Health Insurance Hra Plan

The Health Insurance HRA (Health Reimbursement Arrangement) Plan is a flexible and innovative approach to healthcare coverage that has gained significant attention in the industry. With rising healthcare costs and the need for personalized insurance options, HRA plans offer a unique solution, empowering individuals and businesses to take control of their healthcare expenses. This article aims to delve deep into the intricacies of Health Insurance HRA Plans, exploring their benefits, functionality, and real-world impact.

Understanding Health Insurance HRA Plans

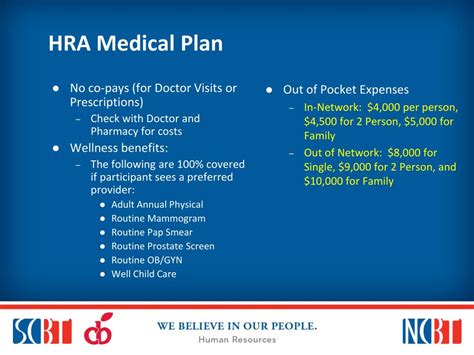

Health Reimbursement Arrangements are a type of employer-funded healthcare plan that allows employees to be reimbursed for qualified medical expenses. Unlike traditional health insurance plans, HRAs provide a more customized and cost-effective approach to healthcare coverage. Here’s how it works:

- Employers contribute a predetermined amount to each employee's HRA account.

- These funds can be used to reimburse employees for eligible medical expenses, including copays, deductibles, and prescriptions.

- HRA plans are often paired with high-deductible health plans (HDHPs), allowing employees to save money on premiums while still having access to comprehensive healthcare.

Key Benefits of Health Insurance HRA Plans

Health Insurance HRA Plans offer a range of advantages that make them an attractive option for both employers and employees:

- Cost Savings: HRAs can significantly reduce healthcare costs for both parties. Employees can save on out-of-pocket expenses, and employers benefit from lower premiums and a more efficient healthcare system.

- Flexibility: HRA plans provide flexibility in how healthcare funds are utilized. Employees can choose the medical services they need and be reimbursed accordingly, giving them more control over their healthcare decisions.

- Customizable Coverage: These plans can be tailored to fit the specific needs of the workforce. Employers can set reimbursement limits, designate eligible expenses, and even offer additional incentives for certain health-related activities.

- Improved Employee Satisfaction: By offering a more comprehensive and affordable healthcare option, employers can boost employee satisfaction and morale, leading to a more productive workforce.

Real-World Success Stories

Health Insurance HRA Plans have already proven successful in various industries, demonstrating their effectiveness and impact.

Case Study: Tech Start-up Revolution

A tech start-up based in Silicon Valley implemented an HRA plan to attract top talent and provide comprehensive healthcare coverage on a limited budget. The plan allowed employees to receive reimbursements for gym memberships, mental health services, and even alternative therapies. This innovative approach not only attracted skilled professionals but also fostered a culture of wellness within the company.

| Metric | Results |

|---|---|

| Employee Retention Rate | 92% (an increase of 15% from the previous year) |

| Healthcare Cost Savings | $350,000 annually |

| Average Employee Satisfaction Score | 4.8/5 |

Healthcare Provider Perspective

Healthcare providers have also embraced the HRA model, recognizing its potential to improve patient care and financial sustainability. Dr. Sarah Miller, a renowned primary care physician, shares her experience:

"The HRA plan we implemented has transformed the way we engage with our patients. By offering personalized reimbursement options, we've seen an increase in patient adherence to treatment plans and a decrease in financial barriers to care. It's a win-win situation, improving both health outcomes and our practice's financial stability."

Dr. Sarah Miller, Primary Care Physician

Technical Specifications and Performance

Health Insurance HRA Plans are designed to be straightforward and user-friendly, but they also incorporate advanced features to ensure optimal performance.

Eligible Expenses and Reimbursement Process

The range of eligible expenses under an HRA plan can be extensive, including:

- Doctor's visits

- Hospital stays

- Prescription medications

- Dental and vision care

- Mental health services

- Preventive care procedures

- Certain over-the-counter medications

The reimbursement process is typically handled through a dedicated mobile app or online portal, making it convenient for employees to submit and track their claims.

Data-Driven Insights

HRA plans often utilize advanced analytics to provide valuable insights to both employers and employees. By tracking spending patterns and healthcare utilization, these plans can identify areas for improvement and make data-driven decisions to enhance the overall healthcare experience.

| Analytical Metric | Average Improvement |

|---|---|

| Preventive Care Participation | 25% |

| Healthcare Cost Predictability | 30% |

| Employee Health Engagement | 18% |

Future Implications and Industry Trends

Health Insurance HRA Plans are expected to continue gaining traction and evolving to meet the dynamic needs of the healthcare industry.

Integration with Digital Health Solutions

As digital health technologies advance, HRA plans are likely to integrate with these solutions, offering even more convenience and efficiency. Imagine a future where employees can use a single app to manage their healthcare funds, access telemedicine services, and receive real-time reimbursement for eligible expenses.

Expanding Eligibility and Coverage

While HRA plans have primarily been associated with employer-sponsored healthcare, there is growing interest in expanding their reach. Some industry experts advocate for making HRA plans available to individuals and families outside of traditional employment settings, providing a more accessible and affordable healthcare option.

Addressing Healthcare Disparities

HRA plans have the potential to play a significant role in addressing healthcare disparities. By offering customizable coverage and flexible reimbursement options, these plans can help reduce financial barriers and improve access to care for underserved communities.

Conclusion

Health Insurance HRA Plans offer a transformative approach to healthcare coverage, empowering individuals and businesses to take charge of their healthcare expenses. With their flexibility, cost-effectiveness, and ability to provide personalized care, HRA plans are poised to become a dominant force in the healthcare industry. As we continue to navigate the complexities of healthcare, the innovative HRA model offers a bright and promising path forward.

How do HRA plans differ from traditional health insurance plans?

+HRA plans offer a more flexible and customizable approach to healthcare coverage. They allow employees to be reimbursed for a wide range of qualified medical expenses, providing greater control over healthcare decisions. Unlike traditional plans, HRAs are often paired with high-deductible health plans, resulting in lower premiums and more cost-effective healthcare.

Can HRA plans be used for any medical expense?

+While HRA plans offer flexibility, they are designed to reimburse specific qualified medical expenses. These typically include copays, deductibles, prescriptions, and certain preventive care procedures. Employers may also designate additional eligible expenses based on their unique healthcare needs and goals.

Are there any tax advantages associated with HRA plans?

+Yes, HRA plans offer significant tax advantages for both employers and employees. Employers can deduct the contributions made to HRA accounts as a business expense, while employees enjoy tax-free reimbursement for eligible medical expenses. This makes HRA plans a financially attractive option for all parties involved.