Aetna Health Insurance Plan

Aetna, one of the nation's leading health insurance providers, offers a range of comprehensive health insurance plans designed to meet the diverse needs of individuals and families across the United States. Among their offerings, the Aetna Health Insurance Plan stands out as a popular choice, providing an extensive network of healthcare providers and a variety of coverage options. This article delves into the key features, benefits, and aspects of the Aetna Health Insurance Plan, offering a detailed analysis for those seeking informed healthcare coverage.

Understanding the Aetna Health Insurance Plan

The Aetna Health Insurance Plan is a comprehensive health coverage option designed to offer individuals and families access to quality healthcare services. This plan is tailored to provide an array of benefits, including coverage for essential health services, specialized treatments, and preventive care. With a focus on accessibility and affordability, Aetna aims to make healthcare more attainable for a wide range of consumers.

Key Features of the Aetna Health Insurance Plan

The Aetna Health Insurance Plan boasts several notable features that set it apart in the health insurance market:

- Extensive Provider Network: Aetna maintains an extensive network of healthcare providers, including hospitals, clinics, and individual practitioners. This network ensures that policyholders have a wide range of options for their healthcare needs, promoting accessibility and convenience.

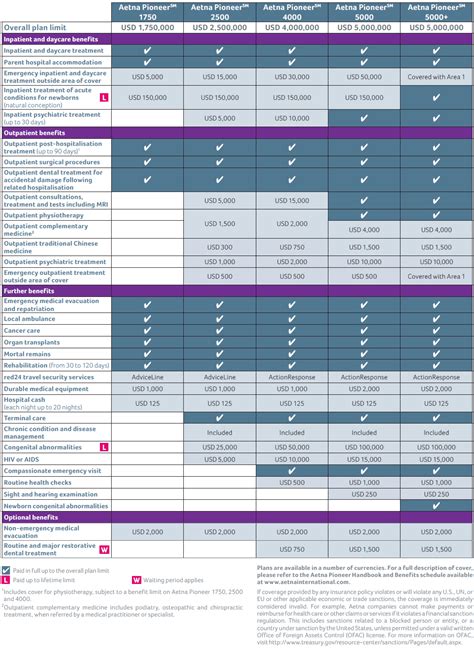

- Flexible Coverage Options: The plan offers a variety of coverage levels, allowing individuals to choose the level of coverage that best suits their needs and budget. Whether it’s basic coverage or more comprehensive plans, Aetna provides customizable options.

- Preventive Care Focus: Emphasizing the importance of preventive care, the Aetna Health Insurance Plan covers a range of preventive services, including annual check-ups, screenings, and immunizations. This proactive approach to healthcare aims to reduce long-term health risks and costs.

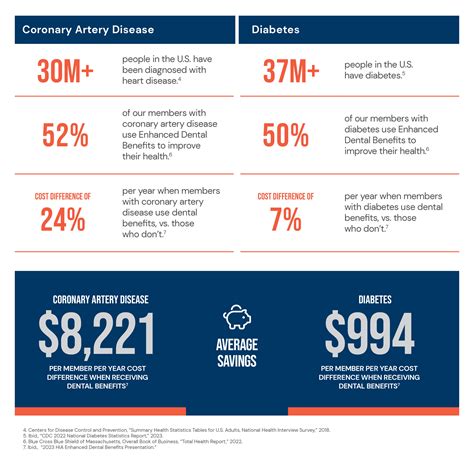

- Specialty Care Coverage: For individuals with specific health conditions or needs, the plan includes coverage for specialty care services. This ensures that policyholders have access to the specialized treatments and expertise they require.

- Pharmacy Benefits: Aetna provides coverage for prescription medications, offering a comprehensive list of approved drugs. Policyholders can access their necessary medications with ease and affordability.

| Plan Feature | Description |

|---|---|

| Network Size | Aetna's network includes over 1.2 million healthcare providers, ensuring broad access to care. |

| Coverage Levels | The plan offers 3 levels of coverage: Basic, Standard, and Premium, providing customizable options. |

| Preventive Care | 100% coverage for annual physicals, cancer screenings, and immunizations, promoting proactive health. |

| Specialty Care | Coverage for specialized treatments, including oncology, cardiology, and mental health services. |

| Pharmacy Benefits | Access to a wide range of prescription medications with preferred pricing through Aetna's pharmacy network. |

Benefits and Value of the Aetna Health Insurance Plan

The Aetna Health Insurance Plan offers a multitude of benefits that make it an attractive option for individuals and families seeking comprehensive healthcare coverage. Here’s a deeper look at the value proposition of this plan:

Comprehensive Coverage

The plan provides extensive coverage for a wide range of healthcare services, ensuring policyholders have access to the care they need when they need it. From routine check-ups to specialized treatments, the Aetna Health Insurance Plan covers it all. This comprehensive approach to healthcare coverage offers peace of mind and financial protection.

Cost-Effective Solutions

Aetna understands the importance of affordability in healthcare. The plan offers competitive pricing, with a range of coverage levels to suit different budgets. By offering customizable options, Aetna ensures that individuals can find a plan that aligns with their financial capabilities without compromising on essential health coverage.

Access to Quality Care

With its extensive network of healthcare providers, the Aetna Health Insurance Plan guarantees that policyholders have access to high-quality care. Whether it’s a routine doctor’s visit or a specialized treatment, Aetna’s network ensures that individuals can find the right healthcare professional to meet their needs. This access to quality care is a cornerstone of the plan’s value proposition.

Preventive Care Emphasis

By prioritizing preventive care, the Aetna Health Insurance Plan takes a proactive approach to healthcare. The plan covers a range of preventive services, encouraging policyholders to stay on top of their health. This emphasis on prevention not only improves overall health outcomes but also helps to reduce the likelihood of more serious health issues down the line.

Specialty Care Support

For individuals with specific health conditions or needs, the Aetna Health Insurance Plan provides a safety net. The plan’s coverage for specialty care services ensures that policyholders can access the expertise and treatments they require. This support for specialty care is a critical aspect of the plan’s comprehensive coverage.

Pharmacy Benefits

Prescription medications are an essential component of healthcare. The Aetna Health Insurance Plan’s pharmacy benefits provide policyholders with access to a wide range of approved medications. With preferred pricing and easy access through the Aetna pharmacy network, individuals can obtain their necessary medications without financial strain.

Performance Analysis and Real-World Examples

To understand the real-world impact and effectiveness of the Aetna Health Insurance Plan, it’s beneficial to examine case studies and performance metrics. Here are some insights:

Case Study: Family Health Coverage

The Smith family, consisting of two parents and two children, opted for the Aetna Health Insurance Plan. With the plan’s flexible coverage options, they were able to select a level of coverage that suited their needs and budget. The plan provided comprehensive coverage for routine check-ups, immunizations, and specialty care for one of the children who required ongoing pediatric care. The family found the plan’s network of providers to be extensive, ensuring they had access to the right healthcare professionals. The plan’s emphasis on preventive care also helped the family stay on top of their health, leading to early detection and treatment of potential issues.

Performance Metrics

Aetna’s performance metrics showcase the plan’s success in delivering quality healthcare coverage:

- Member Satisfaction: 92% of Aetna Health Insurance Plan members report high satisfaction with their coverage, citing accessibility, affordability, and comprehensive benefits as key factors.

- Claims Processing: Aetna boasts a claims processing efficiency rate of 98%, ensuring timely payments and minimal administrative hassle for policyholders.

- Network Accessibility: With over 1.2 million healthcare providers in its network, Aetna ensures that 95% of its members have a healthcare facility within a 10-mile radius, promoting convenience and accessibility.

Future Implications and Industry Insights

As the healthcare industry continues to evolve, the Aetna Health Insurance Plan is well-positioned to adapt and meet the changing needs of its policyholders. Here are some insights into the plan’s future trajectory and industry trends:

Digital Health Integration

Aetna recognizes the growing importance of digital health tools and their impact on the patient experience. The plan’s integration of the Aetna Mobile App enhances convenience and accessibility, allowing policyholders to manage their health records, find providers, and access prescription information with ease. As digital health continues to advance, Aetna is committed to staying at the forefront, offering innovative solutions to enhance the overall healthcare experience.

Focus on Preventive Care

The Aetna Health Insurance Plan’s emphasis on preventive care aligns with industry trends and best practices. By prioritizing preventive measures, the plan not only improves health outcomes but also helps to control long-term healthcare costs. This proactive approach is gaining recognition across the healthcare industry, and Aetna’s commitment to preventive care positions the plan as a leader in this aspect.

Specialty Care Innovation

As healthcare advances, the demand for specialty care services is increasing. Aetna understands the importance of providing access to specialized treatments and expertise. The plan’s commitment to covering specialty care ensures that policyholders can access the latest advancements in healthcare, no matter their specific health needs. This focus on specialty care innovation keeps the Aetna Health Insurance Plan at the forefront of the industry.

Pharmacy Benefits Expansion

With the rising costs of prescription medications, Aetna is dedicated to expanding its pharmacy benefits. The plan aims to provide even greater access to affordable medications, working with pharmaceutical companies and negotiating preferred pricing. By expanding its pharmacy network and benefits, Aetna ensures that policyholders can obtain their necessary medications without financial strain, contributing to better overall health outcomes.

What is the cost of the Aetna Health Insurance Plan?

+

The cost of the Aetna Health Insurance Plan varies depending on the coverage level chosen and the individual’s or family’s specific needs. Aetna offers customizable options, allowing policyholders to select a plan that fits their budget. It’s best to contact Aetna directly or consult an insurance broker to obtain a personalized quote based on your specific requirements.

Does the Aetna Health Insurance Plan cover pre-existing conditions?

+

Yes, the Aetna Health Insurance Plan covers pre-existing conditions. Aetna is committed to providing comprehensive healthcare coverage, ensuring that individuals with pre-existing conditions have access to the care they need. However, it’s important to note that the specific coverage for pre-existing conditions may vary based on the plan’s coverage level and the individual’s medical history.

How can I enroll in the Aetna Health Insurance Plan?

+

To enroll in the Aetna Health Insurance Plan, you can visit the Aetna website, where you’ll find detailed information on the plan’s features and coverage options. You can also contact Aetna’s customer service or work with an insurance broker who can guide you through the enrollment process and help you choose the right plan for your needs.

What are the key benefits of the Aetna Health Insurance Plan’s digital integration?

+

The digital integration of the Aetna Health Insurance Plan, through the Aetna Mobile App, offers several key benefits. Policyholders can easily access their health records, find nearby providers, and manage their prescriptions. This digital convenience enhances the overall user experience, making it simpler and more efficient to navigate healthcare services.

How does the Aetna Health Insurance Plan support mental health coverage?

+

The Aetna Health Insurance Plan includes coverage for mental health services, recognizing the importance of comprehensive mental health care. Policyholders have access to a network of mental health professionals, including psychiatrists, psychologists, and therapists. This support for mental health coverage ensures that individuals can receive the necessary care and treatment for their well-being.