Affordable Health Insurance For Individual

Finding affordable health insurance as an individual can be a daunting task, especially with the myriad of options and complexities involved. In today's healthcare landscape, understanding your coverage needs and exploring various plans is crucial to securing the best value for your money. This article aims to provide an in-depth guide to help you navigate the world of individual health insurance, offering insights and strategies to find a plan that suits your budget and health requirements.

Understanding Your Health Insurance Needs

Before diving into the world of health insurance plans, it's essential to assess your specific needs. Consider factors such as your age, current health status, pre-existing conditions, and future healthcare expectations. Are you generally healthy and only require basic coverage, or do you have specific medical needs that demand a more comprehensive plan? Understanding your unique requirements is the first step toward making informed choices.

Evaluating Your Health Status and Risks

Take an honest look at your health history and potential future risks. Do you have a family history of certain diseases? Are you planning to start a family soon, which could lead to increased medical expenses? Evaluating these factors will help you determine the level of coverage you need. For instance, if you're generally healthy but have a family history of chronic conditions, a plan with higher coverage limits and lower deductibles might be a prudent choice.

Assessing Your Budget and Financial Constraints

Your budget is a critical factor when choosing an insurance plan. Health insurance premiums can vary significantly based on the level of coverage, the insurance company, and your location. It's important to find a balance between the coverage you need and what you can afford. Consider your monthly income and other financial obligations to determine a realistic budget for health insurance premiums.

Exploring Individual Health Insurance Plans

The market for individual health insurance is diverse, offering a range of plans with varying levels of coverage and cost. Understanding the different types of plans available is key to making an informed decision.

Types of Individual Health Insurance Plans

Health Maintenance Organization (HMO): HMOs typically offer lower premiums but have more restrictions. You'll need to choose a primary care physician (PCP) within the HMO's network, and most services require a referral from your PCP. HMOs are a good option if you're generally healthy and prefer a more structured healthcare plan.

Preferred Provider Organization (PPO): PPOs offer more flexibility in terms of provider choice. You can see doctors and specialists inside or outside the network, although out-of-network care may cost more. PPOs often have higher premiums but can be a good choice if you value the freedom to choose your healthcare providers.

Exclusive Provider Organization (EPO): EPOs are similar to PPOs but don't cover out-of-network care, except in emergencies. They usually have lower premiums than PPOs but offer more flexibility than HMOs.

Point of Service (POS) Plans: POS plans combine features of HMOs and PPOs. You choose a primary care physician and must get referrals for most specialty care, but you can also access out-of-network providers for an additional cost.

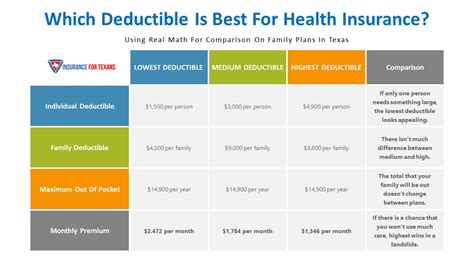

Comparing Plans and Premiums

When comparing individual health insurance plans, consider not just the premiums but also the deductibles, copayments, and out-of-pocket maximums. A plan with a lower premium might have higher out-of-pocket costs, so it's essential to look at the big picture.

Additionally, evaluate the coverage limits and exclusions of each plan. Some plans may have specific restrictions on certain procedures or treatments, so ensure that the plan aligns with your healthcare needs.

| Plan Type | Premium Range | Deductible Range |

|---|---|---|

| HMO | $300 - $500/month | $1,000 - $2,500 |

| PPO | $400 - $700/month | $1,500 - $4,000 |

| EPO | $350 - $600/month | $1,200 - $3,000 |

| POS | $350 - $650/month | $1,000 - $3,500 |

Maximizing Your Coverage While Staying Affordable

Finding an affordable health insurance plan that provides adequate coverage can be a challenge. Here are some strategies to help you maximize your coverage while staying within your budget.

Utilize Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are tax-advantaged accounts designed to help individuals save for medical expenses. HSAs are often paired with High Deductible Health Plans (HDHPs), which typically have lower premiums. You can contribute pre-tax dollars to your HSA and use the funds to pay for qualified medical expenses, such as deductibles, copays, and prescription drugs. Any unused funds roll over year to year and can grow tax-free, providing a long-term savings strategy for your healthcare needs.

Explore Government-Sponsored Programs

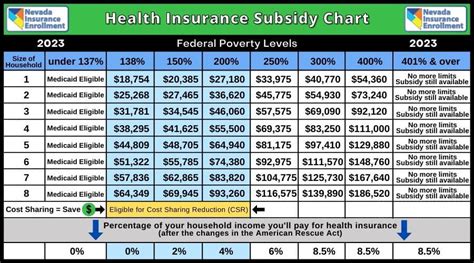

If you're struggling to find affordable health insurance, consider government-sponsored programs like Medicaid or the Children's Health Insurance Program (CHIP). These programs provide health coverage to eligible low-income individuals and families. Additionally, the Affordable Care Act (ACA) has expanded coverage options and made insurance more affordable through premium tax credits and cost-sharing reductions. Visit your state's health insurance marketplace to explore your options and see if you qualify for any subsidies.

Consider Short-Term Health Insurance

Short-term health insurance plans offer a temporary solution for individuals who are between jobs, awaiting long-term coverage, or need coverage for a specific period. These plans are generally more affordable than traditional health insurance but have limitations. They often don't cover pre-existing conditions and may have shorter coverage durations. While they might not provide the same level of protection as long-term plans, they can be a cost-effective option for those in transitional periods.

Navigating the Enrollment Process

Once you've found an affordable health insurance plan that meets your needs, it's time to navigate the enrollment process. Here's a step-by-step guide to ensure a smooth experience.

Research Enrollment Periods

Health insurance plans typically have specific enrollment periods. Open Enrollment for ACA-compliant plans occurs annually, usually from November to December, for coverage starting the following year. However, you may also qualify for a Special Enrollment Period (SEP) if you've experienced a qualifying life event, such as losing your job, getting married, or having a baby.

Gather Necessary Documents

Before enrolling, ensure you have all the required documents. This may include proof of identity, income verification, and any other supporting documents as requested by the insurance provider. Having these documents ready can expedite the enrollment process.

Understand Your Coverage and Benefits

Once you've enrolled, take the time to thoroughly understand your coverage and benefits. Review your policy documents and familiarize yourself with the plan's details, including covered services, network providers, and any limitations or exclusions. This knowledge will help you make the most of your insurance coverage.

FAQs

Can I get individual health insurance if I have a pre-existing condition?

+Yes, thanks to the Affordable Care Act (ACA), insurance companies cannot deny coverage or charge more based on pre-existing conditions. However, short-term health insurance plans and some other types of coverage may not cover pre-existing conditions.

What happens if I miss the Open Enrollment period?

+If you miss the Open Enrollment period, you may still be able to enroll in a health insurance plan if you qualify for a Special Enrollment Period (SEP). SEPs are triggered by certain life events, such as losing your job, getting married, or having a baby. You'll need to provide proof of the qualifying event to enroll outside of the Open Enrollment period.

How do I know if I'm eligible for premium tax credits or cost-sharing reductions?

+Eligibility for premium tax credits and cost-sharing reductions is determined by your income and family size. Generally, if your household income is between 100% and 400% of the federal poverty level, you may qualify for these subsidies. You can use the Health Insurance Marketplace's eligibility tool to determine if you're eligible.

Finding affordable health insurance as an individual is a complex but necessary process. By understanding your needs, exploring your options, and employing cost-saving strategies, you can secure the coverage you need without breaking the bank. Remember, health insurance is an investment in your well-being, and with the right plan, you can have peace of mind knowing you’re protected.