Allstate Insurance Cards

In the realm of insurance, it is crucial for policyholders to have quick and easy access to their insurance information, especially during times of need. Allstate Insurance, a leading name in the industry, understands this necessity and provides its customers with comprehensive insurance cards that serve as vital documents. These cards contain essential details that help streamline various processes, from reporting claims to verifying coverage.

The Allstate Insurance Card: A Comprehensive Overview

The Allstate Insurance Card is a compact yet information-rich document designed to offer policyholders a convenient way to access and present their insurance details. It serves as a physical representation of the insurance coverage provided by Allstate, offering quick reference to critical information in a format that is both user-friendly and easily verifiable.

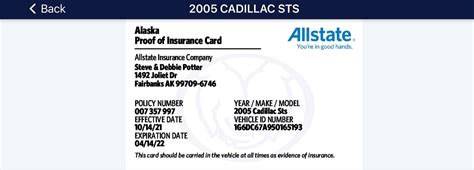

The front of the card typically features the Allstate logo, along with the policyholder's name, policy number, and a brief summary of the coverage types included in their policy. This includes details such as the effective dates of the policy, the types of coverage (e.g., auto, home, or life insurance), and any relevant endorsements or amendments. The back of the card often provides additional information, including emergency contact details, claims reporting procedures, and a summary of the policyholder's rights and responsibilities.

Key Features and Benefits

- Easy Identification: The Allstate Insurance Card acts as a unique identifier, allowing policyholders to quickly and easily present their insurance details when needed. This is particularly useful in situations such as accidents, where immediate verification of insurance coverage is crucial.

- Compact and Portable: Designed to be compact and easily carried, the insurance card fits conveniently in wallets, purses, or glove compartments. This portability ensures that policyholders can access their insurance information anytime, anywhere.

- Streamlined Claims Process: By providing essential policy information on the card, Allstate aims to simplify the claims process. Policyholders can easily refer to their card when reporting a claim, ensuring they have the necessary details at hand.

- Emergency Assistance: Many insurance cards, including Allstate’s, also include emergency contact numbers and resources. This feature provides policyholders with immediate access to help in case of urgent situations, further emphasizing Allstate’s commitment to customer support.

- Policy Summary: The card serves as a quick reference guide, summarizing the key aspects of the policyholder’s coverage. This summary helps policyholders understand their coverage at a glance and can be a useful reminder of the specific benefits they have access to.

Technical Specifications and Design

Allstate’s insurance cards are designed with a focus on durability and ease of use. The cards are typically made from high-quality, durable materials to withstand everyday wear and tear. The layout and design are carefully crafted to ensure key information is easily readable and accessible, with clear fonts and a logical flow of information.

In terms of technical specifications, the cards often include barcodes or QR codes that can be scanned for quick verification of insurance details. These codes can be used by various entities, such as law enforcement or medical facilities, to instantly access the policyholder's information, further expediting the verification process.

| Card Feature | Description |

|---|---|

| Card Size | Standard credit card size (3.375" x 2.125") for easy portability. |

| Material | High-quality, durable PVC material to withstand daily use. |

| Printing Technology | Utilizes advanced printing techniques for crisp, clear text and graphics. |

| Security Features | May include holographic images, microprinting, and UV-reactive inks to deter counterfeiting. |

| Data Storage | Features a magnetic stripe or chip for secure data storage and quick access. |

Performance and Customer Satisfaction

Allstate’s insurance cards have consistently received positive feedback from policyholders. The cards’ convenience and ease of use have been lauded, with many customers appreciating the ability to quickly access their insurance details without the need to search through paperwork or digital records.

Furthermore, the cards' design and durability have been praised, with customers noting that the cards remain in excellent condition despite frequent use. This aspect is particularly important, as it ensures policyholders can rely on their cards to provide accurate and up-to-date information when needed.

Case Study: Real-World Application

Consider the experience of John, an Allstate policyholder who was involved in a minor car accident. John was able to quickly locate his Allstate insurance card and provide the necessary details to the other driver and the responding officer. The card’s clear layout and concise information allowed John to efficiently exchange insurance information, expediting the accident reporting process.

John's experience highlights the practical benefits of Allstate's insurance cards. The card's compact size and clear design made it an efficient tool for managing the situation, allowing John to focus on resolving the accident rather than searching for paperwork or navigating complex insurance procedures.

Future Implications and Innovations

As technology continues to evolve, Allstate is exploring ways to enhance its insurance cards further. The company is investing in digital solutions, such as mobile apps and online portals, to provide policyholders with even more convenient access to their insurance information.

Additionally, Allstate is researching ways to integrate advanced technologies like Near Field Communication (NFC) into its insurance cards. This would enable policyholders to tap their cards on compatible devices, instantly transmitting their insurance details for quick verification. Such innovations would not only enhance convenience but also improve security and data protection.

Allstate is also committed to ensuring its insurance cards remain compliant with industry standards and regulations. The company regularly updates its card designs and security features to meet evolving security requirements, ensuring policyholders' information remains protected.

Conclusion

Allstate’s insurance cards are more than just pieces of plastic; they are powerful tools that empower policyholders with the knowledge and assurance of their insurance coverage. Through careful design, advanced technology, and a commitment to customer satisfaction, Allstate ensures its insurance cards remain a trusted and reliable resource for its policyholders.

As Allstate continues to innovate and adapt to the changing landscape of insurance, its insurance cards will undoubtedly remain a cornerstone of its service offering, providing policyholders with the peace of mind they deserve.

How can I obtain an Allstate insurance card if I don’t have one?

+If you are an Allstate policyholder and do not have an insurance card, you can request one by contacting your Allstate agent or representative. They can guide you through the process of obtaining a new card, which typically involves providing your policy number and some basic personal information.

What information is typically included on an Allstate insurance card?

+An Allstate insurance card typically includes your name, policy number, effective dates of coverage, and a summary of the types of insurance you have (e.g., auto, home, life). It may also feature emergency contact details and instructions for reporting claims.

Can I use my Allstate insurance card as proof of insurance when registering my vehicle or obtaining a driver’s license?

+Yes, your Allstate insurance card serves as proof of insurance for various purposes, including vehicle registration and obtaining a driver’s license. However, it’s essential to check with your local authorities or relevant departments to ensure the card meets their specific requirements.