Affordable Full Coverage Car Insurance

Securing affordable full coverage car insurance is a critical financial decision for vehicle owners, offering peace of mind and protection against unforeseen incidents. This comprehensive guide delves into the intricacies of full coverage auto insurance, exploring how drivers can obtain the best policies at competitive rates, all while adhering to essential safety and legal standards.

Understanding Full Coverage Car Insurance

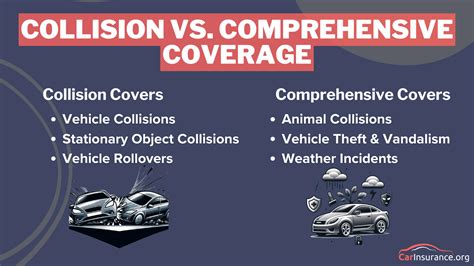

Full coverage car insurance is an all-encompassing term that covers both liability insurance and comprehensive and collision insurance. Liability insurance is mandatory in most states and covers bodily injury and property damage to others if you’re at fault in an accident. Comprehensive and collision insurance, while not legally required, are essential for complete protection. They cover damage to your own vehicle, regardless of fault.

This comprehensive package safeguards against a wide range of incidents, including:

- Accidents resulting in bodily harm or property damage to others.

- Vandalism, theft, or natural disasters.

- Collision with another vehicle or object.

- Glass damage, including windshield repairs or replacements.

The Benefits of Full Coverage

Opting for full coverage car insurance offers numerous advantages. It provides a financial safety net, ensuring that you're not left with a hefty bill in the event of an accident or other unforeseen circumstances. Additionally, it can often lead to lower out-of-pocket costs compared to liability-only coverage, especially when repairs are extensive.

Full coverage also offers peace of mind, knowing that you're protected in a wide variety of situations. It's particularly beneficial for newer or leased vehicles, where repairs or replacements can be costly.

| Coverage Type | Description |

|---|---|

| Liability Insurance | Covers bodily injury and property damage to others. |

| Comprehensive Insurance | Covers non-collision incidents like theft, vandalism, or natural disasters. |

| Collision Insurance | Covers damage to your vehicle after a collision. |

Factors Affecting Full Coverage Premiums

The cost of full coverage car insurance can vary significantly based on several key factors. These include the make and model of your vehicle, with some cars being more expensive to insure due to their repair costs or theft rates. Your driving history is also a critical factor; a clean record can lead to lower premiums, while violations or accidents can increase costs significantly.

Other factors that influence premiums include your age, gender, and marital status, with younger drivers and certain demographics often facing higher rates. The location where your vehicle is primarily driven also matters, as urban areas with higher traffic and crime rates can lead to increased premiums.

Additionally, the coverage limits you choose and any optional add-ons can impact your overall premium. For instance, raising your deductible can lower your premium, but it also means you'll pay more out-of-pocket if you need to make a claim.

Tips to Reduce Premiums

There are several strategies you can employ to reduce the cost of your full coverage car insurance:

- Shop Around: Premiums can vary significantly between insurers, so it’s worth comparing quotes from multiple providers.

- Bundle Policies: Insurers often offer discounts when you combine multiple policies, such as auto and home insurance.

- Raise Your Deductible: Opting for a higher deductible can lead to lower premiums, but ensure it’s an amount you’re comfortable paying if needed.

- Maintain a Clean Driving Record: Avoid violations and accidents to keep your premiums as low as possible.

- Explore Discounts: Many insurers offer discounts for safe driving, loyalty, or even certain vehicle features like anti-theft systems.

The Best Affordable Full Coverage Options

When seeking affordable full coverage car insurance, it’s essential to explore a range of options to find the best fit for your needs and budget. Here are some top choices:

State Farm

State Farm is a leading insurer known for its competitive rates and comprehensive coverage options. They offer a range of discounts, including for multiple policies, safe driving, and good grades for students. State Farm’s Drive Safe & Save program also rewards safe driving habits with potential premium reductions.

GEICO

GEICO is renowned for its affordable insurance options, including full coverage. They provide a wide range of discounts, such as for military members, federal employees, and even for members of certain professional organizations. GEICO also offers a digital discount for using their mobile app and online services.

Progressive

Progressive is another insurer that excels in offering affordable full coverage options. They provide a snapshot program that allows you to plug a small device into your car’s diagnostics port, tracking your driving habits to potentially lower your premium. Progressive also offers a range of discounts, including for multiple policies and safe driving.

| Insurers | Discounts |

|---|---|

| State Farm | Multiple policies, safe driving, good grades |

| GEICO | Military, federal employees, professional organizations, digital usage |

| Progressive | Snapshot program, multiple policies, safe driving |

Making the Most of Your Full Coverage Policy

Once you’ve secured an affordable full coverage car insurance policy, there are several steps you can take to ensure you’re maximizing its benefits and value:

Regularly Review Your Policy

Insurance needs can change over time, so it’s essential to review your policy annually. This ensures that your coverage limits and deductibles still meet your needs, and that you’re not paying for coverage you no longer require.

Understand Your Deductible

While a higher deductible can lead to lower premiums, it’s crucial to understand the financial implications. Ensure you have the funds set aside to cover your deductible in the event of a claim. This can help prevent financial strain if an accident occurs.

Utilize All Available Discounts

Insurance companies offer a range of discounts, and it’s worth exploring all options to reduce your premium. From safe driving rewards to loyalty discounts, ensuring you’re taking advantage of all applicable discounts can significantly lower your costs.

Consider Usage-Based Insurance

Usage-based insurance, like Progressive’s Snapshot program, can be an excellent option for safe drivers. These programs track your driving habits, and if you maintain a safe record, you could see significant premium reductions.

The Future of Affordable Full Coverage

The insurance landscape is constantly evolving, and the future of affordable full coverage car insurance looks promising. With advancements in technology, insurers are increasingly able to offer more personalized policies, taking into account individual driving habits and risk profiles.

Telematics, which uses sensors and GPS technology to monitor driving behavior, is expected to play a larger role in insurance pricing. This could lead to more accurate premiums, with safe drivers potentially seeing significant savings. Additionally, the rise of autonomous vehicles may also impact insurance costs in the future, potentially leading to lower premiums as accident rates decrease.

How can I find the best rates for full coverage car insurance?

+Shopping around and comparing quotes from multiple insurers is key. Utilize online tools and insurance brokers to easily compare rates and coverage options. Also, be sure to explore all available discounts to lower your premium.

What factors can increase my full coverage car insurance premiums?

+Several factors can lead to higher premiums, including your driving history, the make and model of your vehicle, your age and gender, and the location where your vehicle is primarily driven. Additionally, opting for higher coverage limits and lower deductibles can also increase your premium.

Are there any disadvantages to full coverage car insurance?

+While full coverage offers extensive protection, it can be more expensive than liability-only coverage. Additionally, if you have an older vehicle, the cost of full coverage may not be worth the potential payout in the event of an accident. It’s essential to balance your coverage needs with your budget.