Auto Insurance Comprehensive

Comprehensive auto insurance is a vital component of any vehicle owner's financial protection plan. It provides coverage for damages and losses that are not typically covered by liability or collision insurance, offering peace of mind and financial security in a variety of unforeseen circumstances. This policy extension safeguards policyholders against perils such as theft, vandalism, natural disasters, and even damages sustained while parked. In this in-depth exploration, we delve into the intricacies of comprehensive auto insurance, its benefits, and how it can be tailored to meet individual needs.

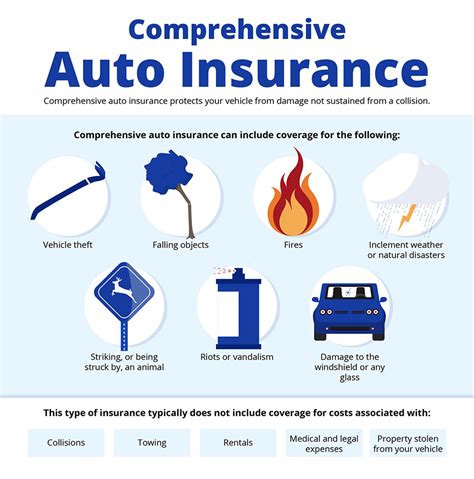

Understanding Comprehensive Auto Insurance

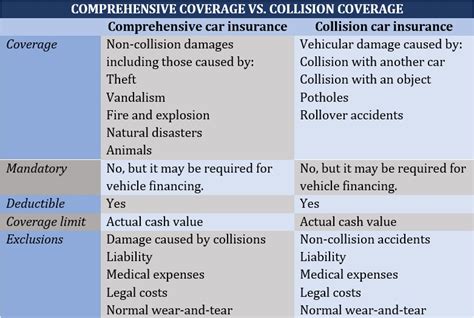

Comprehensive auto insurance is a type of coverage that protects vehicle owners from a wide range of non-collision-related incidents. Unlike liability insurance, which covers damages caused to others in an accident, or collision insurance, which covers repairs to your own vehicle after a crash, comprehensive insurance steps in to cover a broader spectrum of potential issues. This type of insurance is often referred to as “other than collision” coverage, highlighting its extensive reach beyond the typical collision scenarios.

The value of comprehensive insurance becomes evident when considering the multitude of unforeseen events that can impact a vehicle's condition. From hail damage to fire, from falling objects to acts of vandalism, and even from certain types of animal collisions, comprehensive insurance provides a safety net against these unpredictable occurrences. Moreover, it covers theft, which can be a significant financial burden for vehicle owners. By offering protection against these diverse perils, comprehensive insurance ensures that policyholders are not left bearing the full financial burden of unexpected vehicle damages.

Covered Incidents and Exclusions

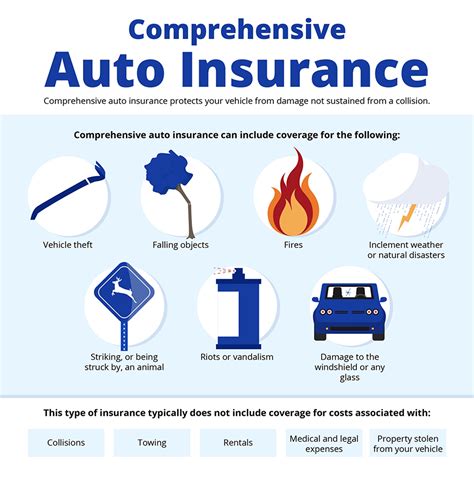

Comprehensive auto insurance typically covers a wide array of incidents, including but not limited to:

- Natural disasters: This includes damages caused by events like hail, storms, floods, and earthquakes.

- Theft: Comprehensive insurance covers the full or partial cost of a vehicle that has been stolen.

- Vandalism: If your vehicle is damaged due to malicious acts, comprehensive insurance can help cover the repairs.

- Animal collisions: Incidents involving collisions with animals, such as deer, are often covered by comprehensive insurance.

- Fire and explosions: Damage caused by fire or explosions, including those caused by faulty wiring or fuel systems, is typically included.

However, it's important to note that comprehensive insurance does have its limitations and exclusions. Here are some common exclusions:

- Normal wear and tear: Issues like worn-out tires, brakes, or engine parts due to regular use are not covered.

- Mechanical or electrical breakdowns: Comprehensive insurance does not cover repairs related to normal mechanical failures or electrical malfunctions.

- Intentional damage: If the damage to your vehicle is caused by your own intentional actions, it will not be covered.

- Government-mandated actions: Damages resulting from government actions, such as road construction or traffic control, are generally not covered.

Benefits and Considerations

Choosing comprehensive auto insurance offers several key advantages that can significantly enhance your financial security and peace of mind. Firstly, it provides a comprehensive safety net against a wide range of unforeseen incidents, ensuring that your vehicle is protected from natural disasters, theft, vandalism, and other non-collision-related damages. This coverage is especially beneficial for individuals living in areas prone to extreme weather conditions or those with high rates of vehicle theft or vandalism.

Secondly, comprehensive insurance often includes additional benefits and services that can further enhance your coverage. For instance, many policies offer rental car reimbursement, which can be invaluable if your vehicle is being repaired or replaced. Additionally, some insurers provide roadside assistance, further extending the scope of your coverage to include emergencies like flat tires, dead batteries, or running out of gas.

However, it's important to carefully consider the potential drawbacks and make an informed decision. One of the primary considerations is the cost. Comprehensive insurance can add a significant amount to your premium, especially if you live in an area with high rates of theft or natural disasters. Furthermore, not all vehicles may require the same level of comprehensive coverage. Older vehicles, for example, may not be worth the cost of a comprehensive policy, as the potential payout may not cover the full cost of repairs or replacement.

Tailoring Comprehensive Coverage to Your Needs

Every vehicle owner’s situation is unique, and comprehensive auto insurance can be customized to meet individual needs and circumstances. Here are some key factors to consider when tailoring your comprehensive coverage:

- Vehicle Value: The value of your vehicle plays a significant role in determining the appropriate level of coverage. For newer or high-value vehicles, comprehensive insurance is often a wise investment to protect against potential losses. However, for older or less valuable vehicles, the cost of comprehensive coverage may outweigh the benefits.

- Risk Factors: Consider the specific risks you face. If you live in an area prone to natural disasters or high crime rates, comprehensive insurance can provide essential protection. On the other hand, if you live in a low-risk area, you may be able to opt for a more limited coverage plan.

- Deductibles: Comprehensive insurance typically offers a range of deductible options. Choosing a higher deductible can lower your premium, but it also means you’ll pay more out of pocket if a claim is made. Weigh the potential costs and benefits to find the right balance for your budget and risk tolerance.

- Additional Coverages: Many comprehensive policies offer optional coverages that can further enhance your protection. These may include rental car reimbursement, roadside assistance, or glass coverage. Evaluate your needs and budget to determine which additional coverages are worth including in your policy.

| Coverage Option | Description |

|---|---|

| Rental Car Reimbursement | Covers the cost of a rental car while your vehicle is being repaired or replaced. |

| Roadside Assistance | Provides emergency services like towing, battery jumps, and flat tire changes. |

| Glass Coverage | Covers the cost of repairing or replacing damaged glass, including windshields. |

Making Informed Decisions

As with any insurance decision, making an informed choice about comprehensive auto insurance involves careful consideration of your unique circumstances and priorities. While comprehensive insurance provides an invaluable safety net against a wide range of unforeseen incidents, it’s essential to balance the benefits with the potential costs and drawbacks. By understanding the coverage, exclusions, and customization options, you can make a decision that optimizes your financial security and peace of mind.

When evaluating your options, take the time to review your policy carefully, seek expert advice, and compare quotes from multiple insurers. This ensures that you not only get the coverage you need but also the best value for your money. Remember, the right comprehensive auto insurance policy should provide you with the protection you deserve without straining your finances.

What is the difference between comprehensive and collision insurance?

+Collision insurance covers damages to your vehicle resulting from a collision, regardless of who is at fault. Comprehensive insurance, on the other hand, covers damages from non-collision incidents like theft, vandalism, natural disasters, and animal collisions.

Are there any circumstances where comprehensive insurance is not necessary?

+Comprehensive insurance may not be necessary for older vehicles with low resale value or for individuals with limited financial resources. In such cases, the cost of comprehensive coverage may outweigh the potential benefits.

How much does comprehensive auto insurance typically cost?

+The cost of comprehensive insurance varies based on factors like your location, vehicle make and model, driving record, and the level of coverage you choose. On average, it can add around 100 to 200 per year to your premium, but this can vary significantly.

What is the process for filing a comprehensive insurance claim?

+Filing a comprehensive insurance claim typically involves the following steps: reporting the incident to your insurance company, providing details and documentation of the damage, having your vehicle inspected by a claims adjuster, and receiving a settlement offer based on the policy terms and the assessed value of the damage.