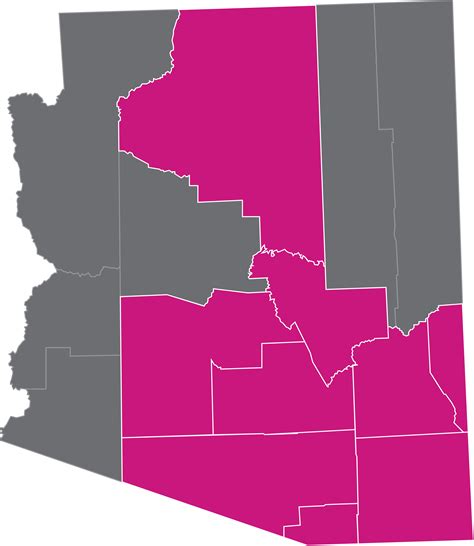

Arizona Marketplace Insurance

In the vast landscape of healthcare coverage, Arizona's Marketplace Insurance stands out as a vital resource for individuals and families seeking accessible and affordable healthcare plans. With a diverse range of options and tailored benefits, Arizona Marketplace Insurance has become a cornerstone of healthcare accessibility in the state. This comprehensive guide will delve into the intricacies of this marketplace, exploring its features, benefits, and the impact it has on the healthcare landscape of Arizona.

Understanding Arizona Marketplace Insurance

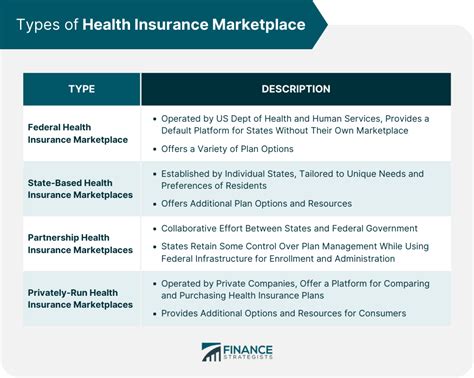

Arizona Marketplace Insurance, also known as the Health Insurance Marketplace, is a federally facilitated exchange platform designed to provide a centralized marketplace for individuals and small businesses to compare and purchase health insurance plans. Established as a result of the Affordable Care Act (ACA), this marketplace plays a crucial role in ensuring that all Arizonans have access to quality healthcare, regardless of their income or pre-existing conditions.

The Marketplace offers a wide array of insurance plans from various providers, each with unique features and benefits. These plans are categorized into different metal tiers, such as Bronze, Silver, Gold, and Platinum, indicating the level of coverage and out-of-pocket costs associated with each plan. This categorization simplifies the process of choosing a plan that aligns with an individual's healthcare needs and budget.

One of the key advantages of Arizona Marketplace Insurance is its commitment to affordability. Through various subsidies and tax credits, the marketplace ensures that healthcare coverage is financially manageable for individuals and families, even those with lower incomes. These subsidies can significantly reduce the cost of premiums, making healthcare an achievable reality for many Arizonans.

Eligibility and Enrollment

Eligibility for Arizona Marketplace Insurance is primarily determined by citizenship or legal residency status, and individuals must reside in Arizona to qualify. While the marketplace is open to all Arizonans, certain criteria, such as income level and family size, can impact the type of coverage and financial assistance one may receive. It’s essential for prospective enrollees to understand these eligibility requirements to make informed decisions about their healthcare coverage.

The enrollment period for Arizona Marketplace Insurance typically runs from November 1st to December 15th each year. However, individuals who experience a qualifying life event, such as marriage, divorce, birth of a child, or loss of other health coverage, may be eligible for a Special Enrollment Period, allowing them to enroll outside of the standard open enrollment window.

Plan Options and Benefits

Arizona Marketplace Insurance offers a comprehensive range of plan options to cater to diverse healthcare needs. These plans can include:

- Individual Plans: Tailored for single individuals, these plans offer coverage for personal healthcare needs.

- Family Plans: Designed to cover the healthcare needs of entire families, including children and dependents.

- Catastrophic Plans: These plans are specifically for young adults and individuals under 30 who may require emergency healthcare coverage.

- Short-Term Plans: Offering temporary coverage, these plans are ideal for those in transition or awaiting other insurance options.

Each plan category comes with its own set of benefits, including coverage for essential health benefits, such as ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative services, and more. Additionally, many plans also offer preventive care services, such as annual check-ups, immunizations, and screenings, at no additional cost to the enrollee.

| Plan Type | Benefits |

|---|---|

| Individual Plans | Customized coverage for personal healthcare needs |

| Family Plans | Comprehensive coverage for families, including children and dependents |

| Catastrophic Plans | Emergency coverage for young adults and individuals under 30 |

| Short-Term Plans | Temporary coverage for individuals in transition |

Financial Assistance and Subsidies

Arizona Marketplace Insurance recognizes that healthcare costs can be a significant financial burden, especially for low- and middle-income households. To address this, the marketplace offers a range of financial assistance programs and subsidies to make healthcare coverage more affordable.

One of the primary forms of financial assistance is the Premium Tax Credit, which can lower the monthly cost of insurance premiums for eligible individuals and families. The amount of the tax credit is based on factors such as income, family size, and the cost of insurance plans in the area. Additionally, cost-sharing reductions can further reduce out-of-pocket costs for those with lower incomes, making essential healthcare services more accessible.

For individuals and families with higher incomes, Arizona Marketplace Insurance offers a variety of plan options with different levels of coverage and out-of-pocket costs. While these plans may not qualify for premium tax credits, they still provide a valuable range of healthcare coverage options, ensuring that everyone can find a plan that suits their needs and budget.

Navigating the Marketplace

Understanding the nuances of Arizona Marketplace Insurance can be complex, but the process is made more accessible with the help of trained navigators and assistance programs. These professionals provide guidance and support to individuals and families, helping them navigate the enrollment process, understand their eligibility, and choose the right plan for their needs.

The Marketplace website also offers a wealth of resources, including detailed plan comparisons, premium calculators, and eligibility tools. These online tools empower users to make informed decisions about their healthcare coverage, ensuring they can select a plan that provides the best value for their unique circumstances.

The Impact of Arizona Marketplace Insurance

Since its inception, Arizona Marketplace Insurance has had a profound impact on the healthcare landscape of the state. By providing a centralized platform for healthcare coverage, the marketplace has made it easier for Arizonans to access quality healthcare, regardless of their financial situation or pre-existing conditions.

One of the most significant impacts of Arizona Marketplace Insurance is its role in reducing the number of uninsured individuals in the state. Through its commitment to affordability and accessibility, the marketplace has made healthcare coverage a reality for many who previously could not afford it. This, in turn, has led to improved health outcomes and a more stable healthcare system in Arizona.

Improving Health Outcomes

With more Arizonans having access to healthcare coverage, the state has seen a positive shift in health outcomes. Preventive care, which is often covered at no additional cost under Marketplace plans, has become more accessible, leading to earlier detection and treatment of health issues. This proactive approach to healthcare has contributed to a decrease in the prevalence of chronic diseases and improved overall population health.

Additionally, the Marketplace's focus on affordability has made it possible for individuals with pre-existing conditions to obtain coverage. This has not only provided peace of mind for these individuals but has also contributed to better management and treatment of their conditions, leading to improved quality of life.

Stabilizing the Healthcare System

Arizona Marketplace Insurance has played a critical role in stabilizing the state’s healthcare system. By increasing the number of insured individuals, the marketplace has reduced the financial burden on hospitals and healthcare providers, who no longer have to absorb the costs of treating uninsured patients. This, in turn, has led to more sustainable healthcare practices and improved access to care for all Arizonans.

Furthermore, the marketplace's emphasis on preventive care has contributed to a reduction in emergency room visits for non-emergency issues. By encouraging individuals to seek regular healthcare services, the Marketplace has helped alleviate the strain on emergency departments, allowing them to focus on true emergencies and provide more efficient care.

Future Outlook and Innovations

As healthcare continues to evolve, Arizona Marketplace Insurance remains committed to staying at the forefront of innovation and accessibility. The marketplace is continually evaluating its plans and services to ensure they meet the changing needs of Arizonans, especially in light of emerging healthcare challenges.

Digital Transformation

Arizona Marketplace Insurance is embracing digital transformation to enhance the user experience and improve accessibility. The marketplace is investing in technology to streamline the enrollment process, making it faster and more convenient for individuals to compare plans, understand their eligibility, and enroll in coverage. This digital shift aims to reach a broader audience, including those who may have previously faced barriers to accessing healthcare coverage.

Expanding Coverage Options

The marketplace is also exploring ways to expand coverage options, particularly for individuals with unique healthcare needs. This includes developing plans that cater to specific demographics, such as older adults or individuals with chronic conditions, to ensure that everyone has access to the care they require.

Community Engagement

Arizona Marketplace Insurance recognizes the importance of community engagement in ensuring the success of its mission. The marketplace is actively working with community organizations, healthcare providers, and local governments to promote awareness and understanding of the importance of healthcare coverage. By partnering with these stakeholders, the marketplace aims to reach underserved communities and ensure that everyone has equal access to the resources they need to make informed decisions about their healthcare.

FAQ

How do I know if I’m eligible for Arizona Marketplace Insurance?

+

Eligibility for Arizona Marketplace Insurance is primarily based on citizenship or legal residency status, and individuals must reside in Arizona. Income level and family size can also impact eligibility and the type of coverage and financial assistance one may receive. It’s recommended to use the eligibility tools on the Marketplace website or consult with a trained navigator for a more detailed assessment.

What is the difference between the metal tiers of insurance plans (Bronze, Silver, Gold, Platinum)?

+

The metal tiers of insurance plans indicate the level of coverage and out-of-pocket costs associated with each plan. Bronze plans typically have lower premiums but higher out-of-pocket costs, while Platinum plans have higher premiums but lower out-of-pocket costs. Silver and Gold plans fall in between these extremes, offering a balance between premiums and out-of-pocket costs.

How do I choose the right insurance plan for my needs?

+

Choosing the right insurance plan involves considering your healthcare needs, budget, and any financial assistance you may be eligible for. It’s essential to review the benefits and coverage details of each plan, including essential health benefits and any additional services you may require. Consulting with a trained navigator or using the plan comparison tools on the Marketplace website can also help you make an informed decision.

What happens if I miss the open enrollment period?

+

If you miss the open enrollment period, you may still be eligible for a Special Enrollment Period if you experience a qualifying life event, such as marriage, divorce, birth of a child, or loss of other health coverage. It’s important to note that not all life events qualify, so it’s best to review the specific criteria on the Marketplace website or consult with a trained navigator.

Can I use my Arizona Marketplace Insurance plan outside of Arizona?

+

Arizona Marketplace Insurance plans are designed for use within the state of Arizona. However, if you travel or move to another state, you may be able to switch to a plan that is valid in your new location. It’s important to review the terms of your specific plan and consult with your insurance provider to understand your coverage options outside of Arizona.