Amex Insurance Near Me

American Express, widely known as Amex, is a renowned financial services company that offers a comprehensive range of products, including insurance services. With its global reach and a focus on premium experiences, Amex provides various insurance options tailored to meet the needs of its diverse clientele. This article explores the world of Amex insurance, delving into its offerings, benefits, and how you can access these services conveniently near your location.

The Spectrum of Amex Insurance Services

Amex insurance covers a broad spectrum of services, designed to protect individuals and businesses across various sectors. From personal protection to business risk management, Amex offers tailored insurance solutions to cater to diverse requirements.

Personal Insurance

Amex’s personal insurance portfolio is extensive, providing coverage for various aspects of an individual’s life. These include:

- Travel Insurance: Amex offers comprehensive travel insurance plans, covering trip cancellations, medical emergencies, and lost luggage. These plans are especially beneficial for frequent travelers, providing peace of mind during domestic and international journeys.

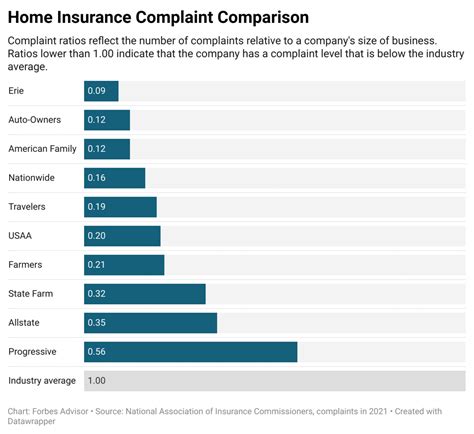

- Home Insurance: Protecting your home and its contents is crucial. Amex’s home insurance policies offer coverage for a range of incidents, from natural disasters to theft and vandalism.

- Health Insurance: Amex provides health insurance plans that cover routine check-ups, major medical procedures, and emergency care. These plans often include access to exclusive healthcare providers and facilities.

- Life Insurance: Amex’s life insurance policies offer financial protection to beneficiaries in the event of the policyholder’s death. These plans can help secure the future of loved ones and cover various expenses, from funeral costs to long-term financial support.

Business Insurance

Amex understands the unique risks faced by businesses, and thus, offers a range of business insurance solutions. These include:

- Commercial Property Insurance: This type of insurance covers physical damage or loss to your business property, including buildings, equipment, and inventory.

- General Liability Insurance: Amex’s general liability insurance policies protect your business against third-party claims, such as bodily injury or property damage, arising from your business operations.

- Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, this policy protects professionals like consultants, accountants, and lawyers from lawsuits arising from their services.

- Business Interruption Insurance: This policy covers your business’s financial losses if it must temporarily cease operations due to an insured peril, such as a fire or natural disaster.

| Insurance Type | Key Benefits |

|---|---|

| Travel Insurance | Covers trip cancellations, medical emergencies, and lost luggage. |

| Home Insurance | Protects against natural disasters, theft, and vandalism. |

| Health Insurance | Covers routine check-ups, major procedures, and emergency care. |

| Life Insurance | Provides financial protection to beneficiaries in case of the policyholder's death. |

| Commercial Property Insurance | Covers physical damage or loss to business property. |

| General Liability Insurance | Protects against third-party claims arising from business operations. |

| Professional Liability Insurance | Covers lawsuits arising from professional services. |

| Business Interruption Insurance | Covers financial losses during temporary business cessation due to insured perils. |

Accessing Amex Insurance Near You

Amex has a vast network of agents and brokers across the globe, ensuring that their insurance services are accessible to a wide range of customers. Whether you’re seeking personal or business insurance, here’s how you can find Amex insurance services near your location.

Online Search

One of the easiest ways to locate Amex insurance services is through an online search. Visit the official Amex website and use the location-based search tool to find the nearest Amex office or agent. You can also use online insurance marketplaces or comparison websites that often list Amex insurance products alongside other providers.

Direct Contact

If you already have an Amex credit card or other financial products, you can directly contact your Amex representative to inquire about insurance services. Amex often provides dedicated customer support lines or online chat services to guide you through the insurance selection and application process.

Referrals and Recommendations

Word-of-mouth recommendations can be powerful when searching for insurance services. Ask your friends, family, or business associates who have worked with Amex insurance. Their personal experiences and insights can help you make an informed decision and locate the right Amex insurance agent or broker near you.

Local Amex Offices

Amex maintains a network of local offices across various regions. These offices often have dedicated insurance specialists who can provide detailed information about Amex insurance products and guide you through the application process. You can locate the nearest Amex office through their official website or by using online mapping tools.

Benefits of Amex Insurance

Amex insurance offers several benefits and advantages, making it a preferred choice for many individuals and businesses. Here are some key benefits:

- Reputation and Trust: Amex has built a reputation for excellence in the financial services industry. Their insurance offerings are known for their reliability and customer-centric approach.

- Tailored Solutions: Amex understands that every customer has unique needs. Their insurance products are designed to be flexible and customizable, ensuring that you get a policy that perfectly fits your requirements.

- Global Reach: With a global presence, Amex insurance provides coverage for individuals and businesses operating across borders. This is especially beneficial for frequent travelers and international businesses.

- Customer Service: Amex is renowned for its exceptional customer service. Their insurance customers often receive dedicated support, personalized assistance, and efficient claim processes.

- Additional Perks: Many Amex insurance policies come with added benefits, such as travel assistance services, emergency medical evacuation coverage, and access to exclusive healthcare providers.

Frequently Asked Questions (FAQs)

How can I compare Amex insurance policies with other providers to find the best fit for my needs?

+

Comparing insurance policies is essential to finding the best coverage at the right price. Utilize online insurance marketplaces or comparison websites that provide detailed information about various providers, including Amex. These platforms allow you to input your specific needs and preferences, generating a list of suitable policies. Additionally, consult with insurance brokers or agents who can provide impartial advice and help you understand the differences between various policies.

What are some key factors to consider when choosing an Amex insurance policy for my business?

+

When selecting an Amex insurance policy for your business, consider factors such as the nature and size of your business, the specific risks it faces, and your budget. Assess the coverage limits, deductibles, and exclusions of each policy to ensure they align with your business’s needs. Also, consider the claims process and customer support offered by Amex, as these can be critical in times of need.

Are there any discounts or special offers available for Amex insurance policies?

+

Amex often offers discounts and special promotions on its insurance policies. These may include bundle discounts when you purchase multiple policies, loyalty rewards for long-term customers, or promotional offers during specific periods. It’s always a good idea to inquire about these discounts when discussing insurance options with an Amex representative.

Can I get a quote for an Amex insurance policy online, or do I need to visit an Amex office?

+

Yes, you can often get an initial quote for an Amex insurance policy online. Visit the official Amex website and use their online quoting tool, which will provide an estimate based on the information you provide. However, for a more accurate and personalized quote, it’s recommended to consult with an Amex insurance agent or broker who can assess your specific needs and provide tailored recommendations.

In conclusion, Amex insurance offers a comprehensive range of services, providing individuals and businesses with the protection they need. With its global reach, tailored solutions, and exceptional customer service, Amex insurance is a trusted choice for many. By following the steps outlined above, you can easily locate and access Amex insurance services near your location, ensuring you receive the coverage and support you deserve.