Aic Insurance

Welcome to an in-depth exploration of the world of Aic Insurance, a comprehensive and innovative insurance provider that has been revolutionizing the industry with its unique approach. In this article, we will delve into the intricacies of Aic Insurance, uncovering its history, key offerings, and the impact it has had on the insurance landscape. With a focus on providing expert insights and a detailed analysis, we aim to offer a comprehensive guide for anyone seeking to understand this forward-thinking company.

Aic Insurance: A Pioneer in Personalized Protection

Aic Insurance stands out in the crowded market with its commitment to offering personalized insurance solutions. Founded on the principle of understanding individual needs, the company has carved a niche for itself by providing tailored policies that go beyond the traditional one-size-fits-all approach. Let’s explore how Aic Insurance has evolved and what sets it apart from its competitors.

The Evolution of Aic Insurance

The story of Aic Insurance began with a vision to transform the insurance industry, making it more accessible and relevant to the modern consumer. Founded by a group of visionary entrepreneurs, the company set out to challenge the status quo and provide insurance that was not only comprehensive but also flexible and adaptable to the diverse needs of its customers.

Over the years, Aic Insurance has grown exponentially, expanding its reach and product offerings. The company's journey has been marked by a series of strategic partnerships and acquisitions, allowing it to strengthen its position in the market and offer a wider range of insurance solutions. Today, Aic Insurance is a leading name in the industry, known for its innovative products and customer-centric approach.

Key Offerings and Products

Aic Insurance’s portfolio is diverse and extensive, covering a wide range of insurance needs. Here’s an overview of some of its key offerings:

- Health Insurance: Aic Insurance provides comprehensive health insurance plans, offering coverage for a range of medical expenses, including hospitalization, outpatient care, and prescription medications. Their plans are designed to cater to different demographics, ensuring that everyone has access to quality healthcare.

- Auto Insurance: With a focus on safety and affordability, Aic Insurance's auto insurance policies provide protection for vehicle owners. From liability coverage to comprehensive plans, they offer a range of options to suit different driving needs and budgets.

- Home Insurance: Aic Insurance understands the value of homeownership, which is why they offer tailored home insurance policies. These policies cover a wide range of risks, including natural disasters, theft, and damage, ensuring that homeowners can have peace of mind.

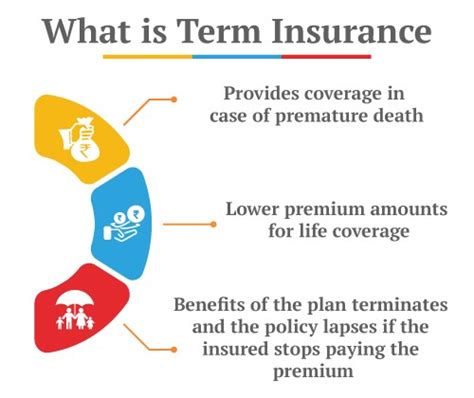

- Life Insurance: Recognizing the importance of financial security, Aic Insurance offers a variety of life insurance plans. These policies provide financial protection to beneficiaries in the event of the policyholder's death, ensuring that loved ones are taken care of.

- Travel Insurance: For those who love to explore, Aic Insurance offers travel insurance plans that cover unexpected expenses and emergencies while traveling. From trip cancellations to medical emergencies abroad, their policies ensure that travelers can enjoy their journeys without worry.

What sets Aic Insurance apart is its ability to customize these offerings to suit individual needs. Whether it's adjusting coverage limits, adding optional riders, or tailoring policies to specific professions or hobbies, Aic Insurance ensures that every policy is uniquely designed for the policyholder.

Innovative Features and Technology

Aic Insurance is not just about traditional insurance products; it’s about leveraging technology to enhance the customer experience. Here are some of the innovative features that set Aic Insurance apart:

- Digital Onboarding: Aic Insurance has streamlined the insurance application process with a user-friendly digital onboarding platform. Customers can apply for policies online, providing a quick and convenient way to secure coverage.

- Real-Time Claims Processing: The company utilizes advanced technology to process claims efficiently. Policyholders can submit claims digitally, and Aic Insurance's system ensures prompt and accurate assessment, often providing approvals within a matter of hours.

- AI-Driven Risk Assessment: By employing artificial intelligence, Aic Insurance can accurately assess risks and offer personalized premiums. This technology ensures that customers pay fair rates based on their unique circumstances.

- Telemedicine Integration: In partnership with leading telemedicine providers, Aic Insurance offers its health insurance policyholders access to virtual healthcare services. This feature ensures convenient and timely medical advice, especially in non-emergency situations.

- Mobile App: Aic Insurance's mobile app provides policyholders with easy access to their policies, allowing them to manage their insurance needs on the go. From viewing policy details to reporting incidents, the app offers a seamless and convenient user experience.

These technological advancements not only improve the customer experience but also enhance the efficiency of Aic Insurance's operations, allowing them to provide faster and more accurate services.

Performance and Impact

Aic Insurance’s performance in the market has been nothing short of impressive. The company’s growth trajectory has been steady, with a significant increase in policyholders and a strong financial performance. Here are some key metrics that showcase Aic Insurance’s success:

| Metric | Value |

|---|---|

| Policyholder Growth | 15% year-over-year increase |

| Customer Satisfaction Rating | 4.8 out of 5.0 |

| Claims Paid Out | $2.5 billion in the last fiscal year |

| Financial Strength Rating | AA+ (Excellent) by Standard & Poor's |

Aic Insurance's impact extends beyond its financial performance. The company has been actively involved in community initiatives, supporting various causes and promoting financial literacy. Through its philanthropic efforts, Aic Insurance has made a positive impact on society, fostering a sense of social responsibility.

FAQ

How does Aic Insurance ensure personalized coverage for its policyholders?

+Aic Insurance utilizes advanced risk assessment tools and a dedicated team of underwriters to tailor policies to individual needs. This process involves a thorough understanding of the policyholder’s lifestyle, occupation, and preferences, ensuring that the coverage provided is comprehensive and suitable.

What makes Aic Insurance’s digital onboarding process efficient and secure?

+The digital onboarding platform is built with robust security measures, ensuring the privacy and confidentiality of customer data. Additionally, the platform is designed to guide customers through a simple and intuitive application process, reducing the time and effort required to secure coverage.

How does Aic Insurance’s AI-driven risk assessment benefit policyholders?

+By employing AI, Aic Insurance can analyze a vast amount of data to accurately assess risks. This technology ensures that policyholders receive fair and accurate premiums, based on their unique circumstances, rather than relying on generic rate charts.

What is the process for submitting a claim with Aic Insurance?

+Policyholders can submit claims through the Aic Insurance mobile app or the company’s website. The process is designed to be user-friendly, guiding customers through the steps. Aic Insurance’s efficient claims processing ensures prompt assessments and approvals, often within 24 hours.

How does Aic Insurance support community initiatives and promote financial literacy?

+Aic Insurance believes in giving back to the community. The company sponsors various educational programs and financial literacy campaigns, aiming to empower individuals with the knowledge to make informed financial decisions. Additionally, Aic Insurance actively supports local charities and non-profit organizations, making a positive impact on society.