Auto Insurance Pricing

Auto insurance pricing is a complex and multifaceted topic that plays a crucial role in the lives of countless individuals and businesses worldwide. Understanding the intricacies of how insurance companies determine premiums is not only intellectually stimulating but also practically beneficial, especially when considering the significant financial implications of vehicle ownership.

In this comprehensive exploration, we delve deep into the world of auto insurance pricing, unraveling the various factors, methodologies, and trends that shape the cost of this essential coverage. By the end of this article, readers will not only gain a thorough understanding of the subject but also be equipped with the knowledge to make more informed decisions when selecting and managing their auto insurance policies.

The Fundamentals of Auto Insurance Pricing

At its core, auto insurance pricing is a delicate balance between the insurer’s need to remain profitable and the policyholder’s desire for affordable coverage. Insurance companies employ a multitude of factors to calculate premiums, ensuring they accurately assess the risk associated with insuring a particular vehicle and driver.

Key Factors Influencing Auto Insurance Premiums

-

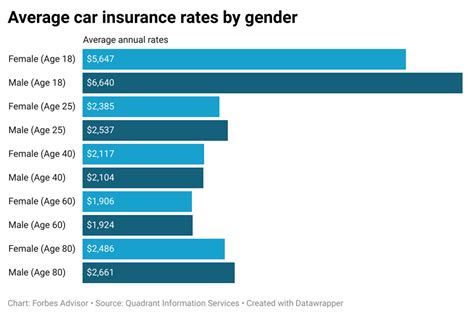

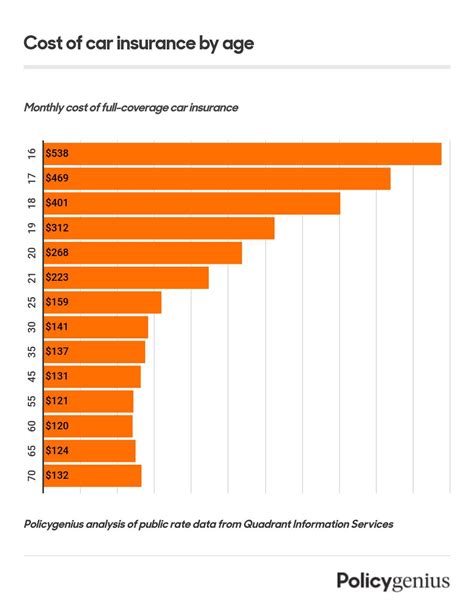

Driver Profile: Age, gender, driving record, and years of driving experience significantly impact insurance premiums. Younger, less experienced drivers, especially males, are often considered higher-risk, leading to higher premiums.

-

Vehicle Characteristics: The make, model, and year of the vehicle are crucial. Sports cars and luxury vehicles, for instance, typically attract higher premiums due to their performance capabilities and higher repair costs.

-

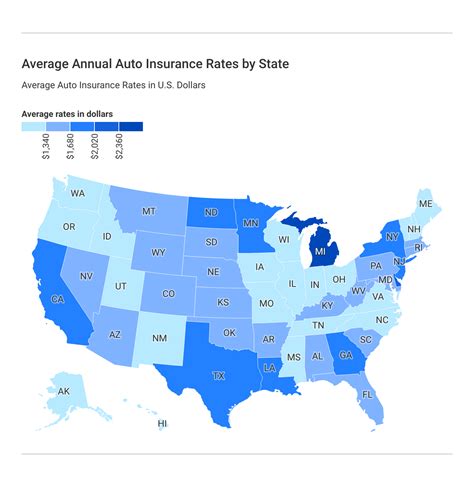

Usage and Location: How and where a vehicle is used matters. Urban areas with higher traffic density and crime rates often result in increased premiums, while vehicles primarily used for commuting or pleasure driving may be eligible for discounts.

-

Coverage and Deductibles: The level of coverage chosen by the policyholder, such as liability-only or comprehensive coverage, influences premiums. Additionally, selecting a higher deductible can lower the cost of insurance.

-

Claims History: A history of accidents or insurance claims can lead to higher premiums. Insurers use this information to assess the risk of future claims and adjust premiums accordingly.

The Science Behind Premium Calculation

Insurance companies employ sophisticated algorithms and statistical models to calculate premiums. These models are based on extensive data analysis, allowing insurers to predict the likelihood and cost of future claims accurately.

For instance, an insurer might use historical data to determine that drivers aged 16-25 with a poor driving record are more likely to be involved in accidents, resulting in higher premiums for this demographic. Similarly, the model might identify that vehicles with powerful engines are more frequently involved in high-speed collisions, leading to increased premiums for such vehicles.

| Risk Factor | Impact on Premium |

|---|---|

| Age | Younger drivers often pay more |

| Vehicle Type | Sports cars, SUVs, and luxury vehicles may have higher premiums |

| Location | Urban areas or high-crime regions may result in higher costs |

| Coverage Level | Comprehensive coverage can be more expensive than liability-only |

| Claims History | Previous claims can lead to increased premiums |

Strategies to Lower Auto Insurance Costs

While auto insurance is a necessary expense for vehicle owners, there are several strategies to mitigate the financial burden and potentially lower insurance premiums.

Optimizing Your Insurance Profile

One of the most effective ways to reduce insurance costs is by maintaining a clean driving record. This means avoiding accidents and moving violations, as these can significantly impact premiums. Additionally, completing defensive driving courses or safe driving programs can lead to discounts, as insurers reward safe driving behaviors.

Another strategy is to consider the vehicle you're insuring. Some vehicles are naturally more expensive to insure due to their make, model, or usage. Choosing a vehicle with a strong safety record and low theft rates can result in lower insurance costs. Similarly, older vehicles with fewer safety features may be less expensive to insure than newer models.

Exploring Discount Opportunities

Insurance companies offer a variety of discounts to attract and retain customers. Common discounts include:

-

Multi-Policy Discounts: Bundling your auto insurance with other policies, such as home or renters insurance, can result in significant savings.

-

Safe Driver Discounts: As mentioned earlier, maintaining a clean driving record can lead to discounts.

-

Good Student Discounts: Some insurers offer discounts to students with good grades, recognizing the correlation between academic achievement and responsible driving.

-

Loyalty Discounts: Staying with the same insurer for an extended period can lead to loyalty discounts.

-

Vehicle Safety Discounts: Vehicles equipped with advanced safety features, such as anti-lock brakes or air bags, may be eligible for discounts.

Shopping Around and Negotiating

Insurance rates can vary significantly between providers, so it’s crucial to shop around and compare quotes. Online quote comparison tools can provide a quick and convenient way to assess different insurers’ rates.

Once you've identified a competitive rate, it's worth discussing your options with an insurance agent. They can often negotiate better rates or tailor a policy to your specific needs, ensuring you're not paying for coverage you don't require.

The Future of Auto Insurance Pricing

The auto insurance industry is undergoing significant changes, largely driven by technological advancements and shifting consumer behaviors. These changes are expected to have a profound impact on how insurance premiums are calculated and structured.

The Rise of Telematics and Usage-Based Insurance

Telematics refers to the use of technology to monitor vehicle usage and driver behavior. Usage-Based Insurance (UBI) is an insurance model that utilizes telematics data to calculate premiums based on actual driving behavior rather than historical data.

With UBI, insurers can offer policies that reward safe driving habits, providing discounts to drivers who maintain a low-risk profile. This model has the potential to revolutionize the industry, as it incentivizes safer driving and provides a more accurate assessment of individual risk.

Data-Driven Pricing and Predictive Analytics

Advancements in data analytics and machine learning are allowing insurers to refine their pricing models further. By analyzing vast amounts of data, insurers can identify new risk factors and predict claims with greater accuracy.

For instance, insurers can now use data from social media and online behavior to assess a driver's risk profile. Additionally, predictive analytics can help insurers identify potential fraud and adjust premiums accordingly, ensuring a more fair and accurate pricing structure.

The Impact of Autonomous Vehicles

The widespread adoption of autonomous vehicles is expected to have a significant impact on auto insurance. With self-driving cars, the risk of human error is significantly reduced, potentially leading to a decrease in accidents and, consequently, insurance claims.

However, the introduction of autonomous vehicles also raises new liability questions. For instance, who is at fault in an accident involving an autonomous vehicle? As the industry grapples with these questions, it's likely that insurance policies will need to be restructured to account for these changing dynamics.

Consumer Empowerment and Transparency

The future of auto insurance pricing is also about empowering consumers. With the rise of digital platforms and instant quote comparisons, consumers are becoming more knowledgeable about insurance and are demanding greater transparency and control over their policies.

Insurers are responding to this trend by offering more personalized and flexible policies, allowing consumers to tailor coverage to their specific needs. This shift towards consumer-centric models is expected to continue, with insurers focusing on providing value and convenience to retain customers.

How often should I review my auto insurance policy and rates?

+It's recommended to review your policy annually or whenever your circumstances change, such as a move to a new location, a change in vehicle, or a significant life event. Regular reviews ensure you're getting the best value and coverage for your needs.

Can I negotiate my auto insurance rates?

+Absolutely! Negotiating with your insurance provider is a great way to potentially lower your rates. Discuss your options, such as bundling policies or taking advantage of discounts, to see if you can secure a better deal.

What factors can I control to lower my auto insurance premiums?

+You can control several factors, including maintaining a clean driving record, choosing a safe and affordable vehicle, and exploring discount opportunities. Additionally, regularly reviewing and optimizing your coverage can help ensure you're not overpaying for unnecessary features.

How does my credit score impact my auto insurance rates?

+In many states, insurers use credit-based insurance scores to assess the risk of insuring a driver. Generally, individuals with higher credit scores are considered lower risk and may be eligible for lower premiums. However, this practice is not allowed in all states, so it's essential to check your local regulations.

What is the average cost of auto insurance in the United States?

+The average cost of auto insurance in the U.S. varies widely depending on several factors, including location, vehicle type, and driver profile. According to recent data, the national average is around $1,674 per year, but this can range from under $1,000 to over $3,000 in different states.

In conclusion, auto insurance pricing is a dynamic and ever-evolving field. By understanding the factors that influence premiums and adopting strategies to lower costs, individuals can make more informed decisions about their insurance coverage. As the industry continues to innovate and adapt to new technologies and consumer demands, the future of auto insurance pricing looks set to be more personalized, transparent, and focused on value.