Www Progressive Insurance Com

Welcome to a comprehensive exploration of Progressive Insurance, a prominent player in the world of auto insurance. With a rich history spanning decades, Progressive has established itself as a trusted provider, offering innovative solutions to meet the diverse needs of its customers. In this article, we delve into the company's evolution, its unique offerings, and the factors that have contributed to its success and longevity in the highly competitive insurance industry.

A Legacy of Innovation: Progressive’s Journey

Founded in 1937 by Joseph Lewis in Cleveland, Ohio, Progressive Insurance started with a simple yet revolutionary idea: to provide customers with more control over their insurance experience. From its early days as a small, regional insurer, Progressive has grown into a national powerhouse, consistently pushing the boundaries of traditional insurance models.

One of the key milestones in Progressive's journey was the introduction of its snapshot program in 2008. This innovative program allowed customers to install a small device in their vehicles, which tracked driving habits such as mileage, speed, and braking. The data collected was then used to offer personalized insurance rates, rewarding safe drivers with lower premiums. This groundbreaking initiative not only revolutionized the way auto insurance rates were determined but also solidified Progressive's reputation as an industry leader in technology-driven solutions.

Comprehensive Coverage Options

Progressive Insurance offers a wide array of coverage options to cater to the diverse needs of its customers. From standard liability coverage to more specialized policies like rental car coverage and rideshare insurance, Progressive ensures that drivers can find a plan that suits their unique circumstances.

For instance, the company's Rental Car Reimbursement coverage provides up to $50 per day (with a maximum of $500) for rental expenses when a customer's vehicle is being repaired due to an insured loss. This add-on coverage ensures that policyholders can maintain their mobility and peace of mind during unexpected repairs.

Unique Offerings:

- Pet Injury Protection: Progressive offers up to $1,000 in coverage for veterinary fees if a customer’s pet is injured in an auto accident.

- Gap Insurance: This coverage helps pay the difference between the actual cash value of a vehicle and the remaining balance on a customer’s loan or lease in the event of a total loss.

- Custom Parts and Equipment Coverage: Progressive recognizes that many drivers customize their vehicles, and this coverage ensures that those modifications are protected in the event of an accident or other covered loss.

Claim Process and Customer Service

Progressive Insurance is renowned for its efficient claim process and exceptional customer service. The company offers a 24⁄7 claims hotline, ensuring that policyholders can receive assistance whenever they need it. Additionally, Progressive’s online claim filing system allows customers to start the process conveniently from their own devices.

The company's Claims Satisfaction Guarantee is a testament to its commitment to customer satisfaction. If a customer is not completely satisfied with the handling of their claim, Progressive will assign a new adjuster to review the case and ensure a fair resolution.

Key Claim Process Features:

- Appraisal Services: Progressive provides access to a network of independent appraisers who can assess the damage to a vehicle and provide an unbiased estimate for repairs.

- Direct Repair Program: Through this program, Progressive works with a network of repair shops to facilitate the repair process, ensuring quality repairs and often providing a lifetime guarantee on the work.

- Claims Center Locations: Progressive operates multiple claims centers across the country, allowing for faster and more efficient processing of claims.

Digital Innovations and Convenience

Progressive Insurance has consistently embraced digital technologies to enhance the customer experience. The company’s website (www.progressive.com) and mobile app offer a seamless and intuitive interface for policyholders to manage their insurance needs.

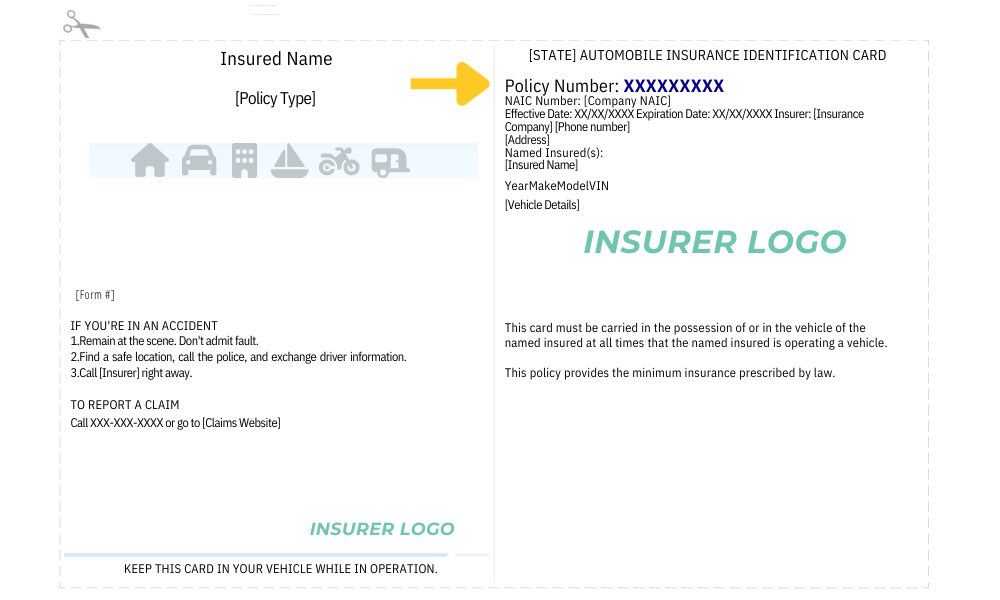

Policyholders can use the app to pay bills, view policy details, and access digital ID cards. Additionally, the app includes a roadside assistance feature, enabling customers to request help with a simple tap and providing real-time updates on the status of their assistance request.

Digital Tools:

- Name Your Price® Tool: This interactive tool allows customers to set their desired premium amount and then receive customized coverage options to meet their budget.

- Online Policy Management: Progressive’s online platform enables customers to make policy changes, add or remove vehicles, and access their insurance documents anytime, anywhere.

- Digital Claims Tracking: Policyholders can track the progress of their claims online or through the app, receiving real-time updates and notifications.

Financial Strength and Stability

Progressive Insurance is known for its strong financial standing, consistently earning high ratings from leading credit rating agencies. This financial stability ensures that policyholders can trust Progressive to be there when they need them most.

| Rating Agency | Rating |

|---|---|

| A.M. Best | A+ (Superior) |

| Standard & Poor's | A (Strong) |

| Moody's | A1 (Good) |

Progressive's financial strength is a testament to its effective risk management strategies and long-term viability, providing added peace of mind for its customers.

What is Progressive’s snapshot program, and how does it work?

+The snapshot program is an innovative initiative by Progressive that allows customers to install a small device in their vehicles to track driving habits. This data is then used to offer personalized insurance rates, rewarding safe drivers with lower premiums. The program is designed to promote safer driving and provide customers with more control over their insurance costs.

How does Progressive’s Rental Car Reimbursement coverage work?

+Progressive’s Rental Car Reimbursement coverage provides up to 50 per day (with a maximum of 500) for rental expenses when a customer’s vehicle is being repaired due to an insured loss. This coverage ensures that policyholders can maintain their mobility and continue with their daily routines while their vehicle is being repaired.

What is Progressive’s Claims Satisfaction Guarantee, and how does it work?

+Progressive’s Claims Satisfaction Guarantee is a commitment to ensuring customer satisfaction during the claims process. If a customer is not completely satisfied with the handling of their claim, Progressive will assign a new adjuster to review the case and ensure a fair resolution. This guarantee demonstrates Progressive’s dedication to providing excellent customer service.