Whole Life Insurance Vs Term Insurance

When it comes to financial planning and securing the future of your loved ones, understanding the difference between whole life insurance and term insurance is crucial. These two types of life insurance policies offer distinct advantages and cater to different needs. In this comprehensive guide, we will delve into the specifics of whole life insurance and term insurance, helping you make an informed decision based on your unique circumstances.

Whole Life Insurance: A Lifetime of Protection

Whole life insurance, also known as permanent life insurance, is designed to provide coverage for the entirety of your life, as long as the premiums are paid. It is a popular choice for individuals seeking long-term financial security and stability for their families. Let’s explore the key features and benefits of whole life insurance.

Guaranteed Coverage Until the End of Your Life

One of the primary advantages of whole life insurance is the guarantee of coverage. Once you purchase a whole life policy, it remains active throughout your lifetime, regardless of any changes in your health or personal circumstances. This means that as long as you pay the premiums, your beneficiaries will receive the death benefit upon your passing.

For example, imagine you purchase a whole life insurance policy at age 30. Even if you develop a health condition or face financial challenges later in life, the policy will continue to provide coverage, ensuring your loved ones receive the promised benefits.

Cash Value Accumulation

Whole life insurance policies accumulate cash value over time. A portion of your premium payments goes towards building this cash value, which acts as a savings component within the policy. The cash value grows tax-deferred, providing you with a financial asset that can be accessed during your lifetime.

You can utilize the cash value for various purposes, such as taking out loans against it, making withdrawals, or even using it to pay for future premiums. This flexibility makes whole life insurance an attractive option for those seeking both protection and potential financial growth.

Fixed Premiums

Whole life insurance policies typically come with fixed premiums, meaning the amount you pay remains constant throughout the policy’s duration. This predictability allows for easier financial planning and budgeting, as you know exactly how much you need to allocate for your insurance premiums each month or year.

| Policy Feature | Description |

|---|---|

| Guaranteed Coverage | Provides lifetime protection as long as premiums are paid. |

| Cash Value Accumulation | Builds tax-deferred savings within the policy. |

| Fixed Premiums | Premiums remain constant throughout the policy's duration. |

Term Insurance: Temporary Protection with Affordable Premiums

Term insurance, on the other hand, offers coverage for a specific period, typically ranging from 10 to 30 years. It is designed to provide protection during key stages of life, such as when you have financial obligations like a mortgage or young children who rely on your income. Let’s uncover the key characteristics of term insurance.

Affordable Premiums for a Set Period

One of the main attractions of term insurance is its affordability. Premiums for term policies are generally much lower compared to whole life insurance, making it an accessible option for individuals with limited budgets. The cost-effectiveness of term insurance allows you to secure significant coverage without straining your finances.

For instance, if you are a young professional starting your career, term insurance can provide adequate protection for your family without requiring a significant financial commitment.

Renewable and Convertible Options

Many term insurance policies offer the flexibility to renew or convert the coverage at the end of the term. Renewal allows you to extend the policy for an additional period, often at a higher premium rate due to increased age and potential health changes. Conversion, on the other hand, enables you to transform your term policy into a permanent life insurance policy, ensuring continued coverage without the need for medical underwriting.

Level or Decreasing Death Benefit

Term insurance policies typically offer either a level or decreasing death benefit. A level death benefit remains constant throughout the term, providing consistent protection. In contrast, a decreasing death benefit starts at a higher amount and gradually decreases over time, often mirroring the declining financial needs of individuals as their children grow up and debts are paid off.

| Policy Feature | Description |

|---|---|

| Affordable Premiums | Lower costs compared to whole life insurance. |

| Renewable and Convertible | Options to extend or convert coverage at the end of the term. |

| Level or Decreasing Death Benefit | Choice between constant or decreasing death benefit amounts. |

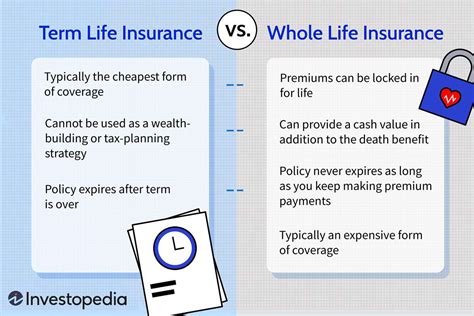

Comparing Whole Life and Term Insurance

Now that we have explored the features of whole life and term insurance, let’s compare them side by side to help you determine which option aligns better with your financial goals and circumstances.

Coverage Duration

Whole Life Insurance: Provides lifetime coverage, ensuring protection for your loved ones regardless of age or health changes.

Term Insurance: Offers coverage for a specific period, typically ranging from 10 to 30 years. It is suitable for temporary financial obligations or specific life stages.

Cost

Whole Life Insurance: Premiums are generally higher compared to term insurance, as they include the cost of both protection and cash value accumulation.

Term Insurance: Premiums are more affordable, making it an attractive option for those on a budget. However, term insurance may require additional policies or conversion to maintain coverage.

Flexibility

Whole Life Insurance: Offers fixed premiums and guaranteed coverage, providing stability and predictability. The cash value component adds flexibility for future financial needs.

Term Insurance: Provides flexibility through renewable and convertible options, allowing you to extend or convert coverage to meet changing circumstances.

Savings Component

Whole Life Insurance: Builds cash value over time, creating a savings component within the policy. This can be accessed through loans, withdrawals, or used to pay future premiums.

Term Insurance: Does not typically include a savings component, as the focus is solely on providing temporary protection.

| Comparison Aspect | Whole Life Insurance | Term Insurance |

|---|---|---|

| Coverage Duration | Lifetime | Specific period (10–30 years) |

| Cost | Higher premiums | More affordable |

| Flexibility | Fixed premiums and guaranteed coverage | Renewable and convertible options |

| Savings Component | Builds cash value | No savings component |

Factors to Consider When Choosing

When deciding between whole life and term insurance, it’s essential to evaluate your specific needs and financial situation. Here are some key factors to consider:

- Your Age and Health: Whole life insurance may be more suitable if you are in good health and seeking long-term protection. Term insurance is a viable option if you are young and healthy, as it provides affordable coverage during key life stages.

- Financial Goals: Consider your financial objectives. If you aim to build wealth and have a stable financial plan, whole life insurance's cash value accumulation can be beneficial. Term insurance is ideal if you have short-term financial obligations and a limited budget.

- Family's Needs: Assess your family's financial needs and dependencies. Whole life insurance ensures lifelong protection, while term insurance provides temporary coverage during specific life stages.

- Budget Constraints: Evaluate your financial capabilities. Whole life insurance requires higher premiums, whereas term insurance offers more affordability.

FAQs

Can I switch from term insurance to whole life insurance later in life?

+Yes, you can often convert your term insurance policy to a whole life or permanent insurance policy during the term or at its expiration. However, the conversion process may be subject to certain conditions and restrictions, so it’s essential to review your policy terms and consult with your insurance provider.

What happens if I stop paying premiums for my whole life insurance policy?

+If you stop paying premiums for your whole life insurance policy, the policy may lapse, and coverage will be terminated. However, some policies offer a grace period, allowing you to pay the missed premiums within a certain timeframe to reinstate coverage. It’s crucial to understand the terms of your policy and stay current with premium payments to maintain uninterrupted coverage.

Can I access the cash value of my whole life insurance policy during my lifetime?

+Yes, you can access the cash value of your whole life insurance policy through various options. You may take out a policy loan, make withdrawals, or use the cash value to pay future premiums. Keep in mind that borrowing against the cash value may impact the policy’s death benefit and potential growth, so it’s essential to carefully consider your financial needs and consult with a financial advisor.

How do I know if term insurance is the right choice for me?

+Term insurance is an excellent choice if you have temporary financial obligations or specific life stages that require coverage. It is particularly suitable for young professionals or individuals with limited budgets who want affordable protection during key periods. However, if you seek long-term financial security and stability, whole life insurance may be a better fit.

Are there any tax implications associated with whole life insurance policies?

+Whole life insurance policies offer tax advantages, as the cash value within the policy grows tax-deferred. However, it’s important to consult with a tax professional to understand the specific tax implications in your jurisdiction. Additionally, if you borrow against the cash value or surrender the policy, there may be tax consequences, so seeking professional advice is recommended.

Choosing between whole life insurance and term insurance involves careful consideration of your unique circumstances and financial goals. Whole life insurance provides lifetime coverage, cash value accumulation, and fixed premiums, making it an ideal choice for long-term financial security. Term insurance, on the other hand, offers affordable premiums and flexibility for temporary protection during specific life stages. By evaluating your needs and consulting with financial advisors, you can make an informed decision that aligns with your vision for a secure future.