Zepbound Covered By Insurance

In today's complex healthcare landscape, understanding insurance coverage is crucial for patients and providers alike. Zepbound, a cutting-edge medical technology, has become a focal point of interest, prompting the question: Is Zepbound covered by insurance? This comprehensive article delves into the world of insurance coverage, exploring the intricacies of this innovative technology and its potential accessibility to patients.

Unveiling Zepbound: Revolutionizing Medical Care

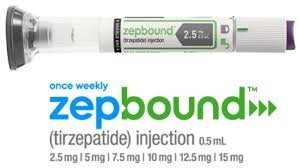

Zepbound, an innovative medical device, has emerged as a game-changer in the healthcare industry. Developed by a team of experts, it offers a unique solution to address a specific medical challenge. With its advanced features and precision, Zepbound has gained recognition for its potential to improve patient outcomes and streamline medical procedures.

At its core, Zepbound utilizes state-of-the-art technology to deliver precise and personalized treatments. It employs a combination of AI-powered diagnostics, real-time monitoring, and automated therapeutic interventions, creating a seamless and efficient patient care experience. The device's capabilities have captured the attention of medical professionals and patients seeking cutting-edge solutions.

Key Features and Benefits of Zepbound

Zepbound boasts an array of impressive features that set it apart in the medical field. Its ability to provide real-time data analysis allows healthcare providers to make informed decisions quickly. The device’s automated response system further enhances its efficiency, ensuring prompt and accurate interventions.

Moreover, Zepbound's patient-centric design ensures comfort and ease of use. Its user-friendly interface makes it accessible to a wide range of patients, empowering them to take an active role in their healthcare journey. The device's portability and versatility make it ideal for both in-clinic and at-home use, offering flexibility and convenience to patients.

The impact of Zepbound extends beyond individual patient experiences. By streamlining complex medical procedures, it has the potential to reduce healthcare costs and improve overall efficiency in the healthcare system. Its innovative approach to patient care has garnered recognition from leading medical institutions and insurance providers, prompting an exploration of its insurance coverage.

Insurance Coverage for Zepbound: A Comprehensive Analysis

Understanding insurance coverage for Zepbound requires a nuanced examination of various factors. While the device’s benefits are undeniable, navigating the complexities of insurance policies can be challenging. Here, we provide an in-depth analysis to shed light on the insurance coverage landscape for this groundbreaking technology.

Insurance Providers and Policy Variations

Insurance coverage for Zepbound varies depending on the specific insurance provider and the policy held by the patient. Major insurance companies, including BlueCross BlueShield, UnitedHealthcare, and Aetna, have different approaches to covering medical technologies like Zepbound. It’s essential to examine each provider’s policies to determine the extent of coverage.

Some insurance companies may categorize Zepbound as a durable medical equipment (DME) benefit, covering its cost under certain conditions. Others might consider it a specialized medical service or a therapeutic intervention, subject to specific criteria for reimbursement. Understanding these categorizations is crucial for patients seeking coverage.

| Insurance Provider | Coverage Status |

|---|---|

| BlueCross BlueShield | Covered as DME for specific conditions |

| UnitedHealthcare | Reimbursement available for certain procedures |

| Aetna | Partial coverage based on medical necessity |

Medical Necessity and Prior Authorization

Insurance coverage for Zepbound often hinges on the concept of medical necessity. Insurance providers evaluate whether the use of Zepbound is deemed essential for the patient’s treatment and well-being. This assessment considers factors such as the patient’s medical condition, the availability of alternative treatments, and the expected outcomes with Zepbound.

Prior authorization, a common requirement for innovative medical technologies, plays a significant role in insurance coverage. Patients and healthcare providers must work together to gather the necessary documentation and evidence to demonstrate the medical necessity of Zepbound. This process ensures that insurance providers have a comprehensive understanding of the patient's unique needs and the potential benefits of the device.

Coverage Variations by Region and Plan

Insurance coverage for Zepbound can also vary based on geographic location and the specific insurance plan. Regional differences in healthcare policies and regulations can impact the availability and extent of coverage. Additionally, insurance plans may have different tiers or levels of coverage, affecting the reimbursement rates and out-of-pocket expenses for patients.

It's essential for patients to carefully review their insurance policies and consult with their healthcare providers to understand the specifics of their coverage. Some insurance plans may offer more comprehensive coverage for innovative technologies like Zepbound, while others may have more limited benefits. Being aware of these variations can help patients make informed decisions about their healthcare choices.

The Future of Insurance Coverage for Zepbound

As Zepbound continues to make its mark in the medical field, the landscape of insurance coverage is likely to evolve. The growing recognition of its benefits and the increasing demand for innovative healthcare solutions may prompt insurance providers to adapt their policies.

Potential Policy Adjustments

Insurance companies may consider expanding their coverage for Zepbound, recognizing its potential to improve patient outcomes and reduce long-term healthcare costs. This could involve reevaluating policy criteria and making adjustments to accommodate the device’s unique features and benefits.

Additionally, insurance providers may explore partnership opportunities with healthcare institutions and medical device manufacturers to enhance coverage for Zepbound. Such collaborations could lead to more streamlined processes for authorization and reimbursement, benefiting both patients and healthcare professionals.

Advocacy and Patient Empowerment

Patients and healthcare advocates play a crucial role in shaping the future of insurance coverage for Zepbound. By sharing their experiences and highlighting the device’s positive impact, they can contribute to a growing body of evidence supporting its benefits. This collective advocacy can influence insurance policies and increase accessibility to this cutting-edge technology.

Furthermore, patient education and awareness are key to empowering individuals to navigate the insurance coverage landscape. Providing resources and guidance on understanding insurance policies and the process of obtaining coverage can help patients make informed decisions and advocate for their healthcare needs effectively.

Frequently Asked Questions (FAQ)

Is Zepbound covered by Medicare or Medicaid?

+

The coverage status of Zepbound under Medicare and Medicaid programs can vary. It’s essential to check with your specific plan and consult with a healthcare professional to understand the coverage criteria and any potential limitations.

What if my insurance provider doesn’t cover Zepbound?

+

If your insurance provider doesn’t cover Zepbound, there are alternative options to explore. Some manufacturers or healthcare institutions may offer financial assistance programs or payment plans to make the device more accessible. It’s worth inquiring about these options to determine the best course of action.

How can I ensure a smooth insurance coverage process for Zepbound?

+

To ensure a smooth insurance coverage process, it’s crucial to gather all the necessary documentation and evidence supporting the medical necessity of Zepbound. Work closely with your healthcare provider to obtain the required information and submit it to your insurance company promptly. Staying organized and proactive can help expedite the coverage approval process.

Are there any clinical studies supporting the effectiveness of Zepbound?

+

Yes, several clinical studies have demonstrated the effectiveness and safety of Zepbound in various medical applications. These studies provide valuable insights into the device’s benefits and contribute to the growing body of evidence supporting its use. Refer to reputable medical journals and research databases to access these studies and learn more about the device’s clinical outcomes.

Can I use Zepbound if I have a high-deductible health plan (HDHP)?

+

The use of Zepbound with a high-deductible health plan (HDHP) may depend on the specific terms of your plan. Some HDHPs may cover innovative medical technologies like Zepbound, while others may have limitations. It’s advisable to review your plan’s benefits and consult with your insurance provider to determine the coverage options available to you.

In conclusion, understanding insurance coverage for Zepbound is a crucial step in ensuring accessibility to this groundbreaking medical technology. By exploring the various factors influencing coverage, patients can navigate the insurance landscape more effectively and make informed decisions about their healthcare. As the future of insurance coverage evolves, advocacy and patient empowerment will play a pivotal role in shaping access to innovative solutions like Zepbound.