Auto Insurance Rate Quote Comparison

When it comes to auto insurance, finding the best rate can be a daunting task. With numerous providers offering different coverage options and pricing structures, it's crucial to compare quotes to ensure you're getting the most suitable and affordable policy. In this comprehensive guide, we will delve into the world of auto insurance rate comparisons, exploring the factors that influence rates, the steps to obtaining accurate quotes, and the strategies to secure the most competitive prices. By the end of this article, you'll be equipped with the knowledge to navigate the auto insurance market with confidence and make informed decisions.

Understanding the Factors that Influence Auto Insurance Rates

Auto insurance rates are influenced by a multitude of factors, each playing a significant role in determining the cost of your policy. Understanding these factors is essential for effective rate comparison and for identifying areas where you can potentially save money. Here’s a breakdown of the key considerations:

1. Driving Record

Your driving history is a critical factor in auto insurance pricing. Insurers closely examine your record for any accidents, traffic violations, or claims made. A clean driving record with no recent incidents typically leads to lower rates, as it indicates a lower risk of future claims. On the other hand, a history of accidents or violations may result in higher premiums.

| Driving Record Status | Rate Impact |

|---|---|

| Clean Record | Lower Rates |

| Minor Violations | Moderate Increase |

| Major Accidents | Significant Increase |

2. Vehicle Type and Usage

The type of vehicle you drive and how you use it also affects your insurance rates. Sports cars, luxury vehicles, and SUVs often carry higher premiums due to their increased repair costs and higher likelihood of theft. Additionally, the purpose of your vehicle’s usage matters. If you use your car for business or commute long distances daily, your rates may be higher compared to someone who primarily uses their vehicle for pleasure.

| Vehicle Type | Rate Impact |

|---|---|

| Sports Cars | Higher Rates |

| Luxury Vehicles | Increased Rates |

| Standard Sedans | Moderate Rates |

| Hybrid/Electric Cars | Varies; sometimes lower |

3. Coverage Options and Limits

The level of coverage you choose and the policy limits you set can significantly impact your insurance rates. Comprehensive and collision coverage, which protect against damage to your vehicle, generally cost more than liability-only coverage. Additionally, higher policy limits, such as increased bodily injury or property damage coverage, will result in higher premiums.

| Coverage Type | Rate Impact |

|---|---|

| Liability-only | Lower Rates |

| Comprehensive and Collision | Higher Rates |

| Uninsured/Underinsured Motorist | Varies by state |

4. Demographic Factors

Demographic information, including your age, gender, marital status, and location, also plays a role in insurance rates. Younger drivers, particularly those under 25, often face higher premiums due to their lack of driving experience. Similarly, drivers in highly populated areas or regions with a high incidence of accidents or theft may see increased rates.

| Demographic Factor | Rate Impact |

|---|---|

| Age | Higher Rates for Younger Drivers |

| Gender | Varies; sometimes different rates for males and females |

| Marital Status | Married individuals may have lower rates |

| Location | Varies by region; higher rates in urban areas |

The Process of Comparing Auto Insurance Rate Quotes

Now that we’ve explored the factors influencing auto insurance rates, let’s dive into the step-by-step process of comparing quotes to find the best deal.

1. Gather Your Information

Before you begin the quote comparison process, gather all the necessary information to ensure an accurate and fair comparison. This includes your driver’s license, vehicle registration, and any recent insurance policies you’ve had. Additionally, have details about your vehicle, such as make, model, year, and VIN number, readily available.

2. Determine Your Coverage Needs

Decide on the level of coverage you require. Consider factors such as the value of your vehicle, your financial situation, and any specific state requirements. Remember, while it’s essential to have adequate coverage, overinsuring can lead to unnecessary expenses. Assess your needs for liability, collision, comprehensive, and any additional coverage options like rental car reimbursement or roadside assistance.

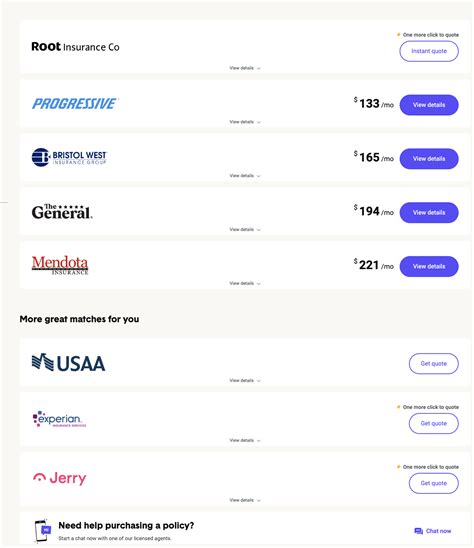

3. Explore Online Quote Tools

Many insurance providers offer online quote tools that allow you to input your information and receive an instant quote. These tools are convenient and provide a quick way to compare rates. However, keep in mind that some insurers may offer discounts or promotions that are not reflected in the initial quote, so it’s important to follow up with a representative to ensure you’re getting the best available rate.

4. Contact Insurance Agents

While online quote tools are efficient, speaking directly with an insurance agent can provide valuable insights and personalized recommendations. Agents can help you understand the nuances of different policies, explain coverage options, and identify any discounts you may be eligible for. They can also address any specific concerns or questions you have about the quote process.

5. Compare Quotes and Analyze

Once you’ve gathered quotes from multiple providers, it’s time to compare and analyze them. Ensure you’re comparing apples to apples by evaluating policies with similar coverage limits and deductibles. Look for any discrepancies or unusual rates, and consider the reputation and financial stability of the insurance companies. Don’t forget to factor in additional benefits or perks offered by different providers.

6. Consider Discounts and Promotions

Insurance companies often offer discounts to attract new customers or reward loyal clients. These discounts can significantly reduce your premiums. Common discounts include multi-policy discounts (bundling your auto insurance with other policies like home or renters insurance), good student discounts, safe driver discounts, and loyalty rewards. Be sure to inquire about these discounts when comparing quotes.

7. Read the Fine Print

While it’s important to focus on the bottom line, don’t forget to scrutinize the policy details. Read through the fine print to understand the exclusions, limitations, and conditions of each policy. Ensure the coverage meets your needs and that there are no hidden fees or unexpected restrictions. Pay close attention to the terms and conditions, as they can vary significantly between providers.

Strategies for Securing the Best Auto Insurance Rates

Now that you have a solid understanding of the quote comparison process, let’s explore some additional strategies to help you secure the most competitive auto insurance rates.

1. Maintain a Good Driving Record

As mentioned earlier, your driving record is a significant factor in determining your insurance rates. Strive to maintain a clean record by practicing safe driving habits and avoiding accidents or violations. Even a single incident can result in increased premiums, so drive defensively and follow traffic rules diligently.

2. Bundle Your Policies

Bundling your auto insurance with other policies, such as home, renters, or life insurance, can lead to substantial savings. Insurance companies often offer multi-policy discounts as an incentive to keep your entire insurance portfolio with them. By combining your policies, you not only save money but also simplify your insurance management.

3. Explore Usage-Based Insurance Programs

Usage-based insurance (UBI) programs, also known as pay-as-you-drive or telematics insurance, are gaining popularity. These programs use data from a device installed in your vehicle to track your driving habits, such as mileage, time of day, and braking patterns. Insurers then use this data to offer personalized rates based on your actual driving behavior. UBI programs can be an excellent option for safe, low-mileage drivers looking to save on insurance costs.

4. Shop Around and Negotiate

Don’t settle for the first quote you receive. Take the time to shop around and compare quotes from multiple insurers. Once you’ve found a competitive rate, don’t be afraid to negotiate. Contact the insurance provider and inquire about any additional discounts or promotions they may be able to offer. Many insurers are willing to match or beat a competitor’s quote to secure your business.

5. Maintain Continuous Coverage

Insurance companies prefer customers who maintain continuous coverage. If you have a gap in your insurance history, it may raise red flags and lead to higher premiums. To avoid this, ensure you have insurance coverage in place at all times, even if it’s just a basic liability policy during periods when you’re not actively driving your vehicle.

6. Utilize Online Comparison Tools

Online insurance comparison tools can be a valuable resource for quickly comparing quotes from multiple providers. These tools allow you to input your information once and receive multiple quotes in a matter of minutes. While they provide a convenient starting point, it’s important to follow up with individual insurers to ensure you’re getting the best available rate and to clarify any questions you may have.

Future Trends and Innovations in Auto Insurance

The auto insurance industry is constantly evolving, with new technologies and innovations shaping the way insurance is priced and delivered. Here’s a glimpse into some of the future trends and developments that may impact auto insurance rates and the quote comparison process.

1. Telematics and Connected Car Technology

Telematics and connected car technology are transforming the way insurance companies assess risk and set rates. With real-time data collection, insurers can gain a more accurate understanding of individual driving behaviors and tailor rates accordingly. This technology also enables usage-based insurance programs, providing personalized rates based on actual driving habits.

2. Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are being leveraged by insurance companies to enhance their underwriting processes and risk assessment. These technologies enable insurers to analyze vast amounts of data, including driving behavior, weather patterns, and accident trends, to make more accurate predictions and offer more competitive rates.

3. Blockchain Technology

Blockchain technology, known for its secure and transparent nature, is expected to play a role in the future of auto insurance. Blockchain can streamline the claims process, enhance data security, and improve overall efficiency in the insurance industry. Additionally, it may facilitate peer-to-peer insurance models, where individuals can directly insure each other without the need for traditional insurance companies.

4. Autonomous Vehicles

The advent of autonomous vehicles is set to revolutionize the auto insurance industry. As self-driving cars become more prevalent, insurance companies will need to adapt their coverage models and pricing structures. The reduced risk of human error in autonomous vehicles may lead to lower insurance premiums, but the potential for new types of accidents and liabilities may also arise.

5. Data-Driven Risk Assessment

Insurers are increasingly leveraging data analytics to assess risk and set rates. By analyzing vast datasets, including historical claims data, weather patterns, and demographic information, insurers can more accurately predict the likelihood of accidents and adjust rates accordingly. This data-driven approach may lead to more personalized and precise insurance pricing.

Conclusion: Empowering Your Auto Insurance Decisions

Comparing auto insurance rate quotes is a critical step in securing the best coverage at the most competitive price. By understanding the factors that influence rates, following a systematic quote comparison process, and implementing strategic approaches, you can navigate the insurance market with confidence. Stay informed about the latest trends and innovations in the industry, as they may offer new opportunities to save on your auto insurance premiums.

Remember, the key to successful auto insurance rate comparison is thorough research, accurate information, and a willingness to explore different options. With the knowledge gained from this guide, you're well-equipped to make informed decisions and secure the most suitable and affordable auto insurance policy for your needs.

How often should I compare auto insurance rates?

+It’s recommended to review and compare auto insurance rates at least once a year, especially during your policy renewal period. Market conditions and personal circumstances can change, so it’s important to ensure you’re still getting the best rate available. Additionally, major life events such as moving to a new location, getting married, or purchasing a new vehicle may trigger the need to reevaluate your insurance needs and rates.

Can I switch insurance providers mid-policy term?

+Yes, you can switch insurance providers at any time during your policy term. However, be aware that some providers may charge a fee for canceling your policy early. It’s generally advisable to time your switch with your policy renewal date to avoid unnecessary costs. When switching, ensure you have continuous coverage to avoid any gaps in insurance protection.

What factors can lead to changes in my auto insurance rates over time?

+Several factors can influence changes in your auto insurance rates over time. These include changes in your driving record (e.g., accidents or violations), increases or decreases in the value of your vehicle, changes in your credit score, and even fluctuations in the overall insurance market. It’s essential to keep your insurance provider informed of any significant changes that may impact your rates.

Are there any common mistakes to avoid when comparing auto insurance rates?

+Yes, there are a few common mistakes to watch out for. First, avoid solely relying on price when comparing quotes. While cost is an important factor, it’s equally crucial to consider the coverage and reputation of the insurance provider. Additionally, be cautious of low-ball quotes that may not include all the necessary coverage or have hidden fees. Always read the policy details carefully before making a decision.

How can I improve my chances of getting the best auto insurance rate quotes?

+To improve your chances of getting the best rate quotes, maintain a clean driving record, consider bundling your policies with the same insurer, and explore usage-based insurance programs if available. Additionally, be proactive in shopping around and negotiating with insurance providers. Don’t be afraid to ask about discounts or promotions that can further reduce your premiums.