Dental Insurance Plans Ma

Welcome to a comprehensive guide on dental insurance plans in the state of Massachusetts. Oral health is a vital aspect of overall well-being, and having the right dental coverage can make a significant difference in maintaining a healthy smile. This article aims to provide an in-depth analysis of the dental insurance landscape in MA, offering valuable insights to help residents make informed decisions about their dental care.

Understanding Dental Insurance Plans in Massachusetts

In Massachusetts, dental insurance plans play a crucial role in ensuring residents have access to affordable and comprehensive dental care. With a wide range of options available, it’s important to understand the different types of plans, their coverage, and how they can benefit individuals and families.

Types of Dental Insurance Plans

Dental insurance plans in MA typically fall into two main categories: Indemnity Plans and Managed Care Plans. Each type has its own unique features and coverage options, catering to different preferences and needs.

Indemnity Plans

Indemnity, or fee-for-service, plans offer flexibility and freedom of choice when it comes to dental care. With this type of plan, you can visit any licensed dentist without needing a referral or pre-authorization. The insurance company will reimburse you for a percentage of the total cost of dental services, based on a predetermined fee schedule.

| Advantages | Considerations |

|---|---|

| Flexibility to choose any dentist | Potential higher out-of-pocket costs |

| Reimbursement for a wide range of services | May require more paperwork for reimbursement |

| No need for prior approval for treatments | Annual maximum limits on coverage |

Managed Care Plans

Managed care plans, on the other hand, are designed to provide cost-effective dental care through a network of preferred providers. These plans typically include Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). While these plans often come with lower out-of-pocket costs, there may be restrictions on the choice of dentists and certain treatments.

- HMOs: Members must choose a primary care dentist from the plan's network and obtain referrals for specialized care. Out-of-network care may not be covered.

- PPOs: Offer more flexibility than HMOs, allowing members to visit any dentist, but with reduced benefits for out-of-network care.

Coverage and Benefits

Dental insurance plans in MA typically cover a range of services, including preventive care, basic procedures, and major dental work. However, the specific coverage and benefits can vary significantly depending on the plan and the insurance provider.

Preventive Care

Most dental insurance plans prioritize preventive care, covering services like dental cleanings, examinations, X-rays, and fluoride treatments. These services are often covered at 100% or with minimal out-of-pocket expenses, encouraging regular dental check-ups to catch potential issues early on.

Basic Procedures

Basic procedures, such as fillings, root canals, and extractions, are usually covered at a higher percentage than major dental work. However, the exact coverage can vary, and some plans may have waiting periods before these procedures are covered.

Major Dental Work

Major dental work, including dental implants, crowns, bridges, and orthodontic treatments, often requires a higher out-of-pocket cost and may have annual or lifetime maximum limits. It’s essential to carefully review the plan’s coverage for these procedures to ensure they align with your needs.

Choosing the Right Dental Insurance Plan

Selecting the right dental insurance plan in MA involves considering several factors, including your dental needs, budget, and the availability of preferred dentists. Here are some tips to guide your decision-making process:

- Assess Your Dental Needs: Determine the type and frequency of dental care you or your family require. Consider any ongoing treatments or potential future needs.

- Compare Plans and Coverage: Research and compare different dental insurance plans in MA. Look at the coverage for preventive, basic, and major procedures, as well as any exclusions or limitations.

- Consider Cost and Benefits: Evaluate the premiums, deductibles, and out-of-pocket costs associated with each plan. Strike a balance between affordable premiums and comprehensive benefits.

- Network of Dentists: If you have a preferred dentist, ensure they are in-network for the plan you choose. This can save you from unexpected costs and provide convenience.

- Read the Fine Print: Carefully review the plan's summary of benefits and coverage to understand any waiting periods, maximum limits, and any specific exclusions.

Performance Analysis and Real-World Examples

To provide a clearer understanding of how dental insurance plans perform in practice, let’s explore a few real-world scenarios and analyze the impact of different plans on dental care:

Scenario 1: Preventive Care for a Family

Imagine a family of four with a dental insurance plan that covers 100% of preventive care services, including biannual cleanings, examinations, and X-rays. By taking advantage of this coverage, the family can ensure their oral health is maintained without incurring any out-of-pocket costs for these essential services.

Scenario 2: Emergency Dental Treatment

Consider a situation where an individual experiences a dental emergency, such as a broken tooth. With a dental insurance plan that covers emergency treatments at 80% and includes a network of preferred providers, the individual can receive prompt care with reduced out-of-pocket expenses.

Scenario 3: Orthodontic Treatment for a Teenager

A teenager requires orthodontic treatment, which can be a significant investment. If the family has a dental insurance plan with coverage for orthodontics, they can benefit from reduced costs. However, it’s essential to understand any limitations, such as annual maximums or age restrictions, to ensure the plan aligns with their needs.

Scenario 4: Specialized Dental Care

Some individuals may require specialized dental care, such as periodontal treatment or oral surgery. In these cases, having a dental insurance plan that covers these services, either through in-network providers or with a percentage of reimbursement, can make a significant difference in managing the financial burden of such treatments.

Future Implications and Industry Trends

The dental insurance landscape in MA is continually evolving, influenced by various factors such as technological advancements, changing consumer preferences, and healthcare reforms. Here are some key trends and future implications to consider:

Digital Dentistry and Telehealth

The integration of digital technology in dentistry, coupled with the rise of telehealth services, is transforming the way dental care is delivered and accessed. Dental insurance plans may increasingly cover virtual consultations and remote monitoring, providing greater convenience and accessibility for patients.

Preventive Focus and Early Intervention

There is a growing emphasis on preventive care and early intervention in dental insurance plans. Insurers are recognizing the long-term benefits of investing in preventive measures, which can lead to improved oral health outcomes and reduced costs for both patients and providers.

Value-Based Care Models

Value-based care models, which focus on delivering high-quality care while controlling costs, are gaining traction in the dental industry. Dental insurance plans may shift towards these models, incentivizing providers to deliver efficient and effective care while rewarding patients for maintaining good oral health.

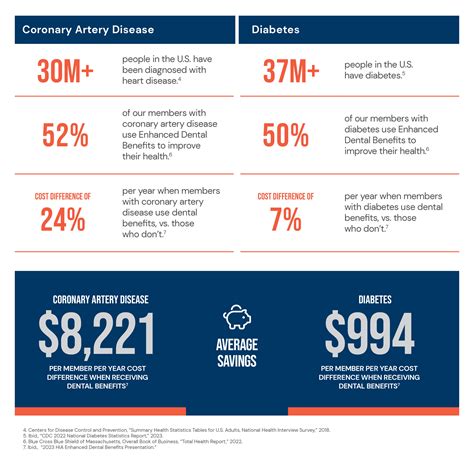

Integration with Overall Healthcare

As the understanding of the link between oral health and overall systemic health deepens, dental insurance plans may increasingly integrate with medical insurance. This integration can lead to more comprehensive coverage, addressing the oral-systemic health connection and promoting holistic well-being.

Conclusion

Understanding the intricacies of dental insurance plans in Massachusetts is crucial for residents seeking to maintain their oral health and manage dental care costs effectively. By exploring the different types of plans, their coverage, and real-world examples, individuals can make informed decisions about their dental insurance choices.

As the dental insurance landscape continues to evolve, staying informed about industry trends and future developments is essential. With a proactive approach to oral health and a well-chosen dental insurance plan, residents of MA can enjoy the benefits of a healthy smile and peace of mind.

What is the average cost of dental insurance in Massachusetts?

+

The average cost of dental insurance in MA can vary based on factors such as the type of plan, coverage, and age. Indemnity plans generally have higher premiums, while managed care plans like HMOs and PPOs can be more affordable. Premiums can range from around 30 to 60 per month for individuals and may be higher for family plans.

Are there any dental insurance plans that cover 100% of costs?

+

While some dental insurance plans cover 100% of certain preventive services like cleanings and exams, it’s uncommon for plans to cover 100% of all dental costs. Most plans have copayments, deductibles, and percentage-based coverage for different procedures, with major work often having higher out-of-pocket costs.

How can I find a dentist who accepts my dental insurance plan in MA?

+

You can typically find a list of in-network dentists on your insurance provider’s website. You can also contact your insurance company directly to verify which dentists are included in your plan’s network. Some plans offer an online tool to search for providers based on your location and insurance coverage.

What happens if I need dental care outside of my plan’s network?

+

If you receive dental care from an out-of-network provider, you may be responsible for higher out-of-pocket costs. Managed care plans like HMOs may not cover out-of-network care at all, while PPOs usually offer reduced benefits for out-of-network services. It’s best to check with your insurance provider for specific details regarding out-of-network coverage.

Are there any discounts or programs for those who can’t afford dental insurance in MA?

+

Yes, there are various programs and resources available in MA to help those who cannot afford dental insurance. These include community health centers that offer discounted or sliding-scale fees, dental schools that provide low-cost services, and state-sponsored programs like MassHealth Dental for eligible individuals. It’s worth exploring these options to access affordable dental care.