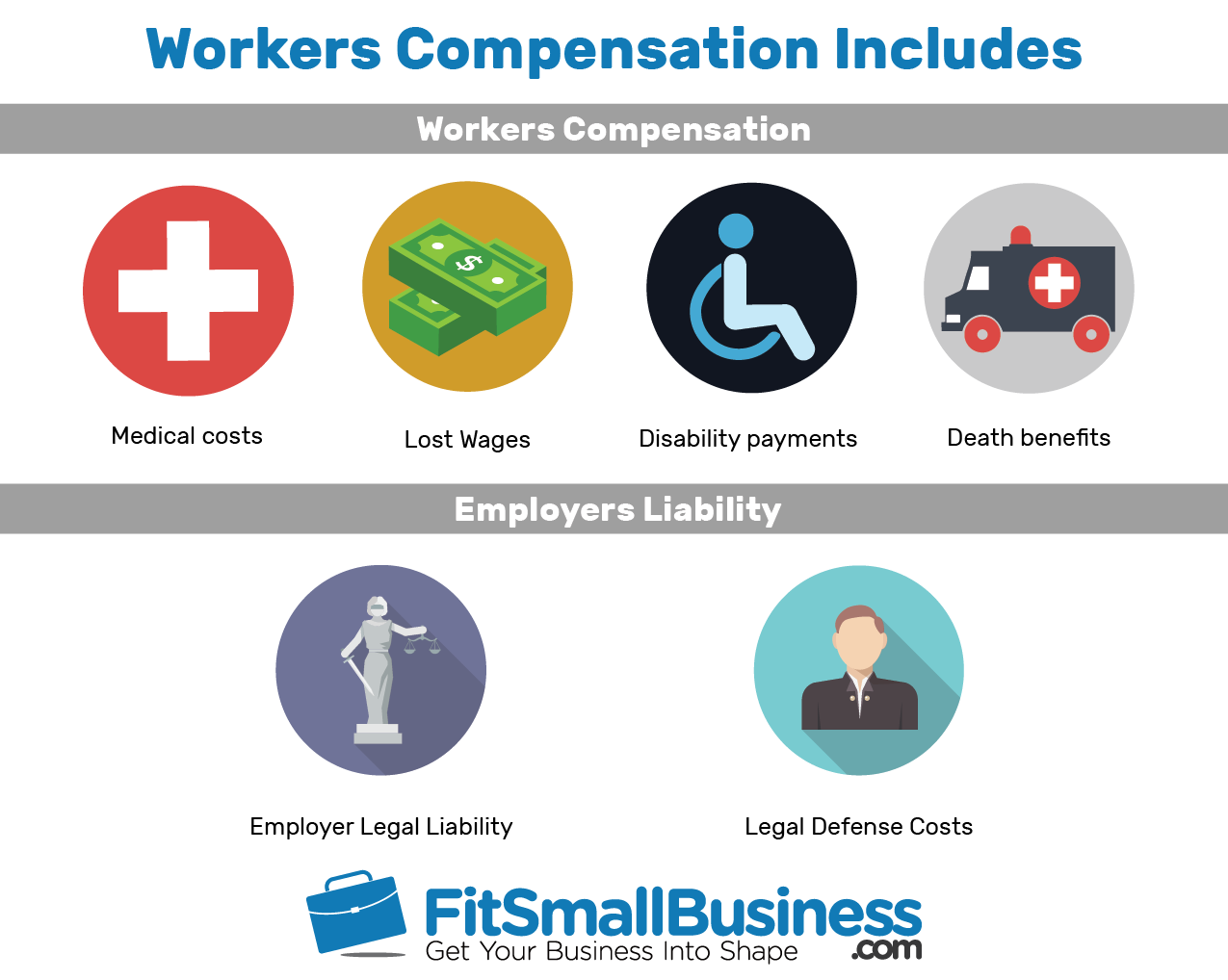

Workers’ compensation insurance in California provides a comprehensive range of benefits to injured workers, ensuring they receive the necessary medical care and financial support during their recovery.

Medical Benefits

One of the primary advantages of workers’ comp is the coverage of medical expenses related to workplace injuries. This includes immediate emergency care, ongoing treatment, medications, and even travel expenses to and from medical appointments. The system ensures that injured workers receive prompt and appropriate medical attention without incurring significant out-of-pocket costs.

California's workers' comp program also covers long-term care and rehabilitation, ensuring that employees can regain their health and return to work safely. This may involve physical therapy, occupational therapy, and counseling services, depending on the nature of the injury.

Indemnity Benefits

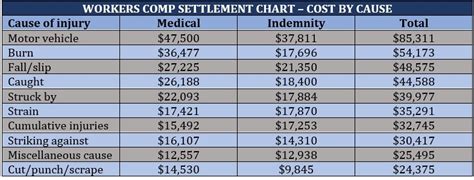

In addition to medical benefits, workers’ compensation insurance provides financial support to employees who are unable to work due to their injuries. This is known as indemnity benefits and can include:

- Temporary Disability Benefits: These payments cover a portion of an employee's lost wages while they are temporarily unable to work due to their injury. The amount is typically calculated as a percentage of the employee's pre-injury wages, with the state setting maximum and minimum benefit amounts.

- Permanent Disability Benefits: If an injury results in a permanent impairment, workers are entitled to permanent disability benefits. The amount is determined based on the severity of the impairment and can be paid as a lump sum or ongoing payments.

- Supplemental Job Displacement Benefits: In some cases, an employee may not be able to return to their previous job due to their injury. In such situations, workers' comp can provide funds to help the employee retrain for a new occupation.

- Vocational Rehabilitation Benefits: These benefits aim to assist injured workers in returning to work by covering the costs of retraining, job placement, and other vocational services.

Impact on Employers and Businesses

Workers’ compensation insurance is not only beneficial for employees but also provides significant advantages for employers and businesses operating in California.

Protection from Liability

By carrying workers’ compensation insurance, employers protect themselves from potential lawsuits and liability claims. The no-fault system in California ensures that employees cannot sue their employers for negligence, as long as the employer has provided the required insurance coverage. This protection helps businesses avoid costly legal battles and potential financial ruin.

Stability and Cost Control

The workers’ compensation system in California is designed to provide stability and predictability for businesses. The DWC sets guidelines and rates for insurance coverage, helping employers budget for and manage their workers’ comp expenses. Additionally, various factors, such as the business’s safety record and loss history, can influence the cost of insurance, encouraging employers to prioritize workplace safety.

Return-to-Work Programs

California’s workers’ comp system encourages and supports employers in implementing return-to-work programs. These programs aim to get injured workers back on the job as soon as possible, often in modified or alternative positions. This not only benefits the employee’s recovery but also reduces the financial burden on the employer and maintains workforce stability.

The Role of Insurance Carriers and Claims Management

In California, workers’ compensation insurance is provided by a range of insurance carriers, including private companies and state-run programs. These carriers play a crucial role in the workers’ comp system by providing the necessary coverage and managing claims.

Insurance Carrier Selection

When choosing a workers’ comp insurance carrier, employers should consider factors such as coverage options, pricing, and the carrier’s reputation for effective claims management. Some carriers specialize in certain industries or offer unique coverage features that may be beneficial for specific types of businesses.

Claims Management and Resolution

The claims management process is a critical aspect of workers’ compensation. When an employee sustains a workplace injury, they must report it to their employer, who then files a claim with the insurance carrier. The carrier assesses the claim, determines eligibility, and authorizes the necessary benefits. This process must be efficient and timely to ensure injured workers receive the care and support they need.

In cases where disputes arise, California's workers' compensation system provides a comprehensive dispute resolution process. This includes informal conferences, mediation, and, if necessary, administrative hearings and appeals. The DWC oversees this process to ensure fairness and timely resolution.

Future Implications and Reforms

California’s workers’ compensation system is constantly evolving to address new challenges and improve its effectiveness. As the state’s workforce and industries change, the system must adapt to ensure it continues to provide adequate protection and support.

Addressing New Workplace Risks

With the rise of new industries and technologies, the nature of workplace injuries is evolving. California’s workers’ comp system must stay abreast of these changes to ensure coverage for emerging risks, such as repetitive strain injuries associated with technology use or mental health issues arising from remote work environments.

Focus on Prevention and Return-to-Work

Preventing workplace injuries is a key focus for California’s workers’ comp system. By encouraging employers to implement effective safety measures and return-to-work programs, the state aims to reduce the number of claims and their associated costs. This not only benefits businesses but also ensures a healthier and more productive workforce.

Continued Reforms and Innovations

California has a history of implementing reforms to address issues within its workers’ compensation system. These reforms often aim to reduce costs, streamline the claims process, and enhance the overall efficiency of the program. As new challenges arise, the state will likely continue to innovate and adapt its workers’ comp regulations to ensure the system remains fair and sustainable.

What are the penalties for employers who fail to carry workers’ compensation insurance in California?

+

Employers who fail to provide the required workers’ compensation insurance coverage in California can face severe penalties. These may include substantial fines, suspension of business operations, and even criminal charges. The state takes these violations seriously to protect employees’ rights and ensure a fair workplace.

How long does it take for a workers’ comp claim to be approved in California?

+

The time it takes for a workers’ compensation claim to be approved in California can vary. Generally, simple and undisputed claims can be approved within a few weeks. However, more complex cases with disputes may take several months or even longer. The process involves thorough evaluations and, if necessary, dispute resolution procedures.

Can injured workers choose their own medical providers under California’s workers’ comp system?

+

In California, injured workers have the right to choose their own medical providers for the initial treatment of their workplace injuries. However, after the initial treatment, the employer or insurance carrier may direct the employee to a specific provider network. This is designed to ensure efficient and cost-effective care.

Are mental health conditions covered by workers’ compensation in California?

+

Yes, mental health conditions can be covered by workers’ compensation in California if they are directly related to a workplace injury or illness. This includes conditions like post-traumatic stress disorder (PTSD) or depression resulting from a workplace incident. However, proving the connection between the mental health condition and the workplace can be complex and often requires expert evaluation.