How Much Is Full Coverage Car Insurance

Full coverage car insurance is a comprehensive policy that provides a wide range of protections for vehicle owners. It combines two essential types of coverage: liability insurance and comprehensive insurance. Liability coverage is mandated by law in most states and protects policyholders against financial losses resulting from accidents they cause. Comprehensive insurance, on the other hand, covers damages to the insured vehicle from non-collision incidents, such as theft, vandalism, or natural disasters.

Understanding the Cost of Full Coverage

The cost of full coverage car insurance can vary significantly depending on numerous factors. Insurance companies consider a multitude of variables when calculating premiums, including the make and model of the vehicle, the driver’s age, driving history, and location. Additionally, the level of coverage and the chosen deductible can greatly impact the overall cost.

Factors Affecting Premium Costs

- Vehicle Type and Usage: More expensive vehicles and those used for business or pleasure trips tend to have higher insurance rates.

- Driver Profile: Younger drivers and those with a history of accidents or violations often face higher premiums. However, safe drivers with a clean record can benefit from lower rates.

- Coverage Options: Full coverage policies offer various add-ons, such as rental car coverage, roadside assistance, or gap insurance. These additional features can increase the overall cost.

- Deductibles: Choosing a higher deductible can lower monthly premiums, but it means you’ll pay more out-of-pocket if you need to file a claim.

To illustrate, let's consider a hypothetical scenario. John, a 30-year-old with a clean driving record, owns a 2018 Toyota Camry. He resides in a suburban area with low accident rates. Based on these factors, his annual full coverage insurance premium might fall between $1,200 and $1,500. However, if John were to add optional coverage like rental car reimbursement, his premium could increase by around $100 annually.

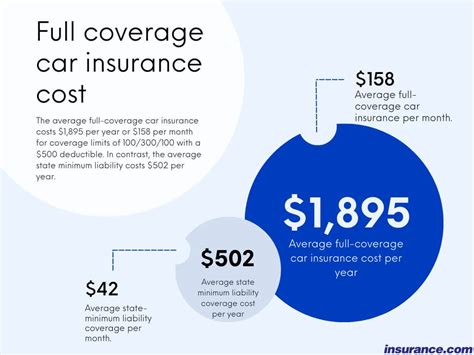

Average Costs of Full Coverage

According to recent data, the average cost of full coverage car insurance in the United States is approximately $1,674 per year. However, this figure is just an estimate, and actual costs can vary widely. Some states, like Maine and Ohio, have lower average premiums, while states like Michigan and Florida tend to have higher costs.

| State | Average Annual Premium |

|---|---|

| Maine | $1,194 |

| Ohio | $1,206 |

| California | $1,614 |

| Florida | $2,100 |

Ways to Save on Full Coverage

While full coverage car insurance is essential, there are several strategies to reduce your premiums without compromising protection.

Tips to Lower Your Premiums

- Shop Around: Compare quotes from multiple insurance providers. Rates can vary significantly between companies, so finding the best deal requires some research.

- Bundle Policies: Many insurers offer discounts when you bundle multiple policies, such as auto and home insurance.

- Increase Deductibles: Opting for a higher deductible can lead to lower premiums. However, ensure you can afford the increased out-of-pocket expenses in case of a claim.

- Take Advantage of Discounts: Insurance companies often provide discounts for safe driving records, vehicle safety features, and loyalty. Ask your insurer about available discounts and how to qualify.

For instance, let's say Jane has been with her current insurer for over five years and has a spotless driving record. By bundling her auto and home insurance policies and increasing her deductible, she could potentially save up to 20% on her annual full coverage premium.

The Importance of Full Coverage

While full coverage car insurance may come at a higher cost, it offers vital protections that can save policyholders from significant financial burdens. In the event of an accident or unforeseen incident, full coverage provides peace of mind, ensuring that both the policyholder and their vehicle are protected.

Real-Life Benefits of Full Coverage

Consider a scenario where David, a cautious driver, gets into an accident with a deer on a dark and rainy night. His vehicle sustains significant damage, and the repair costs amount to $8,000. Without full coverage insurance, David would have to pay for these repairs out of pocket. However, with comprehensive coverage, his insurer covers the majority of the costs, leaving him with a much smaller deductible to pay.

Additionally, full coverage insurance often includes liability protection, which is crucial in cases where the policyholder is at fault for an accident. This coverage can shield the driver from potential lawsuits and cover the costs of medical expenses and property damage for the other party involved.

Conclusion

Determining the cost of full coverage car insurance involves a complex interplay of various factors. While it may seem daunting, understanding these factors and implementing strategies to reduce costs can make full coverage insurance more affordable. Ultimately, the peace of mind and protection offered by full coverage make it a worthwhile investment for many vehicle owners.

What is the difference between full coverage and liability-only insurance?

+Full coverage insurance includes both liability coverage and comprehensive coverage, providing protection for damages to your vehicle and financial liability in case of accidents. Liability-only insurance, on the other hand, only covers the financial liability for accidents you cause, without providing coverage for your own vehicle’s damages.

How can I get a more accurate estimate of my full coverage insurance costs?

+To get a precise estimate, you should obtain quotes from multiple insurance providers. These quotes will consider your specific circumstances, such as your driving history, vehicle type, and location. By comparing these quotes, you can find the most suitable and cost-effective full coverage option.

Are there any ways to lower my full coverage insurance premiums without compromising coverage?

+Yes, there are several strategies to reduce premiums without sacrificing coverage. These include increasing your deductible, bundling policies, and taking advantage of available discounts. Additionally, maintaining a safe driving record and regularly reviewing your coverage needs can help keep costs down.