Insurance Claims Processing

Insurance claims processing is a critical aspect of the insurance industry, playing a pivotal role in ensuring policyholders receive the financial protection and support they are entitled to. This process involves several intricate steps, each designed to verify, evaluate, and settle claims efficiently and fairly. With the increasing complexity of insurance products and the rising number of claims due to various factors, such as natural disasters and changing economic conditions, optimizing the claims processing workflow has become more crucial than ever.

In this comprehensive guide, we will delve deep into the world of insurance claims processing, exploring the latest trends, technologies, and best practices that are shaping this dynamic industry. By the end of this article, you will have a deeper understanding of the strategies and tools employed by industry leaders to enhance efficiency, improve customer satisfaction, and reduce claim processing times.

The Evolution of Insurance Claims Processing

The journey of insurance claims processing has been a transformative one, marked by significant advancements in technology and a deeper understanding of customer needs. Historically, claims processing was a manual, time-consuming process, often involving extensive paperwork and lengthy wait times. Policyholders had to navigate complex procedures and deal with a myriad of administrative hurdles to have their claims approved and settled.

However, with the advent of digital technologies and a shift towards customer-centric models, the insurance industry has undergone a digital transformation. Today, insurance providers are leveraging cutting-edge technologies like artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) to streamline and automate various aspects of claims processing.

For instance, AI-powered chatbots and virtual assistants are now being employed to handle initial claim intakes, providing policyholders with immediate assistance and reducing the burden on human customer service representatives. Additionally, advanced analytics and predictive modeling are being used to identify and prevent fraudulent claims, ensuring that legitimate policyholders receive their due benefits without delay.

Key Trends Shaping the Future of Claims Processing

The insurance industry is continuously evolving, and several key trends are shaping the future of claims processing, driving innovation and efficiency.

Digital Transformation and Automation

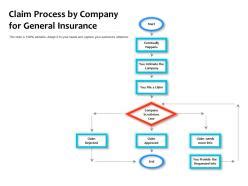

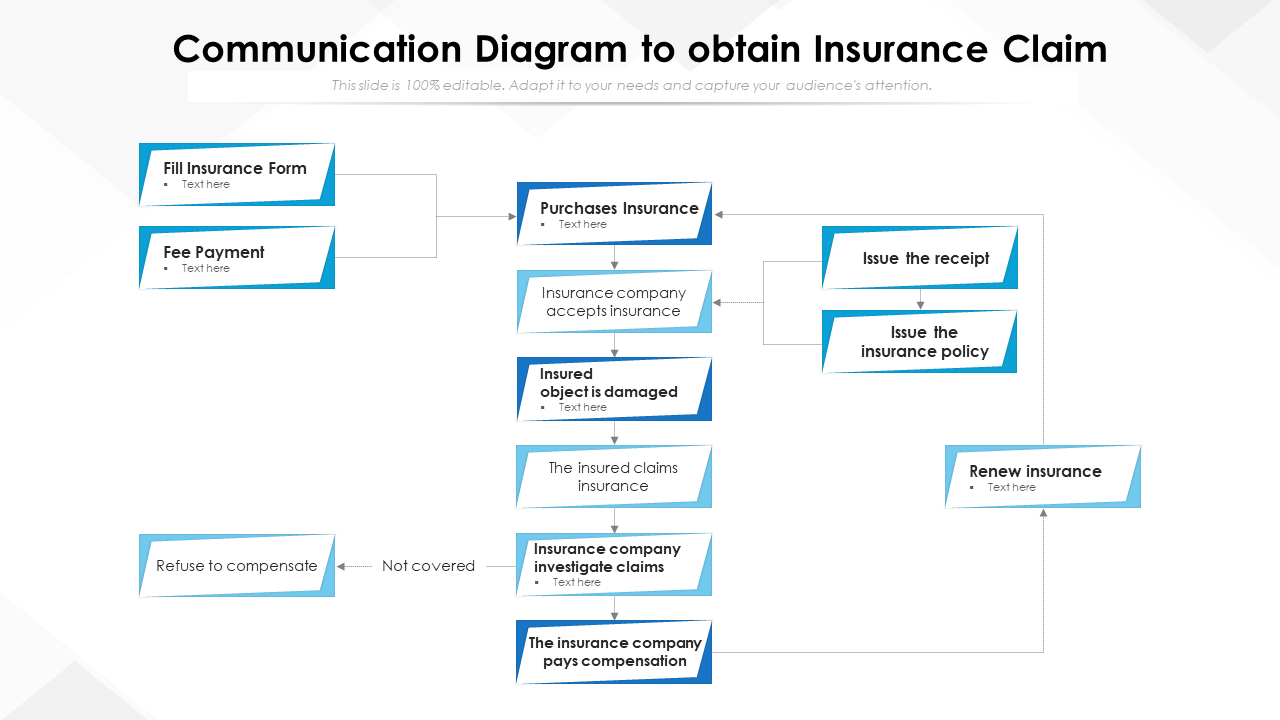

The digital transformation of the insurance industry is a dominant trend, with insurers embracing digital technologies to enhance operational efficiency and customer experience. Automation, in particular, is playing a pivotal role in streamlining claims processing. Robotic process automation (RPA) and intelligent automation solutions are being employed to automate repetitive, rule-based tasks, such as data entry, claim status updates, and document processing.

By automating these processes, insurers can reduce human error, speed up claim processing times, and free up resources for more complex, value-added tasks. Furthermore, digital transformation enables insurers to offer self-service options to policyholders, empowering them to manage their claims online, track progress, and receive updates in real-time.

Data Analytics and Predictive Modeling

Advanced data analytics and predictive modeling techniques are transforming the way insurers approach claims processing. By leveraging vast amounts of data and sophisticated algorithms, insurers can now gain deeper insights into customer behavior, claim patterns, and potential fraud risks.

Predictive models can identify trends and anomalies in claim data, helping insurers detect and prevent fraudulent activities. For instance, these models can analyze claim frequencies, severity, and geographic patterns to identify potential red flags. Additionally, data analytics can help insurers optimize their pricing strategies, personalize coverage options, and improve customer segmentation, leading to more efficient and targeted claims management.

Enhanced Customer Experience and Engagement

In today’s competitive insurance landscape, delivering a superior customer experience is crucial for success. Insurers are investing heavily in enhancing customer engagement and satisfaction throughout the claims process. This involves providing timely and transparent communication, offering multiple channels for policyholders to interact (such as mobile apps, chatbots, and social media), and ensuring a seamless, stress-free claims journey.

Moreover, insurers are leveraging customer feedback and insights to continuously improve their claims handling processes. By gathering and analyzing customer feedback, insurers can identify pain points, streamline processes, and ensure that their services meet or exceed customer expectations.

Best Practices for Efficient Claims Processing

Efficient claims processing is not just about leveraging the latest technologies; it also involves adopting strategic best practices and industry-leading standards. Here are some key strategies that insurers can implement to enhance their claims management capabilities.

Implement a Robust Claims Management System

A comprehensive, integrated claims management system is the backbone of efficient claims processing. Such a system should provide a single, centralized platform for managing all aspects of the claims lifecycle, from intake and assessment to settlement and post-settlement support.

A robust claims management system should offer features like automated claim intake, intelligent document processing, real-time tracking, and seamless integration with other systems, such as customer relationship management (CRM) and policy administration platforms. This ensures that all relevant data is easily accessible and that the claims process is streamlined and efficient.

Utilize Advanced Analytics for Claim Assessment

Advanced analytics and predictive modeling can greatly enhance the accuracy and efficiency of claim assessment. By analyzing historical claim data, insurers can develop sophisticated models to predict claim outcomes, identify potential fraud risks, and estimate claim severity.

For example, predictive models can analyze historical claim data to identify patterns and correlations between various factors, such as claim type, policyholder demographics, and geographic location. This can help insurers make more informed decisions about claim reserves, pricing, and risk management strategies.

Streamline Communication and Collaboration

Effective communication and collaboration are essential for efficient claims processing. Insurers should ensure that all stakeholders, including policyholders, agents, adjusters, and third-party service providers, have access to the necessary information and tools to collaborate seamlessly.

This can be achieved through the use of collaborative platforms, secure messaging systems, and shared digital workspaces. By facilitating open communication and collaboration, insurers can reduce bottlenecks, improve claim handling times, and ensure that all parties are aligned and working towards a common goal.

Focus on Customer Satisfaction and Experience

Customer satisfaction and experience should be at the heart of every insurer’s claims management strategy. Insurers should prioritize timely and transparent communication with policyholders, providing regular updates on claim status and keeping them informed throughout the entire process.

Insurers can also leverage technology to enhance the customer experience. For instance, mobile apps can provide policyholders with real-time claim status updates, allow them to upload necessary documentation, and even offer self-service options for minor claims. Additionally, insurers can use customer feedback to continuously improve their claims handling processes, ensuring that they meet or exceed customer expectations.

Case Studies: Successful Claims Processing Strategies

To illustrate the effectiveness of these strategies and technologies, let’s explore some real-world case studies of insurance companies that have successfully implemented innovative claims processing solutions.

Case Study 1: XYZ Insurance Company

XYZ Insurance Company, a leading provider of auto insurance, was facing challenges with claim intake and processing, leading to long wait times and high customer dissatisfaction. To address these issues, they implemented a digital transformation strategy, leveraging AI and automation to streamline their claims process.

They developed an AI-powered chatbot that could handle initial claim intakes, gathering necessary information from policyholders and providing them with immediate assistance. The chatbot was integrated with their claims management system, ensuring that all relevant data was captured and stored securely. This not only reduced the burden on human customer service representatives but also provided policyholders with a seamless, 24/7 claims reporting experience.

Additionally, XYZ Insurance Company implemented robotic process automation (RPA) to automate repetitive tasks, such as data entry and document processing. This freed up resources, allowing the company to focus on more complex claims and enhance their overall operational efficiency.

Case Study 2: ABC Insurance Group

ABC Insurance Group, a provider of health and life insurance, aimed to enhance their claims management capabilities by leveraging advanced data analytics and predictive modeling. They partnered with a leading analytics firm to develop sophisticated models that could predict claim outcomes and identify potential fraud risks.

By analyzing historical claim data, they developed predictive models that could accurately estimate claim severity and detect anomalies in claim patterns. This enabled ABC Insurance Group to make more informed decisions about claim reserves and pricing strategies, leading to significant improvements in financial performance and operational efficiency.

Furthermore, the predictive models helped ABC Insurance Group identify potential fraud risks, allowing them to focus their resources on high-risk claims and reduce the likelihood of fraudulent activities.

Future Implications and Conclusion

The insurance industry is poised for significant growth and transformation in the coming years, and insurance claims processing will continue to play a critical role in this evolution. As insurers embrace digital technologies and innovative strategies, we can expect to see further enhancements in efficiency, customer satisfaction, and fraud prevention.

The future of insurance claims processing is bright, with insurers leveraging advanced analytics, automation, and customer-centric approaches to deliver superior services. By staying abreast of the latest trends and best practices, insurers can position themselves for success in this rapidly changing landscape. As we move forward, it is clear that the insurance industry is committed to providing efficient, transparent, and customer-focused claims management, ensuring that policyholders receive the support and protection they deserve.

FAQ

How can automation benefit insurance claims processing?

+

Automation can greatly enhance insurance claims processing by streamlining repetitive tasks, reducing human error, and speeding up claim handling times. Robotic process automation (RPA) and intelligent automation solutions can automate data entry, document processing, and claim status updates, freeing up resources for more complex, value-added tasks.

What role does data analytics play in claims management?

+

Data analytics plays a crucial role in claims management by providing insurers with valuable insights into customer behavior, claim patterns, and potential fraud risks. Advanced analytics and predictive modeling can help insurers make more informed decisions about claim reserves, pricing, and risk management strategies, leading to improved financial performance and operational efficiency.

How can insurers enhance the customer experience during the claims process?

+

Insurers can enhance the customer experience during the claims process by prioritizing timely and transparent communication, providing multiple channels for interaction, and offering self-service options. By gathering and analyzing customer feedback, insurers can continuously improve their claims handling processes, ensuring that they meet or exceed customer expectations.