Affordable Health Insurance Agents

Unveiling the Role of Affordable Health Insurance Agents: Navigating Coverage for a Healthier Future

In the complex landscape of healthcare, affordable health insurance agents emerge as crucial navigators, guiding individuals and families toward accessible and comprehensive coverage. This article delves into the multifaceted role of these agents, exploring how they serve as essential intermediaries between policyholders and insurance companies, and the significant impact they have on ensuring financial security and peace of mind for their clients.

With the ever-evolving nature of healthcare policies and the diverse needs of the population, the services provided by affordable health insurance agents are more vital than ever. They are not merely sales representatives but trusted advisors, offering expertise and personalized guidance to help individuals make informed decisions about their health coverage.

The Expertise and Services Offered by Affordable Health Insurance Agents

Affordable health insurance agents are armed with an in-depth understanding of the intricate world of healthcare policies. They stay abreast of the latest changes and trends in the industry, ensuring they can provide accurate and up-to-date information to their clients. This expertise is particularly crucial given the dynamic nature of healthcare legislation and the frequent updates to insurance plans.

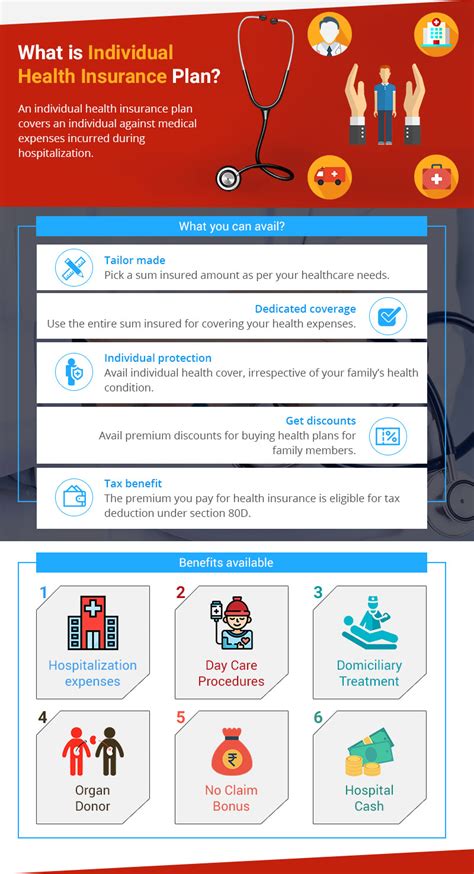

One of the primary services these agents offer is policy comparison. With a myriad of insurance options available, from major medical plans to short-term policies, agents help clients navigate the complex web of coverage options. They provide a tailored analysis of different plans, highlighting the benefits, limitations, and costs associated with each, ensuring clients can make choices that align with their specific healthcare needs and financial situations.

Furthermore, affordable health insurance agents play a pivotal role in assisting clients with the application process. They guide individuals through the often-daunting paperwork, ensuring all necessary information is provided accurately and timely. This meticulous attention to detail is crucial for a smooth application process and timely approval of coverage.

Another key aspect of an agent's role is ongoing support and advocacy. They are not just involved in the initial policy selection but remain engaged throughout the policy period. This includes assisting clients with any changes or updates to their coverage, whether it's due to life events like marriage, divorce, or the birth of a child, or changes in health status. Agents ensure that their clients' policies remain adequate and aligned with their evolving needs.

In addition to these core services, many affordable health insurance agents go above and beyond by providing educational resources and workshops. They aim to empower their clients with the knowledge to make informed decisions, dispel common misconceptions about healthcare coverage, and promote a proactive approach to health management.

Case Studies: Real-Life Impact of Affordable Health Insurance Agents

To illustrate the tangible impact of these agents, consider the following scenarios:

Scenario 1: Young Professionals

For a group of recent graduates entering the workforce, an affordable health insurance agent can be a lifeline. With limited understanding of healthcare policies and a tight budget, these young adults might otherwise opt for inadequate coverage or none at all. However, with the guidance of an agent, they can navigate the options, understand the importance of coverage, and select a plan that provides financial protection without breaking the bank.

Scenario 2: Small Business Owners

Small business owners often struggle to provide comprehensive healthcare benefits to their employees due to financial constraints. Affordable health insurance agents step in to offer solutions. By understanding the business’s unique needs and budget, agents can propose group health insurance plans that are both cost-effective and attractive to employees, fostering a healthier and more loyal workforce.

Scenario 3: Retirees

As individuals approach retirement, their healthcare needs often become more complex, and so do their insurance options. An affordable health insurance agent can be a valuable asset in this transition. By assessing the retiree’s health status, financial situation, and lifestyle, the agent can recommend suitable Medicare plans or supplemental insurance to ensure adequate coverage without unnecessary costs.

The Future of Affordable Health Insurance Agents

As we look ahead, the role of affordable health insurance agents is poised for evolution. With advancements in technology, we can expect more efficient and personalized services. Online platforms and digital tools will likely enhance the agent-client interaction, providing more accessible and interactive ways to compare policies and receive guidance.

Furthermore, the increasing emphasis on preventive care and wellness initiatives presents new opportunities for agents. By integrating these aspects into their services, agents can help clients not only manage existing health conditions but also promote healthier lifestyles, potentially reducing the need for extensive medical interventions and, in turn, lowering insurance costs.

In conclusion, affordable health insurance agents are pivotal figures in the healthcare landscape, offering expertise, guidance, and support to individuals seeking accessible and comprehensive coverage. Their services are essential in ensuring that healthcare is not just a privilege but a right that is understood and exercised by all.

What qualifications do affordable health insurance agents typically have?

+

Affordable health insurance agents are typically licensed professionals who have completed rigorous training and examinations to understand the complex world of healthcare policies. Many agents also have certifications, such as the Health Insurance Professional (HIP) designation, which demonstrates their expertise and commitment to providing high-quality service.

How do I find a reputable affordable health insurance agent?

+

When searching for an affordable health insurance agent, it’s essential to consider their experience, qualifications, and reviews from previous clients. You can also inquire about their areas of specialization and ensure they are licensed and insured. Referrals from trusted sources or online platforms that aggregate agent reviews can be valuable resources.

Can affordable health insurance agents help with specific healthcare needs, such as chronic conditions or pre-existing illnesses?

+

Absolutely! Affordable health insurance agents are equipped to handle a wide range of healthcare needs, including chronic conditions and pre-existing illnesses. They can guide you towards policies that offer the necessary coverage for your specific health requirements, ensuring you receive the care you need without incurring excessive out-of-pocket expenses.

What is the typical process for working with an affordable health insurance agent?

+

The process typically begins with an initial consultation where the agent assesses your healthcare needs, budget, and any existing health conditions. They will then provide tailored recommendations and help you compare different policies. Once you’ve selected a plan, the agent will guide you through the application process and remain available for ongoing support and updates.