About Insurance Policy

Insurance policies are an essential aspect of financial planning and risk management, offering individuals and businesses a safety net against unforeseen events and providing peace of mind. These policies serve as a contractual agreement between an insurer and a policyholder, outlining the coverage, conditions, and benefits offered in exchange for premium payments. This comprehensive guide will delve into the intricacies of insurance policies, exploring their types, benefits, and the key considerations for choosing the right coverage.

Understanding Insurance Policies: Types and Coverage

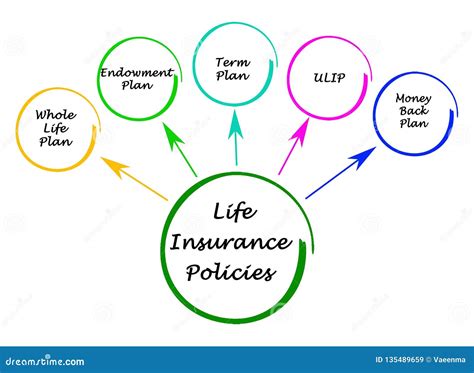

Insurance policies come in various forms, each designed to address specific risks and needs. Here’s an overview of the most common types:

Life Insurance

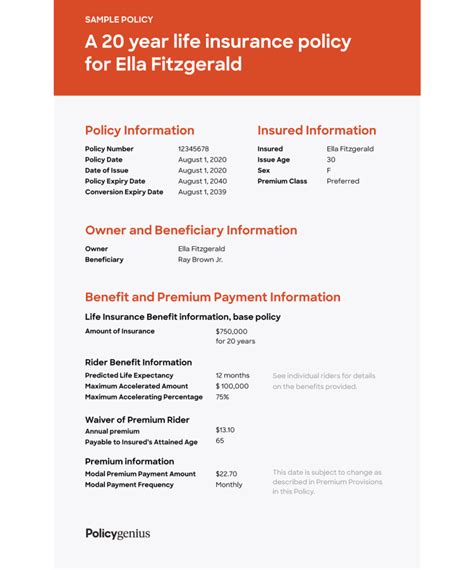

Life insurance policies provide financial protection to the policyholder’s beneficiaries upon their death. These policies can offer a range of benefits, including death benefits, cash value accumulation, and even income replacement for families during challenging times.

| Policy Type | Key Features |

|---|---|

| Term Life Insurance | Offers coverage for a specified term, typically 10-30 years, with lower premiums. Ideal for short-term needs like mortgage protection. |

| Whole Life Insurance | Provides lifetime coverage with level premiums. Builds cash value over time, offering financial flexibility and potential tax advantages. |

| Universal Life Insurance | Offers flexibility in premium payments and death benefits. Allows policyholders to adjust coverage and premiums based on their needs. |

Health Insurance

Health insurance policies are crucial for covering medical expenses, ensuring access to quality healthcare, and protecting individuals from financial strain due to unexpected illnesses or accidents. These policies vary in coverage, including options for individual, family, and group plans.

| Health Insurance Plans | Coverage Highlights |

|---|---|

| Indemnity Plans | Allow policyholders to choose their healthcare providers and offer reimbursement for covered expenses. |

| Managed Care Plans | Include Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs), offering cost-effective care through networks of providers. |

| High-Deductible Health Plans (HDHPs) | Combine lower premiums with higher deductibles, often paired with Health Savings Accounts (HSAs) for tax-advantaged savings. |

Property and Casualty Insurance

This category encompasses a wide range of policies protecting against losses related to property damage, liability, and other risks. Here are some key types:

- Homeowners Insurance: Covers damage to a residence and personal belongings, as well as liability protection for accidents on the property.

- Renters Insurance: Protects tenants' personal property and provides liability coverage for accidents occurring in their rented space.

- Auto Insurance: Mandatory in most regions, offering liability, collision, and comprehensive coverage for vehicle-related incidents.

- Business Insurance: Essential for entrepreneurs, covering risks like property damage, liability, and business interruption.

Key Considerations for Choosing the Right Policy

Selecting an insurance policy that aligns with your needs and circumstances is crucial. Here are some factors to consider:

Assess Your Risks

Evaluate the potential risks you face, whether it’s health-related, financial, or property-related. Understanding your unique vulnerabilities will guide you in choosing the right coverage.

Define Your Budget

Insurance policies come with varying premium costs. Assess your financial capacity and determine the amount you can comfortably allocate for insurance coverage without compromising your financial goals.

Research Providers and Policies

Explore different insurance providers and their offerings. Compare policies based on coverage, exclusions, and additional benefits. Look for reputable companies with a track record of prompt claim settlements.

Consider Customization Options

Many insurance policies allow for customization to meet your specific needs. For instance, you can adjust deductibles, add riders for specific coverage, or opt for additional benefits like disability income protection.

Read the Fine Print

Before finalizing a policy, carefully review the terms and conditions. Pay attention to exclusions, limitations, and any conditions that may impact your coverage. Understanding these details is crucial to avoiding surprises during claims.

The Benefits of Insurance Policies

Insurance policies offer a multitude of advantages, making them an essential component of personal and business financial planning. Here’s a deeper look at the key benefits:

Financial Protection and Peace of Mind

The primary benefit of insurance is the financial protection it provides. In the event of a covered loss, insurance policies offer a safety net, ensuring you or your beneficiaries receive the necessary funds to recover and rebuild. This peace of mind is invaluable, allowing you to focus on healing and recovery without the added stress of financial strain.

Risk Mitigation and Planning

Insurance policies help mitigate risks, both expected and unexpected. By transferring the financial burden of potential losses to an insurer, you gain the ability to plan and prepare for the future with greater certainty. This risk management approach is especially crucial for businesses, ensuring continuity and stability even in the face of adversity.

Access to Quality Healthcare

Health insurance policies are a lifeline for individuals and families, providing access to quality healthcare services. With the right coverage, policyholders can receive necessary medical treatments, procedures, and medications without the worry of excessive out-of-pocket expenses. This access to healthcare is essential for maintaining overall well-being and quality of life.

Business Continuity and Liability Protection

For businesses, insurance policies are a critical component of their risk management strategy. Property and casualty insurance, including commercial liability insurance, protects against a wide range of risks, from property damage to product liability claims. This coverage ensures businesses can continue operations even in the face of unforeseen events, maintaining their financial stability and reputation.

The Future of Insurance: Technological Innovations

The insurance industry is undergoing a digital transformation, leveraging technology to enhance the customer experience and improve efficiency. Here’s a glimpse into the future of insurance:

Digital Onboarding and Claims

Insurers are embracing digital tools for streamlined policy acquisition and claims management. Online applications, digital signatures, and mobile apps for policy management and claims submission are becoming the norm, offering convenience and efficiency to policyholders.

Data Analytics and Risk Assessment

Advanced data analytics and machine learning are transforming risk assessment and underwriting processes. Insurers can now analyze vast amounts of data to make more accurate predictions, offering tailored coverage and competitive premiums based on individual risk profiles.

Telematics and Usage-Based Insurance

Usage-based insurance (UBI) is gaining traction, particularly in auto insurance. Telematics devices installed in vehicles track driving behavior, offering discounts to safe drivers and providing insurers with valuable data for risk assessment. This pay-as-you-drive model rewards responsible driving and encourages safer road habits.

Blockchain and Smart Contracts

Blockchain technology is set to revolutionize insurance contracts, introducing smart contracts that automate certain processes. These self-executing contracts can streamline policy administration, claims settlement, and even insurance fraud detection, ensuring a more secure and efficient insurance ecosystem.

FAQ

What is the average cost of a life insurance policy?

+The cost of a life insurance policy depends on various factors, including age, health, coverage amount, and policy type. On average, a 500,000 term life insurance policy for a healthy 30-year-old can range from 20 to $40 per month. Whole life and universal life policies typically have higher premiums due to their cash value accumulation features.

How do I choose the right health insurance plan?

+When selecting a health insurance plan, consider your healthcare needs, preferred providers, and budget. Assess the coverage limits, deductibles, and out-of-pocket maximums. If you have a regular healthcare provider, ensure they are in-network with the plan. Additionally, evaluate additional benefits like prescription drug coverage and mental health services.

What should I do if my insurance claim is denied?

+If your insurance claim is denied, carefully review the denial letter to understand the reasons. Gather any additional documentation or evidence to support your claim. Contact your insurance provider to discuss the denial and appeal the decision. You may also consider seeking legal advice if necessary.

In conclusion, insurance policies are a vital tool for managing risks and protecting your financial well-being. By understanding the types of policies available, assessing your needs, and staying informed about industry innovations, you can make informed decisions to secure your future and the future of your loved ones.