Auto Insurance Ca

In the province of Ontario, Canada, auto insurance plays a crucial role in protecting drivers and ensuring financial security in the event of accidents or vehicle-related incidents. The unique regulatory landscape and the diverse needs of Ontario drivers make understanding auto insurance in this region essential. This comprehensive guide aims to provide an in-depth analysis of auto insurance in Ontario, covering everything from regulatory frameworks to practical tips for choosing the right coverage.

Understanding Auto Insurance in Ontario

Auto insurance in Ontario operates under a unique regulatory framework known as the Ontario Auto Insurance System. This system, governed by the Insurance Act and regulated by the Financial Services Regulatory Authority (FSRA), aims to provide mandatory third-party liability coverage for all drivers while allowing for a range of additional coverage options to meet diverse needs.

The Ontario Auto Insurance System is notable for its no-fault accident benefits coverage, which provides financial support to injured individuals regardless of fault in the accident. This includes coverage for medical expenses, income replacement, and other benefits, ensuring that accident victims can access the necessary support during their recovery.

Additionally, Ontario's auto insurance system offers a range of coverage options, including liability coverage, which protects against claims for bodily injury or property damage caused to others; collision coverage, which covers the cost of repairing or replacing the insured vehicle after an accident; comprehensive coverage, which protects against non-collision incidents like theft, vandalism, or natural disasters; and uninsured or underinsured motorist coverage, which provides protection in case the at-fault driver has insufficient or no insurance.

Key Features of Ontario Auto Insurance

One of the distinctive features of Ontario auto insurance is its statutory accident benefits coverage, which is mandatory for all drivers. This coverage provides a range of benefits, including:

- Medical and Rehabilitation Benefits: Coverage for medical expenses, rehabilitation, and attendant care.

- Income Replacement Benefits: Compensation for lost income due to injuries sustained in an accident.

- Non-Earner Benefits: Support for individuals who do not have an income, such as students or homemakers.

- Caregiver and Homemaker Benefits: Assistance for individuals who provide care to dependents or manage a household.

- Death Benefits: Financial support for the dependents of individuals who pass away due to an accident.

Another important aspect of Ontario auto insurance is the rating system, which determines insurance premiums based on various factors, including the driver's age, driving record, vehicle type, and location. The province has implemented measures to control insurance rates, such as the Standard Automobile Insurance Policy, which sets a standard for coverage and rates across all insurance providers.

| Rating Factor | Description |

|---|---|

| Driver's Age | Premiums may vary based on age, with younger and older drivers often paying more. |

| Driving Record | At-fault accidents and traffic violations can lead to higher premiums. |

| Vehicle Type | Certain vehicle types, like sports cars or luxury vehicles, may attract higher premiums. |

| Location | Urban areas or regions with a higher incidence of accidents may have higher insurance rates. |

Choosing the Right Auto Insurance Coverage

When selecting auto insurance in Ontario, it's essential to consider your specific needs and circumstances. Here are some key factors to keep in mind:

Assessing Your Coverage Needs

First, evaluate your personal situation and the risks you want to mitigate. Consider factors like the value of your vehicle, your driving record, and the likelihood of accidents or incidents. Do you frequently drive in high-risk areas? Are you concerned about theft or vandalism? Answering these questions will help you determine the type and level of coverage you require.

It's also important to understand the different coverage options available and their specific benefits. For instance, while liability coverage is mandatory, you might also consider adding collision and comprehensive coverage to protect your vehicle and yourself from a wider range of risks.

Comparing Insurance Providers

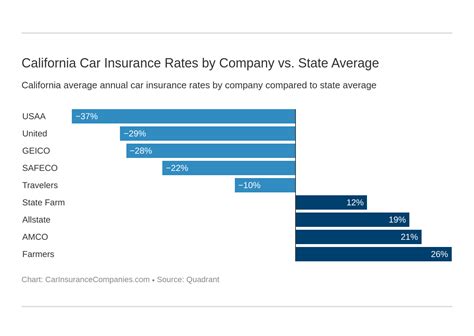

Ontario has a competitive auto insurance market, with numerous providers offering a range of policies and coverage options. When comparing insurers, consider the following:

- Coverage Options: Ensure that the provider offers the specific coverage you require, such as accident benefits, collision coverage, or uninsured motorist coverage.

- Premium Costs: Compare premiums for similar coverage levels to find the most competitive rates. Remember, the cheapest option might not always provide the best value.

- Claims Process: Research the insurer's claims handling process and reputation. Look for providers with a history of prompt and fair claim settlements.

- Customer Service: Consider the insurer's customer service reputation, including their availability, responsiveness, and overall customer satisfaction.

- Discounts and Bundles: Many insurers offer discounts for safe driving, multi-policy bundles, or other specific circumstances. Take advantage of these to reduce your premium costs.

Understanding Deductibles and Limits

Deductibles and coverage limits are important considerations when choosing an auto insurance policy. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles can lower your premium, but it's important to choose a deductible that you can comfortably afford to pay in the event of a claim.

Coverage limits refer to the maximum amount your insurer will pay for a covered loss. It's crucial to ensure that your policy limits are adequate to cover potential losses. For example, if you have a high-value vehicle, you may want to consider higher liability limits to protect yourself in case of an accident where you are at fault.

The Future of Auto Insurance in Ontario

The auto insurance landscape in Ontario is continually evolving, driven by technological advancements, regulatory changes, and shifting consumer needs. Here are some key trends and future implications to consider:

Technological Innovations

The rise of connected vehicles and telematics is expected to play a significant role in shaping the future of auto insurance. Telematics devices can track driving behavior, offering insurers more precise data to assess risk and potentially leading to more personalized insurance rates. Additionally, autonomous vehicles are on the horizon, and their widespread adoption could revolutionize auto insurance by reducing accident rates and shifting liability.

Regulatory Changes

Regulatory bodies in Ontario are continuously reviewing and updating auto insurance regulations to ensure fairness and accessibility. Future changes may include adjustments to the standard policy, expanded coverage options, or measures to address emerging risks like cyber threats in connected vehicles.

Consumer Education and Awareness

As the auto insurance landscape becomes more complex, consumer education will play a vital role. Empowering consumers with knowledge about their coverage options, rights, and responsibilities can lead to better decision-making and more satisfied customers. This includes understanding the intricacies of insurance policies, such as exclusions and conditions, to avoid surprises in the event of a claim.

Industry Competition and Innovation

The competitive nature of the Ontario auto insurance market is likely to drive innovation and improved customer service. Insurers will continue to explore new technologies, such as artificial intelligence and blockchain, to streamline processes, enhance customer experiences, and offer more tailored coverage options.

Frequently Asked Questions (FAQ)

What is the average cost of auto insurance in Ontario?

+

The average cost of auto insurance in Ontario varies based on several factors, including the driver’s age, driving record, vehicle type, and location. According to recent data, the average annual premium for a standard auto insurance policy in Ontario is around 1,500 to 2,000. However, this can range significantly depending on individual circumstances.

Are there any discounts available for auto insurance in Ontario?

+

Yes, many insurance providers in Ontario offer a variety of discounts to their policyholders. Common discounts include safe driving discounts for maintaining a clean driving record, multi-policy discounts for bundling auto insurance with other types of insurance, and loyalty discounts for long-term customers. It’s always a good idea to inquire about available discounts when shopping for auto insurance.

How can I reduce my auto insurance premiums in Ontario?

+

There are several strategies you can employ to reduce your auto insurance premiums in Ontario. First, consider increasing your deductible. While this means you’ll pay more out of pocket in the event of a claim, it can significantly lower your premiums. Additionally, maintaining a clean driving record, taking defensive driving courses, and exploring bundling options with your insurer can all lead to lower premiums.