Renters Insurance Dc

Renters insurance, also known as tenant insurance, is an essential yet often overlooked aspect of protecting oneself as a tenant in the vibrant city of Washington, D.C. With its diverse neighborhoods, bustling city life, and unique cultural attractions, DC offers a wide range of rental options, from cozy apartments to historic row houses. However, amidst the excitement of city living, it's crucial to safeguard your possessions and ensure you're covered in case of unexpected events. That's where renters insurance steps in.

In this comprehensive guide, we'll delve into the world of renters insurance in DC, exploring its significance, the coverage it provides, and the key considerations for choosing a policy that suits your needs. Whether you're a student renting your first apartment in the vibrant U Street Corridor or a young professional settling into a modern condo near the Capitol, understanding renters insurance is vital to your financial well-being.

Understanding Renters Insurance: The Basics

Renters insurance is a type of property insurance specifically designed to cover the personal belongings and liabilities of individuals who rent their living spaces. Unlike homeowners insurance, which covers the structure and its contents, renters insurance primarily focuses on the items you bring into your rental home.

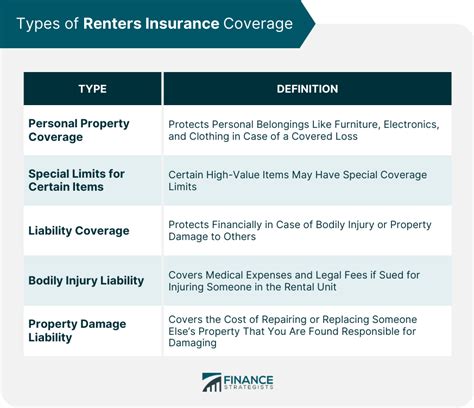

Here's a breakdown of the key components of renters insurance:

Personal Property Coverage

This is the heart of renters insurance. It provides financial protection for your belongings, including furniture, electronics, clothing, and other personal items, in case of theft, fire, water damage, or other covered perils. The coverage typically extends to your possessions both inside and outside your rental unit, offering peace of mind during your daily commute or travels.

| Coverage Type | Description |

|---|---|

| Replacement Cost Coverage | Pays the full cost to replace your items without deducting depreciation. |

| Actual Cash Value Coverage | Reimburses you for the current value of your items, considering depreciation. |

Liability Protection

Renters insurance also provides liability coverage, which is crucial for protecting you against lawsuits and legal fees if someone is injured in your rental unit or if you accidentally cause damage to someone else’s property. This coverage can be a lifesaver, especially in a city like DC, where accidents can happen unexpectedly.

Additional Living Expenses

In the event that your rental unit becomes uninhabitable due to a covered loss, this coverage helps cover your additional living expenses, such as temporary housing and meals, until you can return to your home.

Personal Injury Protection

Some renters insurance policies offer personal injury protection, which can cover legal expenses if you’re sued for defamation, libel, or other non-physical injuries.

Why Renters Insurance is Essential in DC

Washington, D.C., is a city teeming with life, but it also presents unique challenges that highlight the importance of renters insurance. Here’s why it’s a necessity for DC tenants:

High Risk of Theft and Property Damage

With its urban landscape and diverse population, DC experiences a relatively high rate of property crime. Renters insurance provides a safety net against theft, vandalism, and other property damage incidents.

Natural Disasters and Severe Weather

DC is not immune to natural disasters. From summer storms to winter blizzards, severe weather can cause significant damage. Renters insurance can help cover losses from weather-related events.

High Cost of Living

DC’s thriving economy and diverse job market come with a high cost of living. Renters insurance ensures that, should the worst happen, you’re not left facing the financial burden of replacing your belongings alone.

Legal Protection

In a city as populous as DC, accidents and legal disputes can arise. Liability coverage in your renters insurance policy provides a vital layer of protection against potential lawsuits.

Choosing the Right Renters Insurance Policy in DC

Selecting the appropriate renters insurance policy is crucial to ensure you have the coverage you need without paying for unnecessary features. Here are some key factors to consider when choosing a policy in DC:

Coverage Limits

Determine the value of your personal belongings and choose a policy with coverage limits that adequately reflect their worth. Overestimating your coverage can lead to unnecessary expenses, while underestimating may leave you vulnerable.

Deductibles

Consider your financial situation and choose a deductible that aligns with your budget. A higher deductible can lower your premium, but it means you’ll pay more out of pocket if you need to file a claim.

Policy Add-Ons

Some policies offer additional coverage for specific items, such as jewelry, art, or musical instruments. If you have valuable possessions, consider adding these endorsements to your policy.

Discounts and Bundles

Look for insurers that offer discounts for bundling renters insurance with other policies, such as auto insurance. You may also qualify for discounts based on your age, occupation, or loyalty.

Reputation and Customer Service

Research the insurer’s reputation for prompt claim handling and customer satisfaction. You want an insurer that will be there for you when you need them most.

Real-Life Examples of Renters Insurance Claims in DC

To illustrate the importance of renters insurance, let’s explore some real-life scenarios where DC tenants have benefited from having a solid insurance policy:

Case Study 1: Apartment Fire

In a downtown DC apartment building, a fire broke out in a unit above a young professional’s rental. The fire spread quickly, causing significant damage to multiple units, including their own. The tenant’s renters insurance policy covered the cost of replacing their damaged belongings and provided additional living expenses while their unit was being repaired.

Case Study 2: Burglary

A student living near American University experienced a burglary while away for a long weekend. The thieves made off with valuable electronics and jewelry. Fortunately, the student had renters insurance, which reimbursed them for the full value of the stolen items.

Case Study 3: Liability Claim

A DC resident accidentally left a candle unattended, which resulted in a small fire that caused smoke damage to their apartment and the unit below. Their renters insurance policy covered the cost of repairs and also provided liability protection, covering the legal fees and settlement for the neighbor’s claim.

Tips for Maximizing Your Renters Insurance in DC

Now that you understand the importance and benefits of renters insurance, here are some additional tips to get the most out of your policy:

- Create an inventory of your belongings, including photos and receipts, to streamline the claims process.

- Review your policy annually to ensure it aligns with your current needs and the value of your possessions.

- Consider increasing your coverage limits if you make significant purchases, such as a new TV or computer.

- Take advantage of safety features like smoke detectors and security systems, which may qualify you for discounts.

- Understand your policy's exclusions and limitations to avoid surprises when filing a claim.

The Future of Renters Insurance in DC

As the insurance industry continues to evolve, renters insurance is likely to become even more tailored to the unique needs of DC tenants. Here are some potential future developments:

Digital Innovation

Insurance companies are increasingly embracing digital technologies, offering online platforms for policy management and claims filing. This can make renters insurance more accessible and convenient for DC residents.

Enhanced Personalization

With advancements in data analytics, insurers may be able to offer more personalized policies, taking into account individual risk factors and lifestyle choices.

Expanded Coverage Options

As the sharing economy grows, renters insurance policies may start to include coverage for short-term rental platforms like Airbnb, ensuring tenants can protect their belongings even when hosting guests.

Environmental Risks

With climate change becoming an increasingly pressing issue, renters insurance policies may begin to offer coverage for losses related to environmental disasters, such as flooding or extreme weather events.

Conclusion

Renters insurance is an essential tool for safeguarding your financial well-being as a tenant in Washington, D.C. By understanding the coverage it provides and choosing the right policy, you can protect yourself from unexpected losses and legal liabilities. Whether you’re a long-time resident or a new arrival, having a comprehensive renters insurance policy is a wise investment in your peace of mind and financial security.

How much does renters insurance cost in DC?

+The cost of renters insurance in DC can vary based on several factors, including the coverage limits you choose, the value of your belongings, and your deductible. On average, renters insurance in DC costs around 15 to 30 per month. However, it’s essential to get quotes from multiple insurers to find the best coverage at the most competitive price.

Does my landlord require me to have renters insurance?

+While DC does not have a specific law mandating renters insurance, many landlords include it as a requirement in their lease agreements. It’s always a good idea to check with your landlord to understand their expectations and whether they have any preferred insurance providers.

Can I bundle my renters insurance with my auto insurance policy to save money?

+Absolutely! Bundling your renters and auto insurance policies is a great way to save money. Most insurance companies offer discounts when you bundle multiple policies. By doing so, you can potentially reduce your overall insurance costs and streamline your policy management.

What should I do if I need to file a renters insurance claim in DC?

+If you need to file a claim, contact your insurance company as soon as possible. They will guide you through the claims process, which typically involves providing documentation of the loss, such as photos, receipts, and an inventory of damaged or stolen items. It’s essential to cooperate fully with the insurer to ensure a smooth and timely resolution.