Auto Insurance Auto Insurance Quote

When it comes to protecting your vehicle and managing your finances, auto insurance is an essential aspect of responsible car ownership. Obtaining an auto insurance quote is the first step towards ensuring you have adequate coverage for your needs. In this comprehensive guide, we will delve into the world of auto insurance, exploring the factors that influence quotes, the coverage options available, and how to navigate the process to find the best policy for your vehicle.

Understanding Auto Insurance Quotes

Auto insurance quotes provide an estimate of the cost of insuring your vehicle. These quotes are tailored to your specific circumstances and vehicle details, offering a personalized indication of the coverage you can expect and the associated costs. Understanding the quote process is crucial to making informed decisions about your insurance coverage.

Factors Influencing Auto Insurance Quotes

Several key factors come into play when determining your auto insurance quote. These include:

- Vehicle Type and Usage: The make, model, and year of your vehicle, along with its primary usage (commuting, pleasure driving, business, etc.), can impact your quote. Higher-value vehicles or those used for business purposes may incur higher insurance costs.

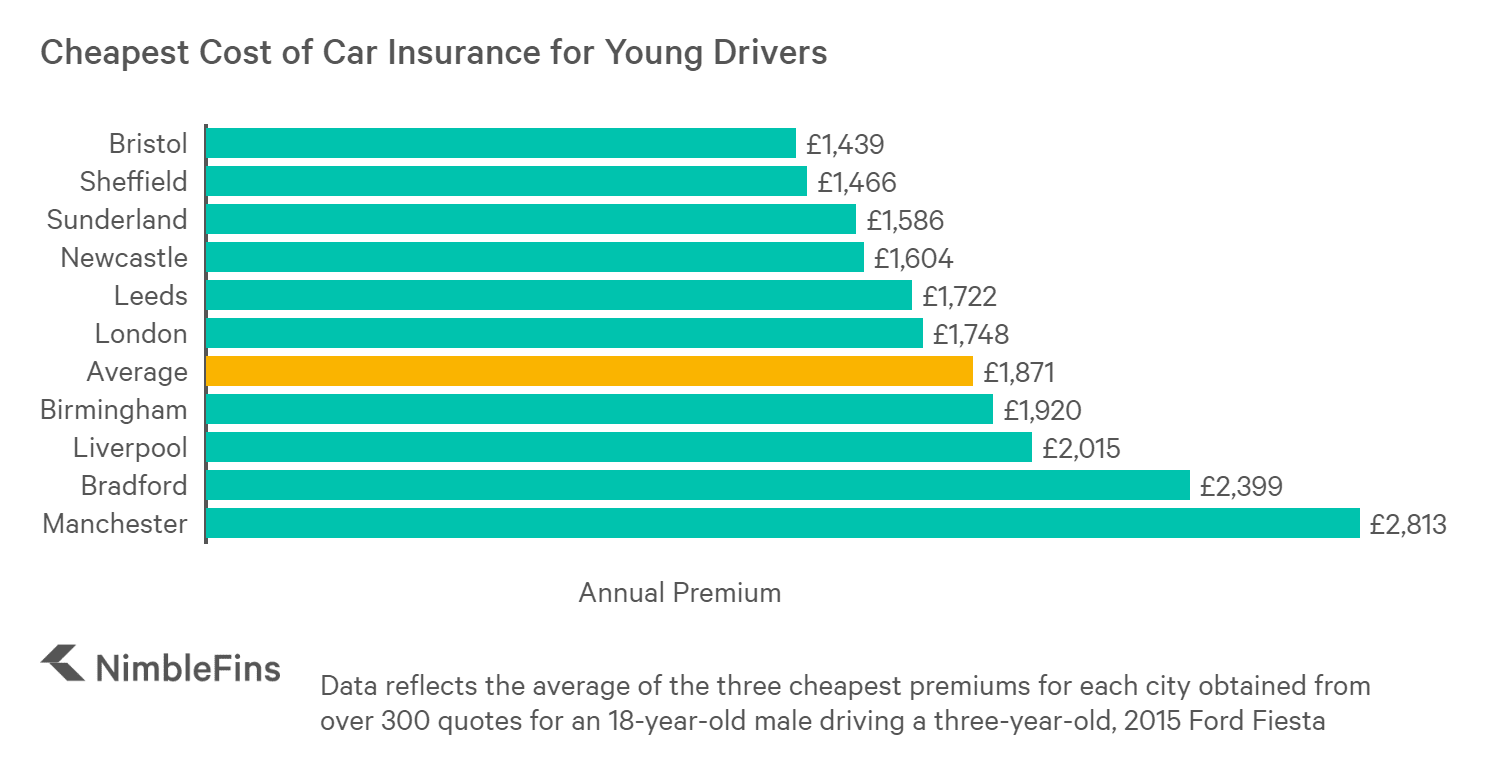

- Driver Profile: Your age, gender, driving record, and years of driving experience are significant factors. Younger or less experienced drivers often face higher premiums due to the perceived risk associated with their demographic.

- Location: The area where you live and park your vehicle plays a role. Urban areas with higher traffic volumes and crime rates may result in increased insurance costs.

- Coverage Options: The level of coverage you choose, such as liability-only or comprehensive coverage, will influence your quote. Higher levels of coverage generally result in higher premiums.

- Discounts and Bundles: Insurance companies often offer discounts for various reasons, such as safe driving records, bundling multiple policies (auto and home insurance), or having certain safety features in your vehicle.

It's essential to provide accurate information when obtaining quotes to ensure you receive an accurate assessment of your insurance needs.

Comparing Quotes and Choosing Coverage

When comparing auto insurance quotes, consider the following aspects to make an informed decision:

- Coverage Limits: Ensure that the policy provides adequate liability coverage limits to protect your assets in the event of an accident. Opting for higher limits may cost more, but it provides greater financial protection.

- Deductibles: Higher deductibles can lead to lower premiums, but you’ll pay more out of pocket if you need to file a claim. Consider your financial situation and choose a deductible that aligns with your comfort level.

- Additional Coverage Options: Explore the availability of add-on coverages like rental car reimbursement, roadside assistance, or gap insurance. These can provide extra protection and peace of mind.

- Customer Service and Claims Handling: Research the reputation of the insurance company for customer service and claims handling. Look for online reviews and ratings to assess their responsiveness and reliability.

- Price Comparison: While price is a crucial factor, it shouldn’t be the sole determinant. Compare quotes from multiple providers to find the best balance between cost and coverage.

The Process of Obtaining an Auto Insurance Quote

Obtaining an auto insurance quote is a straightforward process that can be done online or through an insurance agent. Here’s a step-by-step guide:

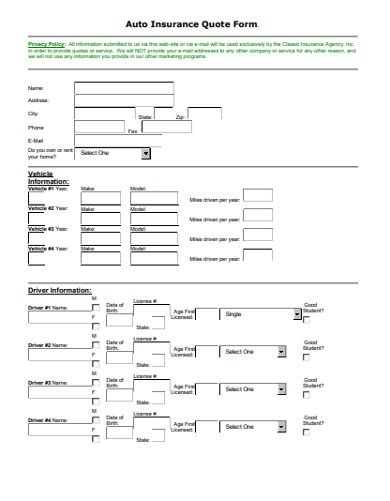

- Gather Information: Have the following details ready: your vehicle’s make, model, year, VIN (Vehicle Identification Number), estimated annual mileage, and any safety features it possesses.

- Choose Your Insurance Provider: Select a reputable insurance company or compare quotes from multiple providers. You can use online comparison tools or contact individual insurance companies directly.

- Provide Personal and Vehicle Details: Fill out the necessary forms or questionnaires, providing accurate information about yourself, your driving history, and your vehicle.

- Select Coverage Options: Choose the coverage types and limits that align with your needs. Consider liability, collision, comprehensive, and any additional coverages you require.

- Review and Compare Quotes: Once you’ve obtained quotes from different providers, take the time to review and compare them. Assess the coverage, deductibles, and overall cost to find the best fit.

- Discuss Customization: If you have specific concerns or requirements, discuss them with an insurance agent or representative. They can help tailor the policy to your needs and provide clarity on any coverage questions.

- Purchase the Policy: Once you’ve made your decision, proceed with purchasing the auto insurance policy. Ensure you understand the terms and conditions, including any exclusions or limitations.

Tips for Obtaining the Best Auto Insurance Quote

To ensure you get the most accurate and competitive auto insurance quote, consider the following tips:

- Shop Around: Don’t settle for the first quote you receive. Compare quotes from multiple providers to find the best rates and coverage options.

- Bundle Policies: If you have multiple insurance needs (auto, home, renters, etc.), consider bundling your policies with the same provider. This can often lead to significant discounts.

- Maintain a Clean Driving Record: A safe driving history is a significant factor in obtaining lower insurance rates. Avoid accidents and moving violations to keep your record clean.

- Explore Discounts: Ask about available discounts, such as safe driver discounts, loyalty discounts, or discounts for having certain safety features in your vehicle.

- Adjust Coverage Levels: Review your coverage needs periodically and adjust your policy accordingly. You may be able to save money by reducing coverage for older vehicles or opting for higher deductibles.

The Importance of Regular Policy Reviews

Auto insurance quotes and policies are not set in stone. It’s essential to periodically review your coverage to ensure it remains adequate and cost-effective. Life circumstances and vehicle usage can change, impacting your insurance needs. Consider the following when reviewing your auto insurance policy:

- Life Changes: Events like getting married, having children, or changing jobs can impact your insurance needs. Review your policy to ensure it aligns with your current life situation.

- Vehicle Upgrades: If you’ve upgraded to a new vehicle or made significant modifications to your existing one, your insurance coverage may need adjustment.

- Discount Eligibility: Keep an eye out for new discounts you may become eligible for, such as good student discounts, loyalty rewards, or safe driving programs.

- Market Rate Comparison: Regularly compare your current insurance rates with those offered by other providers. This can help you identify opportunities to save money without compromising coverage.

- Policy Adjustments: As your financial situation changes, you may want to consider adjusting your coverage limits or deductibles to better align with your budget.

The Future of Auto Insurance

The auto insurance industry is evolving, driven by technological advancements and changing consumer preferences. Here are some trends and developments to watch:

- Telematics and Usage-Based Insurance: Telematics devices and smartphone apps are increasingly being used to monitor driving behavior and offer usage-based insurance policies. These policies can provide personalized rates based on actual driving habits.

- Artificial Intelligence and Data Analytics: Insurance companies are leveraging AI and data analytics to improve risk assessment and pricing accuracy. This technology can help identify trends and patterns, leading to more efficient and fair pricing.

- Digital Transformation: The insurance industry is embracing digital transformation, with online quote comparison tools, mobile apps, and paperless documentation becoming more prevalent. This shift towards digital convenience and efficiency is expected to continue.

- Autonomous Vehicles and New Risks: As autonomous vehicles become more common, the insurance industry will need to adapt to cover new risks and liabilities associated with self-driving cars.

Conclusion

Obtaining an auto insurance quote is a critical step towards protecting your vehicle and managing your finances effectively. By understanding the factors that influence quotes, comparing coverage options, and regularly reviewing your policy, you can make informed decisions and ensure you have the right coverage at the best price. Stay proactive, and don’t hesitate to seek professional advice when needed.

What is the difference between liability-only and comprehensive coverage in auto insurance?

+Liability-only coverage provides protection for damages you cause to others’ property or injuries you cause to others in an accident. It does not cover damage to your own vehicle. Comprehensive coverage, on the other hand, provides broader protection, covering damages caused by events like theft, vandalism, natural disasters, and collisions with animals, in addition to liability coverage.

How often should I review my auto insurance policy?

+It is recommended to review your auto insurance policy annually or whenever your circumstances change significantly. Life events like marriage, having children, or purchasing a new vehicle can impact your insurance needs, so it’s important to keep your coverage up-to-date.

Can I switch auto insurance providers mid-policy term?

+Yes, you can switch auto insurance providers at any time. However, it’s important to ensure you have continuous coverage to avoid gaps in protection. Notify your new provider of your desired effective date, and they will guide you through the process.