All States Auto Insurance

In the vast landscape of the American insurance market, All States Auto Insurance stands as a prominent player, offering comprehensive coverage options tailored to the diverse needs of drivers across the nation. This article delves into the intricacies of All States Auto Insurance, exploring its unique features, benefits, and the impact it has on the industry. As we navigate through the various aspects of this influential insurer, we aim to provide an in-depth analysis that will not only educate but also empower readers to make informed decisions about their auto insurance choices.

Unveiling All States Auto Insurance: A Comprehensive Overview

Headquartered in Des Moines, Iowa, All States Auto Insurance has solidified its position as a trusted provider in the highly competitive auto insurance sector. With a rich history spanning over five decades, the company has not only weathered industry fluctuations but also emerged as a leader, continually adapting its services to meet the evolving demands of modern motorists.

All States Auto Insurance boasts an extensive network of regional offices strategically located across the country, ensuring that its services are accessible to a broad spectrum of consumers. This geographic reach, coupled with a commitment to innovative technologies, has enabled the insurer to offer efficient and personalized experiences to its policyholders.

The All States Advantage: Tailored Coverage and Unparalleled Service

At the heart of All States Auto Insurance’s success lies its unwavering dedication to providing customized coverage solutions. Understanding that every driver’s needs are unique, the company offers a diverse range of policies, including standard liability, comprehensive, collision, and specialty insurance for high-risk drivers. This comprehensive approach ensures that regardless of a driver’s circumstances, they can find a policy that suits their specific requirements.

One of the standout features of All States Auto Insurance is its customer-centric approach. The company leverages advanced technologies to streamline the insurance process, making it more efficient and less burdensome for policyholders. From online quote generation to digital claim filing, All States Auto Insurance has embraced digital innovation to enhance the overall customer experience.

Moreover, the insurer's commitment to customer service excellence is evident in its 24/7 claims support. Policyholders can reach out to a dedicated team of professionals at any time, ensuring prompt and efficient resolution of their concerns. This level of accessibility and support is a testament to All States Auto Insurance's focus on building long-term relationships with its customers.

A Track Record of Success: Industry Awards and Recognitions

All States Auto Insurance’s dedication to service and innovation has not gone unnoticed. The insurer has consistently ranked among the top performers in the industry, garnering recognition from reputable institutions. In 2022, it was honored with the J.D. Power Award for Outstanding Customer Satisfaction, a testament to its unwavering commitment to delivering exceptional experiences.

Additionally, All States Auto Insurance has been praised for its competitive pricing strategies. By offering affordable rates without compromising on coverage quality, the insurer has managed to attract a diverse clientele, further cementing its position as a leading auto insurance provider.

Unraveling the Technical Aspects: All States Auto Insurance’s Coverage Options

All States Auto Insurance’s coverage portfolio is extensive and designed to cater to a wide array of driving scenarios. Here’s a detailed breakdown of its key offerings:

Liability Coverage

This foundational coverage is mandatory in most states and provides protection in the event of an at-fault accident. All States Auto Insurance offers liability limits ranging from 25,000 to 1,000,000, ensuring that policyholders can choose a level of protection that aligns with their specific needs and budget.

Comprehensive and Collision Coverage

For drivers seeking more comprehensive protection, All States Auto Insurance offers collision and comprehensive coverage. These policies provide financial support in the event of accidents, regardless of fault, as well as coverage for non-accident-related incidents such as theft, vandalism, and natural disasters. The insurer also offers gap coverage, which is particularly beneficial for drivers with leased or financed vehicles.

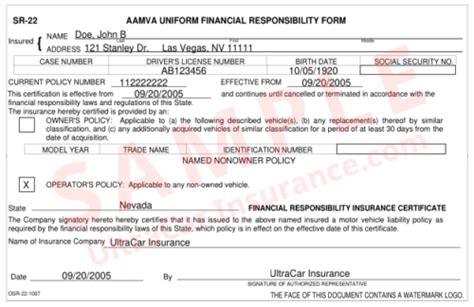

Specialty Insurance for High-Risk Drivers

Recognizing the unique challenges faced by high-risk drivers, All States Auto Insurance has developed specialized policies. These policies are tailored to meet the needs of drivers with a history of accidents, traffic violations, or other risk factors. By offering affordable rates and personalized support, the insurer helps these drivers maintain their mobility while working to improve their driving record.

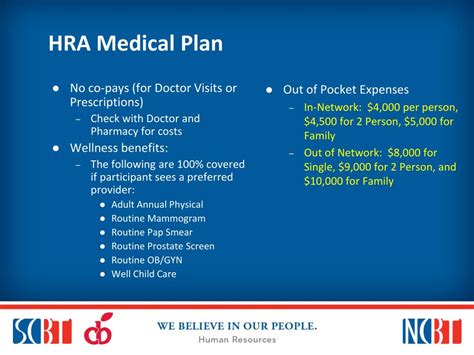

Additional Coverage Options

Beyond the standard policies, All States Auto Insurance provides a range of additional coverage options to enhance the protection provided to policyholders. These include roadside assistance, rental car reimbursement, personal injury protection (PIP), and uninsured/underinsured motorist coverage. These add-ons can be customized to create a policy that is truly comprehensive and suited to individual needs.

| Coverage Type | Description |

|---|---|

| Liability | Protection for at-fault accidents |

| Comprehensive | Coverage for non-accident incidents |

| Collision | Protection for accidents, regardless of fault |

| Specialty Insurance | Tailored policies for high-risk drivers |

| Additional Coverages | Includes roadside assistance, rental car reimbursement, PIP, and uninsured/underinsured motorist coverage |

Performance Analysis: All States Auto Insurance’s Impact on the Industry

All States Auto Insurance’s influence extends beyond its direct operations. The insurer’s innovative practices and customer-centric approach have set a new standard for the industry, prompting other providers to reevaluate their services and strategies.

Market Competitiveness

By offering a wide range of coverage options and competitive pricing, All States Auto Insurance has effectively increased market competition. This has led to a more dynamic and responsive industry, with other insurers striving to match the comprehensive services and affordability offered by All States.

Technological Advancements

The insurer’s embrace of digital technologies has revolutionized the way auto insurance services are delivered. From online quote generation to digital claims processing, All States Auto Insurance has streamlined the insurance experience, making it more accessible and efficient for policyholders. This digital transformation has not only enhanced customer satisfaction but has also set a new benchmark for the industry to follow.

Customer Service Excellence

All States Auto Insurance’s commitment to customer service excellence has had a profound impact on the industry. The insurer’s 24⁄7 claims support and personalized approach have raised the bar for customer satisfaction. This focus on building strong relationships with policyholders has encouraged other insurers to prioritize customer service, ultimately benefiting the entire industry.

Industry Recognition and Awards

All States Auto Insurance’s consistent ranking among the top performers in the industry has inspired other insurers to strive for excellence. The insurer’s recognition for customer satisfaction and competitive pricing has set a standard that other providers are keen to meet, driving overall industry improvement.

Conclusion: A Bright Future for All States Auto Insurance

As we conclude our exploration of All States Auto Insurance, it’s evident that the insurer is not just a prominent player in the industry but a true leader. With its commitment to innovation, customer service, and competitive pricing, All States Auto Insurance is well-positioned for continued success and growth.

As the auto insurance landscape continues to evolve, All States Auto Insurance remains at the forefront, continually adapting its services to meet the changing needs of its policyholders. Its impact on the industry is undeniable, and its influence is sure to shape the future of auto insurance for years to come.

What makes All States Auto Insurance unique compared to other providers?

+All States Auto Insurance stands out for its commitment to personalized coverage and exceptional customer service. The insurer offers a wide range of coverage options, from standard liability to specialty insurance for high-risk drivers, ensuring that every policyholder can find a plan that suits their unique needs. Additionally, its 24⁄7 claims support and focus on customer satisfaction have set a new standard for the industry.

How does All States Auto Insurance ensure competitive pricing without compromising on coverage quality?

+All States Auto Insurance employs a strategic approach to pricing, utilizing advanced technologies and efficient operational processes to keep costs down. This allows the insurer to offer affordable rates without sacrificing the quality of its coverage. The company’s commitment to customer service and personalized support further enhances its value proposition.

What additional benefits do policyholders receive from All States Auto Insurance?

+In addition to comprehensive coverage options, All States Auto Insurance offers a range of additional benefits. These include 24⁄7 claims support, digital claim filing, and a personalized approach to customer service. The insurer also provides educational resources and tools to help policyholders better understand their coverage and make informed decisions.

How does All States Auto Insurance handle claims and what is the typical turnaround time?

+All States Auto Insurance is dedicated to prompt and efficient claims handling. With a team of experienced professionals available 24⁄7, policyholders can expect swift resolution of their claims. The insurer leverages advanced technologies to streamline the claims process, ensuring that policyholders receive timely assistance and support.