Best Car Insurance For Price

When it comes to choosing the best car insurance, one of the primary considerations for many drivers is the price. With a plethora of insurance providers offering various policies, finding the most cost-effective option without compromising on coverage can be a daunting task. This comprehensive guide aims to delve into the world of car insurance, providing an in-depth analysis to help you make an informed decision.

Understanding the Factors that Impact Car Insurance Prices

The cost of car insurance is influenced by a multitude of factors, each playing a crucial role in determining the final premium. These include, but are not limited to, the driver’s age, gender, driving history, location, and the type of vehicle insured. Additionally, the coverage options and limits selected by the policyholder also significantly impact the overall price.

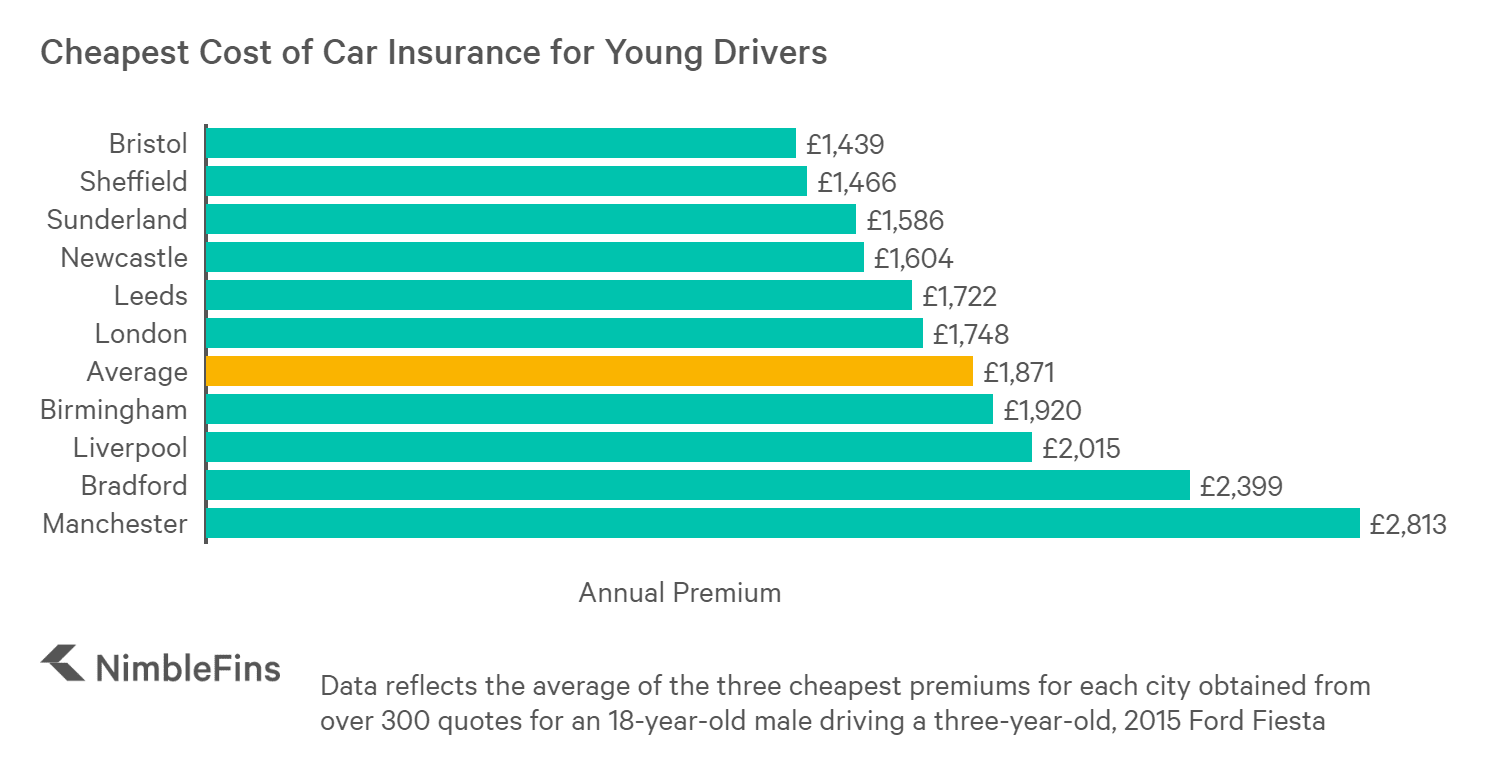

For instance, younger drivers, especially males under the age of 25, often face higher insurance premiums due to their perceived higher risk on the road. Similarly, those with a history of accidents or traffic violations may also see increased rates. The location of the driver is another key factor, with urban areas typically resulting in higher premiums due to increased traffic congestion and the higher likelihood of accidents.

The Impact of Coverage Choices

The type and extent of coverage chosen can have a substantial effect on the overall cost of car insurance. While it might be tempting to opt for the cheapest option, it’s essential to consider the potential financial implications of inadequate coverage. For instance, liability-only insurance may be the most affordable option, but it provides limited protection in the event of an accident.

Comprehensive and collision coverage, although more expensive, offer a higher level of protection by covering a wider range of incidents, including accidents, theft, and natural disasters. Additionally, adding optional coverages such as rental car reimbursement or roadside assistance can further increase the cost but may be worth it for those who frequently travel or rely heavily on their vehicle.

| Coverage Type | Description |

|---|---|

| Liability Insurance | Covers damages to others' property and medical expenses in an accident you cause. |

| Comprehensive Coverage | Protects against non-collision incidents like theft, vandalism, and natural disasters. |

| Collision Coverage | Covers damages to your vehicle in an accident, regardless of fault. |

Top Car Insurance Providers for Affordable Coverage

Identifying the best car insurance providers that offer both affordable rates and comprehensive coverage can be a challenging task. However, with careful research and consideration of various factors, you can find the right fit for your needs. Here’s an overview of some of the top providers known for their competitive pricing:

State Farm

State Farm is a leading provider of car insurance, offering a wide range of coverage options at competitive rates. They excel in providing personalized policies tailored to individual needs, making them an excellent choice for drivers seeking both affordability and flexibility. State Farm’s extensive network of agents and online resources also make it convenient to manage your policy.

One of the key advantages of State Farm is its commitment to customer service. They provide 24/7 assistance, ensuring that policyholders can easily reach out for help or guidance whenever needed. This level of support can be invaluable, especially in the event of an accident or other emergencies.

Geico

Geico, known for its catchy slogan “15 minutes could save you 15% or more on car insurance,” has established itself as a go-to provider for budget-conscious drivers. Their online platform and mobile app make it incredibly convenient to obtain quotes, manage policies, and file claims, making the insurance process seamless and efficient.

In addition to their competitive pricing, Geico offers a wide range of discounts to help policyholders save even more. These discounts can be based on factors such as good driving records, the installation of safety features in the vehicle, and even membership in certain organizations. By taking advantage of these discounts, drivers can further reduce their insurance costs.

Progressive

Progressive is another prominent player in the car insurance market, renowned for its innovative approach and customer-centric services. They offer a suite of tools and resources, such as their Name Your Price tool, which allows drivers to set their desired premium and then find a policy that matches their budget.

Progressive's Snapshot program is particularly noteworthy. This program uses a small device plugged into your car's diagnostic port to monitor your driving habits, such as hard braking, acceleration, and time of day driven. Based on this data, Progressive can offer personalized discounts, potentially reducing your insurance premium significantly. This innovative approach not only rewards safe driving but also provides an incentive for drivers to improve their habits.

Tips for Getting the Best Car Insurance Rates

Finding the most affordable car insurance doesn’t solely depend on choosing the right provider. There are several strategies and best practices you can employ to ensure you’re getting the best possible rate. Here are some tips to help you save on your car insurance premiums:

- Shop Around: Compare quotes from multiple providers to find the most competitive rates. Online comparison tools can make this process quicker and easier.

- Bundle Policies: Consider bundling your car insurance with other types of insurance, such as home or renters' insurance. Many providers offer discounts for bundling multiple policies.

- Maintain a Good Driving Record: Avoid traffic violations and accidents to keep your driving record clean. Insurance companies reward safe drivers with lower premiums.

- Choose Higher Deductibles: Opting for a higher deductible can significantly reduce your insurance premium. However, ensure that you can afford the deductible in the event of a claim.

- Explore Discounts: Insurance providers offer various discounts, including good student discounts, safe driver discounts, and loyalty discounts. Be sure to inquire about all available discounts to maximize your savings.

The Role of Deductibles in Car Insurance

A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lead to significant savings on your insurance premium. For example, increasing your deductible from 500 to 1,000 could result in a 20% to 40% reduction in your premium.

However, it's important to carefully consider this decision. While a higher deductible can save you money in the short term, it means you'll have to pay more out of pocket if you need to make a claim. Ensure that you have the financial means to cover a higher deductible in the event of an accident or other covered incident.

The Future of Affordable Car Insurance

The car insurance industry is continuously evolving, with new technologies and innovations shaping the way policies are priced and delivered. The rise of usage-based insurance (UBI) programs, such as Progressive’s Snapshot and State Farm’s Drive Safe & Save, is a prime example of this evolution.

UBI programs use telematics devices or smartphone apps to track driving behavior, including distance driven, time of day, and driving style. By rewarding safe driving habits with discounts, these programs not only encourage safer roads but also provide a more personalized insurance experience. As UBI gains traction, it has the potential to significantly impact the affordability of car insurance, particularly for safe drivers.

Additionally, the increasing adoption of autonomous vehicles and advanced driver-assistance systems (ADAS) could further disrupt the traditional car insurance model. These technologies have the potential to reduce the number and severity of accidents, leading to lower insurance premiums over time. While these changes are still in their early stages, they highlight the dynamic nature of the car insurance industry and its potential for future innovation and cost reduction.

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the U.S. varies widely based on factors such as location, driving history, and the type of vehicle. According to recent data, the national average for car insurance premiums is around 1,674 per year, but this can range from under 1,000 to over $3,000 depending on individual circumstances.

How can I lower my car insurance premium if I have a poor driving record?

+If you have a poor driving record, your insurance premium will likely be higher than average. However, there are ways to reduce your premium. Consider increasing your deductible, as a higher deductible can lead to lower premiums. Additionally, take advantage of any discounts you may be eligible for, such as safe driver discounts or good student discounts. Finally, shop around and compare quotes from multiple insurers to find the most competitive rate.

Are there any car insurance providers that specialize in offering low-cost policies for high-risk drivers?

+Yes, there are insurance providers that cater specifically to high-risk drivers, offering policies known as non-standard or high-risk auto insurance. These policies are designed for drivers with a history of accidents, violations, or other factors that make them more expensive to insure. While premiums for high-risk drivers are generally higher, these specialized providers can offer more affordable rates compared to standard insurance companies.