Liberty Mutual Homeowners Insurance

When it comes to safeguarding your home and peace of mind, choosing the right homeowners insurance provider is paramount. With numerous options available, it can be a daunting task to navigate the market and find a policy that suits your specific needs. This comprehensive guide aims to shed light on one of the leading insurance providers in the United States, Liberty Mutual, and its homeowners insurance offerings. By delving into the intricacies of their policies, we aim to empower you with the knowledge needed to make an informed decision.

Understanding Liberty Mutual Homeowners Insurance

Liberty Mutual Insurance is a renowned name in the insurance industry, offering a comprehensive range of policies to protect individuals and businesses. Their homeowners insurance, in particular, has gained recognition for its coverage options, competitive pricing, and customer-centric approach. This section provides an in-depth exploration of Liberty Mutual’s homeowners insurance, highlighting its key features and benefits.

Coverage Options

Liberty Mutual offers a variety of coverage options to cater to the diverse needs of homeowners. From standard policies that cover the basics to more comprehensive plans that provide additional protection, they strive to ensure that every homeowner can find a policy that suits their requirements.

One of the standout features of Liberty Mutual's homeowners insurance is its customizable nature. Homeowners can opt for specific coverage endorsements, such as:

- Personal Property Replacement Cost: This endorsement ensures that your personal belongings are replaced at their current market value, rather than their depreciated value, providing an added layer of protection.

- Water Backup Coverage: In the event of a backup of water or sewage, this coverage can help cover the costs of cleanup and repairs, a valuable addition for homeowners in areas prone to such incidents.

- Identity Restoration: With the increasing prevalence of identity theft, this coverage offers peace of mind by providing resources and assistance to help restore your identity if it is compromised.

Additionally, Liberty Mutual offers specialized coverage for high-value items, such as fine art, jewelry, and collectibles. This ensures that your most valuable possessions are adequately protected.

Policy Benefits and Perks

Liberty Mutual’s homeowners insurance policies come with a range of benefits and perks that enhance the overall value of their offerings.

- Discounts: Liberty Mutual provides various discounts to policyholders, including multi-policy discounts, new home discounts, and loyalty discounts, helping to reduce the overall cost of insurance.

- Claims Assistance: The company has a dedicated claims team that is available 24/7 to assist policyholders in the event of a claim. Their efficient and compassionate approach ensures a smooth and stress-free claims process.

- Online and Mobile Tools: Liberty Mutual offers a range of digital tools and resources, such as an online portal and mobile app, allowing policyholders to manage their policies, pay bills, and access policy documents with ease.

- Risk Management Services: Through their partnership with the Institute for Business & Home Safety (IBHS), Liberty Mutual provides valuable resources and information to help homeowners reduce their risk of loss due to natural disasters and other hazards.

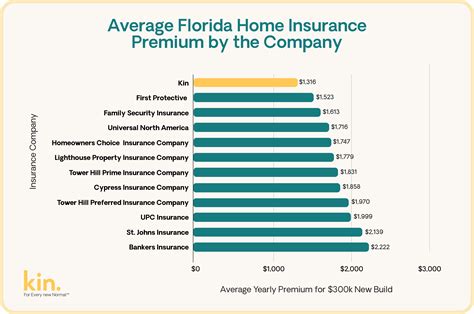

Competitive Pricing and Personalized Quotes

Liberty Mutual is known for its competitive pricing, offering affordable homeowners insurance policies without compromising on coverage. Their pricing structure is designed to be transparent and straightforward, making it easy for homeowners to understand the cost of their policy.

To ensure that policyholders receive the most accurate and personalized quotes, Liberty Mutual takes into account a range of factors, including the location, size, and construction of the home, as well as the homeowner's personal circumstances and risk profile. This tailored approach ensures that each policyholder receives a quote that is fair and reflective of their unique situation.

The Benefits of Choosing Liberty Mutual

Opting for Liberty Mutual homeowners insurance brings a host of advantages, ensuring that your home and belongings are protected while providing you with a range of additional benefits.

Financial Stability and Reliability

Liberty Mutual is a financially stable and reliable insurance provider, consistently earning high ratings from independent financial rating agencies such as A.M. Best and Standard & Poor’s. This stability ensures that policyholders can trust Liberty Mutual to be there when they need them, providing financial security in the event of a claim.

Personalized Service and Expertise

At Liberty Mutual, customer service is a top priority. The company understands that every homeowner’s situation is unique, and they strive to provide personalized service and expert guidance. From policy selection to claims assistance, Liberty Mutual’s team of knowledgeable professionals is dedicated to ensuring that each policyholder receives the support they need.

Comprehensive Coverage and Customization

Liberty Mutual’s homeowners insurance policies offer comprehensive coverage, providing protection against a wide range of perils, including fire, theft, and natural disasters. Additionally, their customizable coverage options allow homeowners to tailor their policies to their specific needs, ensuring that they have the right level of protection for their home and belongings.

Additional Benefits and Resources

Beyond the core coverage, Liberty Mutual provides a range of additional benefits and resources to enhance the overall value of their homeowners insurance policies. These include:

- Identity Theft Protection: Liberty Mutual offers resources and support to help policyholders prevent and recover from identity theft, a growing concern in today's digital world.

- Home Improvement Resources: Through their partnership with the IBHS, Liberty Mutual provides valuable information and resources to help homeowners improve the safety and resilience of their homes against natural disasters.

- Discounts and Rewards: Policyholders can take advantage of various discounts and rewards programs, such as multi-policy discounts and loyalty bonuses, helping to reduce the overall cost of insurance.

Policy Features and Specifications

Liberty Mutual’s homeowners insurance policies are designed to offer comprehensive protection and peace of mind. Let’s delve into the specific features and specifications that make their policies stand out.

Coverage Types

Liberty Mutual offers two main types of homeowners insurance policies: HO-3 (Special Form) and HO-5 (Open Perils). The HO-3 policy provides basic coverage for your home and belongings, while the HO-5 policy offers more extensive coverage, including protection for your personal property against a wider range of perils.

Coverage Limits and Deductibles

The coverage limits and deductibles on your Liberty Mutual homeowners insurance policy can be customized to fit your needs and budget. Here’s a breakdown of the key coverage limits and deductibles:

| Coverage Type | Coverage Limit | Deductible Options |

|---|---|---|

| Dwelling Coverage | Up to the replacement cost of your home | Standard, High, and Low deductible options available |

| Personal Property Coverage | Typically 50% to 70% of the dwelling coverage limit | Standard deductible |

| Liability Coverage | Varies based on policy, often starting at $100,000 | Standard deductible |

| Additional Living Expenses | Usually 20% of the dwelling coverage limit | Standard deductible |

It's important to note that the coverage limits and deductibles can be adjusted to meet your specific needs and budget. Liberty Mutual's agents can help you find the right balance between coverage and cost.

Additional Coverages

Liberty Mutual offers a range of additional coverages to enhance your homeowners insurance policy. These optional endorsements can provide extra protection for specific situations or valuable items.

- Water Backup Coverage: Covers damage caused by water backup through sewers or drains.

- Personal Property Replacement Cost: Replaces your personal belongings at their current market value, rather than their depreciated value.

- Scheduled Personal Property: Provides additional coverage for high-value items like jewelry, fine art, and collectibles.

- Identity Theft Coverage: Offers resources and assistance to help you recover from identity theft.

- Home Systems Protection: Covers the cost of repairing or replacing home systems like HVAC, plumbing, and electrical.

Discounts and Savings

Liberty Mutual provides various discounts to help make their homeowners insurance policies more affordable. Here are some of the discounts you may be eligible for:

- Multi-Policy Discount: Save by bundling your homeowners insurance with other policies, such as auto insurance.

- New Home Discount: If you've recently purchased a new home, you may qualify for a discount.

- Loyalty Discount: Reward for long-term customers who have maintained their policies with Liberty Mutual.

- Safety Features Discount: Installing certain safety features like burglar alarms or smoke detectors may earn you a discount.

- Claims-Free Discount: Policyholders who have not made any claims in a certain period may be eligible for a discount.

Customer Satisfaction and Claims Process

When it comes to homeowners insurance, customer satisfaction and a seamless claims process are essential. Liberty Mutual prides itself on its commitment to providing exceptional customer service and efficient claims handling.

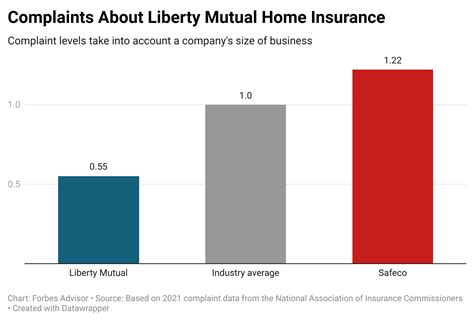

Customer Satisfaction and Reviews

Liberty Mutual has consistently received positive reviews and high ratings from customers and industry experts alike. Here are some key highlights:

- J.D. Power awarded Liberty Mutual high ratings for overall customer satisfaction in their Home Insurance Study.

- The company has an A+ rating from the Better Business Bureau (BBB), indicating a strong commitment to customer service and ethical business practices.

- Customer reviews highlight the friendly and knowledgeable service provided by Liberty Mutual's agents and the ease of managing policies through their online platform.

Claims Process and Handling

Liberty Mutual understands that filing a claim can be a stressful experience. That’s why they’ve designed a streamlined and efficient claims process to ensure a smooth and timely resolution.

Here's an overview of the Liberty Mutual claims process:

- Report the Claim: Policyholders can report a claim 24/7 through the Liberty Mutual website, mobile app, or by calling their customer service hotline.

- Claims Intake: Liberty Mutual's dedicated claims team will promptly assess the claim and provide guidance on the next steps.

- Investigation and Assessment: The claims team will investigate the incident, gather necessary information, and assess the extent of the damage.

- Repair or Replacement: Depending on the nature of the claim, Liberty Mutual will work with the policyholder to arrange repairs or replacement of damaged property.

- Payment: Once the claim is approved, Liberty Mutual will process the payment promptly, ensuring that policyholders receive the funds they need to recover.

Throughout the claims process, Liberty Mutual strives to maintain open communication with policyholders, providing regular updates and ensuring that any questions or concerns are addressed promptly.

Conclusion

Liberty Mutual homeowners insurance offers a compelling combination of comprehensive coverage, competitive pricing, and exceptional customer service. With their range of coverage options, personalized quotes, and additional benefits, they provide homeowners with the protection and peace of mind they deserve.

By choosing Liberty Mutual, you can trust that your home and belongings are safeguarded against a wide range of perils, while also benefiting from their financial stability, personalized service, and valuable resources. Whether you're a first-time homeowner or a long-term policyholder, Liberty Mutual's homeowners insurance policies are designed to meet your unique needs and provide the protection you require.

We hope this guide has provided you with valuable insights into Liberty Mutual's homeowners insurance offerings. Remember, when it comes to protecting your home, it's crucial to choose an insurance provider that understands your needs and delivers on its promises. Liberty Mutual is dedicated to doing just that, making them a top choice for homeowners seeking reliable and comprehensive coverage.

How much does Liberty Mutual homeowners insurance cost?

+The cost of Liberty Mutual homeowners insurance can vary based on several factors, including the location, size, and construction of your home, as well as your personal circumstances and risk profile. On average, policyholders can expect to pay around 1,000 to 2,000 per year for a standard HO-3 policy. However, the actual cost can be higher or lower depending on your specific situation. It’s best to obtain a personalized quote from Liberty Mutual to get an accurate estimate for your home.

What types of discounts does Liberty Mutual offer for homeowners insurance?

+Liberty Mutual offers a range of discounts to help policyholders save on their homeowners insurance premiums. These include multi-policy discounts (for bundling homeowners insurance with other policies like auto insurance), new home discounts, loyalty discounts, safety features discounts (for installing certain safety devices), and claims-free discounts (for policyholders who haven’t made any claims in a certain period). These discounts can significantly reduce the overall cost of insurance, making Liberty Mutual’s policies more affordable.

Does Liberty Mutual provide coverage for high-value items like jewelry and fine art?

+Yes, Liberty Mutual offers specialized coverage for high-value items such as jewelry, fine art, and collectibles. This coverage, known as “Scheduled Personal Property,” provides additional protection for these valuable items, ensuring that they are adequately insured and protected against a wider range of perils. Policyholders can work with Liberty Mutual’s agents to determine the appropriate coverage limits and deductibles for their high-value possessions.