Vehicle Insurance Quotes

Vehicle insurance is an essential aspect of owning and operating a motor vehicle. It provides financial protection and peace of mind to drivers and vehicle owners, ensuring that they are covered in case of accidents, theft, or other unforeseen circumstances. Obtaining insurance quotes is the first step towards securing the right coverage, and it involves a careful evaluation of various factors to find the best policy that suits individual needs.

Understanding Vehicle Insurance Quotes

Vehicle insurance quotes are estimates provided by insurance companies to potential clients, detailing the cost of coverage for a specific vehicle and driver profile. These quotes are based on a range of factors, including the make and model of the vehicle, the driver’s age, driving history, location, and the desired level of coverage.

When requesting insurance quotes, individuals often explore different options to find the most comprehensive and cost-effective policy. Insurance providers use a variety of criteria to assess risk and determine premiums, so it's crucial to understand these factors to make informed decisions.

Factors Influencing Insurance Quotes

Several key factors play a role in determining vehicle insurance quotes:

- Vehicle Type and Value: The make, model, and age of the vehicle significantly impact insurance costs. Sports cars and luxury vehicles generally have higher premiums due to their expensive repair costs and higher risk of theft.

- Driver Profile: Insurance companies consider the age, gender, and driving record of the primary driver. Younger drivers, especially males, often face higher premiums due to their perceived higher risk of accidents.

- Location and Usage: The area where the vehicle is primarily driven and parked can affect insurance rates. Urban areas with higher traffic density and crime rates may result in higher premiums. Additionally, the purpose of the vehicle’s usage, such as personal, commercial, or leisure, can influence the quote.

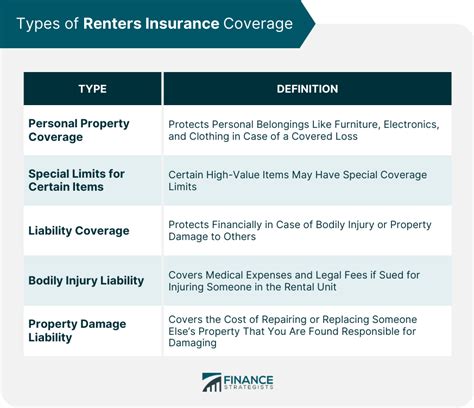

- Coverage Options: The level of coverage desired, including liability, comprehensive, and collision coverage, affects the overall quote. Higher coverage limits typically result in higher premiums.

- Discounts and Bundling: Insurance companies offer discounts for various reasons, such as safe driving records, vehicle safety features, and bundling multiple policies (e.g., auto and home insurance) with the same provider.

By understanding these factors, individuals can better navigate the insurance quote process and make informed choices about their coverage.

The Process of Obtaining Vehicle Insurance Quotes

Obtaining vehicle insurance quotes is a straightforward process, but it requires careful consideration and comparison to find the best policy. Here’s a step-by-step guide:

Step 1: Research and Compare Insurance Providers

Start by researching and comparing different insurance companies. Look for reputable providers with a good track record of customer satisfaction and financial stability. Consider the range of coverage options and any additional services or benefits they offer.

Utilize online resources, consumer reviews, and industry ratings to narrow down your options. Focus on companies that align with your specific needs and preferences.

Step 2: Gather Necessary Information

To obtain accurate insurance quotes, you’ll need to provide detailed information about yourself and your vehicle. This includes your personal details, such as name, date of birth, and driving record, as well as vehicle information like make, model, year, and VIN number.

Additionally, have your current insurance policy (if applicable) and any recent accident or claim history readily available. This information will help insurance providers accurately assess your risk profile.

Step 3: Request Quotes

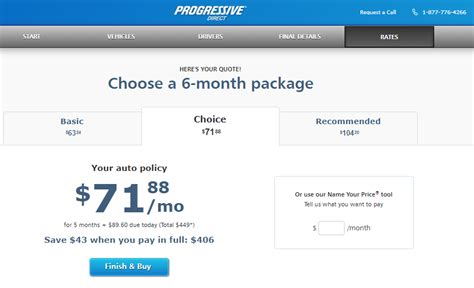

Once you’ve gathered the necessary information, request quotes from your selected insurance providers. You can do this online through their websites or by contacting them directly via phone or email.

When requesting quotes, be as specific as possible about your coverage needs. Indicate the desired levels of liability, comprehensive, and collision coverage, and any additional features you require, such as rental car reimbursement or roadside assistance.

Step 4: Compare Quotes and Evaluate Coverage

After receiving quotes from multiple providers, it’s time to compare and evaluate the options. Carefully examine the coverage details, limits, and exclusions in each policy. Ensure that the policies you’re considering provide adequate protection for your specific needs.

Consider the overall cost of the policy, including any applicable deductibles and additional fees. Remember that the cheapest quote may not always be the best option, as it might offer insufficient coverage.

Step 5: Negotiate and Finalize Your Policy

If you find a quote that meets your needs and budget, you can proceed to negotiate the terms and finalize the policy. Insurance providers often have some flexibility in pricing, so don’t hesitate to ask about discounts or additional coverage options.

Review the policy documents thoroughly, ensuring you understand all the terms and conditions. If you have any questions or concerns, reach out to the insurance provider for clarification.

Maximizing Your Insurance Coverage and Savings

While obtaining vehicle insurance quotes is a critical step, it’s equally important to ensure you’re getting the most value from your policy. Here are some strategies to maximize your coverage and savings:

Understanding Coverage Limits

Different insurance policies offer varying coverage limits. It’s essential to understand these limits and choose a policy that provides adequate protection for your specific situation. Consider your financial responsibilities and the potential costs associated with accidents or other incidents.

For example, if you frequently drive in urban areas with high traffic congestion and accident risks, higher liability limits might be beneficial. Similarly, if you own a valuable vehicle, comprehensive coverage with a lower deductible can provide better protection.

Bundling Policies

Bundling multiple insurance policies, such as auto and home insurance, with the same provider can often lead to significant savings. Insurance companies typically offer discounts when you consolidate your policies, as it reduces administrative costs and simplifies your insurance management.

Additionally, bundling policies can provide better coverage and streamlined claims processes. For instance, if you have a home insurance policy with the same provider as your auto insurance, you may benefit from more efficient handling of claims involving both your home and vehicle.

Utilizing Discounts and Incentives

Insurance companies offer a range of discounts and incentives to attract and retain customers. These discounts can significantly reduce your insurance premiums, so it’s worthwhile to explore all available options.

Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and discounts for vehicles equipped with safety features. Some providers also offer loyalty discounts for long-term customers.

When requesting quotes, inquire about the available discounts and ensure you're taking advantage of all applicable incentives.

Maintaining a Clean Driving Record

Your driving record is a critical factor in determining insurance quotes. Maintaining a clean driving record with no accidents or violations can significantly lower your premiums. Insurance companies view safe drivers as lower risk, resulting in more favorable quotes.

If you have a less-than-perfect driving record, consider taking defensive driving courses or completing safe driving programs. These initiatives can improve your driving skills, reduce the likelihood of accidents, and potentially lead to insurance discounts.

Regularly Review and Update Your Policy

Insurance needs and circumstances can change over time. It’s important to regularly review your policy to ensure it still meets your requirements. Life events such as marriage, purchasing a new vehicle, or moving to a different location may impact your insurance needs.

Additionally, keep an eye on market trends and competitive insurance rates. Periodically shopping around for quotes can help you identify better deals and ensure you're not overpaying for your coverage.

Conclusion

Vehicle insurance quotes are a vital tool for securing the right coverage at an affordable price. By understanding the factors that influence quotes and following a systematic approach to obtaining and evaluating them, you can make informed decisions about your insurance coverage.

Remember to maximize your coverage and savings by exploring bundling options, utilizing discounts, maintaining a clean driving record, and regularly reviewing your policy. With the right approach, you can find an insurance policy that provides the protection you need without straining your finances.

How often should I shop around for insurance quotes?

+It’s recommended to shop around for insurance quotes at least once a year. Market conditions and insurance rates can change, so it’s beneficial to periodically review your options to ensure you’re getting the best deal.

Can I negotiate insurance quotes?

+Yes, you can negotiate insurance quotes. Insurance providers often have some flexibility in pricing, so don’t hesitate to discuss your options and inquire about potential discounts or adjustments to your policy.

What factors can lead to higher insurance premiums?

+Several factors can lead to higher insurance premiums, including a poor driving record with accidents or violations, living in an area with high crime rates or frequent natural disasters, driving a high-performance or luxury vehicle, and choosing higher coverage limits.