Life Insurance Agencies

Life insurance agencies are a crucial component of the financial services industry, providing individuals and families with the security and peace of mind that comes with proper financial protection. These agencies play a vital role in helping people plan for the unexpected, offering a range of life insurance policies to cater to diverse needs. In an era where life's uncertainties are ever-present, understanding the role and significance of life insurance agencies is more important than ever.

In this comprehensive guide, we will delve deep into the world of life insurance agencies, exploring their functions, the services they offer, and the impact they have on individuals and society as a whole. We will navigate through the complex landscape of life insurance, breaking down technical terms and concepts into easily understandable segments. From the fundamental principles of life insurance to the innovative strategies employed by modern agencies, this article aims to provide an expert-level overview, ensuring readers gain a comprehensive understanding of this essential industry.

The Role and Significance of Life Insurance Agencies

Life insurance agencies serve as trusted intermediaries between insurance companies and policyholders. Their primary role is to guide individuals through the often-complex process of selecting and acquiring life insurance policies that align with their unique needs and circumstances. These agencies provide valuable expertise, ensuring that policyholders make informed decisions and obtain adequate coverage to protect their loved ones and financial well-being.

The significance of life insurance agencies lies in their ability to customize insurance solutions for diverse client profiles. Whether it's a young professional seeking term life insurance for financial protection or a family requiring whole life insurance to secure their long-term financial goals, life insurance agencies offer tailored advice and a range of policy options. This personalized approach ensures that individuals receive the right coverage, avoiding unnecessary expenses or inadequate protection.

Moreover, life insurance agencies act as advocates for policyholders, assisting with claim processes and ensuring fair settlements. In the unfortunate event of a policyholder's passing, the agency plays a crucial role in facilitating the timely payment of death benefits to the beneficiaries, providing much-needed financial support during a difficult time.

The Evolution of Life Insurance Agencies

The life insurance industry has undergone significant transformations over the years, and life insurance agencies have adapted to these changes, evolving their practices and services to meet modern needs.

Historically, life insurance agencies operated primarily through in-person meetings, building relationships with clients and offering personalized advice. Agents would assess a client's financial situation, health, and family history to recommend suitable insurance policies. This traditional approach, though effective, had limitations in terms of accessibility and the scope of services offered.

With the advent of technology, life insurance agencies have embraced digital innovations, revolutionizing the way they interact with clients and provide services. Online platforms and mobile applications have made it easier for individuals to access information, compare policies, and even apply for life insurance remotely. This digital transformation has expanded the reach of life insurance agencies, making insurance more accessible and convenient for a wider audience.

Key Innovations in Modern Life Insurance Agencies

- Digital Underwriting: Life insurance agencies now utilize advanced digital tools for underwriting, streamlining the process of assessing risk and determining eligibility. This technology allows for faster and more accurate assessments, reducing the time and effort required from both agents and clients.

- Telemedicine Integration: In recent years, life insurance agencies have partnered with telemedicine providers to offer remote health assessments. This innovation eliminates the need for in-person medical exams, making the insurance application process more convenient and accessible, especially for individuals with busy schedules or limited mobility.

- Customized Insurance Plans: Modern life insurance agencies leverage data analytics and AI to offer highly customized insurance plans. By analyzing an individual’s unique circumstances, including their health, lifestyle, and financial goals, agencies can provide tailored recommendations, ensuring clients receive the most suitable coverage.

- Digital Claim Management: In addition to facilitating the policy acquisition process, life insurance agencies now offer digital claim management services. This allows policyholders to submit claims and track their progress online, providing a more efficient and transparent experience during a stressful time.

| Innovation | Description |

|---|---|

| Digital Underwriting | Advanced technology for risk assessment, enhancing accuracy and speed. |

| Telemedicine Integration | Remote health assessments, eliminating the need for in-person medical exams. |

| Customized Insurance Plans | Data-driven recommendations for tailored coverage. |

| Digital Claim Management | Online claim submission and tracking for efficient and transparent processing. |

Types of Life Insurance Policies Offered by Agencies

Life insurance agencies offer a diverse range of policies to cater to the varying needs and preferences of their clients. Understanding the different types of life insurance policies is crucial for individuals seeking financial protection and peace of mind.

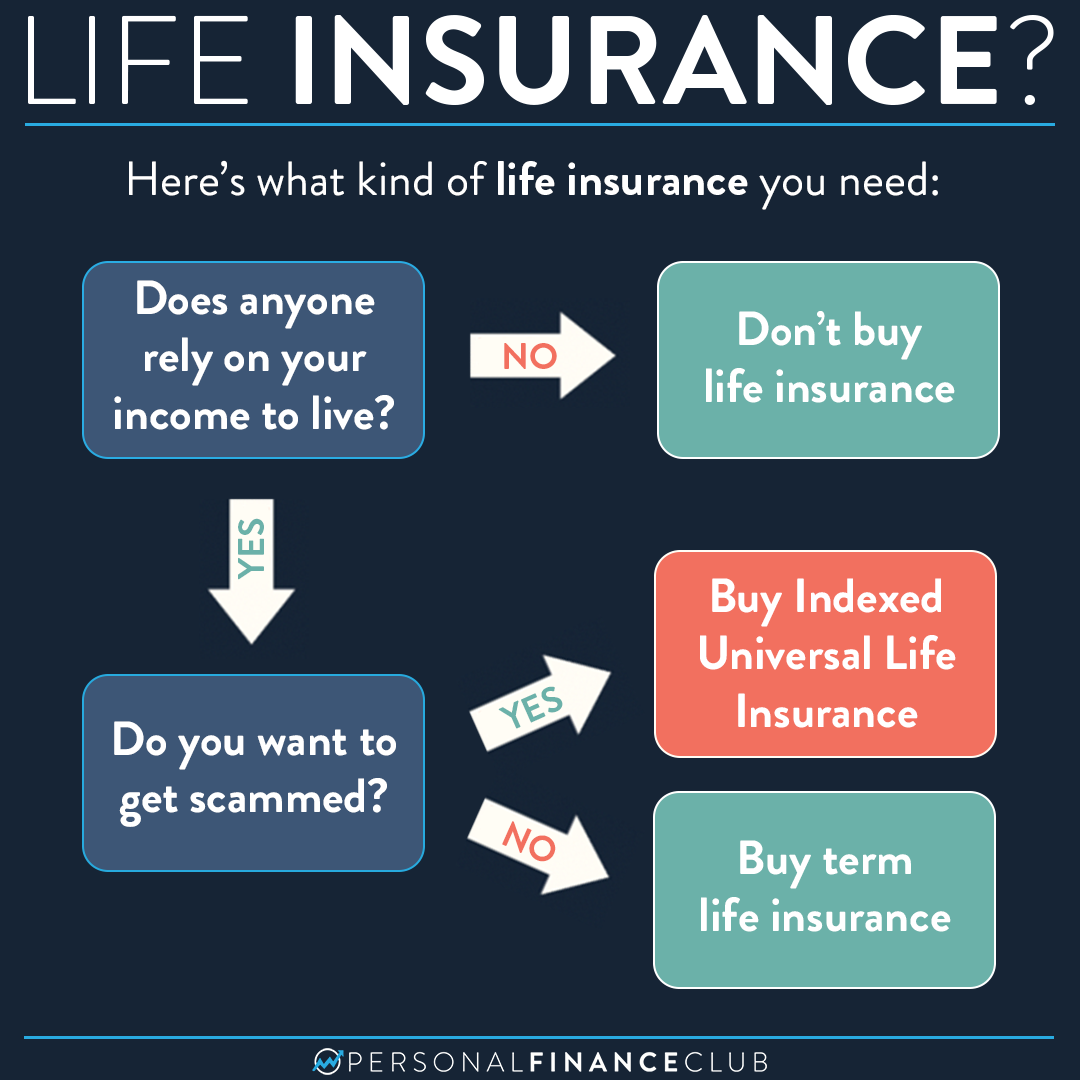

Term Life Insurance

Term life insurance is a popular choice for individuals looking for temporary financial protection. This type of policy provides coverage for a specified period, typically ranging from 10 to 30 years. During the term, the policyholder pays regular premiums, and in the event of their death, the beneficiaries receive a lump-sum payment known as the death benefit. Term life insurance is often more affordable than permanent life insurance, making it an attractive option for those with limited budgets.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, offers lifelong coverage. This policy type provides a death benefit to the beneficiaries, regardless of when the policyholder passes away. In addition to the death benefit, whole life insurance policies accumulate cash value over time, which policyholders can borrow against or use for various financial needs. The premiums for whole life insurance are typically higher than term life insurance, but the policy offers more comprehensive coverage and long-term financial benefits.

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance. It allows policyholders to adjust their premium payments and death benefit amounts within certain limits. The policy also accumulates cash value, similar to whole life insurance, but with universal life insurance, policyholders have more control over how their premiums are invested. This flexibility makes universal life insurance an attractive option for individuals seeking personalized coverage and the ability to adapt their policy to changing financial circumstances.

Variable Life Insurance

Variable life insurance is another form of permanent life insurance that offers investment opportunities within the policy. The death benefit and cash value of the policy are tied to the performance of the underlying investments, which can include stocks, bonds, and mutual funds. This type of policy allows policyholders to potentially grow their investment value over time. However, it also carries more risk, as the policy’s value can fluctuate based on market performance.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is a type of policy that does not require a medical exam or health questionnaire. It is designed for individuals who may have pre-existing health conditions or face challenges obtaining traditional life insurance. While guaranteed issue life insurance typically has higher premiums and lower death benefits compared to other policy types, it provides coverage for individuals who might otherwise be denied insurance.

| Policy Type | Description |

|---|---|

| Term Life Insurance | Temporary coverage with fixed premiums and a lump-sum death benefit. |

| Whole Life Insurance | Permanent coverage with cash value accumulation and lifelong protection. |

| Universal Life Insurance | Flexible permanent coverage with adjustable premiums and death benefits. |

| Variable Life Insurance | Permanent coverage with investment opportunities and market-tied performance. |

| Guaranteed Issue Life Insurance | Coverage without a medical exam, suitable for individuals with health concerns. |

The Process of Acquiring Life Insurance through Agencies

Acquiring life insurance through agencies involves a series of steps designed to ensure the policyholder receives the most suitable coverage. The process begins with an initial consultation, where the agent assesses the client’s needs and provides personalized recommendations.

Initial Consultation and Needs Assessment

During the initial consultation, the life insurance agent will discuss the client’s financial situation, goals, and any specific concerns or needs. This conversation helps the agent understand the client’s circumstances and determine the appropriate type and amount of coverage required. The agent may also ask about the client’s health, family history, and lifestyle to assess potential risks and recommend suitable policies.

Policy Selection and Application

Based on the needs assessment, the agent will present a range of policy options, explaining the features, benefits, and potential drawbacks of each. The client can then select the policy that best aligns with their needs and budget. Once the policy is chosen, the agent will guide the client through the application process, which typically involves completing an application form and providing relevant personal and health information.

Underwriting and Policy Approval

After the application is submitted, the life insurance agency’s underwriting team will review the information provided. Underwriters assess the client’s risk profile, considering factors such as age, health status, family history, and lifestyle. This process determines the client’s eligibility for the chosen policy and may involve further medical exams or health assessments. Once the underwriting process is complete, the agency will notify the client of the policy approval or any potential adjustments to the coverage or premiums.

Policy Delivery and Ongoing Support

Upon policy approval, the life insurance agency will deliver the policy documents to the client, outlining the terms, conditions, and coverage details. The agent will ensure the client understands the policy and is satisfied with the coverage. Ongoing support is a crucial aspect of the agency’s service, as they assist clients with any policy changes, address concerns, and provide guidance on managing their life insurance portfolio.

| Step | Description |

|---|---|

| Initial Consultation | Assessing client needs and providing personalized recommendations. |

| Policy Selection and Application | Choosing a policy and completing the application process. |

| Underwriting and Policy Approval | Reviewing the application and determining eligibility. |

| Policy Delivery and Ongoing Support | Delivering policy documents and providing continuous assistance. |

The Future of Life Insurance Agencies: Industry Trends and Predictions

The life insurance industry is continually evolving, and life insurance agencies are at the forefront of adapting to these changes. As we look to the future, several key trends and predictions shape the landscape of life insurance agencies and their services.

Emphasis on Digital Services

The digital transformation of the life insurance industry is set to continue, with life insurance agencies further integrating digital tools and platforms into their operations. This includes enhanced online presence, improved user experiences on websites and mobile apps, and the continued development of digital underwriting and claim management systems. The goal is to provide clients with seamless and convenient access to insurance services, regardless of their physical location.

Focus on Personalization

Life insurance agencies are recognizing the importance of tailoring insurance solutions to individual needs. With advancements in data analytics and AI, agencies can now offer highly personalized policies that consider a client’s unique circumstances, including their health, lifestyle, and financial goals. This trend is expected to continue, with agencies leveraging technology to provide customized coverage options that truly meet the diverse needs of modern consumers.

Expansion of Telemedicine Partnerships

The integration of telemedicine services into the life insurance process has proven to be a successful innovation. Life insurance agencies are likely to expand their partnerships with telemedicine providers, making remote health assessments a standard part of the policy application process. This not only enhances convenience for clients but also reduces the administrative burden on agencies, allowing for more efficient operations.

Growth of Digital Marketing and Outreach

In an increasingly digital world, life insurance agencies are recognizing the importance of online marketing and outreach strategies. Digital marketing campaigns, social media engagement, and content creation will play a significant role in attracting new clients and educating the public about the importance of life insurance. Agencies will invest in building their online presence and utilizing digital platforms to connect with a wider audience.

Increased Collaboration with Financial Advisors

Life insurance agencies are increasingly collaborating with financial advisors to provide holistic financial planning services to clients. This trend is expected to continue, as clients seek comprehensive financial guidance. By partnering with financial advisors, life insurance agencies can offer a more integrated approach to financial protection, ensuring clients receive tailored advice that aligns with their overall financial goals.

| Trend | Description |

|---|---|

| Emphasis on Digital Services | Further integration of digital tools and platforms for enhanced accessibility and convenience. |

| Focus on Personalization | Leveraging technology for highly customized insurance solutions. |

| Expansion of Telemedicine Partnerships | Standardizing remote health assessments for efficient and convenient policy applications. |

| Growth of Digital Marketing and Outreach | Utilizing online platforms and digital strategies to attract and educate clients. |

| Increased Collaboration with Financial Advisors | Offering holistic financial planning services through partnerships. |

Conclusion: The Essential Role of Life Insurance Agencies

Life insurance agencies are indispensable intermediaries in the financial services industry, playing a crucial role in protecting individuals and families from financial hardship. Through their expertise and personalized approach, these agencies ensure that policyholders receive the right coverage to secure their loved ones’ future and achieve their financial goals.

As the life insurance industry continues to evolve, life insurance agencies will remain at the forefront, adapting to new technologies and trends to provide the best possible services. By embracing digital innovations, focusing on personalization, and collaborating with financial advisors, these agencies will continue to shape the future of financial protection, ensuring individuals have the tools they need to navigate life's uncertainties with confidence.

What are the benefits of working with a life insurance agency instead of directly with an insurance company?

+Working with a life insurance agency provides several advantages. Agencies offer personalized advice, guiding clients through the complex process of selecting the right policy. They act as advocates, ensuring fair treatment during the underwriting and claim processes. Additionally, agencies can provide a range of policy options from multiple insurance companies, allowing clients to compare and choose the best coverage for their needs.

How do life insurance agencies determine the cost of a policy?

+The cost of a life insurance policy is determined through a process called underwriting. Underwriters assess various factors, including the applicant’s age, health status, family history, and lifestyle. Based on this assessment, they determine the risk level and set the premium accordingly. Policies with higher risk levels generally have higher premiums.

Can life insurance agencies assist with policy changes or updates?

+Absolutely! Life insurance agencies provide ongoing support to their clients. If a client’s circumstances change, such as a new family member, a job change, or a significant financial event, the agency can help assess the impact on their insurance needs and guide them through the process of updating their policy. This ensures that clients maintain adequate coverage as their lives evolve.