Aaa Automobile Insurance Quote

In the vast landscape of automobile insurance, Aaa stands out as a trusted provider, offering comprehensive coverage tailored to the unique needs of drivers. This article delves into the intricacies of Aaa's insurance quote process, providing an in-depth analysis to guide prospective policyholders. We'll explore the factors that influence quotes, the steps to obtaining an accurate estimate, and the benefits that make Aaa a popular choice among vehicle owners.

Understanding Aaa’s Insurance Quote Process

Aaa’s approach to insurance quotes is designed to be straightforward and transparent, ensuring that customers receive accurate and personalized estimates. The process involves a careful evaluation of various factors that impact insurance costs, allowing Aaa to offer competitive rates while maintaining comprehensive coverage.

Factors Influencing Aaa’s Insurance Quotes

Several key elements contribute to the calculation of an Aaa insurance quote. These include:

- Vehicle Type and Age: The make, model, and age of your vehicle play a significant role. Aaa considers the vehicle’s safety features, repair costs, and common claims associated with its make and model.

- Driver’s Profile: Your driving history, including any accidents or violations, is a crucial factor. Aaa assesses the risk associated with your driving record to determine an appropriate premium.

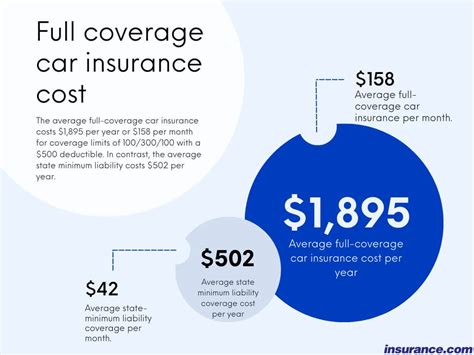

- Coverage Selection: The level of coverage you choose affects your quote. Aaa offers a range of options, from liability-only coverage to comprehensive policies that include collision, medical payments, and uninsured/underinsured motorist protection.

- Location and Usage: Where you live and how you use your vehicle impact your quote. Aaa takes into account local crime rates, accident statistics, and the typical usage patterns of drivers in your area.

- Discounts and Savings: Aaa provides various discounts to make insurance more affordable. These can include multi-policy discounts (if you bundle your auto insurance with other policies), safe driver discounts, good student discounts, and more.

By considering these factors, Aaa aims to provide fair and accurate quotes that reflect the individual needs and circumstances of each driver.

Step-by-Step Guide to Obtaining an Aaa Insurance Quote

The process of getting an Aaa insurance quote is designed to be simple and efficient. Here’s a step-by-step breakdown:

- Visit the Aaa Website: Start by navigating to the official Aaa insurance website. Look for the “Get a Quote” or “Insurance Quote” button, typically found on the homepage or in the navigation menu.

- Provide Basic Information: Begin the quote process by entering your zip code. This allows Aaa to provide region-specific quotes. You’ll then be prompted to enter your personal details, including name, date of birth, and driver’s license number.

- Vehicle Information: Input details about your vehicle, such as make, model, year, and VIN (Vehicle Identification Number). Aaa will use this information to assess the vehicle’s risk profile and provide an accurate quote.

- Coverage Selection: Choose the type of coverage you’re interested in. Aaa offers a range of options, so you can select the level of protection that suits your needs and budget. Consider adding additional coverages like rental car reimbursement or roadside assistance.

- Driver’s Profile: Accurately represent your driving history by providing information about any accidents, violations, or claims you’ve had in the past. This step is crucial for Aaa to provide an accurate quote.

- Review and Customize: After entering all the required information, review the quote and customize it to your preferences. You can adjust coverage limits, deductibles, and add-ons to find the right balance between cost and protection.

- Apply for a Policy: Once you’re satisfied with your quote, proceed to apply for the policy. Aaa will guide you through the application process, which may involve additional documentation or verification steps.

Benefits of Choosing Aaa for Your Automobile Insurance

Aaa is a renowned provider of automobile insurance, offering a range of advantages that make it a popular choice for vehicle owners.

Comprehensive Coverage Options

Aaa provides a wide array of coverage options to ensure that drivers can tailor their insurance policies to their specific needs. This includes:

- Liability Coverage: Protects against bodily injury and property damage claims made against you in the event of an accident you cause.

- Collision Coverage: Covers damage to your vehicle resulting from a collision, regardless of fault.

- Comprehensive Coverage: Offers protection for non-collision incidents like theft, vandalism, weather-related damage, and more.

- Medical Payments Coverage: Provides coverage for medical expenses incurred by you or your passengers after an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you in the event of an accident with a driver who has insufficient or no insurance.

Discounts and Savings

Aaa offers a variety of discounts to make insurance more affordable for its customers. These discounts can significantly reduce the cost of your policy and include:

- Multi-Policy Discount: Save by bundling your auto insurance with other Aaa policies, such as homeowners or renters insurance.

- Safe Driver Discount: If you have a clean driving record, you may qualify for a discount based on your safe driving history.

- Good Student Discount: Eligible students under 25 may receive a discount for maintaining good grades in school.

- Early Quoting Discount: Aaa may offer a discount for quoting your insurance early, before your current policy expires.

- Pay-in-Full Discount: Some states allow a discount for paying your entire premium upfront rather than in installments.

Excellent Customer Service

Aaa is renowned for its exceptional customer service, ensuring that policyholders receive prompt and professional assistance whenever needed. The company offers:

- 24⁄7 Claims Support: Aaa provides round-the-clock claims support, ensuring that you can report and manage claims at any time.

- Dedicated Agents: Policyholders are assigned dedicated agents who provide personalized service and guidance throughout the policy lifecycle.

- Online and Mobile Tools : Aaa offers a range of digital tools, including a mobile app, for policy management, claims reporting, and other self-service options.

Additional Benefits and Services

In addition to comprehensive coverage and excellent customer service, Aaa offers a range of extra benefits and services to enhance the overall insurance experience, such as:

- Roadside Assistance: Aaa provides roadside assistance services, including towing, flat tire changes, and fuel delivery, to help policyholders in emergencies.

- Rental Car Reimbursement: In the event of a covered claim, Aaa may provide rental car reimbursement to cover the cost of a rental vehicle while your car is being repaired.

- Accident Forgiveness: Eligible policyholders may qualify for accident forgiveness, which prevents a single at-fault accident from increasing their insurance rates.

- Usage-Based Insurance (UBI): Aaa offers programs that reward safe driving behavior with discounts, providing an incentive for drivers to practice safer habits.

The Impact of Technology on Aaa’s Insurance Quote Process

Advancements in technology have revolutionized the way Aaa delivers its insurance services, including the quote process. The company has embraced digital tools and data analytics to enhance accuracy, efficiency, and convenience for its customers.

Online Quoting Platforms

Aaa has developed user-friendly online platforms that allow customers to obtain insurance quotes quickly and easily. These platforms are designed to guide users through the quoting process, providing clear instructions and a seamless experience. Policyholders can input their details, select coverage options, and receive personalized quotes in a matter of minutes.

Data Analytics for Accurate Quotes

By leveraging data analytics, Aaa can analyze vast amounts of information to determine accurate insurance quotes. This includes historical claims data, vehicle repair costs, and risk assessment algorithms. The company uses advanced statistical models to identify patterns and trends, allowing for more precise risk assessments and, consequently, more accurate quotes.

Real-Time Updates and Dynamic Pricing

Aaa’s use of technology enables real-time updates to insurance quotes. This means that as new information becomes available, such as changes in coverage options or discounts, the quote can be instantly adjusted. Additionally, dynamic pricing models allow Aaa to offer competitive rates that adapt to market conditions and customer needs.

Mobile Apps for Convenience

Aaa has developed mobile applications that provide policyholders with convenient access to their insurance information and services. These apps allow users to obtain quotes, manage policies, file claims, and track their progress, all from their smartphones. The mobile app experience further enhances the convenience and accessibility of Aaa’s insurance services.

The Future of Automobile Insurance with Aaa

As the automobile insurance industry continues to evolve, Aaa remains at the forefront, embracing technological advancements and innovative practices to enhance its services. The company is committed to providing customers with the best possible experience, ensuring that insurance coverage remains accessible, affordable, and tailored to individual needs.

Expansion of Digital Services

Aaa is expected to continue expanding its digital services, making insurance more accessible and convenient for customers. This includes further enhancements to its online and mobile platforms, allowing for even quicker and more efficient quoting processes. The company may also explore additional digital tools, such as chatbots and voice-activated assistants, to provide instant support and information.

Focus on Personalization

In the future, Aaa is likely to place an even greater emphasis on personalization. By utilizing advanced data analytics and machine learning, the company can offer highly tailored insurance products and services. This could involve dynamic pricing models that adapt to individual driving behaviors and preferences, providing customers with coverage that aligns perfectly with their needs.

Integration of Telematics and Usage-Based Insurance

The integration of telematics and usage-based insurance (UBI) is an area of focus for Aaa. By installing small devices in vehicles, Aaa can collect real-time data on driving behavior, such as acceleration, braking, and mileage. This data can be used to offer more accurate and personalized insurance quotes, as well as incentivize safer driving through reward programs.

Collaboration and Partnerships

Aaa may explore collaborations and partnerships with other industry leaders to enhance its insurance offerings. This could involve working with automotive manufacturers to develop innovative insurance products that align with the latest vehicle technologies, such as autonomous driving features. Additionally, partnerships with tech companies could lead to the development of advanced safety features and driver assistance systems, further reducing the risk of accidents and improving insurance outcomes.

What factors influence my Aaa insurance quote the most?

+

Your driving record, the type of vehicle you own, and your location are the primary factors that influence your Aaa insurance quote. Aaa considers these factors to assess the risk associated with insuring you and your vehicle.

How can I get the most accurate Aaa insurance quote?

+

To get the most accurate quote, provide Aaa with detailed and accurate information about your driving history, vehicle, and location. Ensure that you select the coverage options that align with your needs, and consider any available discounts for which you may be eligible.

Can I customize my Aaa insurance policy after receiving a quote?

+

Absolutely! Aaa’s quote process allows you to customize your policy to fit your needs. You can adjust coverage limits, deductibles, and add-ons to create a policy that provides the right balance of protection and affordability. Remember to review your policy regularly to ensure it continues to meet your changing needs.

What additional services does Aaa offer beyond automobile insurance?

+

Aaa offers a range of additional services, including homeowners insurance, renters insurance, life insurance, and health insurance. Additionally, they provide financial services, such as banking and investment options, as well as travel services, including booking vacations and providing emergency road assistance.