Auto Insurance Plan Reviews And Comparisons

When it comes to choosing the right auto insurance plan, it's crucial to make an informed decision. With numerous options available in the market, comparing and reviewing different plans can be a daunting task. In this comprehensive guide, we will delve into the world of auto insurance, providing you with expert insights, detailed analyses, and practical tips to navigate the process effectively.

Understanding Auto Insurance: A Comprehensive Overview

Auto insurance is a vital aspect of vehicle ownership, providing financial protection and coverage in the event of accidents, theft, or other unforeseen circumstances. It is a legal requirement in most regions and plays a crucial role in ensuring the safety and well-being of drivers and their vehicles.

The auto insurance market offers a wide range of plans, each designed to cater to different needs and preferences. From comprehensive coverage to more basic liability plans, understanding the key components and features is essential for making an informed choice.

Key Components of Auto Insurance Plans

- Liability Coverage: This is the foundational aspect of any auto insurance plan. It covers the costs associated with injuries or property damage caused to others in an accident for which you are at fault. Liability coverage typically includes bodily injury liability and property damage liability.

- Collision Coverage: This optional coverage pays for the repair or replacement of your vehicle in the event of a collision, regardless of fault. It provides financial protection for your vehicle and can be especially beneficial for newer or more expensive cars.

- Comprehensive Coverage: This coverage extends beyond collisions and includes protection against theft, vandalism, natural disasters, and other non-collision incidents. It provides a more comprehensive level of protection for your vehicle and can be valuable for those with high-value or unique vehicles.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for the medical expenses of you and your passengers, regardless of fault. It ensures that you and your loved ones receive the necessary medical attention without worrying about immediate financial burdens.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in the event of an accident with a driver who has insufficient or no insurance. It provides compensation for injuries and damages caused by uninsured or underinsured drivers, ensuring you are not left with significant financial losses.

These key components form the foundation of most auto insurance plans. However, it's important to note that each insurance provider may offer additional coverages or unique features to differentiate their plans. Understanding these components and their relevance to your specific needs is crucial for an effective comparison.

Comparing Auto Insurance Plans: A Detailed Analysis

Comparing auto insurance plans involves a thorough examination of various factors, including coverage options, policy terms, premiums, and customer satisfaction. Here’s a comprehensive breakdown of what to consider when reviewing different plans.

Coverage Options and Policy Terms

Start by evaluating the coverage options offered by each plan. Consider the level of liability coverage, the availability of collision and comprehensive coverage, and any additional coverages that may be relevant to your situation. For instance, if you have a classic car, you may want to look for plans that offer specialized coverage for vintage vehicles.

Additionally, review the policy terms and conditions. Pay attention to deductibles, coverage limits, and any exclusions or limitations. Understanding these details will help you assess the overall value and suitability of the plan for your needs.

Premiums and Payment Options

Premiums, or the cost of the insurance plan, are a significant consideration. Compare the premiums offered by different providers for similar coverage options. Keep in mind that the lowest premium may not always be the best option, as it could indicate a lack of comprehensive coverage or higher deductibles.

Also, explore the payment options available. Some providers offer flexible payment plans, such as monthly or quarterly installments, which can make managing insurance costs more convenient. Assess whether the payment options align with your financial preferences and budget.

Customer Satisfaction and Claims Process

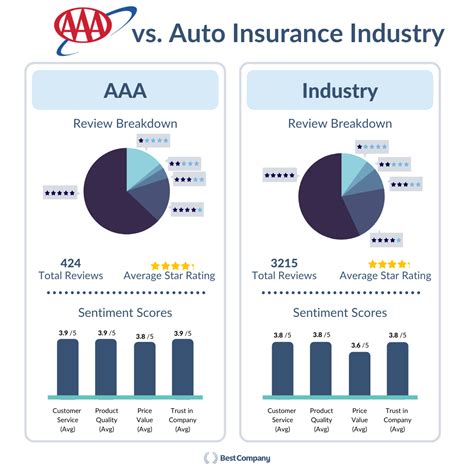

Researching customer satisfaction and the claims process is crucial. Look for reviews and ratings from current and past customers to gauge the overall experience with the insurance provider. Consider factors such as responsiveness, fairness in claims settlement, and customer support.

Inquire about the claims process and the steps involved in filing a claim. Understanding the process and the timeline for claim resolution can provide valuable insights into the efficiency and reliability of the insurance company.

Additional Benefits and Discounts

Many insurance providers offer additional benefits and discounts to attract customers. These can include loyalty discounts, multi-policy discounts, safe driver incentives, or discounts for specific professions or affiliations. Explore these offerings and assess their relevance to your situation. While discounts can significantly reduce your premiums, ensure that the base coverage and service quality are not compromised.

| Provider | Coverage Options | Premiums | Customer Satisfaction |

|---|---|---|---|

| Provider A | Comprehensive coverage, specialized classic car plans | $1200/year (with discounts) | 4.5/5 stars, known for efficient claims process |

| Provider B | Basic liability, collision, and comprehensive coverage | $950/year (no discounts) | 4/5 stars, excellent customer support |

| Provider C | Liability, collision, and comprehensive coverage with add-ons | $1100/year (with multi-policy discount) | 4.2/5 stars, known for innovative digital claims process |

The table above provides a simplified comparison of three hypothetical insurance providers based on their coverage options, premiums, and customer satisfaction ratings. Note that this is for illustrative purposes only, and actual data and ratings would vary based on your specific location and needs.

Expert Tips for Choosing the Right Auto Insurance Plan

Navigating the auto insurance landscape can be complex, but with the right approach and considerations, you can make an informed decision. Here are some expert tips to guide you through the process.

Assess Your Needs and Preferences

Start by evaluating your specific needs and preferences. Consider factors such as the value of your vehicle, your driving habits, and any unique circumstances. For instance, if you frequently drive in high-risk areas or have a history of accidents, you may want to prioritize plans with comprehensive coverage and lower deductibles.

Compare Multiple Providers

Don’t settle for the first plan you come across. Compare at least three to five different providers to get a comprehensive understanding of the market. Use online comparison tools, insurance brokers, or direct quotes from providers to gather information. The more options you evaluate, the better equipped you’ll be to make an informed choice.

Understand Exclusions and Limitations

Pay close attention to the exclusions and limitations outlined in each plan. These details can significantly impact the value and effectiveness of your coverage. For example, some plans may exclude certain types of accidents or have limitations on coverage for high-performance vehicles.

Review Financial Stability and Reputation

When choosing an insurance provider, consider their financial stability and reputation in the industry. Research their financial ratings and track record to ensure they are reliable and capable of honoring claims. A financially stable insurer is more likely to provide consistent coverage and fair claim settlements.

Consider Long-Term Value

While initial premiums are important, consider the long-term value of the plan. Assess the potential for future discounts, loyalty rewards, and the overall cost-effectiveness over several years. Some providers may offer introductory discounts or promotions, but ensure that the plan remains affordable and suitable for your needs in the long run.

Future Implications and Industry Trends

The auto insurance industry is continually evolving, driven by technological advancements, changing consumer preferences, and regulatory updates. Here’s a glimpse into the future of auto insurance and how it may impact your choices.

Telematics and Usage-Based Insurance

Telematics and usage-based insurance are gaining traction in the industry. These innovative approaches use data from telematics devices or smartphone apps to monitor driving behavior and offer personalized insurance rates. By incentivizing safe driving and providing real-time feedback, these technologies can lead to more accurate and fair insurance premiums.

Digitalization and Enhanced Customer Experience

The digitalization of insurance processes is enhancing the overall customer experience. From online quote comparisons to digital claims submission and real-time updates, insurance providers are leveraging technology to streamline operations and improve customer satisfaction. Keep an eye out for providers who embrace digital innovations, as they may offer more convenient and efficient services.

Regulatory Changes and Impact on Coverage

Regulatory changes can have a significant impact on auto insurance coverage and costs. Stay informed about any proposed or enacted regulations in your region that may affect insurance requirements or coverage options. Understanding these changes can help you adapt your insurance strategy and ensure compliance with legal obligations.

Autonomous Vehicles and Insurance Challenges

The rise of autonomous vehicles presents unique challenges for the insurance industry. As self-driving technology advances, questions arise about liability and coverage in the event of accidents. Insurance providers are actively exploring new models and approaches to address these emerging risks, and staying informed about these developments can help you make future-proof insurance choices.

How do I know if I have sufficient liability coverage?

+

The amount of liability coverage you need depends on various factors, including your assets and the risks you face. As a general guideline, experts recommend carrying liability limits that are at least equal to your total net worth. This ensures that your assets are protected in the event of a serious accident. Additionally, consider your personal comfort level and the potential costs associated with lawsuits in your area.

What are some common exclusions in auto insurance policies?

+

Common exclusions in auto insurance policies may include intentional damage, racing or off-road driving, mechanical breakdowns, and damage caused by pests or rodents. It’s important to review the policy’s exclusions list carefully to understand what is not covered. This knowledge can help you make informed decisions about additional coverage options.

How can I reduce my auto insurance premiums?

+

There are several strategies to reduce your auto insurance premiums. These include shopping around for quotes, maintaining a clean driving record, increasing your deductible, taking advantage of discounts (e.g., safe driver, multi-policy), and exploring usage-based insurance options. However, ensure that any premium reduction does not compromise the level of coverage you require.