Aetna Individual Medical Insurance Plans

Aetna, a well-known name in the health insurance industry, offers a comprehensive range of individual medical insurance plans designed to cater to the diverse needs of its customers. In today's fast-paced world, having access to quality healthcare is essential, and Aetna aims to provide affordable and reliable coverage options for individuals and families.

Understanding Aetna’s Individual Medical Insurance Plans

Aetna’s individual medical insurance plans are tailored to offer flexibility and customization, ensuring that policyholders can select a plan that aligns with their specific healthcare requirements and budget. These plans provide coverage for a wide array of medical services, ranging from routine check-ups and preventive care to more complex procedures and treatments.

One of the key strengths of Aetna's individual plans is their emphasis on preventive care. The company recognizes the importance of early detection and management of health issues, which can lead to better overall health outcomes and reduced healthcare costs in the long run. As such, many of their plans include coverage for annual physicals, immunizations, and screening tests, encouraging policyholders to take a proactive approach to their health.

Plan Options and Coverage Highlights

Aetna offers a diverse portfolio of individual medical insurance plans, including:

- Bronze Plans: These plans typically have lower premiums and higher deductibles, making them a cost-effective option for those who anticipate minimal medical expenses. They provide basic coverage for essential health benefits and can be a great choice for younger, healthier individuals.

- Silver Plans: Balancing cost and coverage, Silver plans offer a middle ground between Bronze and Gold plans. They often have lower deductibles and out-of-pocket maximums, making them suitable for individuals with moderate healthcare needs.

- Gold Plans: Designed for those who anticipate more frequent or extensive medical care, Gold plans provide comprehensive coverage with lower out-of-pocket costs. These plans can be particularly beneficial for individuals with chronic conditions or those who require frequent access to healthcare services.

- Catastrophic Plans: Aetna’s catastrophic plans are tailored for younger individuals or those who cannot afford higher premium plans. They offer limited benefits and high deductibles, but they can provide essential coverage in case of a medical emergency.

Regardless of the plan chosen, Aetna's individual medical insurance plans typically cover a range of essential health benefits, including ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, and more.

| Plan Type | Premium Range | Deductible Range |

|---|---|---|

| Bronze | $250 - $500/month | $2,000 - $5,000 |

| Silver | $300 - $600/month | $1,500 - $3,000 |

| Gold | $400 - $800/month | $1,000 - $2,000 |

| Catastrophic | $150 - $300/month | $6,000 - $7,500 |

Aetna’s Network of Providers

Aetna’s extensive network of healthcare providers is a significant advantage for policyholders. The company has partnerships with some of the leading hospitals, clinics, and healthcare professionals across the nation, ensuring that policyholders have access to quality care wherever they are. This network includes:

- Top-rated hospitals and medical centers specializing in various fields, from cardiology to oncology.

- A diverse range of primary care physicians, including family doctors, internists, and pediatricians.

- Specialists in fields such as dermatology, ophthalmology, and orthopedic surgery.

- Mental health professionals, including psychologists and counselors.

- Pharmacies offering competitive pricing and convenient locations.

By leveraging this robust network, Aetna ensures that policyholders can easily find in-network providers for their healthcare needs, reducing out-of-pocket costs and simplifying the healthcare experience.

Network Advantages and Out-of-Network Options

Aetna’s network of providers offers several advantages. Firstly, in-network providers agree to accept Aetna’s negotiated rates, which are often lower than standard charges. This means policyholders can access quality care at more affordable prices. Secondly, the extensive network ensures that policyholders have a wide range of choices, making it easier to find a provider that suits their individual needs and preferences.

While it is beneficial to utilize in-network providers, Aetna also offers coverage for out-of-network services. However, the out-of-pocket costs for these services may be higher, as policyholders will typically pay the difference between the provider's charge and Aetna's allowed amount. It's important for policyholders to review their plan's specifics regarding out-of-network coverage to understand their potential costs.

Aetna’s Digital Tools and Resources

In today’s digital age, Aetna understands the importance of providing its policyholders with convenient and accessible tools to manage their healthcare and insurance needs. The company has developed a suite of digital resources and platforms to enhance the policyholder experience.

Aetna Navigator: Your Digital Companion

Aetna’s flagship digital platform, Aetna Navigator, is a comprehensive online tool designed to empower policyholders. With a user-friendly interface, Aetna Navigator allows users to:

- Easily view and manage their insurance plan details, including coverage, deductibles, and out-of-pocket maximums.

- Search for in-network providers based on their location, specialty, and other criteria.

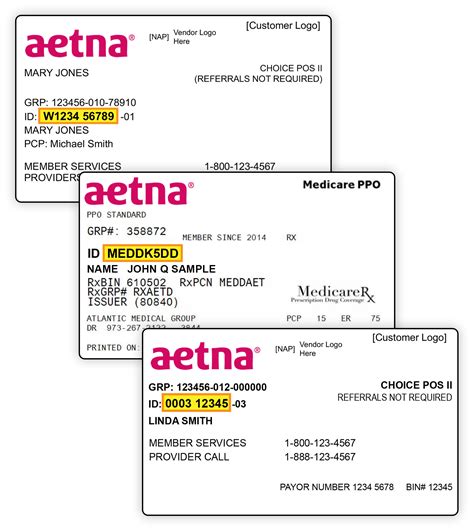

- Access their digital ID card, which can be used as proof of insurance when visiting healthcare providers.

- Review their claims history and understand the status of their claims.

- Receive personalized recommendations for preventive care and wellness programs based on their age, gender, and health conditions.

Aetna Navigator also provides educational resources and articles on various health topics, helping policyholders make informed decisions about their healthcare.

Telemedicine Services: Accessing Care from Home

Aetna recognizes the importance of convenient and accessible healthcare, especially in today’s fast-paced world. To cater to this need, the company offers telemedicine services, allowing policyholders to connect with healthcare providers virtually.

Through Aetna's telemedicine platform, policyholders can schedule virtual appointments with doctors and specialists from the comfort of their homes. These virtual visits are particularly beneficial for non-emergency medical issues, follow-up appointments, and mental health consultations. Telemedicine services can save time and reduce travel expenses, making healthcare more accessible and convenient.

Customer Service and Support

Aetna places a strong emphasis on providing exceptional customer service and support to its policyholders. The company understands that navigating the complexities of healthcare and insurance can be challenging, and it aims to make the process as seamless as possible.

Dedicated Customer Service Teams

Aetna employs dedicated customer service teams who are trained to assist policyholders with a wide range of inquiries and concerns. These teams are readily available via phone, email, and live chat, ensuring that policyholders can receive timely assistance when they need it.

Whether it's clarifying coverage details, understanding billing statements, or navigating the claims process, Aetna's customer service representatives are equipped to provide clear and concise information. They can also assist with more complex issues, such as appealing denied claims or coordinating benefits with other insurance plans.

Education and Resources for Policyholders

In addition to its customer service teams, Aetna provides a wealth of educational resources and tools to help policyholders understand their insurance coverage and navigate the healthcare system. These resources include:

- Informative articles and guides on various healthcare topics, from understanding insurance terminology to choosing the right healthcare providers.

- Video tutorials and webinars covering a range of subjects, from how to use Aetna’s digital platforms to tips for managing chronic conditions.

- Interactive tools, such as cost estimators, to help policyholders understand the potential costs of different medical procedures and services.

- A comprehensive FAQ section on the Aetna website, addressing common queries and concerns related to insurance plans, coverage, and the claims process.

Aetna’s Commitment to Innovation and Continuous Improvement

Aetna is committed to staying at the forefront of the health insurance industry, continuously innovating and improving its services to better meet the needs of its policyholders. The company invests in research and development to enhance its digital platforms, streamline processes, and introduce new benefits and features that enhance the policyholder experience.

Recent Innovations and Future Developments

In recent years, Aetna has introduced several innovative features and programs, including:

- Aetna Health Fund: This program provides policyholders with a dedicated health fund that can be used for a variety of healthcare expenses, including copays, deductibles, and out-of-pocket maximums. It offers a flexible and customizable approach to healthcare financing, empowering policyholders to manage their healthcare costs more effectively.

- Aetna Healthy Rewards: Aimed at encouraging healthy behaviors, this program rewards policyholders for completing various wellness activities, such as regular exercise, healthy eating, and smoking cessation. Participants can earn rewards in the form of gift cards, discounts, or contributions to their health fund.

- Enhanced Telemedicine Services: Aetna has expanded its telemedicine offerings, introducing new features such as video consultations and real-time chat with healthcare providers. These enhancements make telemedicine services more accessible and user-friendly, ensuring policyholders can receive timely medical advice and care.

Looking ahead, Aetna is focused on further integrating technology into its services. The company is exploring the potential of artificial intelligence and machine learning to personalize healthcare recommendations and improve the accuracy of cost estimates. Additionally, Aetna is committed to expanding its network of providers, particularly in underserved areas, to ensure that policyholders have access to quality healthcare regardless of their location.

What are the key differences between Aetna’s Bronze, Silver, and Gold plans?

+Aetna’s Bronze plans typically have lower premiums and higher deductibles, making them a cost-effective option for those with minimal healthcare needs. Silver plans offer a balance between cost and coverage, with lower deductibles and out-of-pocket maximums. Gold plans provide the most comprehensive coverage, ideal for those with frequent or complex healthcare needs.

How does Aetna’s telemedicine service work, and what are the benefits?

+Aetna’s telemedicine service allows policyholders to connect with healthcare providers virtually, offering convenience and accessibility. Benefits include reduced travel time and expenses, easier access to specialists, and the ability to receive medical advice and treatment from the comfort of home.

What resources does Aetna provide to help policyholders navigate their insurance coverage and healthcare needs?

+Aetna offers a range of resources, including informative articles, video tutorials, interactive tools, and a comprehensive FAQ section. These resources help policyholders understand their insurance coverage, choose the right healthcare providers, and navigate the healthcare system effectively.