Aetna Life Insurance Policy Lookup

In the vast landscape of insurance, navigating the intricacies of policies can be a daunting task. This article aims to demystify the process of looking up Aetna life insurance policies, providing a comprehensive guide for policyholders and those seeking information. With a rich history dating back to 1853, Aetna has established itself as a leading provider of health insurance and related services, expanding its offerings to include life insurance policies that cater to diverse needs. Understanding the specifics of your Aetna life insurance policy is crucial, as it empowers you to make informed decisions about your coverage and financial future.

Understanding Your Aetna Life Insurance Policy

Aetna offers a range of life insurance policies, each designed to meet specific needs and life stages. Whether you're seeking term life insurance for a defined period or whole life insurance for lifelong coverage, Aetna provides options tailored to individual circumstances. The key to unlocking the benefits of your policy lies in comprehending its terms and conditions, including coverage limits, premiums, and any applicable riders or add-ons.

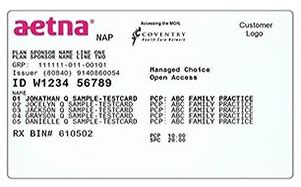

To initiate the lookup process, gather the necessary information. This typically includes your policy number, which is a unique identifier assigned to your specific plan. If you're unaware of your policy number, don't fret; other identifying details, such as your name, date of birth, and the policy's effective date, can often be used to retrieve the necessary information.

Online Policy Lookup: A Digital Advantage

In today's digital age, Aetna offers a convenient online platform for policyholders to access their information. By visiting the official Aetna website, you can create an account or log in to your existing one. From there, you'll have access to a wealth of resources, including a comprehensive overview of your life insurance policy.

The online dashboard provides a user-friendly interface, allowing you to view key policy details at a glance. You can easily navigate to specific sections, such as coverage limits, beneficiary information, and premium payment schedules. This digital access streamlines the process, ensuring you have the information you need when you need it.

Additionally, the online platform often includes helpful tools and resources. For instance, you might find a premium calculator that allows you to estimate future costs based on various scenarios. Some platforms even offer interactive features, enabling you to update beneficiary information or make policy changes with just a few clicks.

The Role of Customer Service: Personalized Assistance

While digital resources are invaluable, sometimes personal assistance is required. Aetna's dedicated customer service team stands ready to provide tailored support. Whether you prefer a phone call, live chat, or email, their experts can guide you through the policy lookup process, ensuring you understand every aspect of your coverage.

Customer service representatives can verify policy details, explain complex terms, and address any concerns you may have. They can also assist with updating personal information, such as address changes or beneficiary designations, ensuring your policy remains current and reflective of your life circumstances.

| Policy Type | Key Features |

|---|---|

| Term Life Insurance | Affordable coverage for a specified period; ideal for short-term financial protection. |

| Whole Life Insurance | Lifetime coverage with cash value accumulation; offers long-term financial security. |

| Universal Life Insurance | Flexible coverage with adjustable premiums and death benefits; provides customization. |

Moreover, customer service representatives can provide insights into additional benefits or riders available with your policy. These add-ons, such as accelerated death benefits or waiver of premium riders, can enhance your coverage, offering extra protection in specific circumstances.

Exploring Policy Benefits and Coverage

Understanding the benefits and coverage of your Aetna life insurance policy is crucial for maximizing its potential. Life insurance policies are designed to provide financial protection to your loved ones in the event of your untimely demise. The coverage amount and specific benefits can vary based on the type of policy you hold and any additional riders you've opted for.

Coverage Limits and Premiums

The coverage limit, or the death benefit, is a key component of your life insurance policy. This is the amount your beneficiaries will receive upon your passing. The premium, on the other hand, is the cost you pay to maintain this coverage. Both of these elements are influenced by factors such as your age, health status, and the type of policy you've chosen.

Aetna offers a range of coverage limits to accommodate different financial needs. Whether you require a basic policy to cover funeral expenses or a more extensive plan to provide long-term financial support for your family, Aetna's policies are customizable to fit your circumstances.

Beneficiary Designation and Updates

Designating beneficiaries is a critical aspect of your life insurance policy. These are the individuals or entities you choose to receive the death benefit upon your passing. It's important to review and update your beneficiary designations regularly, especially if your life circumstances change. This ensures that your policy aligns with your current wishes and intentions.

Aetna's online platform and customer service team can guide you through the process of updating beneficiary information. They can provide guidance on choosing primary and contingent beneficiaries, as well as assist with any necessary paperwork to ensure your wishes are accurately reflected in your policy.

Riders and Additional Benefits

Aetna offers a variety of riders and additional benefits that can enhance your life insurance coverage. These optional add-ons allow you to customize your policy to fit your specific needs and circumstances. Some common riders include:

- Accelerated Death Benefit Rider: This rider allows you to access a portion of your death benefit while you're still alive if you're diagnosed with a terminal illness.

- Waiver of Premium Rider: If you become disabled and unable to work, this rider waives your premium payments, ensuring your coverage remains active.

- Spouse/Partner Rider: This rider extends coverage to your spouse or domestic partner, providing additional protection for your loved ones.

- Child Rider: This option offers coverage for your children, ensuring they're financially protected in the event of your passing.

Each rider has its own set of terms and conditions, and the availability and cost may vary based on your policy and personal circumstances. It's important to carefully review these options with your Aetna representative to determine which riders, if any, are suitable for your needs.

Policy Management and Maintenance

Effective policy management is essential to ensure your Aetna life insurance policy remains up-to-date and aligns with your evolving life circumstances. Regularly reviewing and updating your policy can help you make the most of your coverage and provide peace of mind for you and your beneficiaries.

Reviewing Policy Changes and Updates

Life is full of changes, and these changes can impact your life insurance needs. Whether it's a new addition to your family, a career change, or a significant life event, it's important to assess how these changes affect your policy. Regular policy reviews allow you to make adjustments, such as increasing your coverage limits or adding new beneficiaries, to ensure your policy continues to provide the protection you need.

Aetna's online platform and customer service team can assist you in reviewing and understanding the changes you may need to make. They can guide you through the process of updating your policy, ensuring all necessary information is accurate and up-to-date.

Premium Payment Options and Flexibility

Aetna offers a variety of premium payment options to accommodate different financial situations. You can choose to pay your premiums monthly, quarterly, semi-annually, or annually, depending on what works best for your budget. Additionally, Aetna provides flexibility in payment methods, allowing you to pay via direct deposit, credit card, or check.

If you encounter financial difficulties and are unable to pay your premiums, it's important to contact Aetna as soon as possible. They may offer temporary solutions, such as premium deferment or reduced payment plans, to help you maintain your coverage during challenging times.

Policy Loan and Cash Value Options

Some Aetna life insurance policies, such as whole life and universal life, offer the option of taking out a policy loan or accessing the cash value of your policy. These features can provide financial flexibility, especially in times of need.

A policy loan allows you to borrow against the cash value of your policy. The loan amount and interest rate are determined by your policy's terms and conditions. It's important to note that if the loan is not repaid, it will be deducted from the death benefit upon your passing.

The cash value of your policy grows over time and can be accessed as needed. This accumulated cash value can be used for various purposes, such as covering premiums during financial hardship, supplementing retirement income, or providing a source of emergency funds.

Claim Process and Support

In the unfortunate event of a claim, Aetna is committed to providing support and guidance throughout the process. Understanding the claim process and having the necessary information ready can help streamline the experience and ensure a timely resolution.

Initiating a Claim

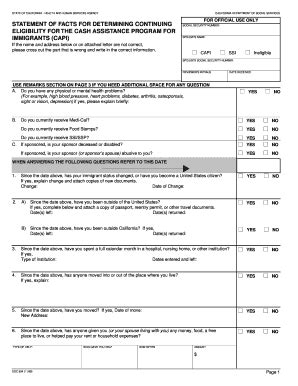

To initiate a claim with Aetna, you'll need to gather certain documents and information. This typically includes a certified copy of the death certificate, the policy number, and any additional information specified in your policy's terms.

Aetna's customer service team can guide you through the claim process, providing a step-by-step overview and answering any questions you may have. They can also assist with completing and submitting the necessary claim forms, ensuring the process is as smooth as possible.

Claim Processing Timeline

The timeline for claim processing can vary depending on the complexity of the claim and the specific circumstances. Aetna aims to process claims as efficiently as possible, but it's important to allow for some time to complete the necessary reviews and verifications.

During the claim process, Aetna may request additional documentation or information to support the claim. It's crucial to provide these materials in a timely manner to avoid delays in processing. The customer service team can guide you through any additional requirements and answer any questions that arise.

Beneficiary Payout Options

Once the claim is approved, Aetna offers various payout options for beneficiaries. These options can be tailored to the beneficiary's needs and preferences, providing flexibility and control over the received funds.

- Lump Sum Payment: This option provides the full death benefit amount in a single payment, allowing beneficiaries to access the funds immediately.

- Installment Payments: For those who prefer a more structured approach, installment payments can be arranged, providing regular payments over a specified period.

- Interest-Bearing Account: Beneficiaries can opt to have the death benefit placed in an interest-bearing account, allowing the funds to grow over time.

- Charitable Donation: If the beneficiary wishes to honor the deceased's legacy, a portion or all of the death benefit can be donated to a charitable organization of their choice.

The payout option chosen can be discussed with the Aetna representative, who can provide guidance and ensure the process aligns with the beneficiary's wishes.

Frequently Asked Questions

How do I find my Aetna life insurance policy number if I don't have it?

+If you're unable to locate your policy number, you can contact Aetna's customer service team. They can assist in retrieving your policy information using alternative details such as your name, date of birth, and the policy's effective date.

Can I change my beneficiary designation online?

+Yes, Aetna's online platform often allows policyholders to update beneficiary information directly. However, it's recommended to verify the changes with a customer service representative to ensure accuracy.

What happens if I miss a premium payment?

+Missing a premium payment may result in a lapse in coverage. However, Aetna may offer options such as a grace period or a reinstatement process to help you maintain your policy. Contacting Aetna promptly can help resolve the issue.

How do I file a claim with Aetna for my life insurance policy?

+To file a claim, gather the necessary documents, including the death certificate, and contact Aetna's customer service team. They will guide you through the claim process, providing support and answering any questions you may have.

Navigating the world of life insurance can be complex, but with Aetna’s comprehensive policies and dedicated support, policyholders can feel confident in their coverage. By understanding the intricacies of their policies and utilizing the available resources, individuals can ensure they’re making the most of their life insurance protection.