Seniors Dental Insurance

Dental health is an essential aspect of overall well-being, especially for seniors who often face unique challenges when it comes to oral care. As we age, maintaining good dental hygiene becomes increasingly crucial, but it can also be financially burdensome. This is where seniors dental insurance steps in as a valuable tool to ensure seniors can access necessary dental services without breaking the bank.

Understanding Seniors Dental Insurance

Seniors dental insurance, often referred to as dental coverage for older adults, is a specialized type of health insurance designed to meet the unique oral care needs of individuals aged 65 and above. It provides comprehensive coverage for a range of dental services, from routine check-ups and cleanings to more complex procedures like root canals and dentures.

The primary goal of seniors dental insurance is to promote preventive care and ensure seniors can maintain their oral health as they age. By covering the cost of regular dental visits, insurers aim to catch potential issues early, preventing them from escalating into more serious (and costly) health problems. This proactive approach not only benefits seniors' oral health but also contributes to their overall quality of life.

Additionally, seniors dental insurance plans often include coverage for restorative procedures, which can be particularly beneficial for older adults who may have experienced tooth decay, gum disease, or tooth loss due to age-related factors. With this type of insurance, seniors can access the dental care they need to restore their oral health and maintain a functional smile.

Key Benefits of Seniors Dental Insurance

Seniors dental insurance offers a multitude of benefits that go beyond the basic coverage provided by standard dental plans. Here are some key advantages:

- Comprehensive Coverage: These plans typically cover a wide range of dental services, including preventive care, basic procedures, and major restorative work. This ensures that seniors have access to a full spectrum of oral care.

- Affordable Costs: With dental insurance, seniors can significantly reduce their out-of-pocket expenses for dental care. Many plans offer low premiums and minimal copays, making dental treatment more financially manageable.

- Flexibility: Seniors dental insurance plans often provide flexibility in choosing dentists and specialists. This allows seniors to select providers who best meet their individual needs and preferences.

- Emergency and Urgent Care: Many plans include coverage for dental emergencies, ensuring that seniors can receive prompt treatment when unexpected oral issues arise.

- Educational Resources: Some insurers provide educational materials and resources to help seniors understand the importance of oral health and how to maintain it effectively.

Choosing the Right Seniors Dental Insurance Plan

When selecting a seniors dental insurance plan, it’s essential to consider various factors to ensure you find the best fit for your specific needs. Here are some key considerations:

Coverage Options

Seniors dental insurance plans can vary significantly in terms of the types of procedures they cover. Some plans may offer more comprehensive coverage, including orthodontics and cosmetic procedures, while others may focus primarily on basic preventive care and emergency treatment. Assess your own dental health needs and choose a plan that aligns with those requirements.

| Plan Type | Coverage |

|---|---|

| Basic | Routine check-ups, cleanings, and basic procedures |

| Comprehensive | Extensive coverage including major restorative work and specialized treatments |

| Customizable | Allows you to choose specific procedures you want covered |

Network of Dentists

Check if the plan has a network of preferred providers and whether your current dentist is included. If not, consider whether you’re willing to switch dentists or if you prefer the flexibility of choosing any licensed dentist.

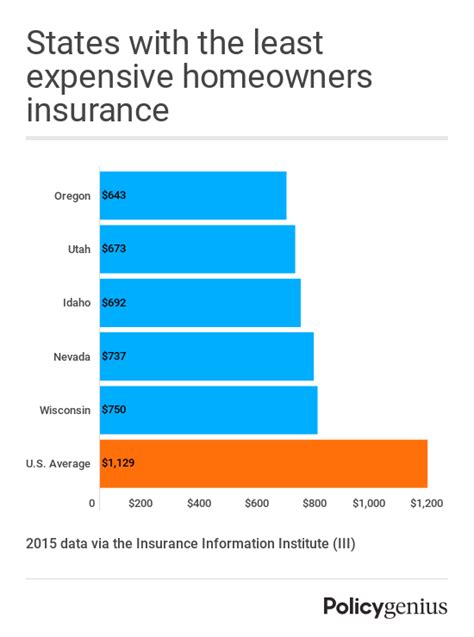

Premiums and Deductibles

Evaluate the cost of the plan, including monthly premiums, deductibles, and copays. Ensure that the plan’s financial structure aligns with your budget and expected dental needs.

Additional Benefits

Look for plans that offer added benefits like vision care, hearing aid coverage, or prescription drug discounts. These additional perks can enhance the overall value of your insurance plan.

The Impact of Seniors Dental Insurance on Oral Health

Seniors dental insurance has a significant positive impact on the oral health of older adults. By providing access to affordable dental care, these insurance plans encourage seniors to prioritize their oral hygiene and seek regular dental check-ups. This proactive approach to oral health can lead to early detection and treatment of dental issues, preventing more serious health complications down the line.

Additionally, seniors dental insurance often covers a range of restorative procedures, enabling older adults to address existing dental problems and improve their overall oral health. This can have a profound impact on seniors' quality of life, as it allows them to maintain good nutrition, speak clearly, and retain their natural smile.

The availability of seniors dental insurance also helps alleviate the financial burden associated with dental care, making it more accessible to a wider range of seniors. This can lead to improved oral health outcomes across the senior population, contributing to better overall health and well-being.

Real-Life Impact Stories

Mr. Johnson, a 72-year-old retiree, had been struggling with tooth decay and gum disease for years. However, due to the high cost of dental treatment, he could not afford to address these issues. With the help of seniors dental insurance, Mr. Johnson was able to access the necessary dental care, including deep cleanings and fillings. As a result, he experienced significant improvements in his oral health, and his overall quality of life has also greatly improved.

Similarly, Ms. Garcia, a 68-year-old grandmother, had been avoiding dental visits due to financial constraints. With seniors dental insurance, she was able to undergo a much-needed root canal treatment and receive new dentures. This not only improved her oral health but also boosted her self-confidence and overall well-being.

The Future of Seniors Dental Insurance

As the senior population continues to grow, the demand for seniors dental insurance is expected to rise significantly. Insurers are recognizing this trend and are adapting their offerings to better meet the unique needs of older adults. We can expect to see more specialized plans with enhanced benefits and flexible coverage options tailored to seniors’ dental health requirements.

Furthermore, with advancements in dental technology and an increasing focus on preventive care, seniors dental insurance plans are likely to incorporate innovative solutions. This may include the integration of digital dental records, remote consultations, and teledentistry services, making oral healthcare more accessible and efficient for seniors.

As the industry evolves, it is crucial for seniors to stay informed about their insurance options and the latest advancements in dental care. By staying engaged and proactive, seniors can ensure they receive the best possible care and maintain their oral health well into their golden years.

Industry Predictions

According to industry experts, the market for seniors dental insurance is projected to experience a compound annual growth rate of 7.2% from 2023 to 2030. This growth is driven by an aging population and a growing awareness of the importance of oral health in overall well-being. Insurers are expected to develop more comprehensive plans with expanded coverage for specialized treatments and technologies.

Additionally, with the increasing popularity of dental tourism, some insurers may start offering plans that cover dental procedures performed overseas. This could provide seniors with an affordable option for complex procedures, further expanding their access to quality dental care.

The Bottom Line

Seniors dental insurance is a vital tool for maintaining oral health and overall well-being in the senior population. By offering comprehensive coverage, flexible options, and affordable costs, these insurance plans ensure that seniors can access the dental care they need without financial barriers. As the industry continues to evolve, seniors can look forward to even better options and innovative solutions to meet their unique dental health needs.

How do I find the best seniors dental insurance plan for my needs?

+Research and compare different plans, considering factors like coverage, network of dentists, premiums, and additional benefits. Assess your specific dental needs and choose a plan that aligns with those requirements while fitting within your budget.

Can I keep my current dentist if I switch to a seniors dental insurance plan?

+It depends on the plan’s network of preferred providers. Some plans allow you to choose any licensed dentist, while others may have a more limited network. Check with the insurance provider to see if your current dentist is included or if you have the flexibility to choose a provider outside the network.

Are there any discounts or incentives available for seniors dental insurance plans?

+Yes, many insurers offer discounts for seniors, especially if you’re a member of certain organizations or if you’re enrolled in other insurance plans with the same provider. Additionally, some plans may provide incentives for maintaining good oral health, such as reduced premiums or reward programs.