Insurance Insurance

Insurance, a financial safeguard against life's uncertainties, has become an integral part of modern existence. From protecting our homes and businesses to ensuring our health and financial stability, insurance policies provide a vital safety net in an increasingly unpredictable world. This article aims to delve into the intricate world of insurance, exploring its various facets, the critical role it plays in our lives, and the transformative innovations shaping its future.

Understanding the Fundamentals of Insurance

At its core, insurance is a contract between an individual or entity (the insured) and an insurance company (the insurer). This contract, known as a policy, details the specific risks or perils covered, the conditions under which the policy is in effect, and the obligations and rights of both parties.

The principle of insurance revolves around risk pooling. When a large number of individuals or entities contribute small amounts regularly (known as premiums), the insurer can accumulate a substantial fund. This fund is then used to compensate policyholders who suffer losses or damages covered by their insurance policy.

The insurance industry operates on the concept of actuarial science, which involves the mathematical and statistical modeling of risk. Insurers use actuarial methods to determine the likelihood of various events occurring and the potential costs associated with them. This data-driven approach ensures that insurance companies can set premiums accurately and maintain a balanced portfolio of risks.

Key Types of Insurance

The insurance landscape is diverse, catering to a wide range of needs and circumstances. Here’s a glimpse into some of the most common types of insurance:

- Life Insurance: This type of insurance provides financial protection to beneficiaries upon the death of the insured individual. Life insurance can be a critical tool for estate planning and ensuring financial stability for loved ones.

- Health Insurance: Health insurance covers medical expenses, including hospitalization, surgeries, medications, and often preventive care. It is an essential component of comprehensive healthcare management, ensuring access to quality medical services.

- Property Insurance: Property insurance safeguards homes, businesses, and valuable assets against damage or loss due to various perils such as fire, theft, natural disasters, or accidents. It provides financial protection and peace of mind.

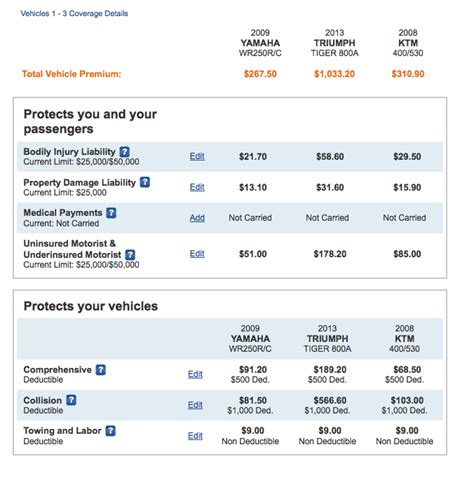

- Automobile Insurance: Auto insurance is a legal requirement in many jurisdictions and offers coverage for damage or injury caused by or to the insured vehicle and its occupants. It protects against financial losses arising from accidents or other incidents.

- Liability Insurance: This insurance protects policyholders from claims arising from injuries or damage caused to others or their property. It is particularly crucial for businesses, as it can cover legal costs and potential settlements.

Each type of insurance serves a unique purpose, and many individuals and businesses often hold multiple policies to comprehensively protect their interests.

The Impact of Insurance on Society

Insurance plays a pivotal role in society, fostering economic stability and growth. It provides a safety net that enables individuals and businesses to take calculated risks, knowing they are protected against potential financial devastation.

For individuals, insurance offers a sense of security and peace of mind. It ensures that life's unexpected twists and turns, from a sudden illness to a natural disaster, do not lead to catastrophic financial consequences. Insurance allows people to focus on their well-being and aspirations, knowing that their financial stability is protected.

In the business realm, insurance is a critical tool for risk management. It enables companies to operate with confidence, knowing that they are protected against a range of potential losses. This, in turn, encourages innovation and expansion, as businesses can invest in new ventures and growth strategies without the fear of financial ruin.

Social and Economic Benefits

The societal impact of insurance extends beyond individual and business protection. It contributes to the overall economic health of a nation by:

- Stimulating economic growth: Insurance encourages investment and entrepreneurship by reducing the financial risks associated with starting or expanding a business.

- Enhancing social welfare: Health and life insurance policies improve access to healthcare and provide financial support during challenging times, thus enhancing overall societal well-being.

- Promoting financial inclusion: Insurance can be a powerful tool for financial inclusion, particularly in developing economies, by providing access to credit and encouraging savings.

- Mitigating economic shocks: Insurance can act as a buffer against economic downturns and natural disasters, helping to stabilize the economy and support recovery efforts.

The positive impact of insurance on society underscores its importance as a critical component of a healthy, thriving economy and a secure, prosperous future.

The Evolution of Insurance: A Technological Transformation

The insurance industry has undergone a remarkable transformation in recent years, driven by technological advancements and changing consumer expectations. This digital revolution has ushered in a new era of efficiency, accessibility, and personalization in insurance services.

Digitalization and Insurance

The widespread adoption of digital technologies has revolutionized the way insurance is sold, administered, and delivered. Insurers are increasingly leveraging data analytics, artificial intelligence (AI), and machine learning to enhance their operations and provide more tailored solutions.

Digital platforms and online tools have simplified the insurance journey for customers. From policy procurement to claim settlement, many insurance processes can now be completed entirely online, offering convenience and speed. Customers can compare policies, obtain quotes, and manage their policies from the comfort of their homes.

Furthermore, the integration of AI and machine learning has enabled insurers to analyze vast amounts of data, leading to more accurate risk assessment and pricing. This data-driven approach allows insurers to offer highly customized policies that better meet the unique needs of individual customers.

| Technology | Impact on Insurance |

|---|---|

| Big Data Analytics | Enhanced risk assessment and underwriting, improved pricing accuracy. |

| Artificial Intelligence (AI) | Automated claim processing, personalized policy recommendations, improved customer service. |

| Internet of Things (IoT) | Real-time data collection for risk assessment, usage-based insurance models. |

| Blockchain | Secure and transparent record-keeping, improved fraud detection, streamlined transactions. |

Emerging Trends and Innovations

The insurance industry is witnessing several emerging trends and innovations that are shaping its future. Here are some key developments:

- Usage-Based Insurance (UBI): UBI, particularly in the auto insurance sector, utilizes telematics and IoT devices to monitor driving behavior and habits. This data is then used to tailor insurance premiums based on individual usage, offering incentives for safe driving and encouraging eco-friendly practices.

- Parametric Insurance: This innovative approach pays out claims based on predefined parameters, such as the severity of a natural disaster, rather than waiting for individual claims to be assessed. It provides rapid and predictable payouts, making it particularly useful in catastrophic events.

- Insurtech Collaboration: Insurers are increasingly partnering with tech startups, known as Insurtechs, to leverage their innovative solutions. These collaborations bring together insurance expertise and technological prowess, resulting in more efficient and customer-centric offerings.

- Digital Claims Management: Advanced digital platforms and AI are revolutionizing the claims process. Insurers are now able to streamline claims handling, reduce processing times, and enhance customer satisfaction through automated claim assessment and faster payouts.

These innovations demonstrate the insurance industry's commitment to staying at the forefront of technological advancement, ensuring it remains relevant and responsive to the evolving needs of its customers.

The Future of Insurance: Navigating Challenges and Opportunities

As the insurance industry continues to evolve, it faces both challenges and opportunities. The rapid pace of technological change, evolving customer expectations, and regulatory environments present a complex landscape for insurers.

Navigating Industry Challenges

The insurance industry must grapple with several key challenges, including:

- Regulatory Compliance: With changing regulatory landscapes, insurers must ensure they are compliant with various laws and regulations, which can be complex and time-consuming.

- Data Privacy and Security: As insurers collect and analyze vast amounts of data, ensuring data privacy and security becomes a critical concern. The risk of data breaches and cyber attacks is a significant challenge.

- Competition and Disruption: The entry of new players, particularly Insurtechs, into the market introduces increased competition and the risk of disruption to traditional insurance models.

- Changing Customer Expectations: Customers now expect seamless digital experiences and rapid responses. Insurers must adapt to meet these expectations, offering convenient and accessible services.

Capitalizing on Opportunities

Despite these challenges, the insurance industry also presents numerous opportunities for growth and innovation. Insurers can leverage these opportunities to stay ahead of the curve and deliver exceptional value to their customers.

- Data-Driven Insights: The wealth of data available to insurers can be harnessed to gain deeper insights into customer behavior and market trends. This can lead to more effective marketing strategies, improved risk assessment, and better-tailored products.

- Personalization and Customization: By leveraging data analytics and AI, insurers can offer highly personalized policies that meet the unique needs of individual customers. This level of customization enhances customer satisfaction and loyalty.

- Sustainable and Ethical Practices: With growing environmental and social consciousness, insurers can position themselves as leaders in sustainability and ethical practices. This includes offering green insurance products and supporting initiatives that promote social responsibility.

- Collaborative Partnerships: Collaborating with Insurtechs and other industry players can unlock new opportunities for growth and innovation. These partnerships can drive digital transformation, enhance operational efficiency, and deliver superior customer experiences.

The future of insurance is bright, as long as insurers remain agile, adaptable, and customer-centric. By embracing technological advancements, staying attuned to market dynamics, and fostering a culture of innovation, the insurance industry can continue to provide essential protection and peace of mind to individuals and businesses worldwide.

How does insurance benefit the economy on a larger scale?

+Insurance plays a pivotal role in stimulating economic growth and enhancing social welfare. By mitigating risks and providing financial protection, insurance encourages investment, entrepreneurship, and innovation. It also promotes financial inclusion and acts as a buffer against economic shocks, thus contributing to overall economic stability and prosperity.

What is the significance of digitalization in the insurance industry?

+Digitalization has transformed the insurance landscape, making it more efficient, accessible, and personalized. It has streamlined processes, enhanced customer experiences, and enabled insurers to leverage data analytics and AI for improved risk assessment and pricing. Digitalization is a key enabler of innovation and competitiveness in the insurance sector.

How can insurers stay ahead in a rapidly changing market?

+To stay ahead, insurers must embrace technological advancements, focus on data-driven insights, and offer highly personalized products. They should also foster collaborative partnerships with Insurtechs and other industry players to drive digital transformation and enhance operational efficiency. Staying agile and adaptable is key to thriving in a dynamic market.