Car Insurance Cheap Florida

Finding affordable car insurance in Florida can be a challenging task due to the unique factors influencing insurance rates in the Sunshine State. Florida is known for its high population of senior citizens, a large number of tourists, and a significant volume of traffic, all of which contribute to a higher risk profile for insurers. Additionally, the state's no-fault insurance laws and the prevalence of uninsured drivers further complicate matters. Despite these challenges, there are strategies and considerations that can help Floridians secure cheaper car insurance.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance market is characterized by a range of factors that set it apart from other states. One of the key differences is the Personal Injury Protection (PIP) coverage, which is mandatory for all registered vehicles. PIP provides coverage for medical expenses and lost wages up to $10,000, regardless of fault in an accident. This coverage is a significant component of the state’s no-fault insurance system, which means that drivers must turn to their own insurance company for compensation after an accident, even if they were not at fault.

Another unique aspect of Florida's car insurance is the high prevalence of uninsured motorists. The state's uninsured motorist rate is estimated to be around 26%, which is significantly higher than the national average of 13%. This means that there is a higher likelihood of an accident involving an uninsured driver, which can impact insurance rates.

Key Factors Affecting Car Insurance Rates in Florida

Several factors contribute to the cost of car insurance in Florida. These include:

- Traffic Density: Florida’s major cities, such as Miami, Orlando, and Tampa, have high traffic volumes, leading to increased accident risks and higher insurance rates.

- Age and Gender: Young drivers, especially males, tend to pay higher premiums due to their higher risk profile. However, rates often decrease as drivers gain more experience.

- Driving Record: A clean driving record with no accidents or traffic violations can lead to significant discounts on insurance premiums.

- Credit Score: Insurance companies in Florida are allowed to use credit-based insurance scores when determining rates. A higher credit score can result in lower premiums.

- Vehicle Type and Usage: The make, model, and age of your vehicle, as well as the annual mileage, can impact insurance costs. Sports cars and luxury vehicles, for instance, often have higher insurance rates.

Strategies to Secure Cheap Car Insurance in Florida

Navigating Florida’s car insurance landscape can be daunting, but with the right approach, it is possible to find affordable coverage. Here are some strategies to consider:

Shop Around and Compare Quotes

The car insurance market in Florida is highly competitive, with numerous insurers offering a variety of coverage options. Shopping around and comparing quotes from multiple providers is essential to finding the best rates. Online comparison tools can be particularly useful for this task.

When comparing quotes, pay attention to the coverage limits and deductibles. While higher deductibles can lead to lower premiums, they also mean you'll pay more out of pocket if you need to make a claim. Ensure that the coverage limits meet your needs and provide adequate protection.

Take Advantage of Discounts

Insurance companies in Florida offer a range of discounts that can significantly reduce your premiums. Some common discounts include:

- Multi-Policy Discount: Bundling your car insurance with other policies, such as homeowners or renters insurance, can result in savings.

- Good Student Discount: If you have a young driver in your household, some insurers offer discounts for students with good grades.

- Safe Driver Discount: Maintaining a clean driving record for a certain period can lead to significant discounts.

- Loyalty Discounts: Staying with the same insurer for an extended period may qualify you for loyalty discounts.

- Defensive Driving Course Discount: Completing a defensive driving course can lead to reduced premiums, especially for senior citizens.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-go or pay-per-mile insurance, is an innovative approach that calculates premiums based on how much you drive. This type of insurance can be especially beneficial for low-mileage drivers. Some insurance companies in Florida offer this option, which can lead to substantial savings for eligible drivers.

Review Your Coverage Regularly

Insurance needs can change over time. It’s important to review your coverage annually to ensure it still meets your requirements and to identify opportunities for cost savings. This includes checking for any changes in your personal circumstances, such as a change in vehicle or address, which can impact your insurance rates.

Performance Analysis and Real-World Examples

To illustrate the effectiveness of these strategies, let’s consider a real-world example. Imagine a family in Tampa, Florida, with two adult drivers and a teenager. The family owns two vehicles, a 2015 sedan and a 2018 SUV. By shopping around and comparing quotes, they were able to find an insurer offering significant discounts for bundling their policies and for the good student status of their teenage driver.

Additionally, by opting for a usage-based insurance plan, they were able to save even more, as the teenager, who was in college, drove very little during the week. The family also reviewed their coverage annually and adjusted their policies based on changes in their circumstances, such as the addition of a new vehicle or the graduation of their teenager from college.

This approach allowed the family to secure comprehensive car insurance coverage at a competitive rate, despite the unique challenges posed by Florida's insurance landscape.

| Family's Insurance Strategy | Savings |

|---|---|

| Bundling Policies | $300 annually |

| Good Student Discount | $200 annually |

| Usage-Based Insurance | $450 annually |

| Annual Review and Adjustments | Varies based on circumstances |

Future Implications and Industry Insights

The car insurance landscape in Florida is continually evolving, and several trends and developments are worth noting. The rise of telematics and usage-based insurance is expected to continue, offering more opportunities for drivers to save based on their individual driving habits. Additionally, the increase in autonomous vehicle technology may lead to further changes in insurance coverage and costs in the future.

Insurance companies are also focusing on digital transformation and customer experience, with many offering online and mobile tools for policy management and claims filing. This shift towards a more digital and customer-centric approach is expected to improve the overall insurance experience for Floridians.

Furthermore, the impact of climate change on Florida's insurance market cannot be overlooked. The state's vulnerability to hurricanes and other natural disasters has already led to significant insurance rate increases in high-risk areas. As climate-related risks continue to evolve, insurers may need to adapt their coverage and pricing strategies to manage these challenges effectively.

Conclusion

Securing cheap car insurance in Florida requires a comprehensive understanding of the state’s unique insurance landscape and a proactive approach to shopping for coverage. By comparing quotes, taking advantage of discounts, and staying informed about industry trends, Floridians can navigate the challenges and find affordable car insurance that meets their needs.

How often should I review my car insurance policy in Florida?

+It is recommended to review your car insurance policy annually or whenever there is a significant change in your personal circumstances, such as a new vehicle, a move to a different area, or a change in marital status.

Are there any specific discounts for senior citizens in Florida?

+Yes, many insurance companies in Florida offer discounts for senior citizens, especially those who have completed defensive driving courses. These discounts can lead to significant savings on insurance premiums.

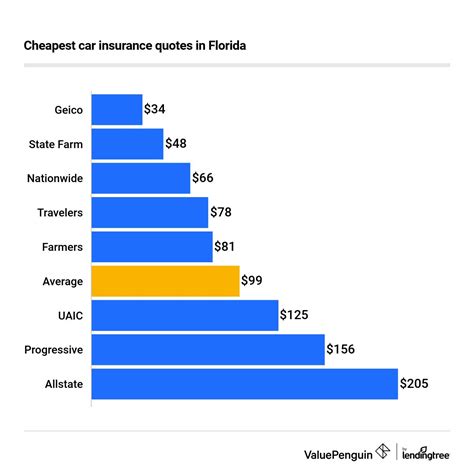

What is the average cost of car insurance in Florida?

+The average cost of car insurance in Florida varies based on numerous factors, including the driver’s age, gender, location, and driving record. However, the average annual premium in Florida is estimated to be around $2,000.