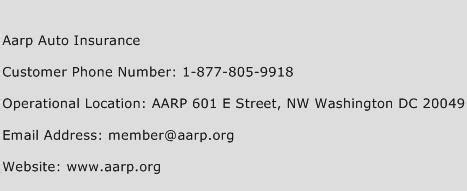

Aarp Auto Insurance Contact Number

AARP Auto Insurance is a popular insurance option for many drivers, especially those aged 50 and above. It offers a range of coverage options and benefits tailored to the needs of mature drivers. In this comprehensive guide, we will delve into the details of AARP Auto Insurance, providing an expert analysis of its offerings, coverage, and customer experience. By the end, you'll have a clear understanding of how AARP Auto Insurance operates and whether it's the right choice for your specific needs.

Understanding AARP Auto Insurance

AARP, which stands for American Association of Retired Persons, is a nonprofit organization that advocates for the well-being of older Americans. It offers a variety of services and benefits, including auto insurance, to its members. AARP partners with leading insurance providers to provide competitive rates and comprehensive coverage to its members. The AARP Auto Insurance Program is administered by Hartford Financial Services Group and The Automobile Association, ensuring a high level of expertise and reliability.

Coverage Options and Benefits

AARP Auto Insurance offers a wide range of coverage options to suit different driving needs and preferences. Here’s a breakdown of some key features:

Liability Coverage

AARP Auto Insurance provides liability coverage, which is essential for protecting you against financial losses if you’re found at fault in an accident. This coverage includes bodily injury liability and property damage liability to cover the costs of injuries and property damage caused by you.

Collision and Comprehensive Coverage

In addition to liability coverage, AARP Auto Insurance offers collision coverage, which pays for repairs or replacements if your vehicle is damaged in an accident, regardless of fault. Comprehensive coverage is also available, protecting against non-collision incidents like theft, vandalism, and natural disasters.

Uninsured/Underinsured Motorist Coverage

This coverage is crucial, as it protects you in the event of an accident with a driver who either doesn’t have insurance or doesn’t have sufficient coverage to pay for the damages. AARP Auto Insurance includes this coverage as part of its comprehensive plans.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, helps cover the cost of medical treatment for you and your passengers in the event of an accident, regardless of fault. This coverage can be a lifesaver in ensuring you receive prompt medical attention without worrying about upfront costs.

Additional Benefits and Discounts

AARP Auto Insurance offers a variety of additional benefits and discounts to its members. These include accident forgiveness, which can prevent your rates from increasing after your first at-fault accident, new car replacement coverage, and discounts for safe driving and multi-policy bundling. The exact discounts and benefits may vary based on your state and coverage options.

Customer Experience and Claims Process

AARP Auto Insurance prides itself on providing an exceptional customer experience. The claims process is designed to be straightforward and efficient. Policyholders can report claims online, over the phone, or through the AARP Auto Insurance mobile app. The company aims to make the claims process as stress-free as possible, ensuring prompt responses and fair settlements.

AARP Auto Insurance also offers a dedicated 24/7 customer service hotline, providing assistance for policyholders and prospective customers alike. The contact number for AARP Auto Insurance is 1-888-687-2277. This hotline can be used for various purposes, including reporting claims, making policy changes, or simply seeking advice and guidance.

Policy Options and Pricing

AARP Auto Insurance offers a range of policy options to suit different budgets and coverage needs. The specific pricing structure can vary based on factors such as the driver’s age, driving record, location, and the chosen coverage options. Generally, AARP Auto Insurance is known for its competitive rates, especially for mature drivers with a clean driving record.

One of the advantages of AARP Auto Insurance is its customizable coverage. Policyholders can choose from a variety of coverage levels and add-ons to create a policy that suits their individual needs. This flexibility ensures that drivers can find an affordable plan without compromising on essential coverage.

Performance and Reliability

AARP Auto Insurance has a strong reputation for reliability and financial stability. The company’s partnership with reputable insurance providers ensures that policyholders receive the benefits and coverage they expect. AARP Auto Insurance consistently receives high ratings from industry experts and customer reviews, indicating its commitment to providing quality service and fair claims handling.

| Rating Agency | Financial Strength Rating |

|---|---|

| A.M. Best | A+ (Superior) |

| Standard & Poor's | AA- (Very Strong) |

Conclusion: Is AARP Auto Insurance Right for You?

AARP Auto Insurance is an excellent option for mature drivers seeking comprehensive coverage at competitive rates. The partnership with leading insurance providers ensures a reliable and financially stable insurance experience. With a range of coverage options, additional benefits, and a commitment to customer satisfaction, AARP Auto Insurance is well-positioned to meet the needs of its members.

However, it's important to note that insurance needs can vary widely, and what works for one person may not be the best fit for another. It's always advisable to compare multiple insurance providers and get quotes tailored to your specific circumstances. This ensures you make an informed decision and find the policy that provides the best value for your money.

Can I get AARP Auto Insurance if I’m not a member of AARP?

+No, AARP Auto Insurance is exclusively available to AARP members. However, becoming an AARP member is straightforward and offers a range of benefits beyond auto insurance.

How do I get a quote for AARP Auto Insurance?

+You can request a quote for AARP Auto Insurance by visiting their website, calling their customer service hotline, or reaching out to an AARP representative. They will guide you through the process and help you find the best coverage options for your needs.

Does AARP Auto Insurance offer discounts for safe driving?

+Yes, AARP Auto Insurance provides discounts for safe driving. These discounts can vary based on your driving record and the specific coverage you choose. It’s always a good idea to inquire about available discounts when requesting a quote.