Allstate Insurance Quotes

Finding the right insurance coverage is a crucial step in protecting your assets and ensuring financial security. With numerous options available, it's essential to choose a reputable provider that offers personalized and comprehensive plans. Allstate, a well-known name in the insurance industry, stands out for its commitment to customer satisfaction and innovative approaches to insurance. This article explores the ins and outs of Allstate insurance quotes, providing an in-depth analysis of their coverage options, benefits, and the process of obtaining a personalized quote.

Understanding Allstate’s Insurance Approach

Allstate Insurance Company, founded in 1931, has a long-standing reputation for providing reliable insurance solutions to individuals and businesses. Their approach to insurance is centered around offering tailored coverage plans that cater to the unique needs of their clients. Whether you’re seeking auto, home, life, or business insurance, Allstate strives to provide comprehensive protection with competitive pricing.

Key Features of Allstate’s Insurance Services

Allstate offers a wide array of insurance products, each designed to address specific risks. Here’s an overview of their key insurance offerings:

- Auto Insurance: Allstate’s auto insurance plans provide coverage for a range of scenarios, including liability, collision, comprehensive, and personal injury protection. They also offer specialized plans for classic cars and ride-sharing drivers.

- Home Insurance: Their home insurance policies cover a variety of structures, from apartments to condominiums and single-family homes. Coverage includes protection against damage from natural disasters, theft, and liability.

- Life Insurance: Allstate provides term and permanent life insurance plans, offering financial protection for your loved ones in the event of your passing.

- Business Insurance: Tailored to meet the needs of small businesses, Allstate’s business insurance covers property damage, liability, and workers’ compensation.

One of Allstate's unique features is their Digital Toolkit, a suite of online tools that allows customers to manage their policies, file claims, and access important documents anytime, anywhere. This digital platform enhances the customer experience, providing convenience and transparency.

The Allstate Insurance Quote Process

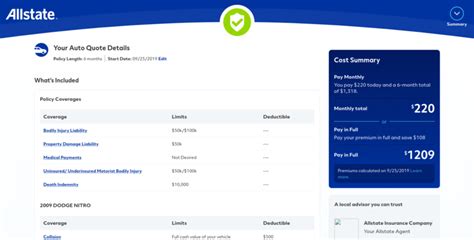

Obtaining an Allstate insurance quote is a straightforward process, designed to be efficient and personalized. Here’s a step-by-step guide to help you navigate the quote journey:

Step 1: Gather Relevant Information

Before requesting a quote, it’s beneficial to have some key details at hand. For auto insurance, this includes your vehicle make, model, and year, as well as your driving history and any existing coverage. For home insurance, you’ll need details about your property, such as its location, size, and any recent renovations.

Step 2: Choose Your Quote Method

Allstate offers multiple ways to obtain a quote, allowing you to choose the method that suits your preferences. You can:

- Request a quote online by filling out a detailed form on their website.

- Call their customer service hotline and speak to a representative who can guide you through the quote process.

- Visit an Allstate agency in person to discuss your insurance needs with an agent.

Step 3: Provide Details for Accurate Pricing

During the quote process, you’ll be asked a series of questions to help Allstate understand your insurance needs. These questions may cover topics such as your personal information, the type of coverage you’re seeking, and any additional features or endorsements you require.

Step 4: Review and Compare Quotes

Once you’ve provided the necessary details, Allstate will generate a personalized quote based on your specific circumstances. Take the time to review the quote carefully, ensuring that it aligns with your expectations and budget. If you have any questions or need further clarification, their customer service team is readily available to assist you.

Benefits of Choosing Allstate for Your Insurance Needs

Selecting Allstate as your insurance provider comes with a range of advantages. Here are some key benefits you can expect:

- Customized Coverage: Allstate understands that every individual and business has unique insurance needs. Their flexible plans allow you to tailor your coverage to fit your specific circumstances.

- Competitive Pricing: Allstate is committed to offering competitive rates without compromising on the quality of coverage. They provide various discounts to help make insurance more affordable, including multi-policy discounts and safe driver incentives.

- Excellent Customer Service: Allstate prides itself on its customer-centric approach. Their dedicated team of agents is known for their expertise and commitment to helping customers find the right coverage. They offer 24⁄7 support, ensuring you have assistance whenever you need it.

- Digital Convenience: With Allstate’s Digital Toolkit, managing your insurance policies becomes easier than ever. You can access your policy information, make payments, and file claims from the comfort of your own home.

- Innovative Tools and Resources

Allstate provides a wealth of resources to help you make informed insurance decisions. Their online tools, such as the Risk Assessment Calculator, assist in identifying potential risks and the appropriate coverage to mitigate them.

Allstate’s Commitment to Customer Satisfaction

Allstate’s dedication to customer satisfaction extends beyond their insurance offerings. They actively engage with their customers to understand their needs and provide the best possible service. Their commitment is reflected in their numerous awards and recognition, including the J.D. Power Award for Excellence in Customer Service.

Allstate also prioritizes community involvement, sponsoring various initiatives and events to support local causes. This commitment to giving back further solidifies their reputation as a trustworthy and responsible insurance provider.

Comparative Analysis: Allstate vs. Competitors

When choosing an insurance provider, it’s essential to compare options to find the best fit. Here’s a comparative analysis of Allstate against some of its competitors:

Allstate vs. State Farm

State Farm is another well-known insurance provider, offering a range of insurance products similar to Allstate. While both companies have a strong reputation, Allstate stands out for its focus on digital innovation and customer convenience. Allstate’s Digital Toolkit provides an edge, allowing customers to manage their policies efficiently and access support anytime.

Allstate vs. Geico

Geico, known for its affordable rates, is a popular choice for many. However, Allstate offers a more comprehensive range of insurance products, including business insurance, which Geico does not provide. Allstate’s personalized approach and customer-centric culture set them apart, ensuring a more tailored and satisfying insurance experience.

Allstate vs. Progressive

Progressive is renowned for its innovative marketing strategies and competitive pricing. While Progressive offers a wide range of insurance products, Allstate’s focus on customer satisfaction and its commitment to providing customized coverage plans give it an advantage. Allstate’s agents take the time to understand each customer’s unique needs, ensuring a more personalized insurance journey.

Future Outlook: Allstate’s Ongoing Innovations

Allstate continuously strives to stay ahead in the insurance industry by investing in technological advancements and innovative solutions. They are actively exploring new ways to enhance the customer experience, improve claim processing, and provide even more tailored coverage options.

One of Allstate's upcoming initiatives is the development of an AI-powered claim assistance tool. This tool aims to streamline the claim process, providing customers with real-time support and guidance. By leveraging AI technology, Allstate aims to reduce claim processing times and enhance overall customer satisfaction.

Additionally, Allstate is exploring partnerships with technology companies to integrate smart home devices into their home insurance offerings. This integration would allow customers to receive discounts on their insurance premiums by implementing safety measures and utilizing smart home technology to prevent potential hazards.

Conclusion

In the ever-evolving world of insurance, Allstate stands out as a trusted and innovative provider. Their commitment to customer satisfaction, personalized coverage, and digital convenience sets them apart from competitors. With a wide range of insurance products and a focus on continuous innovation, Allstate is well-positioned to meet the evolving needs of its customers.

As you embark on your insurance journey, consider Allstate as your partner in protection. Their dedicated team and comprehensive range of insurance solutions ensure that you receive the coverage you need at a price you can afford. Remember, choosing the right insurance provider is a critical decision, and with Allstate, you can rest assured that your assets and future are in capable hands.

Can I bundle multiple insurance policies with Allstate to save money?

+Absolutely! Allstate offers multi-policy discounts, allowing you to save by bundling multiple insurance types, such as auto and home insurance, under one provider.

What additional features or endorsements can I add to my Allstate insurance policy?

+Allstate provides a range of optional endorsements, including rental car coverage, identity theft protection, and accident forgiveness. These additional features can enhance your insurance plan and provide extra peace of mind.

How can I file a claim with Allstate if I experience a loss or damage to my property?

+Filing a claim with Allstate is simple. You can start the process online through their website, call their 24⁄7 customer service hotline, or visit an Allstate agency in person. Their dedicated claims team will guide you through the process and ensure a smooth and timely resolution.