Cyber Liability Insurance

In today's digital age, where technology and the internet have become integral parts of our personal and professional lives, the risks associated with cyber threats and data breaches are ever-increasing. As a result, businesses and individuals are seeking ways to protect themselves from potential financial losses and legal liabilities that can arise from cyber incidents. This is where Cyber Liability Insurance steps in as a crucial tool to safeguard against the complex and evolving landscape of cyber risks.

Understanding Cyber Liability Insurance

Cyber Liability Insurance, often referred to as Cyber Insurance or Cyber Risk Insurance, is a specialized form of coverage designed to protect businesses and individuals from the financial consequences and legal responsibilities arising from cyber-related events. These events can include data breaches, cyber attacks, system failures, identity theft, and various other cyber-related incidents.

This type of insurance has become increasingly important in recent years due to the rapid advancement of technology and the growing sophistication of cybercriminals. As more personal and sensitive data is stored and transmitted digitally, the potential for data breaches and cyber attacks has skyrocketed. Businesses, in particular, are at significant risk, as they often handle large amounts of customer data and rely heavily on digital systems and networks to operate.

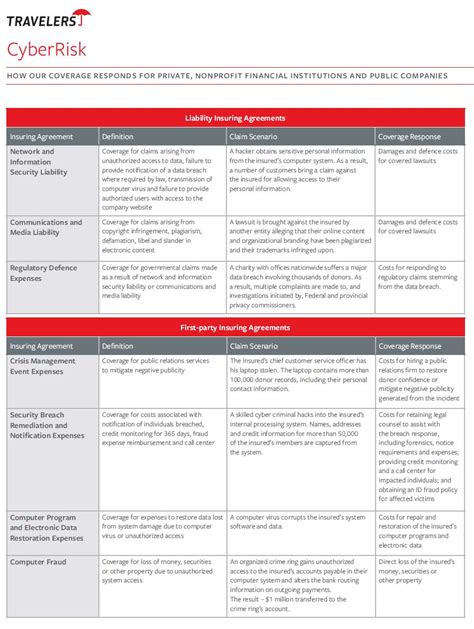

Coverage Provided by Cyber Liability Insurance

Cyber Liability Insurance policies typically offer a range of coverage options tailored to the specific needs of the insured. Here’s an overview of the key coverages commonly provided:

- Data Breach Response and Notification Costs: This coverage helps insured entities cover the costs associated with responding to and notifying affected individuals in the event of a data breach. These costs can include forensic investigations, legal consultations, and the expenses involved in notifying customers and regulatory bodies.

- Business Interruption: Cyber attacks or system failures can disrupt business operations, leading to lost revenue. Business Interruption coverage provides compensation for the financial losses incurred during the downtime, helping businesses stay afloat during recovery.

- Cyber Extortion: Cybercriminals often employ ransomware attacks or threaten to release sensitive data unless a ransom is paid. Cyber Extortion coverage assists insured parties in covering the costs associated with negotiating, paying the ransom (if approved by the insurer), and restoring systems post-attack.

- Privacy Liability: Privacy Liability coverage protects businesses from lawsuits and regulatory fines resulting from privacy breaches or violations of data protection laws. This coverage is especially crucial in industries that handle large volumes of personal data, such as healthcare and finance.

- Media Liability: With the increasing use of social media and online advertising, businesses face risks related to intellectual property infringement, defamation, and other forms of media-related claims. Media Liability coverage provides protection against such claims, including the costs of legal defense and settlements.

- Network Security and Privacy Liability: This coverage protects businesses against claims arising from unauthorized access, use, or disclosure of electronic data due to security breaches or failures in network security.

- Cyber Crime: Cyber Crime coverage helps insured entities recover from financial losses caused by fraudulent wire transfers, funds transfers, or other forms of electronic theft.

- Cyber Terrorism: In the event of a cyber attack carried out by a terrorist organization, this coverage provides protection against the resulting financial losses and damages.

- Cyber Crisis Management: This coverage assists businesses in managing the crisis and reputation damage that can arise from a cyber incident. It may include public relations support, crisis management consulting, and other services to mitigate the impact of the incident.

It's important to note that the specific coverages and limits provided by Cyber Liability Insurance policies can vary greatly depending on the insurer, the industry, and the needs of the insured. Policyholders should carefully review their policies to ensure they have adequate coverage for their unique risks and exposures.

| Cyber Liability Insurance Coverage | Description |

|---|---|

| Data Breach Response and Notification | Covers costs related to investigating and notifying affected parties after a data breach. |

| Business Interruption | Provides compensation for lost revenue due to cyber attacks or system failures. |

| Cyber Extortion | Assists in covering costs associated with negotiating and paying ransoms in response to cyber threats. |

| Privacy Liability | Protects against lawsuits and fines resulting from privacy breaches or data protection violations. |

| Media Liability | Offers coverage for intellectual property infringement and defamation claims related to social media and online advertising. |

The Growing Need for Cyber Liability Insurance

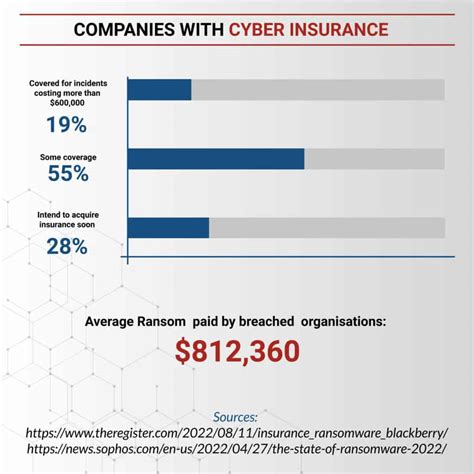

The need for Cyber Liability Insurance has grown exponentially in recent years due to several key factors:

Increasing Frequency and Severity of Cyber Attacks

Cybercriminals are becoming more sophisticated and prolific in their attacks. The number and complexity of cyber attacks have increased significantly, with ransomware attacks, phishing scams, and data breaches becoming commonplace. The potential financial and reputational damage caused by these incidents can be devastating for businesses, making insurance coverage a critical risk management tool.

Rising Cost of Data Breaches

The cost of responding to and mitigating the impact of data breaches has risen sharply. According to the IBM Security and Ponemon Institute 2022 Cost of a Data Breach Report, the average total cost of a data breach for organizations globally was 4.35 million, with the average cost per lost or stolen record reaching 180. This figure underscores the financial burden that businesses face when dealing with data breaches, making insurance coverage an essential component of their risk management strategy.

Stricter Data Protection Regulations

The implementation of stringent data protection regulations, such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States, has significantly increased the legal and financial liabilities for businesses in the event of a data breach. These regulations impose heavy fines and penalties for non-compliance, making it imperative for businesses to have adequate insurance coverage to protect themselves from potential financial ruin.

Growing Awareness and Demand

As cyber threats continue to make headlines and impact businesses across industries, awareness about the importance of cyber security and insurance coverage has grown. Many businesses are now recognizing the value of Cyber Liability Insurance in mitigating the financial and operational risks associated with cyber incidents. This increasing awareness has driven the demand for such insurance products, prompting insurers to develop more comprehensive and tailored coverage options.

The Role of Cyber Liability Insurance in Risk Management

Cyber Liability Insurance plays a critical role in a comprehensive risk management strategy for businesses and individuals. Here’s how it contributes to effective risk management:

Financial Protection

One of the primary functions of Cyber Liability Insurance is to provide financial protection against the costs and losses associated with cyber incidents. These can include expenses related to data breach response, legal fees, regulatory fines, and business interruption. By transferring these financial risks to the insurer, businesses can better manage their financial stability and ensure they have the resources to recover from cyber-related events.

Risk Mitigation

Cyber Liability Insurance policies often come with risk management services and resources to help insured entities reduce their cyber risks. Insurers may provide access to cybersecurity experts, risk assessment tools, and best practice guidelines to help businesses identify and address vulnerabilities in their systems and processes. By actively working to mitigate risks, businesses can reduce the likelihood and impact of cyber incidents.

Crisis Management

In the event of a cyber attack or data breach, Cyber Liability Insurance can provide valuable crisis management support. Insurers may offer resources such as public relations assistance, legal counsel, and access to cyber security experts to help businesses navigate the immediate aftermath of an incident. This support can be crucial in containing the damage, managing public relations, and restoring normal operations as quickly as possible.

Regulatory Compliance

With the increasing number of data protection regulations and privacy laws, businesses must ensure they comply with these standards to avoid hefty fines and legal consequences. Cyber Liability Insurance policies often include coverage for regulatory fines and penalties, helping businesses manage the financial impact of non-compliance. Additionally, insurers may provide resources and guidance to help insured entities understand and adhere to relevant regulations.

Business Continuity

Cyber incidents can disrupt business operations, leading to downtime and lost revenue. Cyber Liability Insurance can provide coverage for business interruption, helping businesses maintain financial stability during recovery. By ensuring they have the necessary funds to continue operations and quickly restore their systems, businesses can minimize the long-term impact of cyber attacks and data breaches.

The Future of Cyber Liability Insurance

As the cyber threat landscape continues to evolve, the future of Cyber Liability Insurance will be shaped by several key factors and trends:

Advancements in Technology

The rapid pace of technological advancements will drive the development of new cyber threats and attack methods. Insurers will need to stay abreast of these changes and continuously update their coverage options to address emerging risks. This may include expanding coverage for new types of cyber incidents and offering more specialized policies tailored to specific industries or business needs.

Increased Regulation and Standardization

With the growing awareness of cyber risks and the potential for significant financial and reputational damage, there is likely to be increased regulation and standardization in the cyber insurance market. This could lead to more consistent coverage options and better protection for policyholders. However, it may also result in higher premiums as insurers seek to manage their own risks more effectively.

Greater Emphasis on Risk Assessment and Mitigation

Insurers are likely to place increasing emphasis on risk assessment and mitigation as a prerequisite for coverage. They may require businesses to implement robust cybersecurity measures and demonstrate their commitment to cyber risk management before offering insurance policies. This shift will encourage businesses to prioritize cybersecurity and adopt best practices to reduce their exposure to cyber threats.

Collaboration between Insurers and Cybersecurity Experts

To stay ahead of the evolving cyber threat landscape, insurers will increasingly collaborate with cybersecurity experts and industry leaders. This collaboration will enable insurers to better understand emerging risks and develop more comprehensive and effective coverage options. It may also lead to the development of innovative insurance products that integrate with existing cybersecurity solutions, providing a more holistic approach to risk management.

Focus on Cyber Resilience

The concept of cyber resilience, which emphasizes the ability of organizations to anticipate, withstand, and rapidly adapt to cyber threats, will likely gain prominence in the future. Insurers may offer incentives and discounts to businesses that demonstrate strong cyber resilience through robust cybersecurity measures and effective incident response plans. This shift will encourage businesses to adopt a proactive approach to cyber risk management and invest in their cyber resilience capabilities.

Growing Demand for Specialized Coverage

As industries and businesses become more specialized, there will be an increasing demand for Cyber Liability Insurance policies that are tailored to specific sectors and business needs. Insurers will need to develop coverage options that address the unique risks and challenges faced by different industries, such as healthcare, finance, and e-commerce. This specialization will ensure that businesses receive the most appropriate and effective coverage for their specific cyber risks.

FAQ

What is Cyber Liability Insurance and why is it important?

+Cyber Liability Insurance is a specialized form of coverage that protects businesses and individuals from financial losses and legal liabilities arising from cyber-related events such as data breaches, cyber attacks, and system failures. It is crucial in today’s digital age, where the risks of cyber incidents are ever-increasing, to safeguard against potential financial ruin and maintain business continuity.

What types of coverage does Cyber Liability Insurance typically offer?

+Cyber Liability Insurance policies provide a range of coverage options, including Data Breach Response and Notification Costs, Business Interruption, Cyber Extortion, Privacy Liability, Media Liability, Network Security and Privacy Liability, Cyber Crime, and Cyber Terrorism. These coverages help insured entities manage the financial and operational impact of cyber incidents.

Why is the demand for Cyber Liability Insurance growing?

+The demand for Cyber Liability Insurance is increasing due to the rising frequency and severity of cyber attacks, the growing cost of data breaches, stricter data protection regulations, and a heightened awareness of cyber risks among businesses and individuals. These factors make insurance coverage an essential component of risk management.

How does Cyber Liability Insurance contribute to risk management?

+Cyber Liability Insurance plays a critical role in risk management by providing financial protection against cyber-related losses, offering risk mitigation resources, and providing crisis management support. It helps businesses maintain financial stability, navigate regulatory compliance, and ensure business continuity in the face of cyber incidents.

What can we expect from the future of Cyber Liability Insurance?

+The future of Cyber Liability Insurance will be shaped by advancements in technology, increased regulation and standardization, a greater emphasis on risk assessment and mitigation, collaboration between insurers and cybersecurity experts, a focus on cyber resilience, and the growing demand for specialized coverage. These factors will drive the development of more comprehensive and effective insurance products.