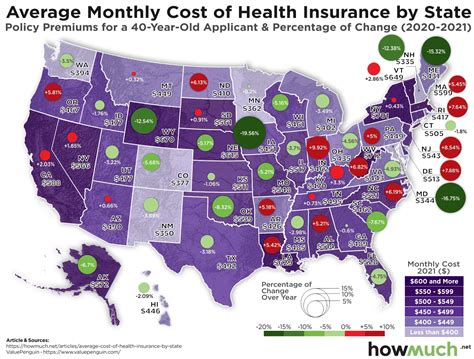

Average Health Insurance Price

The cost of health insurance is a crucial aspect for individuals and families, impacting their financial planning and overall well-being. With the ever-changing healthcare landscape, understanding the average health insurance prices and the factors influencing them is essential. In this comprehensive article, we delve into the intricacies of health insurance pricing, providing you with valuable insights and practical knowledge.

Unveiling the Average Health Insurance Price

Health insurance premiums can vary significantly based on numerous factors. On average, individuals can expect to pay between 400 and 1,000 per month for a comprehensive health insurance plan. However, it is important to note that this range is merely a broad estimate and can differ greatly depending on various circumstances.

When analyzing health insurance prices, it is crucial to consider the specific plan details, such as the coverage limits, deductibles, co-pays, and out-of-pocket maximums. These factors play a significant role in determining the overall cost of the plan and should be carefully evaluated to ensure an accurate assessment of the average price.

Factors Influencing Health Insurance Prices

Several key factors contribute to the variation in health insurance prices. Understanding these factors can help individuals make informed decisions and potentially identify cost-saving opportunities.

- Age: One of the primary factors affecting health insurance prices is the age of the insured individual. Younger individuals generally enjoy lower premiums, as they are less likely to require extensive medical care. As individuals age, their health insurance costs tend to increase, reflecting the higher likelihood of health issues and medical treatments.

- Location: The geographical location where an individual resides can significantly impact health insurance prices. Healthcare costs vary across different regions, influenced by factors such as the cost of living, the availability of healthcare facilities, and the overall demand for medical services. Urban areas often have higher healthcare costs, which can reflect in higher insurance premiums.

- Coverage Type: The type of health insurance coverage chosen also plays a vital role in determining the price. Plans offering more comprehensive coverage, including a wider network of healthcare providers and lower out-of-pocket expenses, typically come with higher premiums. On the other hand, plans with limited coverage and higher deductibles may be more affordable but may not provide the same level of financial protection.

- Plan Deductibles and Out-of-Pocket Limits: The deductible, which is the amount an individual must pay out of pocket before the insurance coverage kicks in, is a critical factor in health insurance pricing. Plans with lower deductibles generally have higher premiums, as they provide more immediate coverage for healthcare expenses. Similarly, plans with higher out-of-pocket limits, such as co-pays and co-insurance, may have lower monthly premiums but can result in higher overall costs if significant medical care is required.

- Tobacco Use: Tobacco usage, including smoking and other tobacco-related habits, can significantly impact health insurance prices. Insurance providers often charge higher premiums for individuals who use tobacco, as they are at a higher risk of developing various health conditions. This risk-based pricing reflects the potential for increased healthcare expenses associated with tobacco use.

- Family Size: The size of an individual's family can also influence health insurance prices. Plans designed to cover multiple family members often come with higher premiums compared to individual plans. This is because larger families may require more extensive medical coverage, including pediatric care, maternity benefits, and coverage for pre-existing conditions.

It is important to note that health insurance pricing is a complex interplay of various factors, and individual circumstances can greatly affect the final cost. Understanding these factors can empower individuals to make informed choices when selecting a health insurance plan that aligns with their needs and budget.

Analyzing Health Insurance Plans: A Comparative Study

To gain a deeper understanding of health insurance prices, let’s explore a comparative study of different plan types and their associated costs. By examining real-world examples, we can better appreciate the variations in pricing and the impact of different coverage options.

Example 1: Individual Plan

John, a 30-year-old non-smoker residing in a suburban area, opts for an individual health insurance plan. He chooses a plan with a 2,000 deductible and a 6,000 out-of-pocket maximum. The plan offers a wide network of providers and includes coverage for specialty care. John’s monthly premium for this plan is $350.

Example 2: Family Plan

Sarah, a 35-year-old mother of two young children, requires a family health insurance plan. She selects a plan with a 3,000 deductible and a 10,000 out-of-pocket maximum, ensuring comprehensive coverage for her family’s medical needs. The plan includes pediatric care, maternity benefits, and coverage for common childhood illnesses. Sarah’s monthly premium for this family plan is $900.

Example 3: High-Deductible Health Plan (HDHP)

Michael, a 28-year-old professional, opts for a High-Deductible Health Plan (HDHP) to maximize his savings. This plan has a 5,000 deductible and a 7,500 out-of-pocket maximum. While the monthly premium is relatively low at $280, Michael understands that he may incur higher out-of-pocket expenses if significant medical care is required. However, the HDHP allows him to contribute to a Health Savings Account (HSA), providing tax advantages and long-term savings.

| Plan Type | Monthly Premium | Deductible | Out-of-Pocket Maximum |

|---|---|---|---|

| Individual Plan (John) | $350 | $2,000 | $6,000 |

| Family Plan (Sarah) | $900 | $3,000 | $10,000 |

| High-Deductible Health Plan (Michael) | $280 | $5,000 | $7,500 |

Navigating the Health Insurance Market: Tips and Strategies

When navigating the health insurance market, it is beneficial to employ certain strategies to find the most suitable plan at the best price. Here are some tips to guide you through the process:

- Research Multiple Providers: Don't settle for the first health insurance plan you encounter. Take the time to research and compare plans from different providers. Each provider may offer unique benefits, coverage options, and pricing structures. By exploring various options, you can identify the plan that best aligns with your needs and budget.

- Understand Your Healthcare Needs: Assess your current and potential future healthcare needs. Consider any ongoing medical conditions, medications, or specialized treatments you or your family members may require. By understanding your healthcare needs, you can choose a plan that provides adequate coverage without unnecessary expenses.

- Evaluate Plan Networks: Review the provider networks associated with each health insurance plan. Ensure that your preferred healthcare providers, including specialists and hospitals, are included in the plan's network. This can help you avoid unexpected out-of-network charges and ensure convenient access to quality healthcare services.

- Consider Plan Deductibles and Out-of-Pocket Limits: Carefully analyze the deductibles and out-of-pocket limits of each plan. While lower deductibles may seem appealing, they often result in higher monthly premiums. Assess your financial situation and determine whether you can afford higher out-of-pocket expenses in the event of significant medical care. Strike a balance that suits your budget and healthcare needs.

- Explore Cost-Saving Opportunities: Look for plans that offer cost-saving options, such as wellness programs, discounts on certain services, or incentives for healthy lifestyle choices. Some providers may also offer discounts for paying premiums annually instead of monthly. Additionally, consider plans that allow you to contribute to a Health Savings Account (HSA) or a Flexible Spending Account (FSA), providing tax advantages and the ability to save for future medical expenses.

- Seek Professional Advice: If you find the health insurance market overwhelming, consider seeking guidance from insurance brokers or financial advisors. These professionals can provide personalized recommendations based on your specific circumstances and help you navigate the complex world of health insurance plans. They can assist in comparing plans, understanding coverage details, and ensuring you make an informed decision.

By implementing these strategies and staying informed about the health insurance market, you can make confident choices and secure a plan that offers the coverage you need at a price that fits your budget.

Future Implications and Trends in Health Insurance Pricing

The landscape of health insurance pricing is continuously evolving, influenced by various economic, social, and technological factors. Understanding these trends and their potential impact is essential for individuals and policymakers alike.

The Impact of Technological Advancements

Technological advancements have the potential to revolutionize the health insurance industry. The widespread adoption of telemedicine and remote healthcare services has gained momentum, particularly in the wake of the COVID-19 pandemic. These digital health solutions offer convenient and cost-effective alternatives to traditional in-person consultations, reducing healthcare expenses and potentially impacting insurance pricing.

Additionally, the integration of artificial intelligence (AI) and data analytics in healthcare is expected to enhance efficiency and accuracy in diagnosing and treating medical conditions. By streamlining healthcare processes and improving patient outcomes, these technologies may contribute to cost savings and influence the pricing structure of health insurance plans.

The Role of Preventive Care

The emphasis on preventive care and early disease detection is gaining prominence in the healthcare industry. Insurance providers are recognizing the long-term benefits of promoting healthy lifestyles and preventing chronic diseases. By encouraging individuals to adopt healthier habits and undergo regular check-ups, insurance companies can potentially reduce the overall healthcare costs associated with preventable illnesses.

As a result, health insurance plans may increasingly incorporate incentives and rewards for individuals who actively engage in preventive care measures. This shift towards preventive care could lead to more affordable health insurance options, as insurance providers strive to reduce the financial burden of managing chronic conditions.

The Influence of Policy Changes

Policy changes at the federal and state levels can significantly impact health insurance pricing. The implementation of new healthcare regulations, tax reforms, or changes in government-sponsored insurance programs can directly affect the cost of health insurance plans. For instance, the expansion of Medicaid or alterations in subsidies for marketplace plans can influence the pricing structure and availability of affordable insurance options.

Furthermore, the ongoing debate surrounding healthcare reform and potential changes to the Affordable Care Act (ACA) continues to shape the future of health insurance pricing. Any significant alterations to the existing healthcare landscape could have far-reaching implications for insurance providers and consumers alike.

Conclusion

Understanding the average health insurance price and the factors influencing it is a crucial step towards making informed decisions about your healthcare coverage. By analyzing real-world examples and exploring various plan types, we can gain a deeper understanding of the complexities involved in health insurance pricing. Additionally, by implementing strategic tips and staying abreast of future trends, individuals can navigate the health insurance market with confidence and secure plans that align with their needs and financial capabilities.

Remember, health insurance is an essential aspect of financial planning and overall well-being. By staying informed and actively engaging in the healthcare landscape, we can advocate for a system that promotes accessibility, affordability, and quality care for all.

What is the average monthly premium for health insurance in the United States?

+

The average monthly premium for health insurance in the United States varies based on several factors, including age, location, and coverage type. As of recent data, the average monthly premium for an individual plan is around 450, while family plans can range from 1,150 to $1,500. It’s important to note that these averages can fluctuate based on specific circumstances and the chosen plan’s details.

Are there any ways to reduce the cost of health insurance premiums?

+

Yes, there are several strategies to potentially reduce the cost of health insurance premiums. These include comparing plans from different providers, understanding your healthcare needs and selecting a plan accordingly, exploring cost-saving opportunities such as wellness programs or tax-advantaged accounts, and considering High-Deductible Health Plans (HDHPs) with lower premiums and the option to contribute to a Health Savings Account (HSA). It’s crucial to carefully assess your financial situation and healthcare needs before making any decisions.

How do deductibles and out-of-pocket limits impact health insurance pricing?

+

Deductibles and out-of-pocket limits play a significant role in health insurance pricing. Plans with lower deductibles generally have higher premiums, as they provide more immediate coverage for healthcare expenses. On the other hand, plans with higher deductibles and out-of-pocket limits may have lower monthly premiums but can result in higher overall costs if significant medical care is required. It’s essential to carefully evaluate your financial situation and healthcare needs when choosing a plan to ensure the right balance between affordability and coverage.