3Rd Party Rental Car Insurance

In the world of travel and car rentals, understanding insurance coverage is crucial. This article delves into the intricacies of third-party rental car insurance, a vital aspect for anyone planning a trip that involves renting a vehicle. From demystifying the concept to exploring its benefits and how it works, we'll provide an in-depth analysis to ensure you're well-informed.

Understanding Third-Party Rental Car Insurance

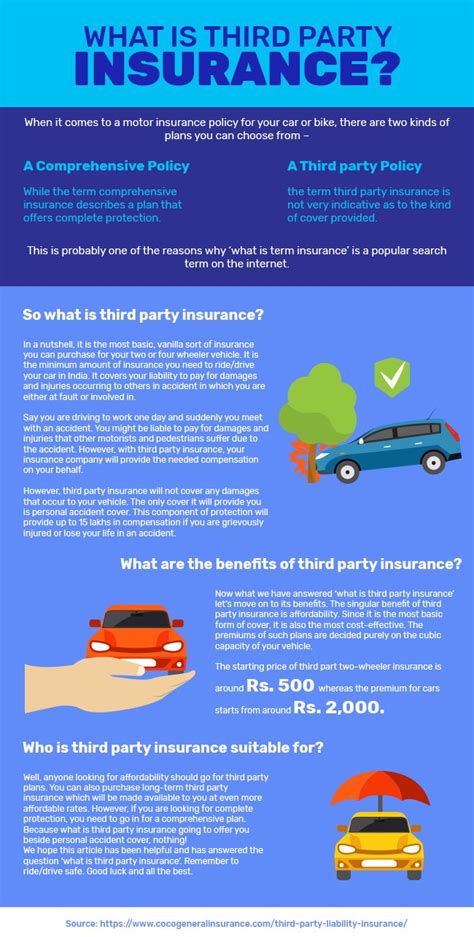

Third-party rental car insurance, often referred to as Liability Insurance or Third-Party Liability, is a crucial component of your rental car agreement. This type of insurance covers damages or injuries that you, as the renter, may cause to others or their property while driving the rental vehicle.

Unlike comprehensive insurance, which covers damages to your rental car, third-party insurance focuses on protecting you financially if you're found legally responsible for an accident that harms others or their belongings. It's an essential aspect of rental car coverage, ensuring you're protected against potential lawsuits and financial liabilities.

Why It's Important

In many countries, having third-party insurance is not just a recommendation but a legal requirement. Even if it's not mandated by law, carrying this type of insurance is a prudent decision. It provides a safety net, ensuring you're financially protected in the event of an accident. Without it, you could face significant out-of-pocket expenses and potential legal issues.

Furthermore, third-party insurance is often a requirement to obtain other types of rental car insurance. For instance, you may need it to purchase Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW), which cover damages to the rental vehicle itself. This interdependence highlights the critical role of third-party insurance in the rental car industry.

How Third-Party Rental Car Insurance Works

When you rent a car, the rental company typically offers various insurance options, including third-party liability coverage. This coverage usually has a set limit, which is the maximum amount the insurer will pay out for damages or injuries caused by you.

Policy Limits

Policy limits can vary significantly depending on the rental company and the country you're in. For example, in the United States, third-party liability insurance often has a limit of $1 million per occurrence. This means the insurer will pay up to $1 million for damages or injuries caused in a single accident.

In contrast, European rental car companies often offer higher limits, sometimes as high as €10 million or more. These higher limits provide greater peace of mind, especially when traveling in countries with higher medical and legal costs.

| Region | Typical Third-Party Liability Limit |

|---|---|

| United States | $1 million |

| Europe | €10 million |

| Australia | $20 million |

| New Zealand | $10 million |

It's important to note that policy limits can also vary based on the type of vehicle you're renting. Luxury vehicles or larger SUVs may have higher policy limits due to the increased potential for damage or injuries in an accident.

Excess or Deductible

Most third-party liability insurance policies also come with an excess or deductible, which is the amount you, as the policyholder, are responsible for paying in the event of a claim. This amount is typically deducted from the total claim amount before the insurer pays out.

For instance, if your third-party liability insurance has a limit of $1 million and an excess of $500, and you cause an accident resulting in $750,000 in damages, you would be responsible for paying the first $500, and the insurer would cover the remaining $749,500.

Coverage and Exclusions

Understanding what is and isn't covered by third-party rental car insurance is essential. Here's a breakdown of the typical coverage and exclusions you can expect.

Covered Scenarios

- Property Damage: This includes damage to other vehicles, street signs, fences, or any other property involved in an accident caused by you.

- Personal Injury: Third-party insurance covers medical expenses and compensation for injuries sustained by others in an accident for which you are at fault.

- Legal Costs: If you're sued as a result of an accident, your third-party insurance can cover the legal fees and any compensation awarded to the other party.

Common Exclusions

- Damage to Your Rental Vehicle: Third-party insurance does not cover damage to the rental car itself. For this, you'll need to purchase additional insurance, such as CDW or LDW.

- Intentional Acts: If an accident occurs due to intentional or reckless behavior, third-party insurance may not provide coverage.

- Business Use: If you're using the rental car for business purposes, your third-party insurance may not apply. Business use often requires a separate commercial policy.

- Certain Locations: Some rental car insurance policies may have geographical restrictions. For instance, they might not cover accidents that occur in certain high-risk areas or during specific events.

How to Obtain Third-Party Rental Car Insurance

There are several ways to obtain third-party liability insurance when renting a car. Here's an overview of the most common methods:

Rental Company Insurance

Most rental car companies offer their own third-party liability insurance as an add-on to your rental agreement. This insurance is typically included in the "Basic" or "Standard" insurance package. It's often the most convenient option, as it's provided by the rental company itself and can be easily added to your rental.

Credit Card Coverage

Many credit cards offer rental car insurance benefits as part of their cardholder benefits. This coverage often includes third-party liability insurance, although it's important to check the specific terms and conditions of your card. Credit card insurance may have certain restrictions, such as the type of vehicle rented or the duration of the rental.

Travel Insurance Policies

Travel insurance policies often include rental car insurance coverage, including third-party liability. This option is particularly beneficial if you're a frequent traveler, as you can get comprehensive travel insurance that covers various aspects of your trip, including rental car insurance.

Third-Party Insurance Providers

There are also specialized insurance providers that offer standalone rental car insurance policies. These policies can be purchased online or through a travel agent. They often provide more flexibility in terms of coverage options and may be more cost-effective for long-term rentals.

The Benefits of Third-Party Rental Car Insurance

Third-party liability insurance offers several key benefits that make it an essential consideration when renting a car.

Financial Protection

The primary benefit of third-party insurance is financial protection. In the event of an accident where you're at fault, this insurance covers the cost of damages and injuries sustained by others. Without it, you could be personally liable for these costs, which can quickly add up and result in significant financial strain.

Peace of Mind

Having third-party insurance provides peace of mind during your travels. You can focus on enjoying your trip without worrying about the potential financial implications of an accident. This insurance ensures you're prepared for the unexpected, allowing you to travel with confidence.

Legal Compliance

In many countries, having third-party liability insurance is a legal requirement when renting a car. By obtaining this insurance, you ensure you're compliant with local laws and regulations, avoiding potential legal issues and fines.

Tips for Choosing Third-Party Rental Car Insurance

When selecting third-party liability insurance, there are several factors to consider to ensure you're getting the best coverage for your needs.

Policy Limits

Ensure the policy limits are sufficient for the region you're traveling in. Higher policy limits are generally recommended, especially if you're traveling to countries with higher medical and legal costs.

Excess or Deductible

Consider the excess or deductible amount. A lower excess or deductible means you'll have to pay less out of pocket in the event of a claim. However, policies with lower excesses often come with higher premiums.

Additional Coverage

Look for policies that offer additional coverage, such as personal accident insurance or coverage for rental vehicle keys. These add-ons can provide extra protection and peace of mind.

Reputable Insurers

Choose insurance providers with a solid reputation and financial stability. This ensures they'll be able to pay out claims if needed.

Read the Fine Print

Always read the terms and conditions carefully. Understand the coverage, exclusions, and any specific limitations or restrictions that may apply to your policy.

Frequently Asked Questions

Is third-party rental car insurance mandatory?

+In many countries, yes. It's a legal requirement to have third-party liability insurance when renting a car. Check the regulations in your destination country to ensure compliance.

Can I use my personal car insurance for rental cars?

+Personal car insurance policies often include some level of third-party liability coverage, but it's crucial to check the specific terms of your policy. Coverage may be limited or have certain restrictions when it comes to rental cars.

What happens if I don't have third-party insurance and cause an accident?

+If you cause an accident and don't have third-party insurance, you could be personally liable for all damages and injuries. This could result in significant out-of-pocket expenses and potential legal issues.

Can I get third-party insurance for a one-way rental?

+Yes, most rental car companies and insurance providers offer third-party insurance for one-way rentals. However, be sure to check the terms and conditions, as there may be additional fees or restrictions.

How much does third-party rental car insurance typically cost?

+The cost of third-party insurance can vary widely depending on the rental company, the duration of the rental, the type of vehicle, and the region. On average, it can range from $10 to $30 per day, but it's best to get a specific quote for your rental.

Understanding third-party rental car insurance is a crucial aspect of responsible travel planning. By ensuring you have adequate coverage, you can protect yourself financially and legally, and travel with peace of mind.