All States Insurance Company

All States Insurance Company is a prominent player in the insurance industry, offering a wide range of services and coverage options to individuals and businesses across the United States. With a rich history spanning several decades, this company has established itself as a trusted provider of comprehensive insurance solutions. In this in-depth article, we will delve into the various aspects of All States Insurance, exploring its products, services, and the unique value it brings to its policyholders.

A Legacy of Trust: The History of All States Insurance Company

All States Insurance Company has a storied past that dates back to the early 20th century. Founded in 1922 by a group of visionary entrepreneurs, the company was established with a clear mission: to provide affordable and reliable insurance coverage to Americans across all 50 states. Over the years, the company has remained true to its founding principles, evolving with the times and adapting to meet the changing needs of its customers.

The early years of All States Insurance were marked by a period of rapid growth and expansion. The company quickly gained recognition for its innovative approach to insurance, introducing new products and services that set it apart from its competitors. By the 1930s, All States Insurance had established itself as a leading provider of auto insurance, offering comprehensive coverage options to drivers across the nation. This focus on automotive insurance laid the foundation for the company's future success.

During the post-World War II era, All States Insurance continued to thrive, expanding its product portfolio to include homeowners' insurance, renters' insurance, and business insurance. The company's commitment to providing tailored coverage solutions for various industries and individual needs became a hallmark of its success. As the insurance landscape evolved, All States Insurance adapted, introducing new technologies and digital platforms to enhance the customer experience and streamline the insurance process.

In recent years, All States Insurance has embraced digital transformation, leveraging technology to provide even more efficient and personalized services to its policyholders. The company's online platforms and mobile applications have revolutionized the way customers interact with their insurance providers, offering real-time policy management, claims tracking, and seamless communication.

A Comprehensive Suite of Insurance Products

All States Insurance Company offers an extensive range of insurance products designed to meet the diverse needs of its customers. Here’s an overview of some of the key insurance offerings:

Auto Insurance

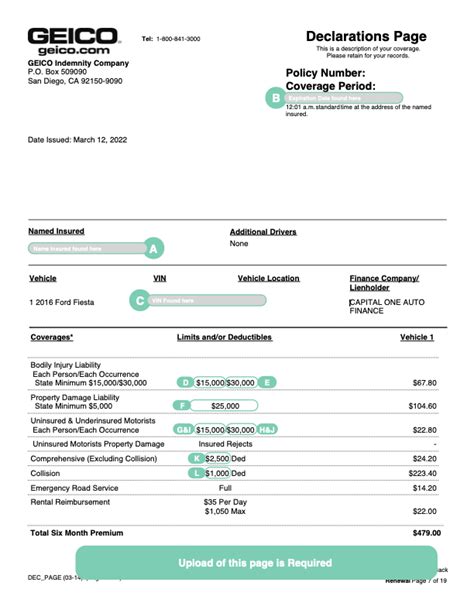

All States Insurance has been a leader in the auto insurance market for decades. Their comprehensive auto insurance plans provide coverage for a wide range of vehicles, including cars, trucks, SUVs, and motorcycles. Policyholders can choose from various coverage options, including liability, collision, comprehensive, and personal injury protection (PIP). The company also offers specialized coverage for classic cars and high-performance vehicles.

| Coverage Type | Description |

|---|---|

| Liability | Covers bodily injury and property damage claims made against the policyholder. |

| Collision | Provides coverage for damage to the insured vehicle caused by a collision. |

| Comprehensive | Covers non-collision-related incidents, such as theft, vandalism, and natural disasters. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for the policyholder and their passengers. |

All States Insurance's auto insurance policies also include valuable add-ons, such as roadside assistance, rental car coverage, and gap insurance. The company's experienced claims adjusters ensure a swift and seamless claims process, providing policyholders with the support they need in times of need.

Homeowners’ Insurance

For homeowners, All States Insurance offers a range of comprehensive policies designed to protect their biggest investment. Their homeowners’ insurance plans provide coverage for the structure of the home, personal belongings, and liability protection. Policyholders can choose from different coverage levels, including basic, broad, and special form policies, to find the right fit for their needs.

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Protects the physical structure of the home against damage or destruction. |

| Personal Property Coverage | Covers the cost of replacing or repairing personal belongings damaged or lost due to a covered event. |

| Liability Coverage | Provides financial protection if the policyholder is held legally responsible for bodily injury or property damage to others. |

All States Insurance's homeowners' insurance policies also include additional coverage options, such as flood insurance, earthquake coverage, and personal liability umbrellas. The company's knowledgeable agents work closely with homeowners to tailor their policies, ensuring adequate protection and peace of mind.

Renters’ Insurance

Recognizing the unique needs of renters, All States Insurance offers specialized renters’ insurance policies. These plans provide coverage for personal belongings and liability protection, ensuring renters are protected against losses and legal liabilities. With affordable premiums and customizable coverage options, All States Insurance makes it easy for renters to secure the insurance they need.

Business Insurance

All States Insurance understands the importance of protecting businesses, large and small. Their business insurance policies are designed to provide comprehensive coverage for a wide range of industries. From general liability and commercial property insurance to professional liability and workers’ compensation, All States Insurance offers tailored solutions to meet the specific needs of businesses.

| Coverage Type | Description |

|---|---|

| General Liability | Protects businesses against third-party claims, including bodily injury, property damage, and advertising injuries. |

| Commercial Property Insurance | Covers physical damage to the business's property, including buildings, equipment, and inventory. |

| Professional Liability (E&O) | Provides coverage for claims arising from professional services, such as negligence or errors. |

| Workers' Compensation | Offers financial protection for employers in the event of work-related injuries or illnesses to employees. |

All States Insurance's business insurance policies can be customized to include additional coverages, such as business interruption insurance, cyber liability insurance, and employment practices liability insurance (EPLI). The company's experienced business insurance specialists work closely with business owners to assess their unique risks and design a comprehensive insurance package.

Exceptional Customer Service and Claims Handling

All States Insurance Company prides itself on delivering exceptional customer service and a seamless claims process. Their dedicated team of customer service representatives is readily available to assist policyholders with any inquiries or concerns. Whether it’s providing information on coverage options, offering guidance during the claims process, or simply answering questions, All States Insurance aims to make the insurance experience as stress-free as possible.

When it comes to claims, All States Insurance takes a proactive approach. Their claims adjusters are highly trained and experienced in handling a wide range of insurance claims, from minor incidents to complex catastrophes. The company's claims process is designed to be efficient and fair, ensuring policyholders receive the compensation they deserve in a timely manner. All States Insurance's commitment to prompt and fair claims handling has earned them a reputation for excellence in the industry.

A Focus on Innovation and Digital Transformation

In today’s rapidly evolving digital landscape, All States Insurance Company recognizes the importance of embracing innovation and technology. The company has made significant investments in digital transformation, leveraging cutting-edge technologies to enhance the customer experience and streamline its operations.

All States Insurance's online platforms and mobile applications have revolutionized the way policyholders interact with their insurance provider. Customers can now manage their policies, make payments, and file claims with just a few clicks. The company's user-friendly interfaces and intuitive design make it easy for policyholders to access their insurance information and stay on top of their coverage.

Additionally, All States Insurance has implemented advanced data analytics and machine learning algorithms to optimize its underwriting processes. By leveraging these technologies, the company can accurately assess risk and offer competitive premiums to its policyholders. This data-driven approach allows All States Insurance to provide tailored insurance solutions that meet the unique needs of its customers.

Furthermore, All States Insurance has embraced digital marketing and social media to engage with its customers and prospective policyholders. Through interactive content, educational resources, and targeted advertising, the company aims to build strong relationships and provide valuable insights to its audience. By staying connected with its customers, All States Insurance can better understand their needs and deliver even more relevant insurance solutions.

A Commitment to Community and Social Responsibility

Beyond its insurance offerings, All States Insurance Company is deeply committed to giving back to the communities it serves. The company actively engages in various social responsibility initiatives, focusing on education, environmental sustainability, and supporting local charities.

All States Insurance's educational initiatives aim to empower individuals and businesses with the knowledge and tools they need to make informed insurance decisions. The company offers a range of resources, including online guides, webinars, and community workshops, to educate policyholders on insurance topics such as risk management, coverage options, and claim processes. By fostering insurance literacy, All States Insurance helps its customers make smarter choices and protect what matters most.

In the realm of environmental sustainability, All States Insurance is dedicated to reducing its environmental footprint and promoting eco-friendly practices. The company has implemented various green initiatives, such as paperless communication, energy-efficient office practices, and recycling programs. All States Insurance also encourages its policyholders to adopt sustainable practices, offering incentives and discounts for environmentally conscious choices.

Furthermore, All States Insurance actively supports local charities and non-profit organizations through donations, volunteer programs, and community partnerships. The company believes in giving back to the communities where its policyholders live and work, fostering a sense of social responsibility and making a positive impact.

Conclusion: A Trusted Partner for Your Insurance Needs

All States Insurance Company has established itself as a trusted partner for individuals and businesses seeking comprehensive insurance solutions. With a rich history, a wide range of insurance products, exceptional customer service, and a commitment to innovation and social responsibility, All States Insurance stands out as a leader in the industry.

Whether you're an individual seeking auto or homeowners' insurance, a renter looking for affordable protection, or a business owner in need of comprehensive coverage, All States Insurance has the expertise and resources to meet your insurance needs. Their commitment to providing tailored solutions, coupled with their focus on customer satisfaction and community engagement, makes them a reliable choice for all your insurance requirements.

As you navigate the complex world of insurance, consider All States Insurance Company as your trusted partner. With their extensive knowledge, personalized approach, and dedication to excellence, you can have peace of mind knowing that your insurance needs are in capable hands.

How can I get a quote for All States Insurance’s products?

+To get a quote for All States Insurance’s products, you can visit their official website and use the online quote tool. Simply provide your basic information, such as your name, address, and the type of insurance you’re interested in. The quote tool will guide you through the process, allowing you to compare different coverage options and customize your policy. Alternatively, you can contact their customer service team, who will be happy to assist you in obtaining a personalized quote.

What sets All States Insurance apart from other insurance companies?

+All States Insurance stands out for its commitment to providing comprehensive insurance solutions, exceptional customer service, and a focus on innovation. Their wide range of insurance products, including auto, homeowners’, renters’, and business insurance, ensures that they can meet the diverse needs of their customers. Additionally, their dedication to community engagement and social responsibility sets them apart as a company that cares about its policyholders and the communities they serve.

How can I file a claim with All States Insurance?

+Filing a claim with All States Insurance is a straightforward process. You can start by contacting their dedicated claims department, either through their toll-free number or by visiting their website. Their claims representatives will guide you through the process, providing the necessary forms and instructions. You can also track the progress of your claim online, ensuring transparency and timely updates.

Does All States Insurance offer discounts on their insurance policies?

+Yes, All States Insurance offers a variety of discounts on their insurance policies to help policyholders save money. These discounts may include multi-policy discounts, good student discounts, safe driver discounts, loyalty discounts, and more. It’s always a good idea to inquire about available discounts when obtaining a quote, as you may be eligible for savings based on your specific circumstances.