Auto Car Cheap Insurance Quote

Finding affordable and reliable car insurance is a priority for many vehicle owners. With the cost of insurance premiums varying significantly, it's crucial to explore options that offer the best coverage at a competitive price. This comprehensive guide aims to provide an in-depth analysis of cheap car insurance quotes, offering valuable insights to help you make an informed decision.

Understanding Auto Insurance Premiums

Insurance premiums are calculated based on various factors, including the type of vehicle, driving history, location, and the level of coverage desired. Understanding these factors is key to securing the most cost-effective insurance plan.

Vehicle Type and Age

The make, model, and age of your vehicle play a significant role in determining insurance rates. Generally, newer and more expensive cars tend to attract higher premiums due to the cost of repairs and replacement parts. On the other hand, older vehicles, especially those with low mileage and good safety ratings, can lead to more affordable insurance quotes.

| Vehicle Type | Average Annual Premium |

|---|---|

| Sports Car | $2,500 |

| Sedan | $1,200 |

| SUV | $1,500 |

| Electric Vehicle | $1,800 |

As illustrated above, sports cars often come with the highest insurance costs due to their high-performance nature and associated risks. In contrast, sedans and SUVs generally offer more affordable options, especially if they have standard safety features and are not high-end models.

Driving Record and History

Your driving record is a critical factor in insurance premium calculations. A clean driving history with no accidents or traffic violations can lead to significantly lower insurance rates. Conversely, a history of accidents, especially those deemed your fault, can increase premiums substantially.

| Driving History | Average Premium Impact |

|---|---|

| Clean Record | 20% Discount |

| At-Fault Accident | 30% Increase |

| Multiple Traffic Violations | 50% Increase |

Maintaining a safe driving record is not only crucial for your well-being but also for keeping insurance costs down. It's worth noting that most insurers offer safe driver discounts, providing an incentive to drive responsibly.

Location and Usage

Where you live and how you use your vehicle also influence insurance rates. Urban areas with higher population densities often have higher premiums due to increased traffic congestion and potential for accidents. Similarly, using your vehicle for work or commercial purposes can raise insurance costs.

| Location and Usage | Average Premium Impact |

|---|---|

| Urban Area | 15% Increase |

| Rural Area | 10% Discount |

| Commuting to Work | 5% Increase |

| Commercial Use | 20% Increase |

Consider the purpose and frequency of your vehicle usage when choosing an insurance plan. If you primarily use your car for leisure and live in a rural area, you may qualify for more affordable rates.

Coverage and Deductibles

The level of coverage you select directly impacts your insurance premium. Comprehensive coverage plans that include collision, liability, and additional perks like rental car reimbursement tend to be more expensive. On the other hand, opting for a basic liability-only plan can be more cost-effective.

Furthermore, increasing your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can lead to lower premiums. This strategy, however, requires careful consideration as it shifts more financial risk onto you in the event of an accident or damage.

| Coverage Type | Average Premium |

|---|---|

| Comprehensive | $1,800 |

| Liability-Only | $1,200 |

Assessing your financial situation and risk tolerance is essential when choosing a deductible and coverage level. While higher deductibles can reduce premiums, they also mean you'll have to pay more in the event of a claim.

Strategies for Securing Cheap Car Insurance

Now that we’ve explored the key factors influencing insurance premiums, let’s delve into strategies to secure cheap car insurance quotes.

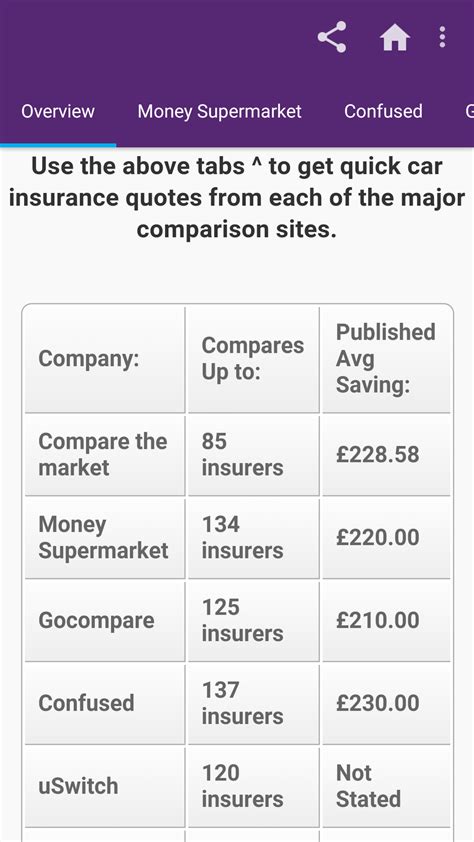

Compare Multiple Quotes

The insurance market is highly competitive, and rates can vary significantly between providers. Taking the time to compare quotes from multiple insurers is a surefire way to find the best deal. Online quote comparison tools can be particularly useful for this purpose, offering a quick and convenient way to assess a range of options.

Bundle Policies

If you have multiple insurance needs, such as auto, home, or life insurance, consider bundling your policies with the same insurer. Many providers offer discounts for customers who choose to do so, providing a cost-effective way to manage your insurance portfolio.

Take Advantage of Discounts

Insurance companies often provide a range of discounts to attract customers. These can include safe driver discounts, multi-car discounts, student discounts, and loyalty discounts for long-term customers. Being aware of these discounts and ensuring you meet the criteria can lead to significant savings on your insurance premiums.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is a relatively new concept that uses telematics to monitor driving behavior. This data is then used to calculate insurance premiums, with safer drivers potentially qualifying for lower rates. While this approach may not suit everyone, it can be a cost-effective option for safe and cautious drivers.

Improve Your Credit Score

Surprisingly, your credit score can impact your insurance premiums. Many insurers use credit-based insurance scoring to assess the risk of insuring a customer. Improving your credit score can lead to more favorable insurance rates, as it indicates a lower risk of default and better financial stability.

The Future of Auto Insurance

The auto insurance industry is evolving rapidly, with new technologies and trends shaping the way insurance is priced and delivered. Here’s a glimpse into the future of auto insurance and how it might impact cheap car insurance quotes.

Autonomous Vehicles and Safety Innovations

The rise of autonomous vehicles and advanced safety features is expected to revolutionize the auto insurance industry. As these technologies become more widespread, they are likely to reduce the frequency and severity of accidents, leading to lower insurance premiums over time. Additionally, insurers may offer discounts for vehicles equipped with advanced safety features.

Data-Driven Insurance Models

With the increasing availability of data and advanced analytics, insurance companies are moving towards more data-driven models. This shift allows for more accurate risk assessment and pricing, potentially leading to more affordable insurance for low-risk drivers. Additionally, insurers may use predictive analytics to identify and mitigate potential risks, further reducing insurance costs.

Digital Transformation

The digital transformation of the insurance industry is already underway, with online platforms and mobile apps offering convenient and efficient ways to manage insurance policies. This trend is expected to continue, making it easier for consumers to compare quotes, purchase insurance, and manage their policies online. The increased competition and efficiency brought by digital transformation are likely to drive down insurance costs over time.

Environmental Considerations

As environmental concerns continue to grow, the insurance industry is likely to respond with more sustainable practices. This may include offering incentives for electric and hybrid vehicles, as well as adopting more environmentally friendly business practices. The shift towards sustainability could potentially lead to more affordable insurance options for environmentally conscious consumers.

Conclusion

Securing cheap car insurance is a complex process, influenced by a multitude of factors. By understanding these factors and employing strategic approaches, it’s possible to find cost-effective insurance quotes that offer the coverage you need. As the auto insurance industry continues to evolve, staying informed about the latest trends and innovations can help you make the most of your insurance choices.

How often should I review my insurance policy to ensure I’m getting the best rates?

+

It’s recommended to review your insurance policy annually or whenever your circumstances change significantly, such as buying a new car or moving to a different location. Regular reviews ensure you’re taking advantage of any discounts or policy changes that could lower your premiums.

Are there any hidden costs or fees associated with car insurance quotes?

+

While insurance quotes typically don’t include hidden fees, it’s essential to carefully review the policy terms and conditions to understand any potential additional costs. These could include administrative fees, surcharge fees, or cancellation fees.

Can I negotiate car insurance rates with my insurer?

+

While insurance rates are largely predetermined based on various factors, you can negotiate certain aspects of your policy. For instance, you can discuss the level of coverage, deductibles, and any additional perks to find a plan that suits your needs and budget.

What are some common mistakes to avoid when shopping for cheap car insurance quotes?

+

Common mistakes include rushing the process and not comparing enough quotes, failing to read the fine print, and neglecting to consider the long-term costs associated with a policy. It’s essential to take your time, thoroughly research your options, and understand the full implications of your chosen policy.