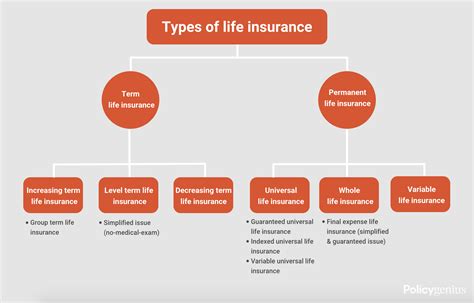

2 Types Of Life Insurance

Understanding the Basics: A Comprehensive Guide to Life Insurance Types

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their loved ones. With a vast array of policies available, it's crucial to understand the different types of life insurance to make informed decisions. In this comprehensive guide, we'll delve into the world of life insurance, exploring two primary categories: Term Life Insurance and Permanent Life Insurance. By the end of this article, you'll have a clear understanding of these policies, their features, and how they can benefit you and your family.

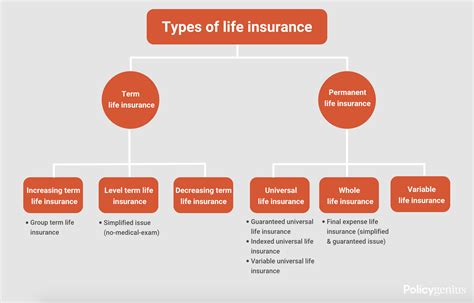

Term Life Insurance: A Temporary Solution for Long-Term Protection

Term life insurance is a popular and affordable option for many individuals seeking life insurance coverage. As the name suggests, this type of policy provides coverage for a specified term, typically ranging from 10 to 30 years. During this term, the policyholder pays regular premiums, and in the event of their death, the beneficiaries receive a tax-free death benefit.

Key Features of Term Life Insurance:

- Affordability: Term life insurance is often the most cost-effective option, especially for younger individuals or those with tight budgets. The premiums are usually lower compared to permanent life insurance policies.

- Flexibility: Policyholders can choose the coverage amount and term length based on their specific needs. This flexibility allows for tailored protection to cover financial obligations like mortgages, education expenses, or income replacement.

- Renewal Options: Many term life policies offer the option to renew the policy at the end of the term. While the premiums may increase with age, this ensures continued coverage even if your health status changes.

- Convertible Feature: Some term life policies allow policyholders to convert their term policy into a permanent life insurance policy without undergoing a medical exam. This can be beneficial if your financial situation or needs change over time.

When to Consider Term Life Insurance:

Term life insurance is ideal for individuals with temporary financial obligations. For example, if you have young children and want to ensure their financial security until they reach adulthood, a term life policy can provide the necessary coverage. It's also a good choice for covering specific debts or obligations that have a defined timeframe.

Permanent Life Insurance: A Lifetime of Protection and Financial Benefits

Permanent life insurance, as the name suggests, provides coverage for the policyholder's entire life, offering a range of benefits beyond just a death benefit. These policies accumulate cash value over time, which can be accessed through loans or withdrawals during the policyholder's lifetime.

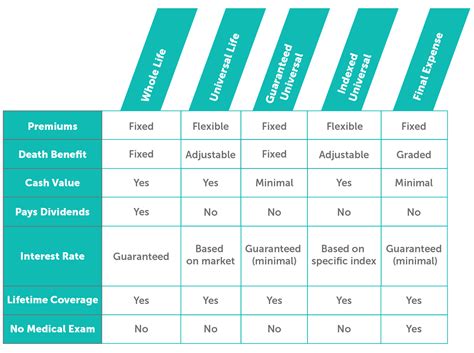

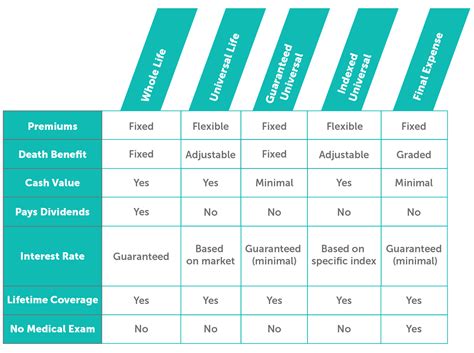

Types of Permanent Life Insurance:

- Whole Life Insurance: This is the most common type of permanent life insurance. It offers a fixed premium and a guaranteed death benefit. The policy accumulates cash value, which can be used for various financial goals like retirement planning or emergency funds.

- Universal Life Insurance: Universal life policies offer more flexibility than whole life. Policyholders can adjust their premiums and death benefits within certain limits, making it a customizable option. The cash value component grows based on market performance, providing potential for higher returns.

- Variable Life Insurance: Variable life policies allow policyholders to invest their premiums in different sub-accounts, similar to mutual funds. While this offers potential for higher returns, it also carries more risk as the policy's value can fluctuate based on market performance.

- Indexed Universal Life Insurance: Indexed universal life policies combine elements of universal life and variable life. The cash value is tied to a financial index, like the S&P 500, providing potential for growth while mitigating some of the risks associated with direct market exposure.

Key Benefits of Permanent Life Insurance:

- Lifetime Coverage: Unlike term life insurance, permanent life insurance remains in force as long as premiums are paid, providing lifelong protection.

- Cash Value Accumulation: The cash value component grows over time, offering a financial safety net that can be used for various purposes like retirement planning, emergency funds, or paying for long-term care.

- Tax Advantages: The cash value within a permanent life insurance policy grows tax-deferred, and withdrawals or loans taken against the cash value are generally tax-free as long as they don't exceed the cost basis of the policy.

- Flexibility and Customization: Many permanent life insurance policies offer flexibility in terms of premium payments and death benefit amounts, allowing policyholders to adjust their coverage based on changing needs or financial situations.

When to Choose Permanent Life Insurance:

Permanent life insurance is ideal for individuals seeking long-term financial protection and those who want to build cash value over time. It's particularly beneficial for estate planning, as the death benefit can be used to pay estate taxes or cover other expenses. Additionally, the cash value component can be a valuable tool for retirement planning or funding long-term care needs.

Comparing Term and Permanent Life Insurance: Which is Right for You?

Choosing between term and permanent life insurance depends on your unique financial situation and goals. Term life insurance is often a more affordable option for those with temporary financial obligations, while permanent life insurance provides long-term protection and financial benefits. Here's a quick comparison:

| Category | Term Life Insurance | Permanent Life Insurance |

|---|---|---|

| Coverage Period | Fixed term (10-30 years) | Lifetime |

| Premiums | Generally lower, especially for younger individuals | Higher, but provides long-term protection and cash value accumulation |

| Death Benefit | Pays out a lump sum to beneficiaries upon death during the term | Pays out a lump sum to beneficiaries upon death at any time |

| Cash Value | None | Accumulates cash value over time, providing financial flexibility |

| Flexibility | Offers flexibility in coverage amounts and term length | Provides flexibility in premium payments and death benefit amounts |

It's important to note that both types of life insurance have their advantages and disadvantages. The right choice depends on your financial goals, risk tolerance, and the level of protection you require. Consulting with a qualified financial advisor or insurance agent can help you make an informed decision tailored to your specific needs.

Conclusion: Navigating the Life Insurance Landscape

Life insurance is a crucial aspect of financial planning, and understanding the different types available is the first step toward securing your future and the future of your loved ones. Whether you opt for the affordability and flexibility of term life insurance or the long-term protection and financial benefits of permanent life insurance, having a solid understanding of these policies will help you make confident decisions about your financial well-being.

Remember, life insurance is not a one-size-fits-all solution. Your needs and circumstances will evolve over time, so it's essential to review and adjust your coverage as necessary. Stay informed, stay protected, and ensure a secure future for you and your family.

Can I switch from term life insurance to permanent life insurance later in life?

+Yes, many term life insurance policies offer a conversion feature, allowing policyholders to convert their term policy into a permanent life insurance policy without undergoing a medical exam. However, the conversion option usually has a deadline, so it’s important to review your policy and make the switch within the specified timeframe.

What happens if I stop paying premiums on my term life insurance policy?

+If you stop paying premiums on your term life insurance policy, the coverage will lapse, and you will no longer be insured. However, some policies offer a grace period, typically 30 days, during which you can pay the missed premium without any interruption in coverage. It’s important to stay up-to-date with your premium payments to maintain continuous coverage.

Can I borrow against the cash value of my permanent life insurance policy?

+Yes, one of the key benefits of permanent life insurance is the ability to access the cash value through loans or withdrawals. However, it’s important to note that any outstanding loan amount will reduce the death benefit payable to your beneficiaries. Additionally, interest will accrue on the loan, and if the policy lapses, the loan amount plus interest will be due.