A Insurance

In today's complex and ever-evolving world, insurance has become an indispensable tool for individuals and businesses alike. It serves as a financial safety net, providing peace of mind and protection against unforeseen events. From health emergencies to natural disasters, insurance policies offer a vital layer of security, ensuring that people can recover and rebuild without being overwhelmed by financial burdens.

The Evolution of Insurance: A Historical Perspective

The concept of insurance is not a modern invention; its roots can be traced back to ancient civilizations. In the 17th century, the foundation of modern insurance was laid in Europe, primarily in maritime trade, where merchants sought to protect their investments against the perils of sea voyages. This early form of insurance, known as marine insurance, evolved into a more comprehensive system, covering not only ships and cargo but also people’s lives and livelihoods.

As societies progressed and industries diversified, so did the need for specialized insurance policies. The Industrial Revolution brought about a surge in manufacturing and transportation, leading to the development of property and casualty insurance. With the rise of the middle class and the advent of the welfare state, health and life insurance gained prominence, providing individuals with financial security and access to healthcare.

The Impact of Insurance on Modern Society

Insurance has become an integral part of our daily lives, offering protection in various aspects of our personal and professional endeavors. Here are some key areas where insurance plays a crucial role:

Health Insurance: A Lifeline for Medical Care

Health insurance is perhaps one of the most significant forms of insurance, providing individuals and families with access to essential medical services. With rising healthcare costs, having adequate health insurance coverage can mean the difference between timely treatment and financial ruin. Many countries have recognized the importance of health insurance and have implemented policies to ensure universal coverage, such as the Affordable Care Act in the United States and the National Health Service in the United Kingdom.

Health insurance not only covers routine check-ups and minor illnesses but also provides a safety net for major medical emergencies. It ensures that individuals can receive the necessary treatments, surgeries, and medications without worrying about the financial burden. Moreover, health insurance often includes preventive care benefits, encouraging individuals to take a proactive approach to their well-being.

Life Insurance: Securing Your Legacy

Life insurance is a financial product that offers a measure of security to individuals and their loved ones. It provides a monetary payout to beneficiaries upon the insured person’s death, ensuring financial stability and continuity for those left behind. Life insurance policies can be tailored to meet specific needs, such as covering funeral expenses, paying off debts, or providing long-term financial support for dependents.

The importance of life insurance becomes evident when considering unexpected events like accidents or sudden illnesses. In such situations, life insurance can help families avoid financial hardship and maintain their standard of living. Additionally, life insurance policies often include features like cash value accumulation, offering policyholders the opportunity to build savings and investment opportunities within their insurance plan.

Property and Casualty Insurance: Protecting Your Assets

Property and casualty insurance is designed to safeguard individuals’ assets and provide compensation in the event of damage or loss. This category of insurance includes homeowners’ insurance, renters’ insurance, and auto insurance, among others. These policies offer coverage for a wide range of perils, including fire, theft, natural disasters, and accidents.

For homeowners, insurance provides peace of mind, knowing that their largest investment is protected. It covers not only the structure of the home but also the personal belongings within it. In the unfortunate event of a disaster, such as a hurricane or earthquake, property insurance ensures that homeowners can rebuild their lives and homes without shouldering the entire financial burden. Similarly, renters' insurance provides coverage for personal belongings and liability protection, offering security to those who rent their homes.

Business Insurance: Mitigating Risks for Enterprises

Insurance is not just for individuals; it is also crucial for businesses of all sizes. Business insurance helps protect companies from a variety of risks, including property damage, liability claims, and interruptions to operations. With the right insurance coverage, businesses can continue to operate and recover from unforeseen events without incurring significant financial losses.

Common types of business insurance include commercial property insurance, which covers physical assets and inventory, and general liability insurance, which protects against lawsuits and third-party claims. Additionally, business interruption insurance can provide financial support during periods when a business is unable to operate due to covered perils, such as a fire or a natural disaster. By investing in comprehensive insurance coverage, businesses can focus on growth and innovation, knowing they are protected against potential financial setbacks.

The Future of Insurance: Embracing Technological Advancements

The insurance industry is undergoing a significant transformation, driven by technological advancements and changing consumer expectations. Here are some key trends shaping the future of insurance:

Digital Transformation and InsurTech

The rise of digital technologies has revolutionized the way insurance is delivered and experienced. InsurTech, a term referring to insurance-focused technology startups, is disrupting traditional insurance models with innovative solutions. These startups leverage technologies like artificial intelligence, blockchain, and big data analytics to streamline processes, enhance customer experiences, and offer more personalized insurance products.

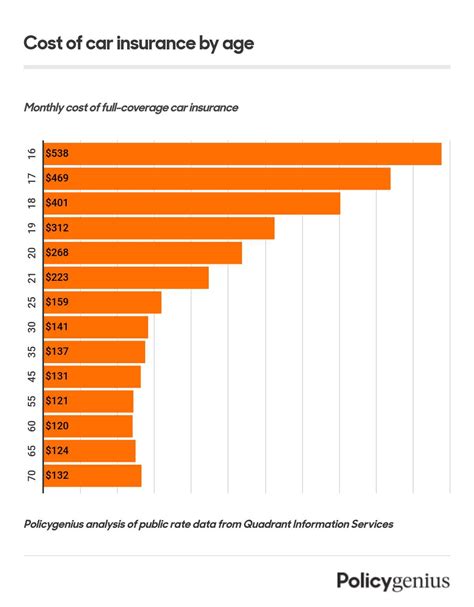

Digital platforms and mobile applications have made it easier for consumers to compare insurance policies, obtain quotes, and manage their policies online. InsurTech companies are also exploring new risk assessment methods, such as telematics in auto insurance, where driving behavior is monitored to offer more accurate premiums. The integration of technology into the insurance industry is expected to continue, leading to increased efficiency, improved customer satisfaction, and more tailored insurance solutions.

Data-Driven Risk Assessment and Personalization

Insurance companies are increasingly leveraging data analytics to make more accurate risk assessments and offer personalized insurance products. By analyzing vast amounts of data, insurers can identify patterns and trends, allowing them to price policies more fairly and accurately. This data-driven approach also enables insurers to offer customized coverage options, catering to the unique needs of individual policyholders.

For example, health insurance companies are using data analytics to develop personalized wellness programs, encouraging policyholders to adopt healthier lifestyles. In property insurance, data-driven models can assess the risk of natural disasters and provide tailored coverage for specific locations. As data analytics continues to evolve, the insurance industry will be better equipped to offer products that meet the diverse needs of its customers.

Blockchain and Smart Contracts

Blockchain technology, known for its security and transparency, is making its way into the insurance industry. Smart contracts, self-executing contracts with predefined rules, can automate various insurance processes, reducing administrative burdens and minimizing the potential for errors. Blockchain-based insurance solutions offer enhanced security, faster claim settlements, and improved record-keeping.

For instance, in the field of parametric insurance, blockchain can be used to create smart contracts that automatically trigger payouts when predefined conditions are met. This technology is particularly useful for insurance products related to weather events, such as crop insurance or flood insurance, where claims can be settled quickly and efficiently based on real-time data.

Conclusion: A Secure Future with Insurance

Insurance is an essential component of modern life, providing individuals and businesses with the financial stability and peace of mind needed to navigate an uncertain world. From health emergencies to natural disasters, insurance policies offer a vital safety net, allowing people to recover and rebuild with confidence. As the insurance industry continues to evolve, embracing technological advancements and data-driven solutions, the future of insurance looks promising, with more tailored and efficient coverage options for all.

What are the benefits of health insurance?

+Health insurance offers several key benefits, including access to essential medical services, financial protection against high healthcare costs, and coverage for preventive care, which encourages individuals to maintain their health.

How does life insurance provide security for families?

+Life insurance provides financial stability to families by offering a monetary payout upon the insured person’s death. This can help cover funeral expenses, pay off debts, and provide long-term financial support for dependents, ensuring they can maintain their standard of living.

What are the advantages of business interruption insurance for small businesses?

+Business interruption insurance is crucial for small businesses as it provides financial support during periods when they are unable to operate due to covered perils. This insurance ensures that businesses can continue to pay employees, maintain operations, and recover without incurring significant financial losses.