Automobile Liability Insurance Covers

Automobile liability insurance is an essential component of any comprehensive vehicle ownership plan, providing crucial financial protection for drivers and their vehicles. This type of insurance safeguards policyholders from the significant financial risks associated with causing accidents, ensuring they can meet the legal obligations that arise from such incidents. Understanding the coverage offered by automobile liability insurance is vital for every vehicle owner, as it forms the foundation of their financial security on the road.

Understanding Automobile Liability Insurance Coverage

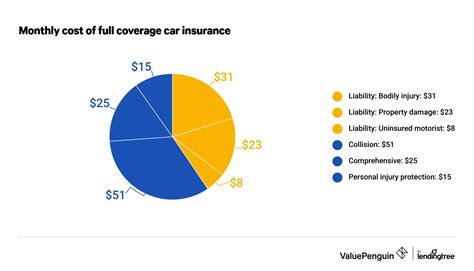

Automobile liability insurance is designed to protect individuals from the financial repercussions of causing accidents while driving. This coverage is split into two main categories: Bodily Injury Liability and Property Damage Liability. Each of these categories offers distinct protections, ensuring that policyholders can address a wide range of potential financial liabilities.

Bodily Injury Liability

Bodily Injury Liability coverage is a vital component of automobile liability insurance. It is designed to cover the medical expenses and other costs associated with injuries sustained by individuals in accidents caused by the policyholder. This coverage extends to both passengers in the policyholder’s vehicle and individuals in other vehicles involved in the accident. In addition, it can also provide protection against legal fees and settlements if the injured party pursues legal action.

| Category | Coverage |

|---|---|

| Medical Expenses | Covered up to policy limits |

| Pain and Suffering | Compensation for non-economic damages |

| Legal Fees | Protection against litigation costs |

The specific coverage limits for Bodily Injury Liability can vary based on the policy and the state's regulations. It's important for policyholders to understand these limits and ensure they have adequate coverage to protect against significant financial losses.

Property Damage Liability

Property Damage Liability coverage is another critical aspect of automobile liability insurance. This coverage applies when the policyholder’s vehicle causes damage to someone else’s property, typically another vehicle, but it can also include structures like buildings or fences. It provides financial protection to cover the cost of repairs or replacements, ensuring the policyholder can meet their legal obligations without incurring substantial financial burden.

| Category | Coverage |

|---|---|

| Vehicle Repairs | Covers repairs or replacements up to policy limits |

| Structure Damage | Provides coverage for damage to buildings, fences, and other structures |

| Rental Car Costs | May cover the cost of a rental car for the affected party during repairs |

Similar to Bodily Injury Liability, the coverage limits for Property Damage Liability can vary depending on the policy and state regulations. Policyholders should ensure they have sufficient coverage to protect against the cost of repairing or replacing damaged property.

Additional Considerations and Benefits

While Bodily Injury Liability and Property Damage Liability are the primary components of automobile liability insurance, there are additional benefits and considerations that policyholders should be aware of.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist Coverage provides protection for policyholders when they are involved in an accident with a driver who either has no insurance or has inadequate insurance coverage. This coverage can help cover medical expenses, property damage, and other costs associated with the accident, ensuring the policyholder is not left with significant out-of-pocket expenses.

Rental Car Coverage

Rental Car Coverage is an optional benefit that can be added to an automobile liability insurance policy. This coverage provides reimbursement for the cost of renting a vehicle when the policyholder’s car is being repaired due to an insured event, such as an accident or theft. It ensures the policyholder has a reliable mode of transportation during the repair process.

Roadside Assistance

Roadside Assistance is another valuable benefit that can be included in an automobile liability insurance policy. This coverage provides emergency services such as towing, flat tire changes, jump-starts, and fuel delivery. It offers peace of mind to policyholders, ensuring they have access to necessary assistance when their vehicle breaks down.

The Importance of Adequate Coverage

Choosing the right level of coverage for automobile liability insurance is crucial. While state laws typically set minimum requirements for liability insurance, these minimums may not provide sufficient protection in the event of a serious accident. Policyholders should carefully consider their individual needs and financial circumstances when determining the appropriate coverage limits.

Insufficient coverage can lead to significant out-of-pocket expenses in the event of an accident, potentially causing financial hardship. It's essential to review policy limits regularly and adjust coverage as necessary to ensure adequate protection.

Tips for Choosing the Right Coverage

- Consider your personal assets and financial situation: Ensure your coverage limits are high enough to protect your assets in the event of a major accident.

- Review your policy annually: As your financial situation changes, your insurance needs may also change. Regularly review your policy to ensure it aligns with your current needs.

- Compare quotes from multiple insurers: Shopping around can help you find the best coverage at the most competitive rates.

- Understand your state’s specific regulations: Each state has unique laws regarding minimum liability insurance requirements. Ensure your policy meets or exceeds these requirements.

Conclusion

Automobile liability insurance is a critical component of responsible vehicle ownership. By understanding the coverage it provides, from Bodily Injury Liability to Property Damage Liability, policyholders can make informed decisions about their insurance needs. With the right coverage in place, drivers can have peace of mind, knowing they are protected against the financial risks associated with causing accidents.

FAQ

What is the difference between Bodily Injury Liability and Property Damage Liability coverage?

+

Bodily Injury Liability covers the medical expenses and other costs associated with injuries sustained by individuals in accidents caused by the policyholder. Property Damage Liability, on the other hand, provides financial protection for damage to someone else’s property, typically another vehicle or structure, caused by the policyholder’s vehicle.

Are there any other types of liability coverage available besides Bodily Injury and Property Damage Liability?

+

Yes, there are additional types of liability coverage available. Uninsured/Underinsured Motorist Coverage provides protection when the at-fault driver has no insurance or inadequate insurance coverage. Rental Car Coverage reimburses policyholders for rental car expenses when their vehicle is being repaired due to an insured event. Roadside Assistance offers emergency services like towing and jump-starts.

How do I choose the right coverage limits for my automobile liability insurance policy?

+

Choosing the right coverage limits involves considering your personal assets and financial situation. Ensure your limits are high enough to protect your assets in the event of a major accident. Review your policy annually and adjust coverage as necessary. Compare quotes from multiple insurers to find the best coverage at the most competitive rates. Finally, understand your state’s specific regulations regarding minimum liability insurance requirements.

What happens if I cause an accident and my liability coverage limits are insufficient to cover all the damages?

+

If you cause an accident and your liability coverage limits are insufficient, you may be responsible for paying out-of-pocket for any damages or injuries that exceed your policy limits. This can result in significant financial hardship, so it’s crucial to ensure your coverage limits are adequate.