Annual Auto Insurance

Understanding annual auto insurance is crucial for any vehicle owner. This comprehensive guide aims to provide an in-depth analysis of the factors, costs, and considerations involved in securing annual auto insurance coverage.

The Essentials of Annual Auto Insurance

Annual auto insurance is a policy that provides coverage for a full year, ensuring that your vehicle and its passengers are protected during that period. It is a vital aspect of vehicle ownership, offering financial protection and peace of mind in the event of accidents, theft, or other unforeseen circumstances.

This type of insurance policy is typically a standard offering from insurance providers, covering a range of scenarios and providing options for customization to meet individual needs. It is distinct from short-term or temporary insurance policies, which may be more suitable for specific situations like test drives or temporary vehicle usage.

The annual nature of this insurance policy allows for a more stable and predictable financial arrangement, often resulting in cost savings compared to monthly or quarterly payment plans. It also provides an opportunity for policyholders to review and assess their coverage annually, ensuring that their insurance needs are adequately met and that they are not overpaying for unnecessary coverage.

Key Components of Annual Auto Insurance Policies

Annual auto insurance policies consist of several key components, each serving a specific purpose in providing comprehensive coverage. These include liability coverage, which protects the policyholder in the event they are found at fault for an accident, covering the costs of injuries and damages to others.

Additionally, comprehensive and collision coverage are vital aspects of annual auto insurance. Comprehensive coverage protects against non-collision incidents like theft, vandalism, and natural disasters, while collision coverage covers damages to the insured vehicle in the event of a collision, regardless of fault.

Medical payments coverage, often referred to as MedPay, is another critical component, providing coverage for medical expenses incurred by the policyholder and their passengers in the event of an accident, regardless of fault. This coverage can be a lifesaver, ensuring that medical bills are covered without delay.

| Component | Description |

|---|---|

| Liability Coverage | Covers costs for injuries and damages caused to others. |

| Comprehensive Coverage | Protects against non-collision incidents like theft and natural disasters. |

| Collision Coverage | Covers damages to the insured vehicle in the event of a collision. |

| Medical Payments Coverage (MedPay) | Provides coverage for medical expenses for the policyholder and passengers. |

Factors Influencing Annual Auto Insurance Costs

The cost of annual auto insurance can vary significantly depending on several factors. Understanding these factors can help policyholders make informed decisions about their coverage and potentially save money.

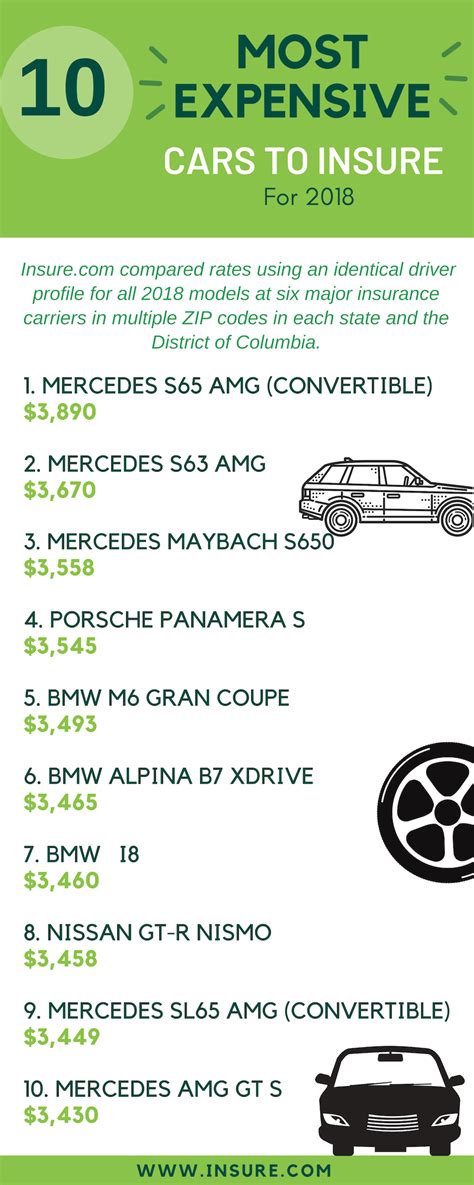

Vehicle Type and Usage

The type of vehicle being insured plays a significant role in determining insurance costs. Generally, more expensive vehicles, sports cars, and vehicles with high-performance engines are considered higher risk and will result in higher insurance premiums. Additionally, the intended use of the vehicle can impact insurance costs. For instance, vehicles used for business purposes or those driven frequently in high-risk areas may incur higher premiums.

Driver’s Profile and History

The driver’s profile and history are key considerations for insurance providers. Younger drivers and those with a history of accidents or traffic violations are often considered higher risk and may face higher insurance premiums. Conversely, experienced drivers with a clean driving record and a history of safe driving may benefit from lower insurance rates.

Coverage and Deductibles

The level of coverage and the chosen deductibles can significantly impact insurance costs. Higher levels of coverage and lower deductibles typically result in higher premiums, as the insurance provider assumes more financial responsibility. On the other hand, opting for lower coverage and higher deductibles can lead to cost savings, although it may mean a larger out-of-pocket expense in the event of a claim.

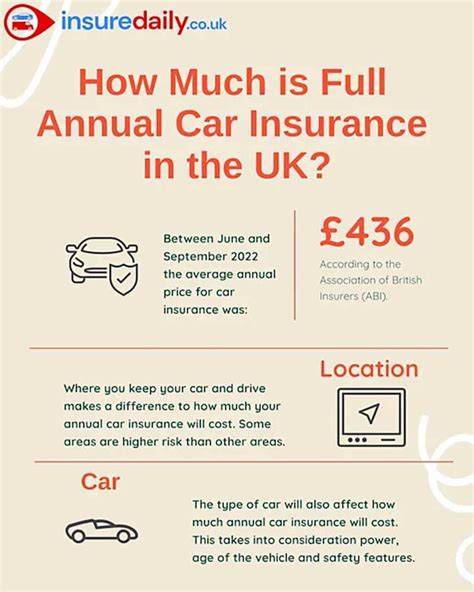

Location and Risk Factors

The location where the vehicle is primarily driven and stored can influence insurance costs. Areas with a high incidence of accidents, theft, or natural disasters are often considered higher risk, leading to higher insurance premiums. Similarly, the specific address where the vehicle is garaged can impact rates, as certain neighborhoods may be more prone to theft or vandalism.

| Factor | Impact on Insurance Costs |

|---|---|

| Vehicle Type and Usage | Expensive or high-performance vehicles, and business use, can increase costs. |

| Driver's Profile and History | Younger drivers and those with a history of accidents or violations may face higher premiums. |

| Coverage and Deductibles | Higher coverage and lower deductibles typically result in higher premiums. |

| Location and Risk Factors | Areas with high accident rates or theft can lead to increased insurance costs. |

Maximizing Savings on Annual Auto Insurance

While annual auto insurance is a necessary expense for vehicle owners, there are several strategies that can help minimize costs without compromising on essential coverage.

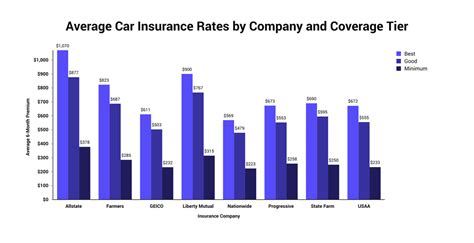

Shopping Around and Comparing Quotes

Insurance rates can vary significantly between providers, so it’s essential to shop around and compare quotes. Online comparison tools can be a valuable resource, allowing you to quickly assess rates from multiple providers. Additionally, speaking directly with insurance agents can provide insights into potential discounts and customized coverage options.

Bundling Policies and Utilizing Discounts

Bundling multiple insurance policies, such as auto and home insurance, can often lead to significant savings. Many insurance providers offer discounts for bundling policies, as it provides them with additional business and a more stable customer base.

Additionally, there are various discounts available that can reduce insurance costs. These may include safe driver discounts, loyalty discounts for long-term customers, discounts for completing defensive driving courses, and even discounts for certain professions or membership associations.

Understanding Coverage Options

Understanding the different coverage options available and selecting the right level of coverage is crucial for maximizing savings. It’s important to strike a balance between adequate coverage and unnecessary expenses. For example, if you own an older vehicle with a low market value, comprehensive and collision coverage may not be cost-effective, as the insurance payout may not significantly exceed the cost of the premium.

Maintaining a Clean Driving Record

Maintaining a clean driving record is one of the most effective ways to keep insurance costs down. Insurance providers view drivers with a history of accidents or traffic violations as higher risk, leading to increased premiums. By driving safely and responsibly, you can not only avoid accidents but also qualify for lower insurance rates.

Annual Auto Insurance Claims and Performance

Understanding how to effectively handle claims and assessing the performance of your insurance provider is a critical aspect of annual auto insurance. It ensures that you receive the benefits you’re entitled to and provides insights for future policy decisions.

Filing Claims and Resolving Disputes

When an accident occurs, it’s important to promptly file a claim with your insurance provider. This typically involves providing detailed information about the incident, including the date, time, location, and any relevant witnesses or evidence. It’s essential to be honest and accurate in your claim, as any misinformation can lead to complications or even the denial of your claim.

In the event of a dispute, such as a denied claim or a disagreement over the value of damages, it's important to understand your rights and options. Many insurance providers have internal dispute resolution processes, and if these fail to provide a satisfactory outcome, external dispute resolution services or legal avenues may be necessary.

Assessing Insurance Provider Performance

Evaluating the performance of your insurance provider is crucial for ensuring you receive the best service and value. Key factors to consider include the provider’s financial stability, ensuring they have the means to pay out claims; their claims handling process, including speed and efficiency; and their customer service, ensuring they provide timely and helpful support when needed.

Additionally, researching and understanding the provider's track record with customer satisfaction and claims payouts can provide valuable insights. Online reviews and industry ratings can be helpful in this regard, offering a glimpse into the experiences of other policyholders.

Future Implications and Policy Adjustments

The performance of your insurance provider and your experience with claims can influence future policy decisions. If you’re satisfied with your provider’s service and claims handling, you may choose to renew your policy with them. However, if you encounter issues or feel you’re not receiving the value you expected, it may be time to consider switching providers.

Additionally, your experience with claims can provide valuable insights for future policy adjustments. For instance, if you find yourself frequently filing claims for minor incidents, it may be cost-effective to adjust your deductible to a higher amount, thereby reducing your premium. Conversely, if you've had a significant claim and feel your current coverage is inadequate, you may wish to increase your coverage limits to provide better protection in the future.

FAQs

What is the difference between annual and monthly auto insurance policies?

+

Annual auto insurance policies provide coverage for a full year, offering stability and often cost savings. Monthly policies, on the other hand, provide more flexibility but may result in higher overall costs due to administrative fees and the potential for rate increases over time.

How can I reduce my annual auto insurance costs?

+

You can reduce costs by shopping around for quotes, bundling policies, utilizing available discounts, and understanding your coverage options to select the most cost-effective plan. Maintaining a clean driving record and avoiding unnecessary coverage can also lead to savings.

What should I do if my annual auto insurance claim is denied?

+

If your claim is denied, first review the reasons provided by your insurance company. You can then appeal the decision, providing additional evidence or clarification as necessary. If the denial persists, you may need to seek external dispute resolution or legal advice.

How often should I review my annual auto insurance policy?

+

It’s a good practice to review your policy annually to ensure your coverage remains adequate and cost-effective. Life changes, such as a new vehicle, a move to a different area, or a change in marital status, can impact your insurance needs and costs.

Can I switch insurance providers mid-year if I find a better deal?

+

Yes, you can switch providers at any time, although you may incur cancellation fees with your current provider. It’s essential to ensure your new policy is active before canceling the old one to avoid any gaps in coverage.